Overview

The article outlines ten essential accounting and finance certifications that can profoundly enhance career growth and earning potential for professionals in these fields. Certifications such as CPA, CMA, and CFA are highlighted for their ability to not only increase salaries—often by 10-30%—but also to improve job prospects and align candidates with the evolving demands of the industry. This underscores the critical importance of continuous professional development in accounting and finance.

Key Highlights:

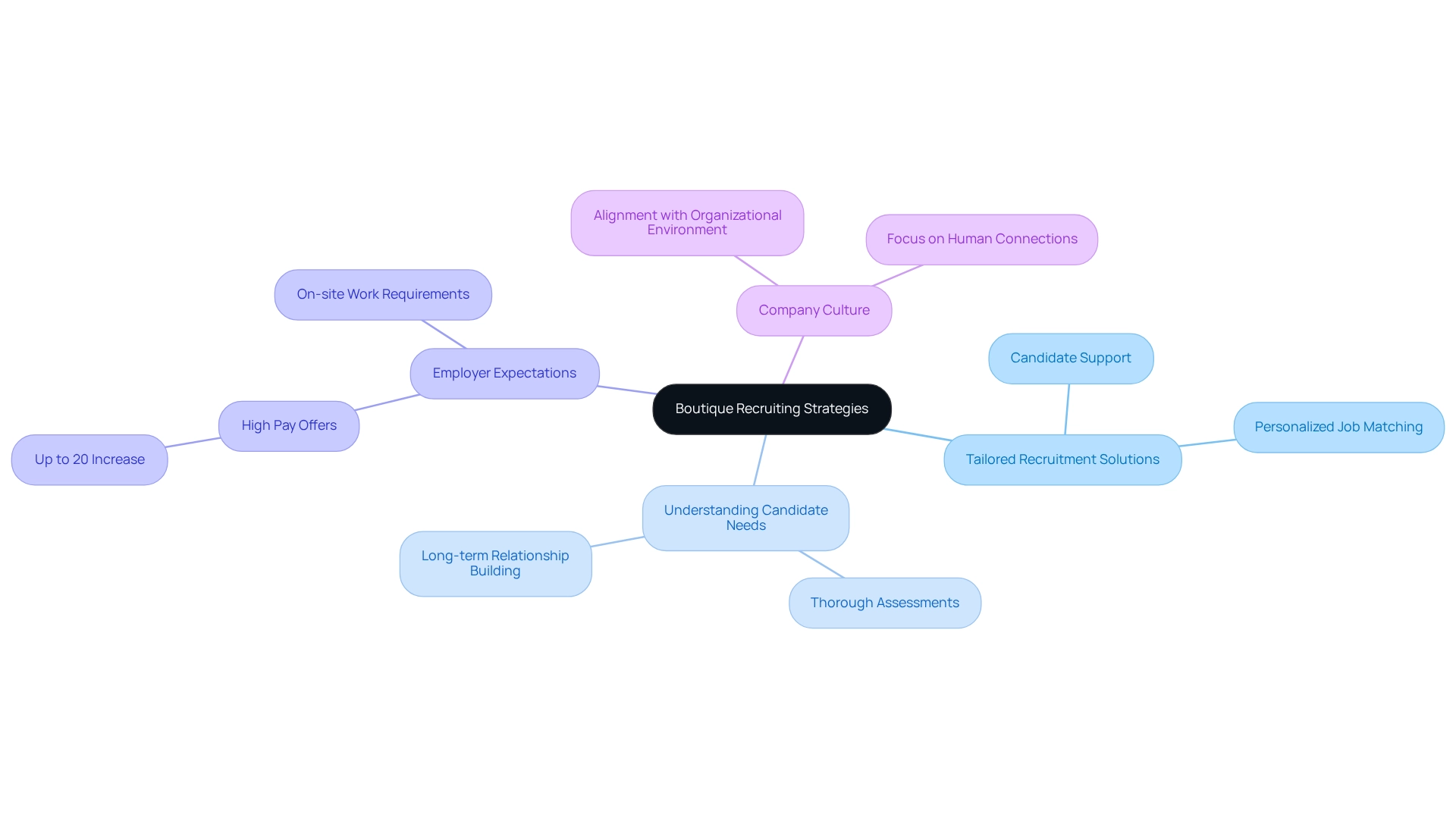

- Boutique Recruiting specializes in connecting high-quality candidates with employers in accounting and finance through tailored recruitment solutions.

- The firm emphasizes a deep understanding of candidates’ and employers’ needs, enhancing job satisfaction and retention rates.

- In 2025, employers are offering up to 20% higher pay for on-site roles in accounting and finance, reflecting a competitive job market.

- The CPA designation is the gold standard in accounting, leading to a 10-15% salary increase for certified accountants.

- Over 1.3 million individuals in the U.S. hold CPA credentials, highlighting its demand and relevance.

- CMAs earn approximately 21% more than non-certified counterparts, emphasizing the value of this certification in management accounting.

- CFAs are essential for investment analysis and portfolio management, with a rigorous three-level exam process ensuring high competency.

- CFAs have seen a yearly salary increase of 7% since 2012, indicating strong career growth opportunities.

- CIAs are crucial for internal auditing, with a projected 6% growth in employment for accountants and auditors by 2033.

- CFEs are increasingly in demand for fraud prevention, with their specialized knowledge vital for mitigating fraud risks.

- CFP holders can earn up to 30% more than non-certified planners, significantly enhancing career prospects in personal financial planning.

- CGMAs are vital for global business accounting, bridging gaps in small enterprises and adapting to automation trends.

- CGFMs are essential for public sector finance, addressing compliance and transparency challenges in government resource management.

Introduction

In the competitive landscape of accounting and finance, specialized certifications have become essential for professionals striving to elevate their careers. Credentials such as the Certified Public Accountant (CPA) and the Chartered Financial Analyst (CFA) signify a substantial commitment to mastering the complexities of financial practices while enhancing one’s marketability.

As organizations increasingly seek qualified candidates to navigate intricate financial landscapes, understanding the value of these certifications is imperative for both job seekers and employers.

This article explores the prestigious certifications available within the accounting and finance sectors, examining how they not only enhance individual career trajectories but also contribute to organizational success in a rapidly evolving industry.

Boutique Recruiting: Tailored Recruitment Solutions for Accounting and Finance Professionals

Boutique Recruiting stands out in connecting high-quality candidates with employers in the sectors of accounting and finance through its tailored recruitment solutions. By prioritizing a deep understanding of the unique needs of both candidates and employers, the firm ensures that placements transcend mere job filling, fostering long-term relationships that benefit all parties involved. This personalized approach not only facilitates the delivery of candidates who meet technical qualifications but also ensures alignment with company culture, significantly enhancing retention rates and job satisfaction.

In 2025, the recruitment landscape for professionals with accounting and finance certifications is evolving. Notably, employers are now offering up to 20% higher pay to attract talent willing to work on-site four to five days a week. This statistic reflects the competitive nature of the job market, where roles such as CFO, Senior Accountants, Financial Analysts, and individuals with accounting and finance certifications are in high demand.

The effectiveness of personalized recruitment strategies is evident, as firms like Boutique Recruiting leverage their industry knowledge to provide customized solutions that resonate with both candidates and employers. Testimonials from satisfied clients highlight this success:

- “Boutique Recruiting is the best! I applied for a job via their page on LinkedIn and Irene Hernandez from their office called me immediately to discuss the role. She set up an interview asap and was such a great support during the whole process. I could call her anytime with questions and best of all, I got the job!” – Kate Woodcraft.

Industry leaders emphasize the critical role of personalized recruitment in finance, echoing sentiments that successful placements require a focus on human connections. As Walt Disney famously stated, “You can dream, create, design, and build the most wonderful place in the world…but it requires people to make the dream a reality.” This commitment to understanding company culture and specific job requirements positions Boutique Recruiting as a trusted partner for businesses seeking high-quality talent and individuals pursuing rewarding career opportunities. Boutique Recruiting tailors its approach by conducting thorough assessments of company culture and job specifications, ensuring that candidates not only possess the necessary skills but also align with the organizational environment.

Certified Public Accountant (CPA): The Gold Standard in Accounting Certifications

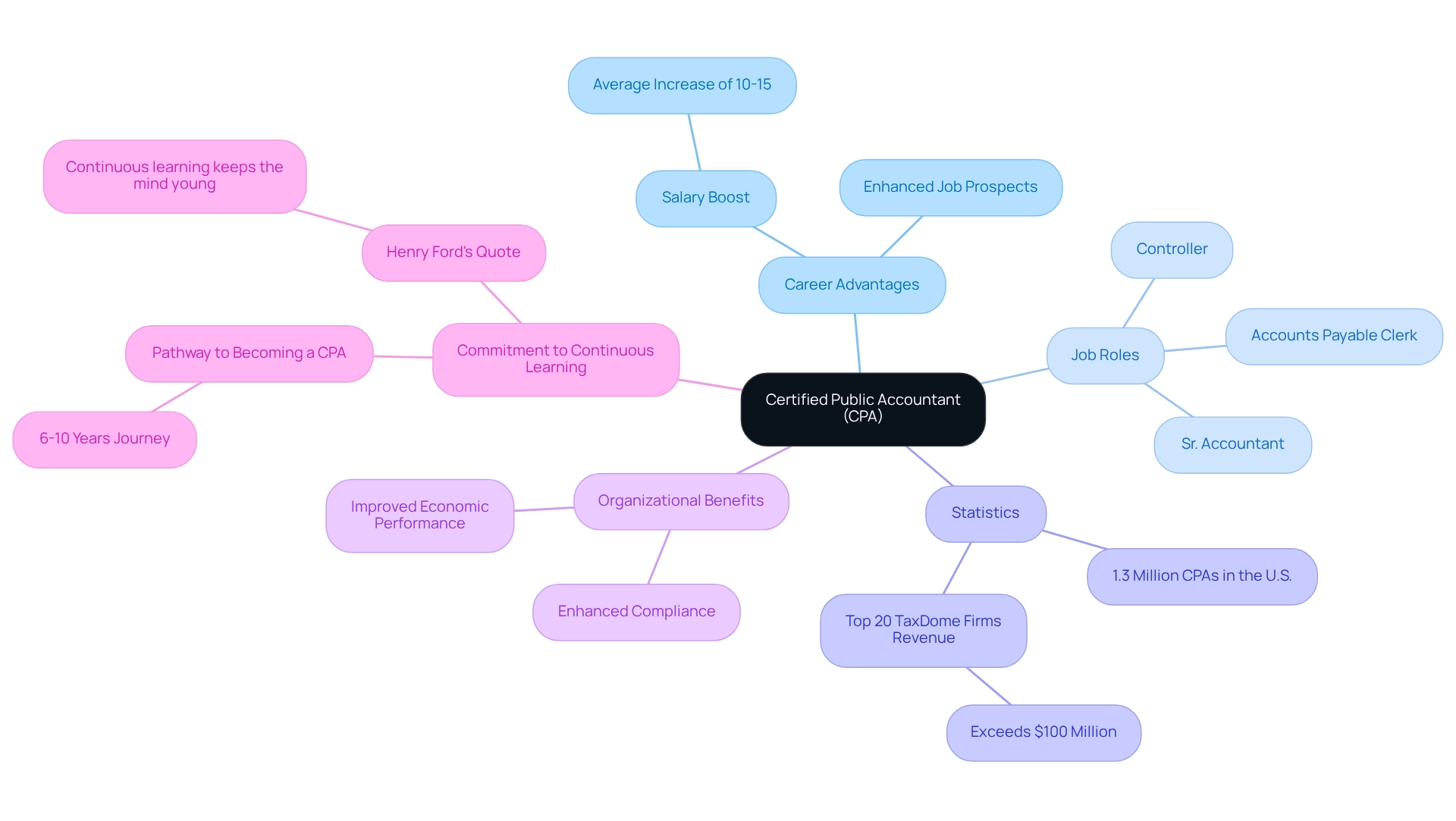

The Certified Public Accountant (CPA) designation stands as the gold standard in the accounting profession, symbolizing a profound level of expertise and dedication. CPAs are adept at navigating complex financial responsibilities, including auditing, tax preparation, and financial reporting. In 2025, the significance of CPA qualification continues to expand, with employers increasingly preferring candidates who possess this credential, as it demonstrates not only technical abilities but also a dedication to ethical practices.

Achieving CPA credentials can result in significant career advantages, including an average salary boost of 10-15% relative to non-certified accountants. This credential not only enhances job prospects but also opens doors to advanced roles within the industry, such as:

- Controller

- Sr. Accountant

- Accounts Payable Clerk

Current statistics reveal that over 1.3 million individuals in the U.S. possess CPA credentials, underscoring its relevance and demand in the job market.

Expert insights reinforce the value of this certification for career advancement. As Michael Carter aptly states, “To be a CPA is to be a keeper of monetary wisdom.” This perspective emphasizes the role of CPAs as trusted advisors in monetary matters, further elevating their status in the eyes of employers. Furthermore, cultivating a positive mindset among accounting experts can be accomplished through such motivational quotes, inspiring them to pursue excellence in their careers.

Boutique Recruiting focuses on specialized recruitment services for accounting positions, ensuring that organizations locate the suitable CPA-certified individuals to improve their economic performance and compliance. Case studies illustrate the tangible benefits of hiring CPAs for organizations. Organizations that prioritize CPA-certified individuals often witness enhanced economic performance and adherence, highlighting the certification’s effect on organizational success. Notably, the combined revenue of the top 20 TaxDome firms exceeds $100 million, emphasizing the financial advantages of employing CPAs.

The journey to becoming a CPA, typically spanning 6-10 years, reflects the dedication required to achieve this esteemed designation, which is crucial for those pursuing accounting and finance certifications, ultimately leading to enhanced career opportunities and earning potential. As Henry Ford wisely remarked, “Continuous learning keeps the mind young,” emphasizing the significance of ongoing career development in the accounting field. Moreover, navigating job offers and examining various opportunities is essential for career success, and accounting and finance certifications, such as CPA qualification, greatly improve candidates’ marketability in this competitive environment.

Certified Management Accountant (CMA): Elevate Your Financial Management Skills

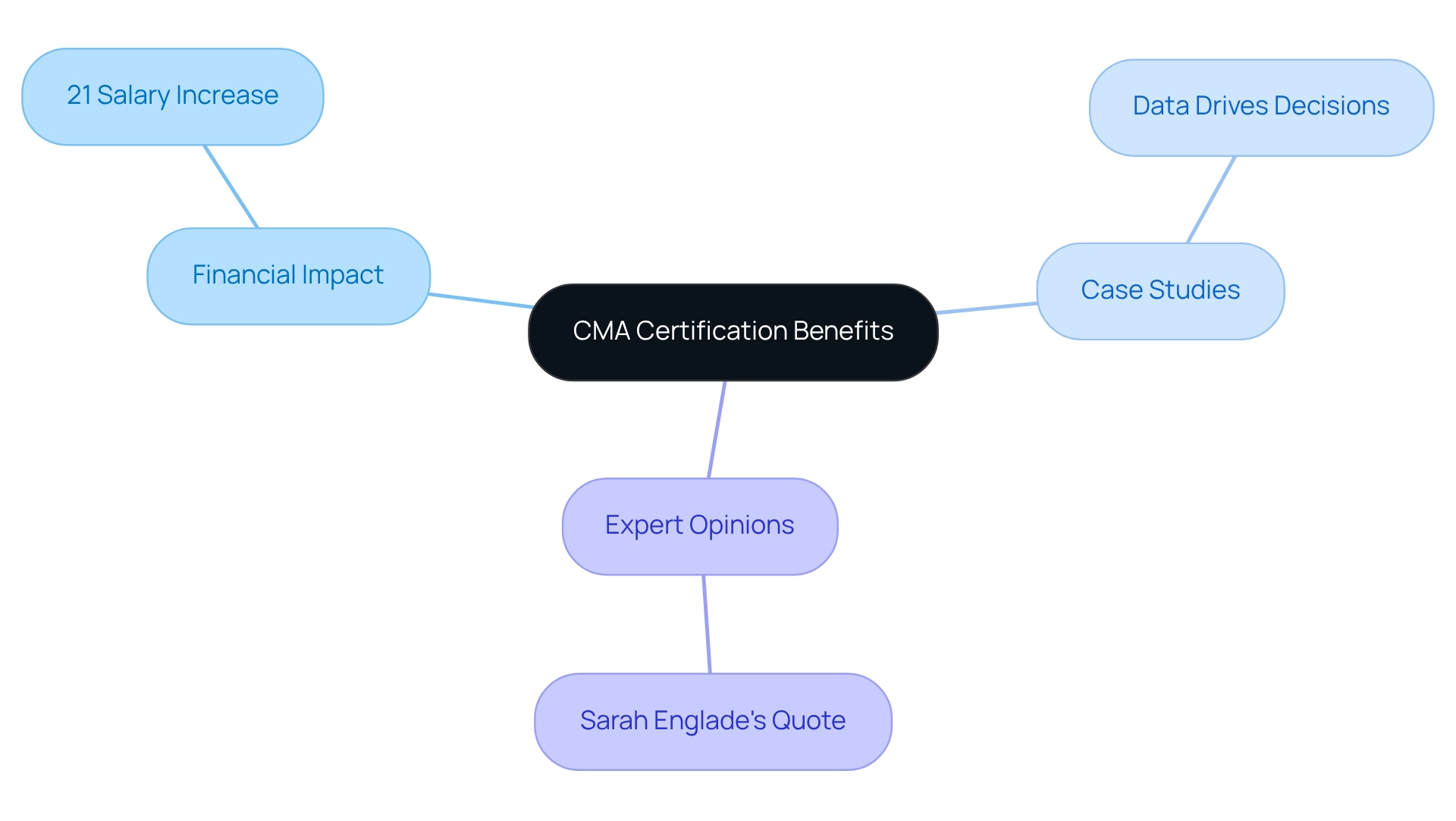

The Certified Management Accountant (CMA) certification is essential for professionals seeking advancement in management accounting. This credential underscores critical money management skills, strategic planning, and decision-making capabilities. CMAs excel at analyzing financial data, which enables them to provide insights that significantly enhance business performance. In an environment where organizations increasingly prioritize strategic initiatives, accounting and finance certifications, such as the CMA credential, emerge as a vital asset for those aspiring to elevate their careers in finance and accounting.

Statistics reveal that CMAs earn approximately 21% more than their non-certified counterparts, underscoring the credential’s impact on career progression. Furthermore, case studies demonstrate how CMAs utilize data-driven insights to influence business strategies, transcending traditional number management to foster informed decision-making. For instance, the case study titled “Data Drives Decisions” illustrates how accountants presenting real-time, accurate data empower businesses to make informed and confident decisions, showcasing the pivotal role CMAs play in shaping strategic outcomes.

As the demand for CMAs continues to surge in the finance sector, driven by the latest trends in management accounting credentials, their role in strategic planning becomes increasingly crucial. Finance executives recognize that individuals can enhance their credibility and expand their career prospects with accounting and finance certifications. This sentiment is echoed by Sarah Englade, Owner and Founder of Monarch Talent Solutions, who asserts, “With the appropriate qualification, you can boost your credibility, broaden your career opportunities, and attain your career objectives in the accounting sector.” In 2025, the advantages of obtaining a CMA certification are clear: it not only equips individuals with the skills necessary for success but also positions them as key contributors to their organizations’ strategic objectives.

Chartered Financial Analyst (CFA): A Must-Have for Aspiring Financial Analysts

The Chartered Financial Analyst (CFA) designation stands as a pinnacle credential in the finance sector, particularly for individuals pursuing careers in investment analysis and portfolio management. With over 180,000 CFA charterholders globally, this program encompasses a wide array of topics, including investment analysis, portfolio management, and ethical standards. The CFA curriculum is meticulously structured to equip candidates with a profound comprehension of market dynamics and investment approaches, which is essential in today’s competitive landscape.

Earning the CFA necessitates that candidates successfully navigate three challenging levels of exams, a process that rigorously tests not only their knowledge but also their unwavering commitment to the profession. This demanding examination process ensures that CFA charterholders are exceptionally prepared to meet the industry’s demands, rendering them highly appealing to employers. Indeed, CFAs have experienced a remarkable yearly salary increase of 7% since 2012, underscoring the enhanced career opportunities for CFA holders in 2025, as employers increasingly seek individuals capable of serving as fiduciaries, prioritizing clients’ monetary interests.

For HR managers in financial institutions, grasping the value of the CFA designation is crucial in the recruitment process. Utilizing the CFA Institute Career Center can facilitate the verification of prospective candidates’ statuses, ensuring informed hiring decisions. This resource empowers HR professionals to connect with qualified candidates who possess the CFA credential, thereby enhancing their recruitment strategies in a competitive talent market.

Moreover, the CFA program has adeptly adapted to recent changes in the economic landscape, further solidifying its relevance. For instance, the launch of innovative courses, such as the Financial Reporting and Analysis course by PrepNuggets in March 2018, illustrates the growing demand for specialized knowledge in finance. This course has garnered positive feedback, indicating a successful entry into a competitive market filled with established CFA prep providers, and highlights the evolving landscape of CFA preparation.

As David P. Meyer, a Securities Attorney and author, articulates, “A CFA is a Chartered Financial Analyst, and a person who has earned this credential is most likely a competent advisor.” This statement underscores the credibility of the CFA designation, reinforcing its significance within the finance industry.

In summary, the CFA designation not only epitomizes a high level of expertise but also enhances job placement rates for its holders, making it an indispensable credential for aspiring financial analysts aiming for career growth in 2025 and beyond. For HR managers, leveraging the CFA credential in recruitment can lead to superior hiring outcomes and a more robust talent pool.

Certified Internal Auditor (CIA): Specialize in Internal Auditing Excellence

The Certified Internal Auditor (CIA) designation is the only globally recognized credential in internal auditing, symbolizing a professional’s mastery of internal audit practices, risk management, and governance. CIAs excel at evaluating and enhancing an organization’s internal controls, ensuring compliance with regulations while boosting operational efficiency. This qualification is essential for those aiming to specialize in internal auditing, reflecting a commitment to upholding high standards of professionalism and ethical conduct.

As we look toward 2025, the demand for CIAs is set to rise. The U.S. Bureau of Labor Statistics projects a 6% growth in employment for accountants and auditors from 2023 to 2033. Organizations employing CIAs reap the benefits of their advanced skills in risk management, crucial for navigating today’s complex regulatory landscape. For instance, internal audit managers with 5-10 years of experience can earn significantly higher salaries—ranging from $110,500 to $157,750—if they possess a CIA designation. This disparity in salaries between certified and non-certified auditors underscores the financial advantages of this credential; CIAs not only command higher wages but also enhance organizational efficiency and compliance, ultimately improving the bottom line.

Moreover, the CIA designation equips professionals with essential techniques related to forensic auditing, including interviewing and investigation methods, which are increasingly vital in today’s job market. As managerial accounting principles like cost-volume-profit analysis and budgeting gain prominence, mastering these concepts becomes imperative for candidates pursuing the CIA designation. This knowledge empowers CIAs to provide valuable insights that drive strategic decision-making within organizations. Expert opinions emphasize that mastering the testable subjects of the CIA exam is crucial for success, reinforcing its significance in cultivating a skilled workforce capable of meeting evolving industry standards. Organizations that have employed CIAs report improved internal controls and risk management practices, further illustrating the certification’s impact in the workplace.

Certified Fraud Examiner (CFE): Combat Fraud with Specialized Knowledge

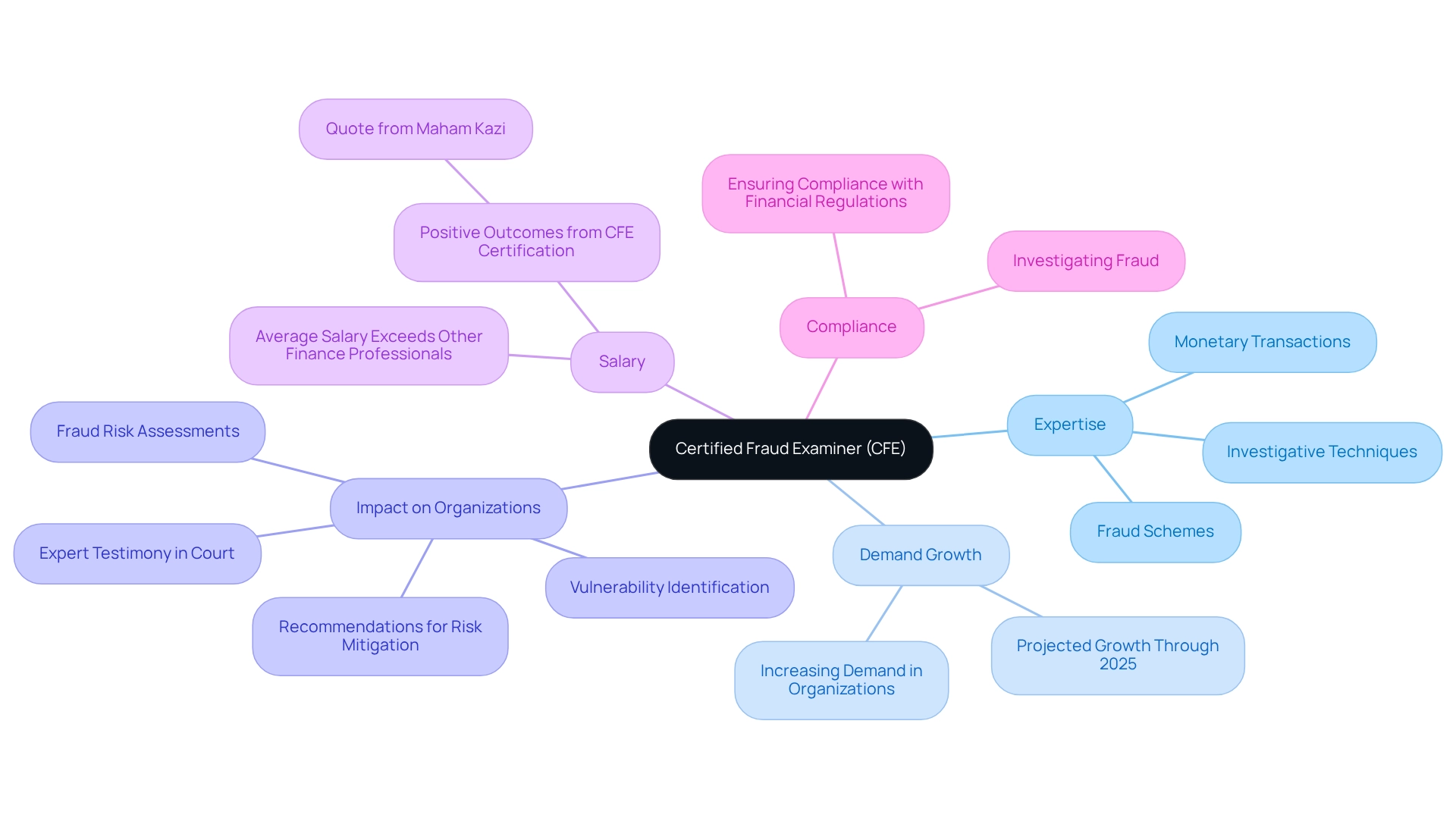

The Certified Fraud Examiner (CFE) credential is indispensable for professionals dedicated to fraud prevention and detection. CFEs bring specialized expertise in monetary transactions, fraud schemes, and investigative techniques, which enables them to efficiently identify and mitigate fraud risks within organizations. As businesses increasingly prioritize fraud prevention, the demand for CFEs is escalating, with projections indicating substantial growth in this field through 2025.

CFEs are pivotal in conducting fraud risk assessments, pinpointing vulnerabilities, and recommending solutions to reduce risks. Their expertise is crucial in combating various forms of fraud, including embezzlement and identity theft, which pose significant threats to both individuals and organizations. Consider this: organizations employing CFEs have demonstrated enhanced defenses against fraud, effectively safeguarding their assets and maintaining trust in monetary systems. Furthermore, CFEs provide expert testimony in court cases, bolstering the prosecution’s case against fraudsters.

Additionally, the average salary of Certified Fraud Examiners reflects their value in the finance sector, often exceeding that of other finance professionals. As Maham Kazi, an accountant, remarked, “This Compensation Guide shows clear increase positive outcome of certified fraud examiner salary.” This monetary incentive, coupled with the growing recognition of the importance of specialized knowledge in fraud prevention, underscores the CFE certification as a vital asset for individuals pursuing accounting and finance certifications. As the landscape of monetary regulations evolves, CFEs ensure compliance while investigating fraud, further solidifying their significance in today’s corporate environment. Recent statistics reveal an increasing demand for CFEs in organizations, emphasizing their essential role in protecting monetary integrity.

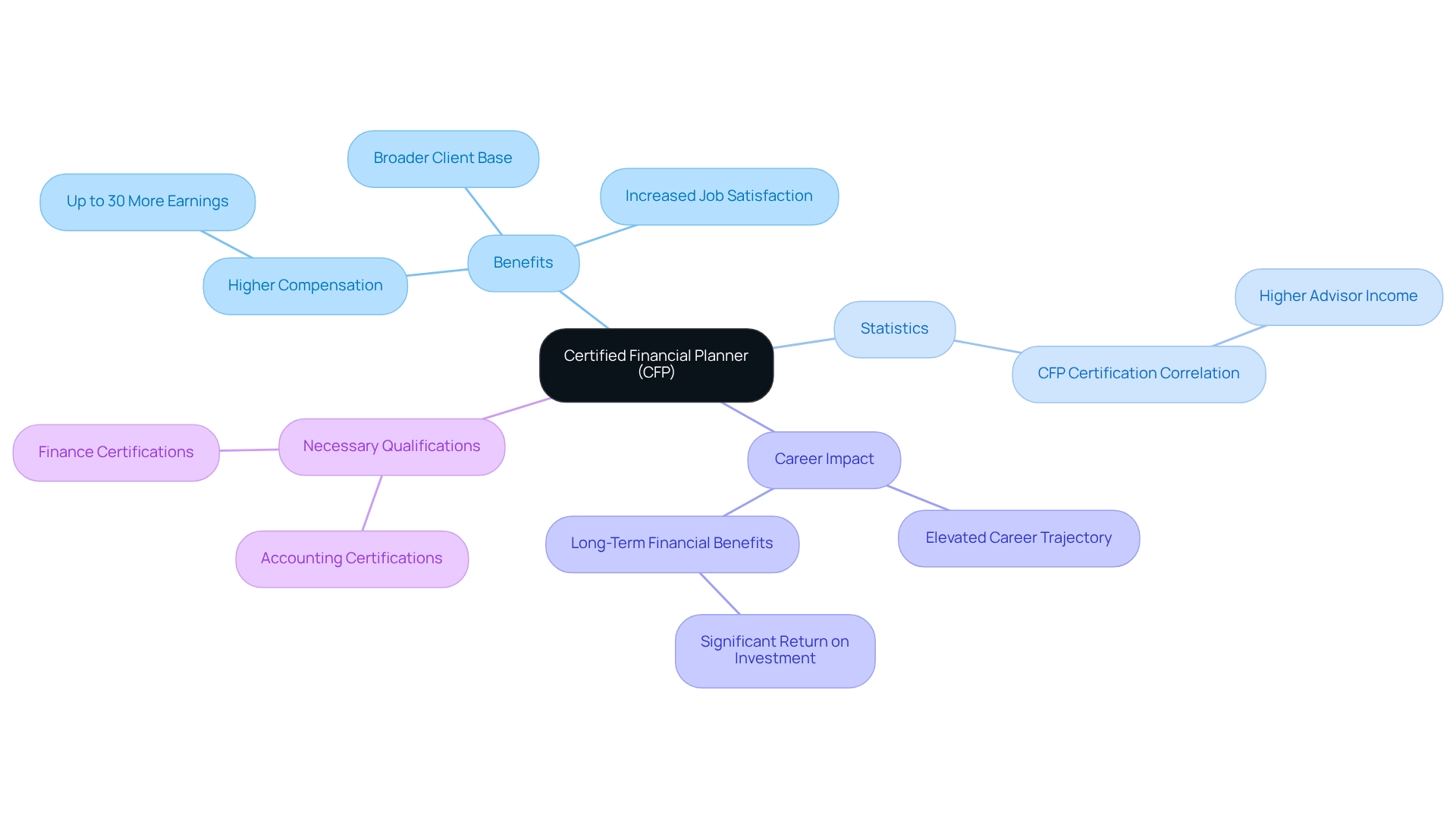

Certified Financial Planner (CFP): Master Personal Financial Planning

The Certified Financial Planner (CFP) designation represents a pivotal qualification for those aspiring to excel in personal money planning. Encompassing a wide array of topics such as investment strategies, retirement planning, and estate management, this designation prepares CFP experts to deliver comprehensive financial guidance. They assist individuals and families in realizing their economic objectives. With the demand for financial planning services projected to surge significantly in 2025, obtaining the CFP credential can substantially elevate a professional’s career trajectory and earning potential.

Statistics reveal that CFP accreditation correlates with higher compensation, with research indicating that certified planners can earn up to 30% more than their non-certified counterparts. This credential not only enhances credibility but also opens doors to a broader client base, underscoring its importance in today’s competitive landscape. Successful planners with CFP credentials frequently report increased job satisfaction and a robust client portfolio, illustrating the credential’s impact on fostering long-term career success.

As Gabriel wisely stated, “Opportunity doesn’t knock, you knock until opportunity answers.” Given these trends, the CFP credentials emerge as an indispensable asset for individuals committed to advancing their careers in financial planning. Ambitious professionals should take decisive steps toward acquiring accounting and finance certifications, as these qualifications are essential for achieving success in the field.

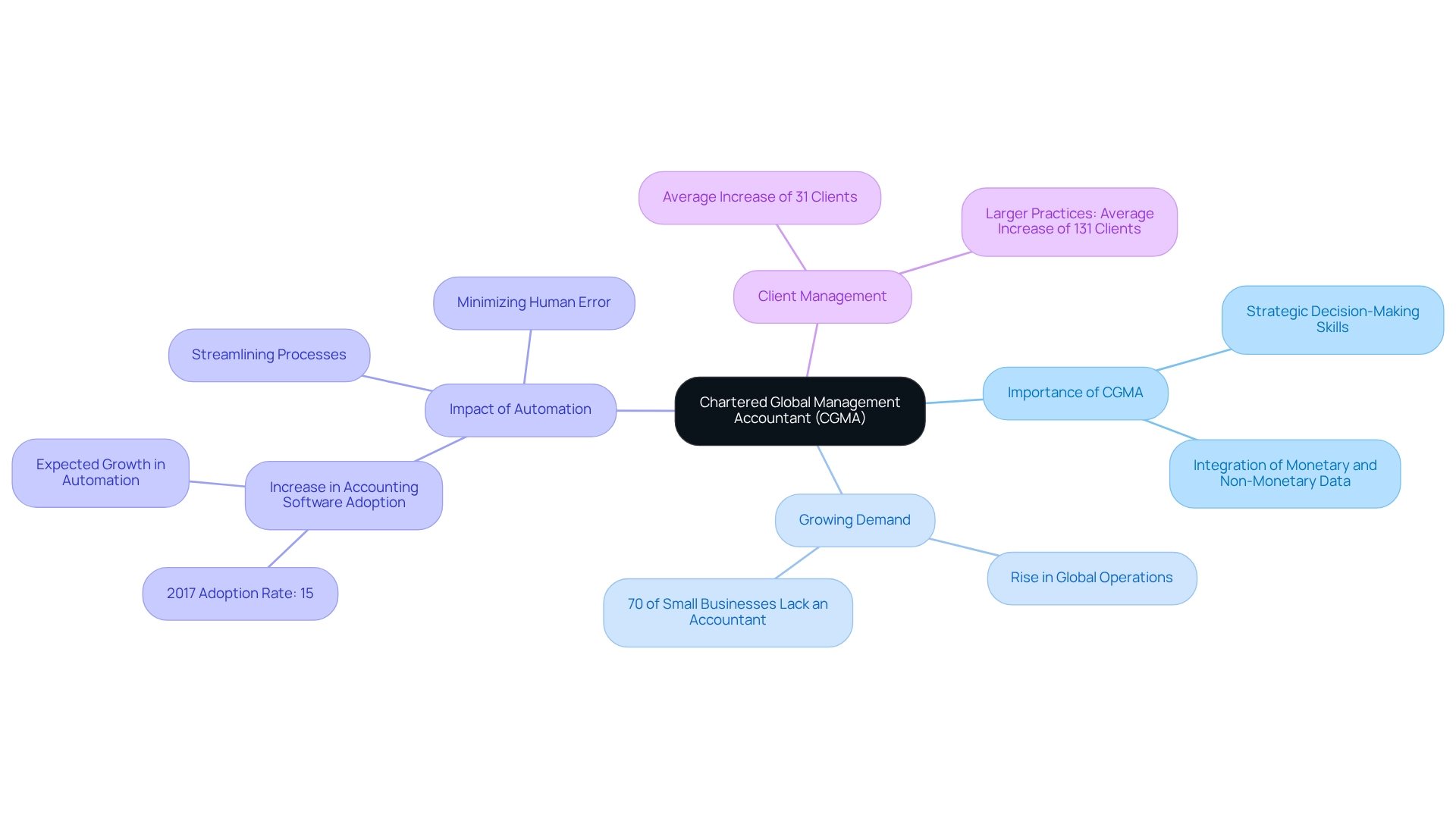

Chartered Global Management Accountant (CGMA): Excel in Global Business Accounting

The Chartered Global Management Accountant (CGMA) designation is specifically designed for management accountants operating within a global business framework. This credential emphasizes essential skills for navigating complex economic environments and making strategic decisions that drive business success. CGMAs are recognized for their ability to integrate both monetary and non-monetary data, establishing them as invaluable resources for organizations.

As companies increasingly expand their operations globally, the demand for professionals holding accounting and finance certifications, such as CGMA, is on the rise, underscoring the credential’s strategic importance for career advancement in 2025. Recent trends indicate that organizations are eager to leverage insights from tax return experiences to foster strategic growth, further highlighting the critical role of CGMAs in today’s market.

With approximately 70% of small enterprises lacking an accountant, CGMAs are pivotal in bridging this gap by providing comprehensive financial oversight. Additionally, the surge in accounting software adoption among small businesses, which has significantly increased since 2017, reflects a shift towards automation that CGMAs are well-prepared to manage. This transformation in the accounting landscape not only streamlines processes but also minimizes human error, reinforcing the significance of accounting and finance certifications in enhancing organizational efficiency and decision-making capabilities.

As Jorge Martinez noted, practices have acquired an average of 31 new clients, with larger practices reporting an increase of 131 clients. This illustrates how CGMAs can effectively drive client management and business growth. The connection to the latest trends in management accounting for global firms further solidifies the relevance of the CGMA in 2025.

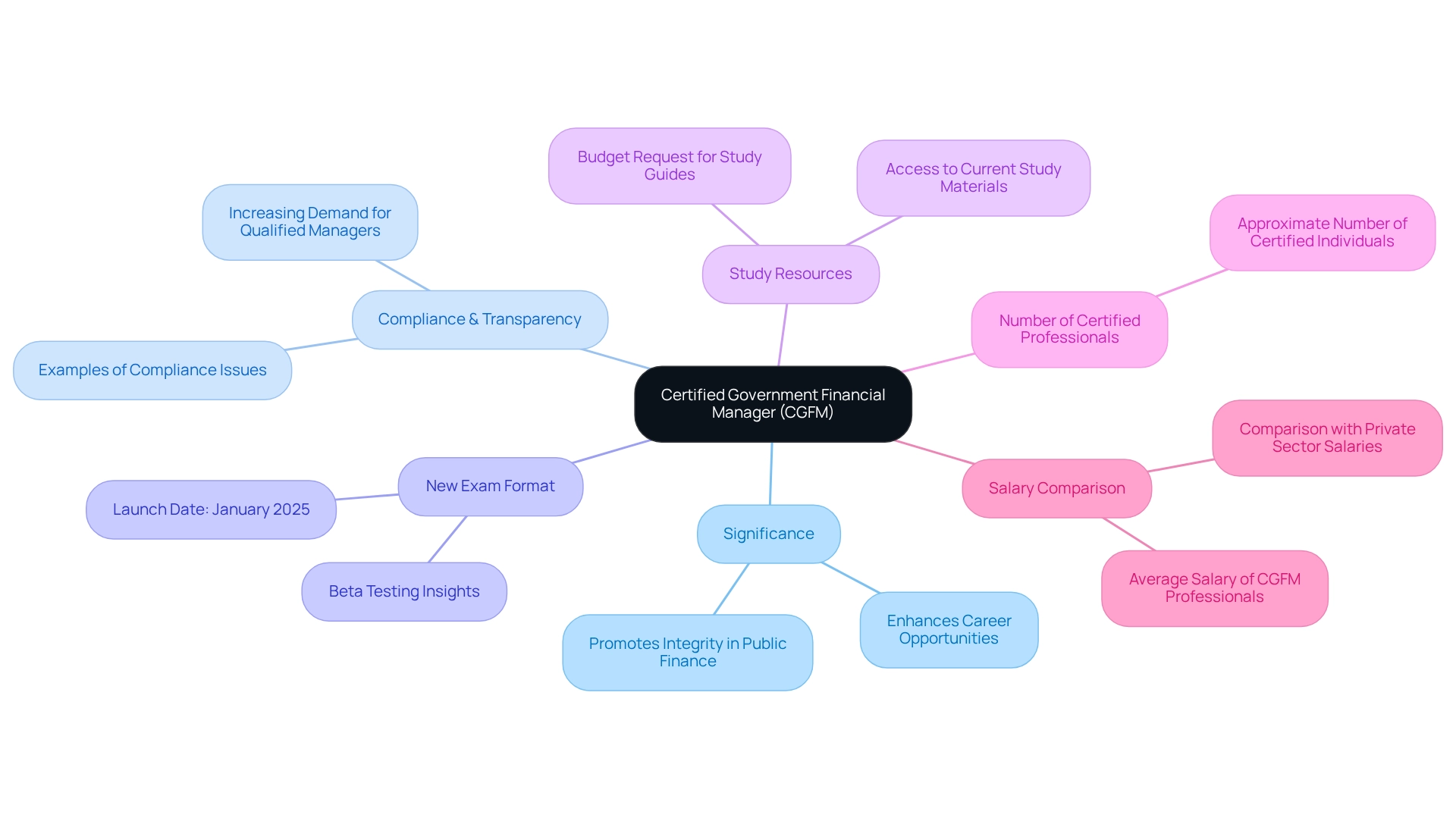

Certified Government Financial Manager (CGFM): Navigate Public Sector Finance

The Certified Government Manager (CGFM) credential is a pivotal asset for professionals engaged in government resource management. This credential, which includes accounting and finance certifications, encompasses critical areas such as governmental accounting, auditing, and reporting, equipping CGFMs to effectively tackle the unique challenges presented by public sector finance.

With an increasing emphasis on compliance and transparency, government entities are actively seeking qualified fiscal managers, making accounting and finance certifications, such as the CGFM qualification, an essential tool for those aspiring to excel in public finance. As we approach 2025, the relevance of accounting and finance certifications is underscored by the introduction of a new exam format set to launch in January, following extensive beta testing. This update is designed to ensure that candidates are evaluated based on the most contemporary practices and knowledge in the field.

Additionally, the CGFM team is committed to supporting its members by presenting a budget proposal that aligns with last year’s figures for study guides, thereby guaranteeing access to essential study resources crucial for exam success.

The significance of the CGFM credential is further emphasized by the rising number of certified professionals in the U.S., which has reached approximately [insert statistic] certified individuals, showcasing its value in enhancing career opportunities within the public sector. Moreover, Certified Government Financial Managers earn an average salary of [insert average salary] compared to their private sector counterparts, highlighting the economic benefits of obtaining the CGFM qualification.

By addressing the distinct challenges faced in governmental fiscal management, the CGFM certification not only promotes individual career advancement but also bolsters the overall integrity and efficiency of public financial operations.

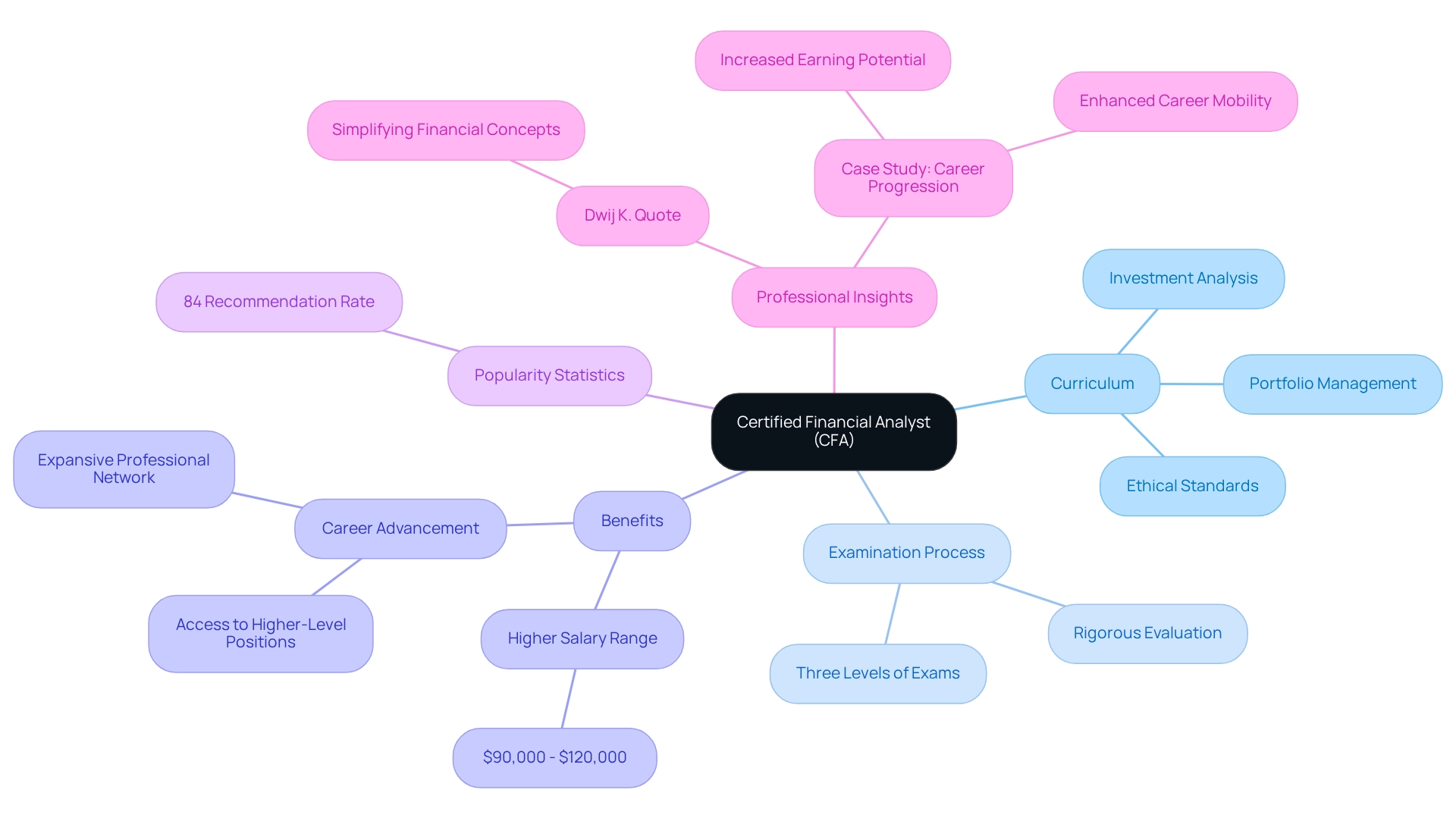

Certified Financial Analyst (CFA): Essential for Investment Management Careers

The Certified Financial Analyst (CFA) designation stands as a premier credential in the finance sector, particularly for individuals aspiring to careers in investment analysis and portfolio management. The CFA program features a comprehensive curriculum that encompasses investment analysis, portfolio management, and ethical standards, ensuring candidates cultivate a robust understanding of financial markets and investment strategies.

Achieving the CFA charter necessitates passing three rigorous levels of exams, a process that not only evaluates knowledge but also demonstrates a commitment to excellence in the field. This demanding training equips CFA charterholders for various roles, including research analysts and junior portfolio managers, rendering them highly appealing to employers.

Recent statistics reveal that 84% of students entering the CFA program endorse it, underscoring its popularity and perceived value among finance professionals. Furthermore, the CFA designation is recognized globally, offering significant advantages for careers in wealth management, particularly in thriving economic regions such as North America and Europe.

CFA charterholders enjoy a competitive salary edge, often earning between $90,000 and $120,000 annually—substantially higher than their counterparts in other finance roles. This credential not only facilitates access to higher-level positions but also opens the door to an expansive network, enhancing career progression opportunities.

As Dwij K., a digital marketer, notes, “My expertise lies in simplifying intricate financial concepts into easily understandable segments, making me a reliable source for those looking to enter the finance field.” This perspective emphasizes the CFA’s role in equipping individuals with the skills necessary for effective communication within the finance sector.

Case studies further illustrate the significance of the CFA designation in investment management, demonstrating how it symbolizes expertise and adherence to ethical standards. For instance, the case study titled “How Adding CFA Can Help You in Career Progression” reveals that professionals who earn the CFA frequently experience increased earning potential and enhanced career mobility. As the finance industry continues to evolve, the relevance of accounting and finance certifications, including the CFA certification, remains steadfast, positioning it as a vital asset for aspiring investment analysts.

Conclusion

In the dynamic realm of accounting and finance, specialized certifications are pivotal in shaping successful careers and enhancing organizational success. Credentials such as the CPA, CMA, and CFA not only signify a professional’s commitment to excellence but also equip them with the critical skills needed to navigate complex financial landscapes. As demonstrated throughout this article, these qualifications lead to substantial career benefits, including higher earning potential and improved job prospects.

The evolving recruitment landscape underscores the increasing demand for certified professionals, with employers prioritizing candidates who can demonstrate both technical expertise and the ability to align with company culture. Organizations that invest in hiring certified professionals often experience enhanced financial performance and compliance, reflecting the tangible benefits of these credentials. The testimonials and expert insights shared highlight the importance of personalized recruitment strategies that focus on finding the right fit for both candidates and employers.

As the accounting and finance sectors continue to evolve, the value of obtaining specialized certifications cannot be overstated. For aspiring professionals, pursuing these credentials is a strategic move that not only enhances individual career trajectories but also contributes to the overall integrity and efficiency of the financial industry. Embracing the journey towards certification is essential for anyone looking to make a significant impact in their field, ensuring they remain competitive in an ever-changing job market.

Are you ready to elevate your career? Consider the profound impact that specialized certifications can have not just on your professional growth but also on the organizations you aim to serve. Reach out today for a consultation and take the first step towards securing your future in the financial landscape.

Frequently Asked Questions

What is Boutique Recruiting and what does it specialize in?

Boutique Recruiting specializes in connecting high-quality candidates with employers in the accounting and finance sectors through tailored recruitment solutions.

How does Boutique Recruiting ensure successful placements?

The firm prioritizes a deep understanding of the unique needs of both candidates and employers, ensuring that placements go beyond mere job filling and foster long-term relationships that benefit all parties involved.

What are the benefits of Boutique Recruiting’s personalized approach?

This approach facilitates the delivery of candidates who meet technical qualifications while ensuring alignment with company culture, significantly enhancing retention rates and job satisfaction.

How is the recruitment landscape evolving for accounting and finance professionals in 2025?

Employers are offering up to 20% higher pay to attract talent willing to work on-site four to five days a week, reflecting the competitive nature of the job market for roles such as CFO, Senior Accountants, and Financial Analysts.

What do testimonials say about Boutique Recruiting’s effectiveness?

Clients have praised Boutique Recruiting for their immediate support and assistance throughout the job application process, highlighting the firm’s commitment to candidate success.

Why is the CPA designation important in the accounting profession?

The CPA designation symbolizes a profound level of expertise and dedication, demonstrating technical abilities and a commitment to ethical practices, which are increasingly preferred by employers.

What are the career advantages of obtaining CPA credentials?

Achieving CPA credentials can result in an average salary boost of 10-15% compared to non-certified accountants and opens doors to advanced roles within the industry.

How does Boutique Recruiting assist organizations in finding CPA-certified individuals?

The firm focuses on specialized recruitment services for accounting positions, ensuring organizations locate suitable CPA-certified individuals to enhance their economic performance and compliance.

What is the significance of the CMA certification for management accountants?

The CMA certification underscores critical money management skills, strategic planning, and decision-making capabilities, making it essential for professionals seeking advancement in management accounting.

How does obtaining a CMA certification impact salary and career prospects?

CMAs earn approximately 21% more than their non-certified counterparts, and the certification enhances credibility and career opportunities in the finance sector.

What role do CMAs play in strategic planning within organizations?

CMAs analyze financial data to provide insights that enhance business performance and influence strategic initiatives, positioning themselves as key contributors to their organizations’ objectives.