Overview

The article identifies ten essential finance and accounting certifications that can significantly enhance career growth in the finance sector. These credentials are not merely letters after a name; they represent a strategic advantage in a competitive job market. By detailing the specific benefits, average salaries, and industry demands associated with each certification, it becomes evident how credentials like CPA, CMA, and CFE are increasingly sought after by employers. This underscores their critical role in professional advancement.

In a landscape where the right qualifications can open doors to lucrative opportunities, understanding the value of these certifications is paramount. Are you aware of how these credentials can elevate your career trajectory? As the financial sector continues to evolve, the demand for qualified professionals with recognized certifications is on the rise, making it essential for candidates to stay ahead of the curve.

Moreover, the article highlights that obtaining these certifications not only boosts earning potential but also enhances job security. Employers are actively seeking candidates who demonstrate commitment to their professional development through such qualifications. This trend reinforces the importance of investing in your education and credentials.

In conclusion, the journey towards career advancement in finance is paved with the right certifications. Take action now by exploring these essential qualifications and positioning yourself as a top candidate in the field. Your future in finance awaits—are you ready to take the next step?

Key Highlights:

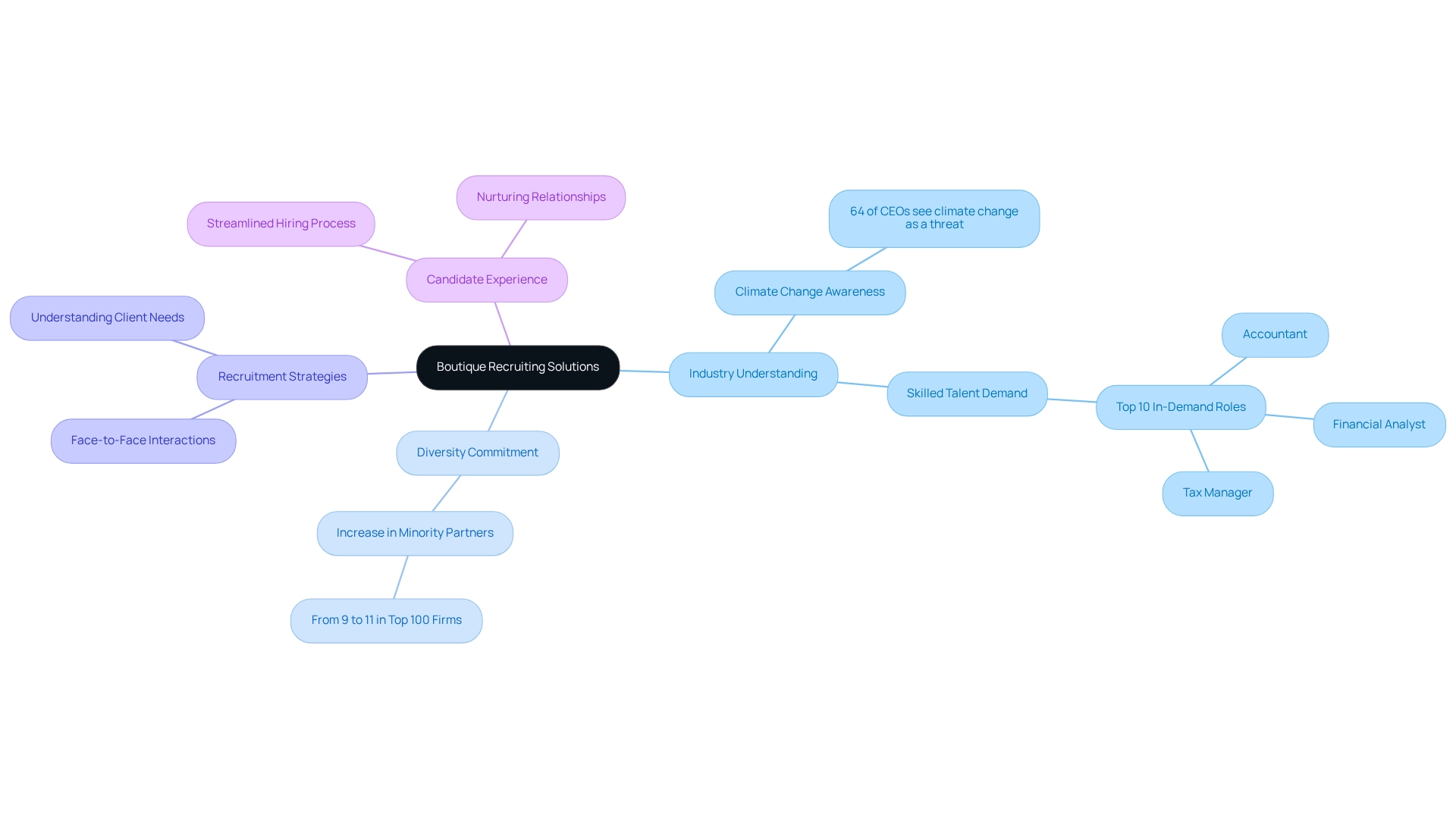

- Boutique Recruiting delivers tailored recruitment solutions for finance and accounting professionals, emphasizing the importance of cultural fit and qualifications.

- The demand for skilled finance and accounting roles, such as Accountant and Financial Analyst, is projected to remain strong through 2025.

- Key statistics reveal that 64% of CEOs see climate change as a growth threat, highlighting the need for adaptable finance professionals.

- The CPA designation is the gold standard in accounting, significantly enhancing career prospects and earning potential, with average salaries around $85,000 in 2025.

- The CMA certification focuses on fiscal management and strategic decision-making, with entry-level salaries projected between $80,000 and $95,000.

- The CIA credential is essential for internal auditors, ensuring compliance and effective management, with CIAs earning competitive salaries in 2025.

- Enrolled Agents (EAs) specialize in tax representation, with salaries ranging from $50,000 to $80,000, reflecting their expertise in navigating tax regulations.

- CFEs are crucial for combating fraud, with a high demand driven by significant financial losses from fraud, particularly in healthcare.

- CISA certification is vital for IT auditors, with rising demand in finance and IT sectors to safeguard financial information.

- CFP professionals are in demand for personal financial planning, with many earning over $100,000 annually as the job market strengthens.

- CPP certification enhances payroll management expertise, with a notable increase in job opportunities and salaries for certified professionals.

- CRMP certification is critical for managing financial risks, with organizations increasingly valuing experts in risk management strategies.

Introduction

In the fiercely competitive landscape of finance and accounting, the pursuit of top talent has never been more critical. Boutique Recruiting stands out as a key player, providing tailored recruitment solutions meticulously designed to meet the unique needs of both candidates and employers. By emphasizing personalized approaches, this firm guarantees that the right candidates not only hold the necessary qualifications but also integrate seamlessly into organizational culture. As the demand for skilled professionals continues to surge—particularly in pivotal roles such as Accountant and Financial Analyst—the significance of effective recruitment strategies becomes paramount.

This article will explore various certifications that can significantly enhance career prospects in finance, ranging from:

- Certified Public Accountants

- Certified Risk Management Professionals

Illuminating the pathways that lead to success in this dynamic industry.

Boutique Recruiting: Tailored Recruitment Solutions for Finance and Accounting Professionals

Boutique Recruiting stands out in the finance and accounting recruitment sector by delivering customized solutions that cater to the distinct needs of both candidates and employers. By thoroughly understanding industry demands and company culture, they ensure that candidates not only meet the required qualifications but also integrate seamlessly into the organizational framework. This tailored approach is crucial in a sector where the right match can profoundly influence team dynamics and overall business performance, especially as the demand for skilled finance and accounting certifications remains robust with roles such as Accountant, Financial Analyst, and Tax Manager ranking among the top 10% of sought-after positions as we approach 2025. Boutique Recruiting harnesses its extensive network and profound industry insights to effectively connect high-quality candidates with employers, streamlining the hiring process and enhancing the overall candidate experience. Eric Eddy aptly notes that the company’s ability to provide exceptional candidates promptly and effectively underscores their successful recruitment strategies.

Recent trends reveal that:

- 64% of CEOs recognize climate change as a significant threat to their growth opportunities, underscoring the necessity for adaptable and skilled individuals in finance.

- The percentage of minority partners in the top 100 firms has increased from 9% to 11%, reflecting a growing commitment to diversity within the industry.

This shift emphasizes the importance of inclusive hiring practices, which Boutique Recruiting actively champions in its recruitment strategies, particularly by focusing on candidates with finance and accounting certifications. By implementing effective recruitment strategies tailored to the finance sector—such as face-to-face interactions and a dedication to understanding unique client needs—Boutique Recruiting not only enhances hiring success rates but also nurtures enduring relationships between candidates and employers. This commitment to personalized service resonates with industry leaders, who highlight the importance of grasping the unique requirements of each role and organization. Insights from the ‘Demand for Skilled Talent Report’ by Robert Half identify common recruitment pitfalls and propose effective strategies for attracting and retaining top talent, reinforcing the value of Boutique Recruiting’s customized approach in navigating the complexities of finance and accounting recruitment.

Certified Public Accountant (CPA): A Cornerstone Certification for Accountants

The Certified Public Accountant (CPA) designation is widely regarded as the gold standard in the accounting profession, symbolizing a high level of expertise and a steadfast commitment to ethical standards. As we look towards 2025, the demand for CPAs in the U.S. remains robust, with employers actively seeking these professionals for their adeptness in navigating complex financial regulations and providing strategic insights. To acquire this esteemed qualification, candidates must conquer a rigorous exam and meet specific educational and experience requirements, underscoring the dedication necessary to attain this credential.

The CPA designation not only opens doors to a variety of career paths—including public accounting, corporate finance, and consulting—but also significantly boosts earning potential. In 2025, the average salary for CPAs in the finance industry hovers around $85,000, reflecting the intrinsic value of this credential, with many professionals earning well above the national average for accountants. Furthermore, the importance of CPA credentialing is evident in numerous employer case studies, which demonstrate that organizations prefer candidates with this designation when making hiring decisions.

For HR managers within financial institutions, grasping the importance of CPA certification is essential for effective recruitment strategies. The CPA credential signifies not only a candidate’s technical expertise but also their commitment to ethical practices, which is crucial for maintaining fiscal integrity. This relevance is particularly pronounced in today’s climate, where 64% of CEOs acknowledge that climate change poses a significant threat to growth opportunities, highlighting the need for professionals who can provide sound guidance. As Warren Buffett aptly stated, “Accounting is the language of business,” emphasizing the pivotal role that accounting plays in organizational success.

In summary, the CPA designation is more than just a credential; it is an invaluable asset for anyone serious about a career in finance and accounting certifications, as it presents numerous opportunities for growth and advancement in a competitive job market. HR managers should leverage the significance of CPA qualifications in their hiring processes, ensuring they attract top talent capable of navigating complex economic landscapes.

Certified Management Accountant (CMA): Elevate Your Financial Management Skills

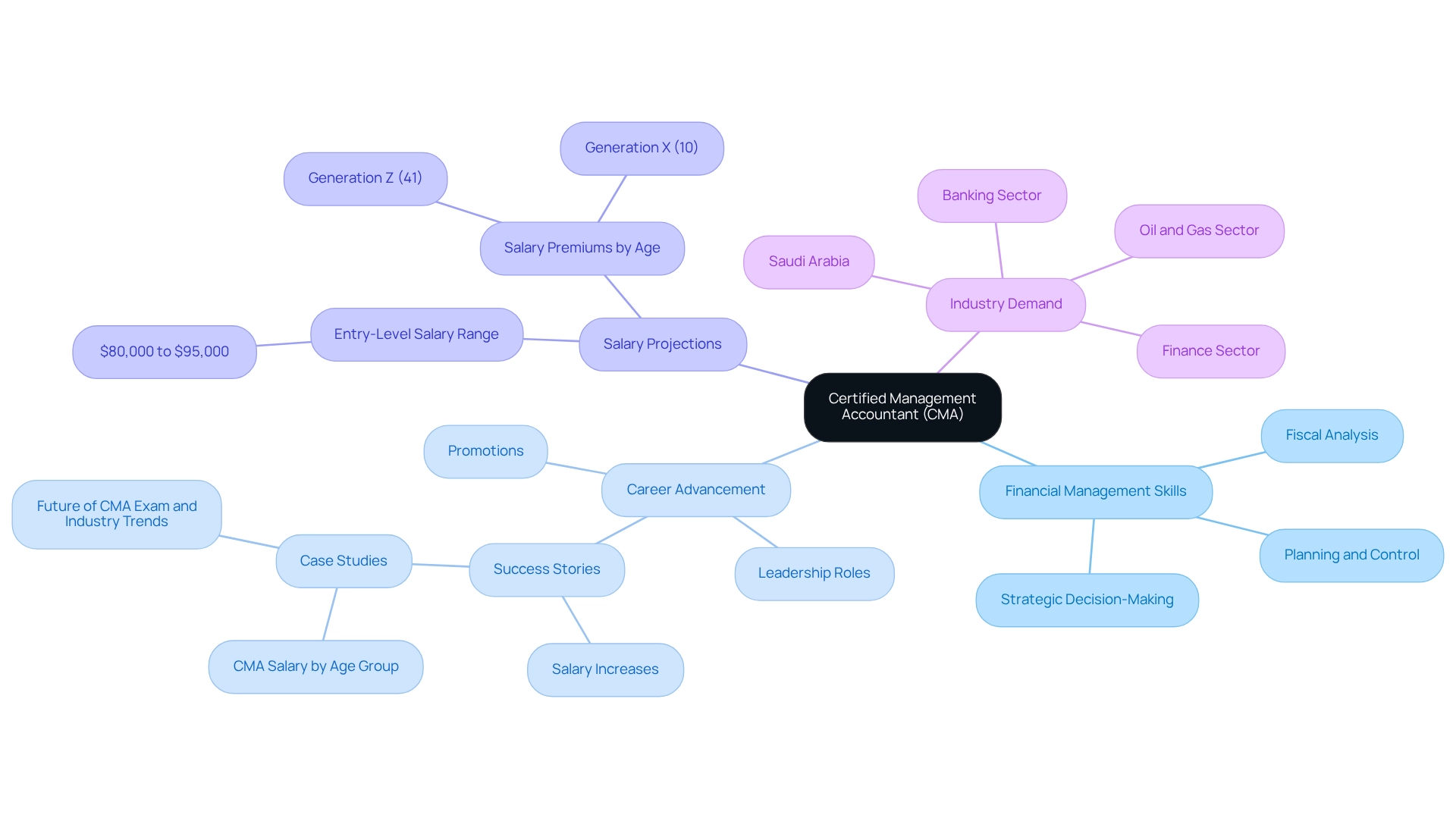

The Certified Management Accountant (CMA) certification is a pivotal credential among finance and accounting certifications for individuals aiming to excel in fiscal management and strategic decision-making. This qualification sharpens critical skills in fiscal analysis, planning, and control, rendering it particularly advantageous for those aspiring to leadership roles within organizations. CMAs possess the expertise to deliver insights that enhance business performance, and their proficiency is increasingly recognized as indispensable in today’s competitive landscape.

Pursuing a CMA can significantly propel an individual’s career trajectory. In 2025, the average salary for newly certified CMAs in entry-level positions is projected to range from $80,000 to $95,000 annually, excluding bonuses and additional incentives. This credential not only leads to immediate financial benefits but also opens avenues for advancement in management accounting, fiscal planning, and corporate strategy, highlighting the importance of finance and accounting certifications. The demand for Certified Management Accountants is on the rise, particularly in sectors such as finance, banking, and oil and gas, especially in regions like Saudi Arabia. As organizations seek professionals adept at navigating intricate financial landscapes, the relevance of finance and accounting certifications, including the CMA qualification, becomes increasingly pronounced. Moreover, industry trends indicate that younger CMAs, notably those from Generation Z, command a substantial salary premium, underscoring the qualification’s role in enhancing career prospects.

Numerous success stories abound, with many CMAs ascending into leadership positions, underscoring the qualification’s impact on professional development. For instance, case studies reveal that CMAs who attain their certification frequently experience significant salary increases and promotions within their organizations, highlighting the direct influence of the CMA on career advancement. The CMA exam is continuously updated to reflect the dynamic nature of management accounting, emphasizing strategic planning, ethical leadership, and emerging technologies. This adaptability not only enhances career opportunities but also reinforces the importance of finance and accounting certifications, such as the CMA, in financial management roles.

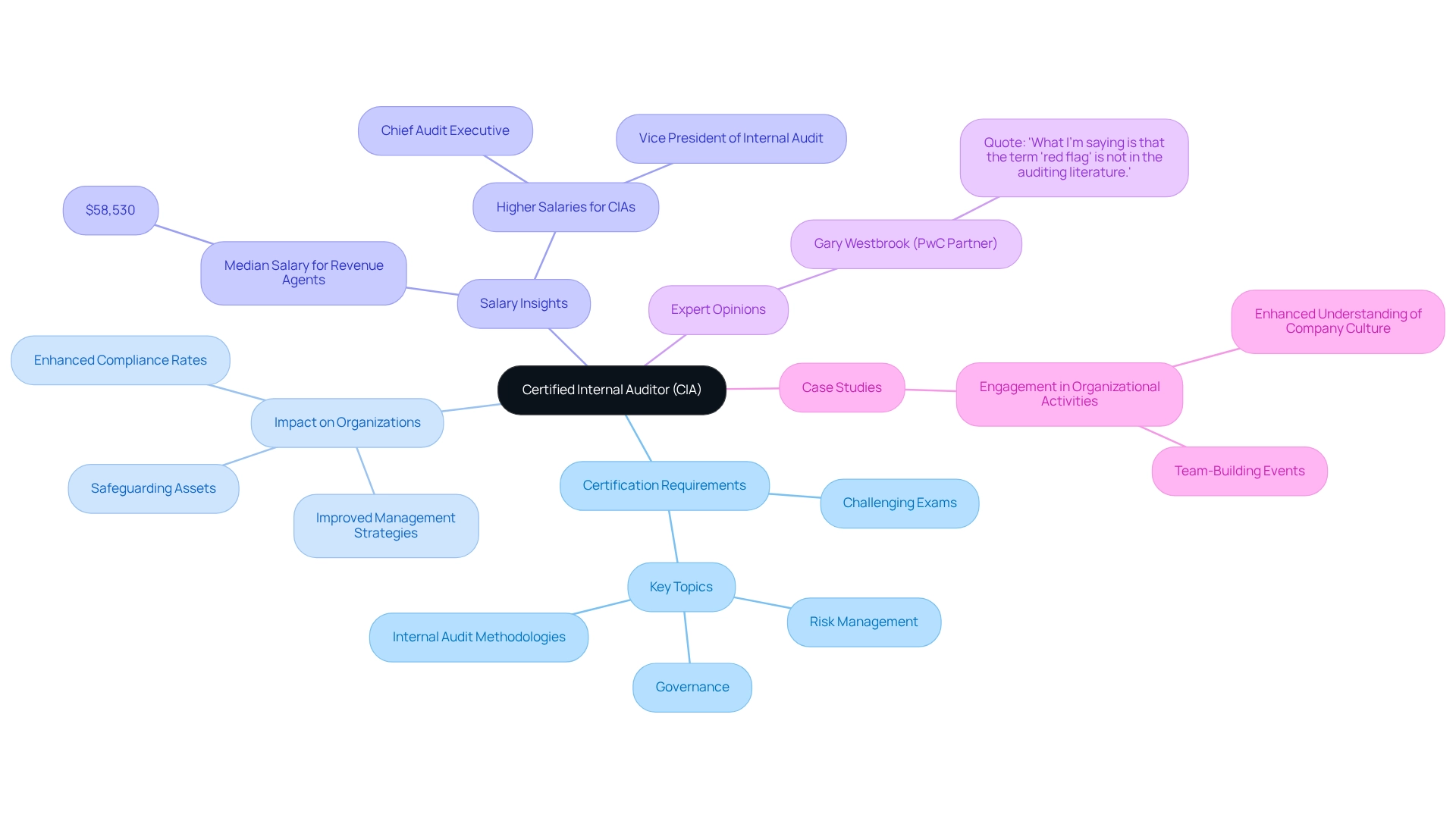

Certified Internal Auditor (CIA): Essential for Internal Audit Professionals

The Certified Internal Auditor (CIA) designation stands as the singular internationally recognized credential specifically for internal auditors, signifying a professional’s expertise in overseeing and evaluating an organization’s internal controls and management processes. To secure this credential, candidates must adeptly navigate a series of challenging exams that encompass crucial topics such as governance, risk management, and internal audit methodologies.

As we approach 2025, the significance of the CIA credential has escalated, particularly in sectors where compliance and effective management of challenges are paramount. CIAs play a pivotal role in safeguarding organizational assets and ensuring adherence to regulatory standards. Organizations employing CIAs have reported enhanced compliance rates and improved management strategies, illustrating the tangible benefits of this credential.

Current job market data indicates that Certified Internal Auditors command competitive salaries, with average earnings for CIAs varying across different industries. In 2025, CIAs with finance and accounting certifications in finance and accounting positions can anticipate earning considerably more than their non-certified peers, reflecting the high demand for their specialized expertise. For instance, while the median salary for revenue agents hovers around $58,530, CIAs frequently secure salaries that are significantly higher, especially in senior roles such as Chief Audit Executive or Vice President of Internal Audit.

Expert insights further underscore the critical nature of the CIA certification in internal auditing. CIAs not only facilitate organizational compliance but also play an essential role in managing uncertainties, aiding businesses in navigating intricate regulatory environments. As Gary Westbrook, a partner at PwC, articulates, “What I’m saying is that the term ‘red flag’ is not in the auditing literature. That’s not something we use to describe any issue,” emphasizing the nuanced comprehension CIAs must possess in their roles. Their capacity to evaluate and enhance internal controls is vital in today’s dynamic business landscape, where the stakes for compliance and risk mitigation are at an all-time high.

Moreover, case studies illustrate the efficacy of CIA-certified professionals in driving internal audit success. Actively participating in organizational initiatives, such as team-building events, has proven advantageous for CIAs, enabling them to cultivate relationships and gain deeper insights into company culture, ultimately bolstering their audit effectiveness. This engagement not only enriches their understanding of the workplace but also fortifies their capability to conduct comprehensive audits.

In conclusion, the CIA qualification transcends mere certification; it represents a crucial asset for internal auditors aspiring to excel in their careers and contribute significantly to their organizations.

Enrolled Agent (EA): Specialize in Taxation and Representation

Enrolled Agents (EAs) are distinguished tax experts authorized to represent taxpayers before the Internal Revenue Service (IRS). This certification is particularly advantageous for those focusing on taxation, as EAs must pass a rigorous examination that tests their knowledge across a broad spectrum of tax-related topics. EAs offer a comprehensive suite of services, including tax preparation, strategic planning, and representation during audits. Their specialized status empowers them to advocate effectively for clients in disputes with the IRS, underscoring their critical role in tax compliance and representation.

In 2025, EAs are witnessing a notable increase in demand, driven by their unique expertise in navigating complex tax regulations. Many EAs appreciate the flexibility of remote work, particularly those who run their own practices, enabling them to balance work and personal commitments effectively. This adaptability is becoming increasingly attractive in today’s job market, contributing to the rising demand for EAs.

The average earnings of EAs are competitive compared to other tax experts. For instance, EAs typically earn between $50,000 and $80,000 annually, depending on their experience and client base, which is often higher than many CPAs who may earn between $45,000 and $75,000. This reflects the specialized skills EAs possess and the value they bring to clients, as they often command higher fees for their services due to their in-depth knowledge of tax law and their ability to represent clients in front of the IRS.

Case studies illustrate the effectiveness of EAs in tax representation. For example, a client facing an IRS audit reported that having an EA advocate resulted in a significant reduction in owed taxes and a more favorable resolution of the audit, alleviating stress during the process. Success stories abound, showcasing EAs’ proficiency in tax compliance and planning, which is essential for individuals and businesses aiming to optimize their tax situations.

Recent developments in Enrolled Agent qualifications emphasize the importance of ongoing education, with EAs required to complete 16 hours of continuing education annually, including two hours focused on ethics. This dedication to career development ensures that EAs stay at the forefront of tax law changes and best practices, including finance and accounting certifications, further reinforcing their significance in the financial landscape. As Gary Massey, a CPA, notes, “We know the tax issues. We know our way around the IRS. We know QuickBooks. And we know how to help you save taxes and keep more of your hard-earned profits,” highlighting the unique strengths of EAs in comparison to CPAs. Moreover, current trends in taxation, such as the increasing complexity of tax laws and the growing emphasis on compliance, further highlight the significance of EA qualifications for tax experts.

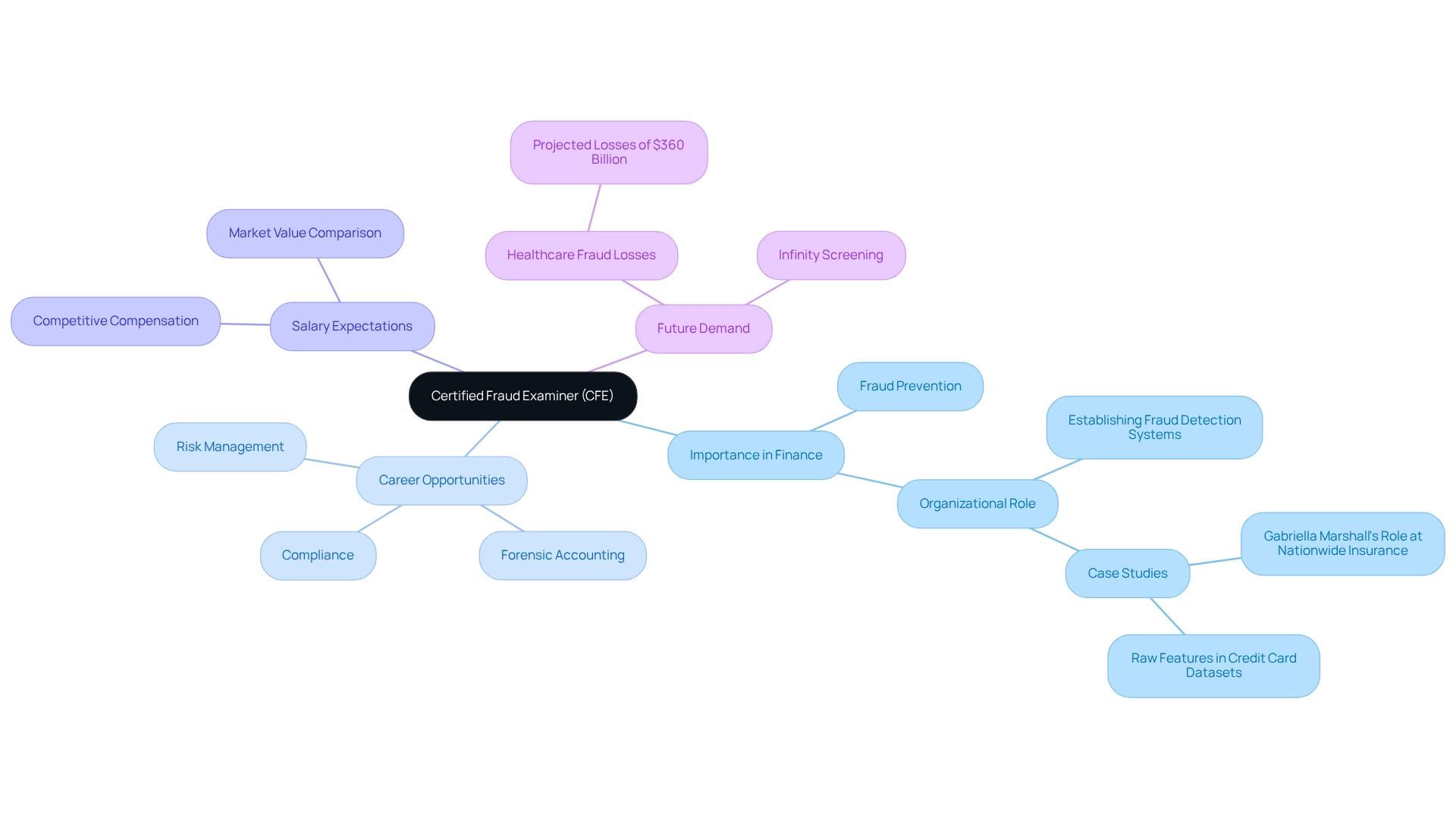

Certified Fraud Examiner (CFE): Combat Fraud in Finance

The Certified Fraud Examiner (CFE) credential stands as a cornerstone for individuals committed to combating fraud across various industries, particularly in finance. CFEs are expertly trained to detect and prevent fraudulent activities, rendering them invaluable assets for organizations striving to protect their assets and uphold their reputations. To attain the CFE designation, candidates must demonstrate their expertise in fraud prevention, detection, and investigation through a rigorous examination process. This credential not only bolsters an individual’s credibility but also unlocks numerous career opportunities in forensic accounting, compliance, and risk management.

In 2025, the demand for CFEs is underscored by alarming statistics, with projections indicating that healthcare fraud losses alone could escalate to $360 billion. This staggering figure underscores the pressing need for skilled professionals equipped to address fraud effectively. Real-world examples further illustrate the impact of CFEs within the finance sector; for instance, Gabriella Marshall, a major case consultant at Nationwide Insurance, utilizes her expertise as a Certified Fraud Examiner to navigate complex cases, exemplifying the critical role CFEs play in the insurance industry.

The significance of CFE certification transcends individual career advancement; it serves as a vital element in the broader fight against fraud. As organizations increasingly prioritize theft prevention, the role of CFEs becomes even more pronounced. Current perspectives emphasize that CFEs are essential in establishing robust fraud detection systems, particularly through the analysis of raw features in credit card transaction datasets, which adhere to standardized reporting regulations. Moreover, the concept of infinity screening emerges as crucial for effective theft prevention in organizations, further highlighting the necessity of CFEs in this arena.

With an average salary that reflects their expertise and the high demand for their skills, CFEs can anticipate competitive compensation across various sectors in 2025. For instance, CFEs frequently earn salaries that significantly surpass those of other finance roles, reinforcing their market value. This combination of credibility, career opportunities, and the urgent need for fraud prevention solidifies the CFE credential as a vital component of finance and accounting certifications for individuals aspiring to excel in the finance industry. Consequently, pursuing the CFE credential not only enhances personal career prospects but also contributes to the overall integrity and security of monetary operations.

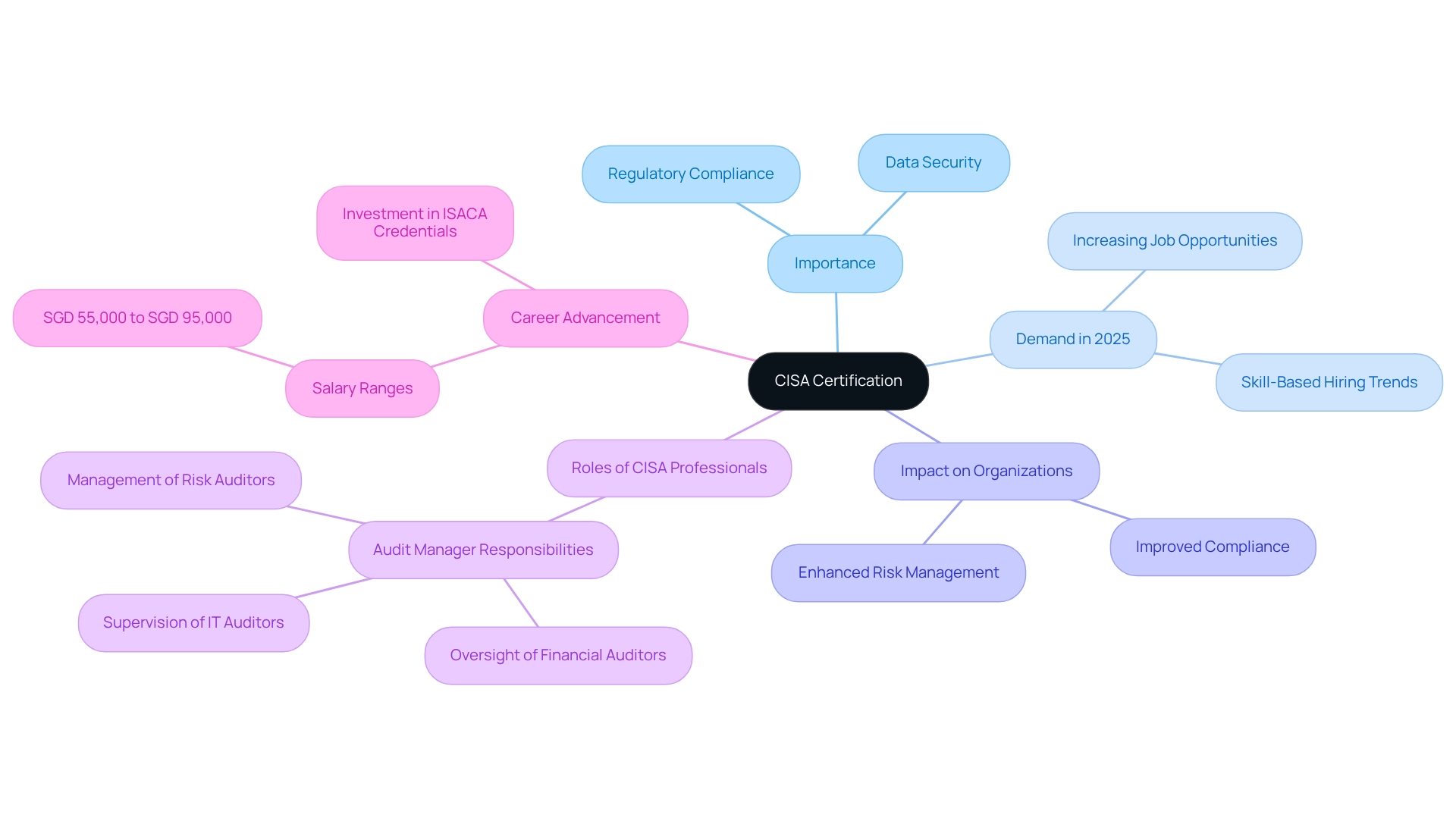

Certified Information Systems Auditor (CISA): Bridge Finance and IT Security

The Certified Information Systems Auditor (CISA) certification is indispensable for professionals responsible for auditing, controlling, and monitoring an organization’s information technology and business systems. In an era where monetary data security is paramount, this credential is particularly significant. Candidates aspiring to earn the CISA designation must pass a rigorous exam that assesses their proficiency in information systems auditing, governance, and risk management.

Experts certified in CISA and other finance and accounting certifications are increasingly sought after in the finance and IT sectors, playing a critical role in safeguarding the integrity and security of financial information. The current landscape underscores a rising demand for these specialists, especially in 2025, as organizations confront escalating threats to data security.

Consider the tangible impact of CISA experts in fortifying data security measures. Organizations employing CISA-certified auditors have reported not only enhanced compliance with regulatory standards but also improved risk management practices. In Singapore, the average salary for CISA specialists in finance and IT is projected to range from SGD 55,000 to SGD 95,000, reflecting the high value attributed to these skills.

Furthermore, the shift towards skill-based hiring highlights the significance of certifications like CISA, as companies increasingly prioritize candidates with demonstrated expertise in information systems auditing. This trend addresses the challenges of attracting skilled professionals while aligning with the sector’s growing need for experts adept at navigating the complexities of data security.

As Jacob Fox, an expert technology writer, notes, “An Audit Manager supervises the activities of IT Auditors, Financial Auditors, Risk Auditors, and other auditors in an organization.” This statement reinforces the crucial role that CISA experts occupy within organizational structures, ensuring the secure and efficient handling of financial data.

In conclusion, the CISA qualification transcends mere certification; it is a vital asset for career advancement in finance and accounting certifications, as it validates the capabilities of professionals in managing privacy regulations and ensuring data security. Investing in ISACA credentials, including CISA, alongside finance and accounting certifications, is not just beneficial for career growth; it is a strategic investment for those seeking to enhance their career prospects in these fields. As the landscape evolves, the importance of CISA credentials will undoubtedly continue to increase.

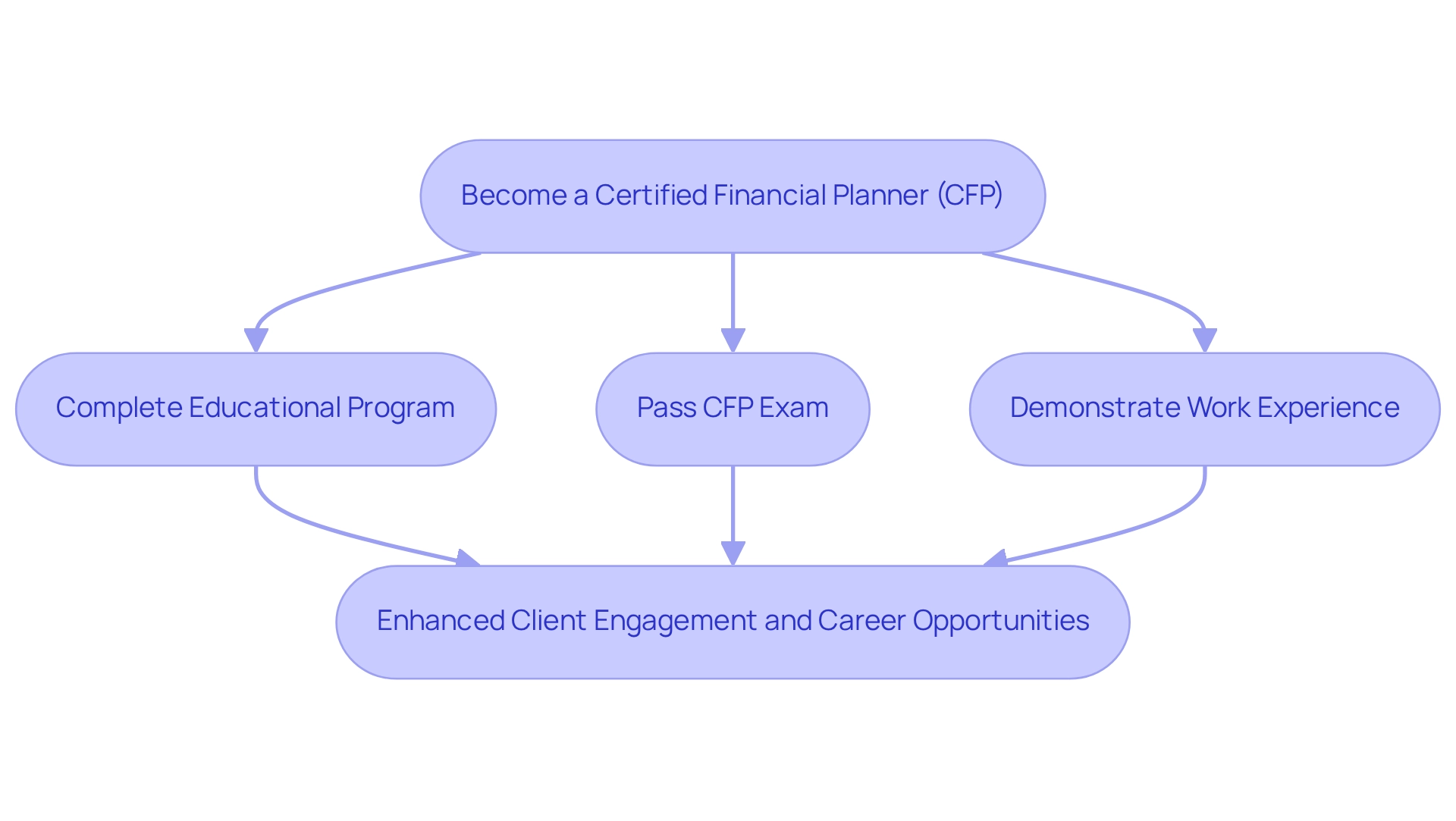

Certified Financial Planner (CFP): Master Personal Financial Planning

The Certified Financial Planner (CFP) designation is a hallmark of excellence for financial advisors who aim to showcase their proficiency in finance and accounting certifications related to personal financial planning. Achieving this prestigious finance and accounting certification requires candidates to undergo a rigorous educational program, successfully pass the CFP exam—which assesses knowledge in critical areas such as tax planning, retirement strategies, and investment management—and demonstrate relevant work experience. This comprehensive training not only strengthens an individual’s credibility but also significantly improves their ability to attract and retain clients in an increasingly competitive market.

In 2025, the demand for Certified Financial Planners is on the rise, fueled by a growing acknowledgment of the worth they provide to clients seeking personalized monetary guidance. This trend is further supported by the national unemployment rate, which has decreased to a 53-year low of 3.4%. This indicates a strong job market that benefits skilled workers. The typical salary for CFPs in the advisory sector reflects this trend, with many professionals earning over $100,000 each year, highlighting the lucrative potential of this career path, and finance and accounting certifications, including the CFP certification, are pivotal in fostering strong client relationships. Advisors equipped with this credential are better positioned to understand and address their clients’ unique monetary needs, leading to improved satisfaction and loyalty. As industry experts note, investing in a CFP educational program, which can range from $3,000 to nearly $10,000, yields substantial returns in terms of client acquisition and retention.

Real-world examples demonstrate the success of CFPs in personal money management. Advisors with the CFP designation have reported enhanced client engagement and trust, resulting in a robust client base and increased referrals. This trend emphasizes the significance of the CFP credential not only as a career milestone but also as a strategic benefit in the evolving landscape of advisory services. The increase in CFP qualifications reflects a broader trend towards professionalism in financial advising, reinforcing its importance in the current market.

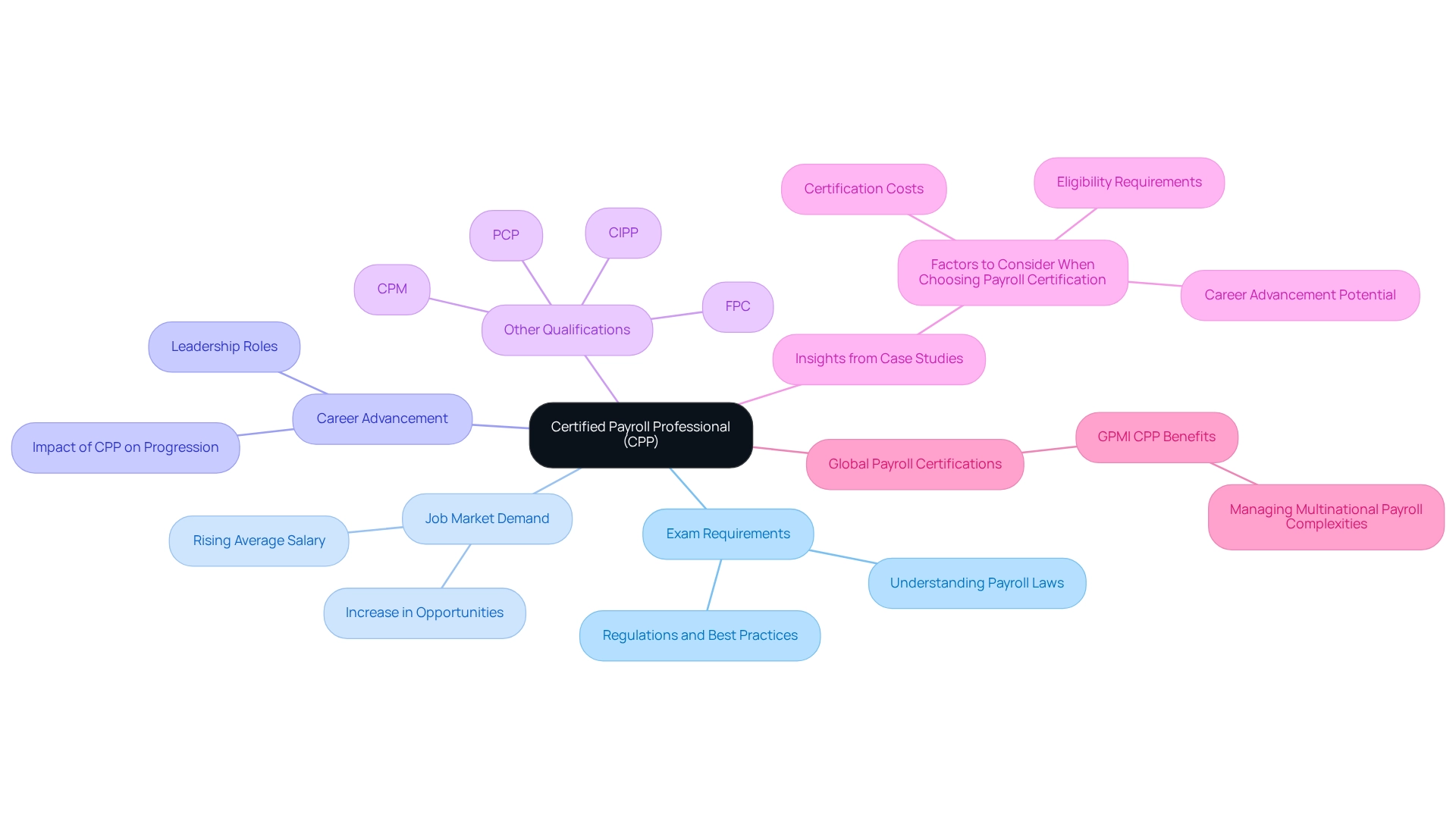

Certified Payroll Professional (CPP): Expertise in Payroll Management

The Certified Payroll Professional (CPP) designation stands as a vital credential for payroll experts, showcasing their proficiency in payroll management and compliance. To attain this credential, individuals must successfully navigate an exam that assesses their grasp of payroll laws, regulations, and best practices. CPPs are instrumental in guaranteeing accurate payroll processing, tax compliance, and the management of employee benefits.

As we approach 2025, the demand for Certified Payroll Professionals continues to surge, with current job market statistics indicating a significant increase in opportunities for those holding this credential. The average salary for CPPs in payroll management is also on the rise, reflecting the high regard for their expertise. This credential not only bolsters an individual’s credibility but also paves the way for career advancement in human resources and payroll management.

In addition to the CPP, other prominent qualifications for payroll managers include the FPC, CPM, PCP, and CIPP. Understanding these options can empower individuals to make informed decisions regarding their career trajectories. Real-world examples illustrate the impact of CPP accreditation on career progression. Professionals armed with this credential frequently ascend to leadership roles, spearheading payroll compliance initiatives and enhancing organizational efficiency. Furthermore, Christina, President of Valor Payroll Solutions, notes that “Global Payroll Certifications, such as the GPMI CPP, provide distinct benefits, equipping individuals to manage multinational payroll complexities.”

Moreover, insights from the case study titled “Factors to Consider When Choosing Payroll Accreditation” underscore critical aspects such as accreditation costs, eligibility requirements, and career advancement opportunities that individuals should weigh when selecting a payroll accreditation. This information aids individuals in determining which qualification best aligns with their career goals and financial situations.

As payroll management evolves, remaining informed about current trends and best practices is imperative. The CPP credential equips individuals with the knowledge necessary to adapt to these changes, ensuring they remain competitive in the job market. Ultimately, the CPP qualification is not merely a testament to expertise; it is a strategic asset for career advancement in the dynamic realm of payroll management.

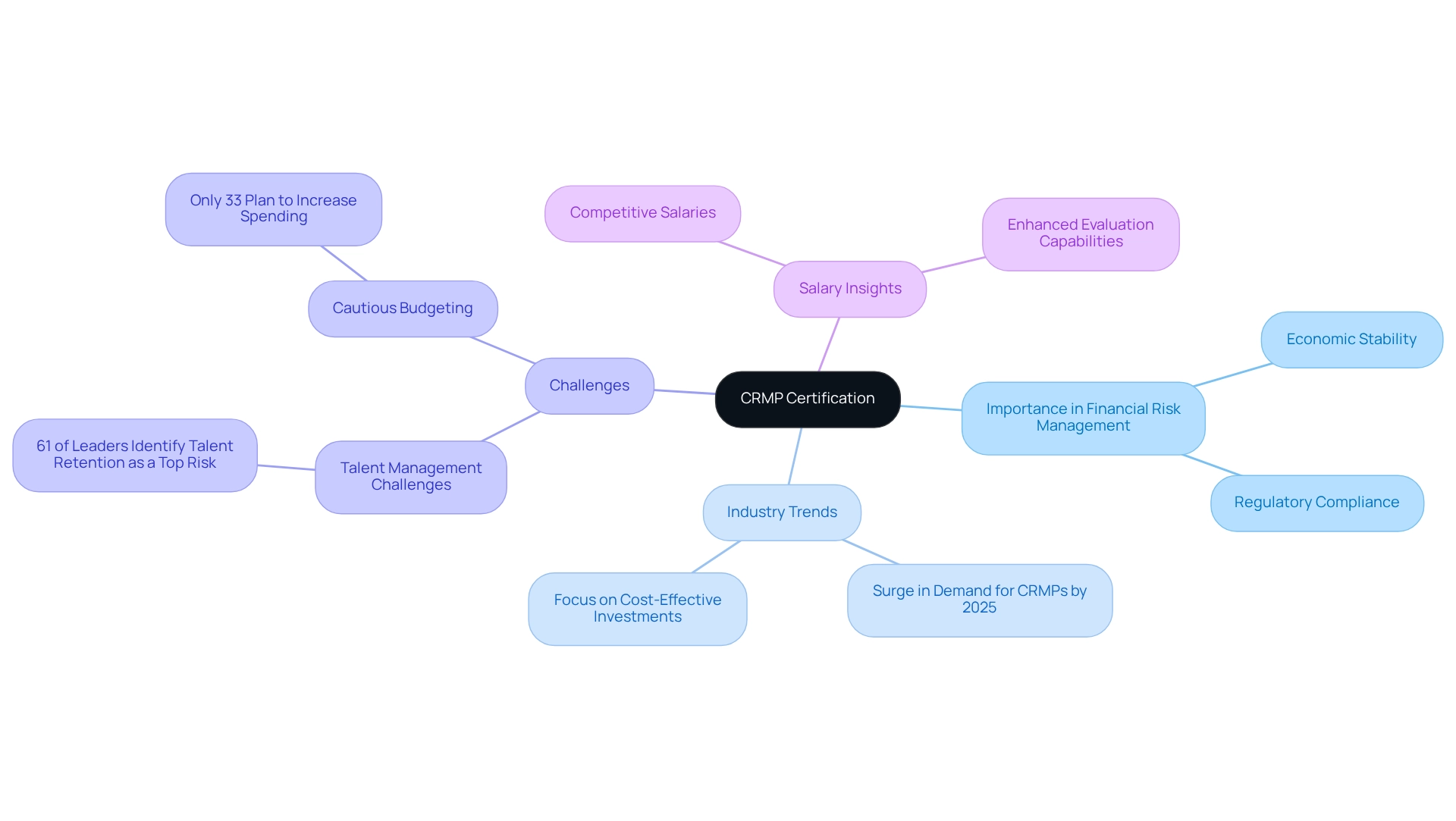

Certified Risk Management Professional (CRMP): Navigate Financial Risks Effectively

The Certified Risk Management Professional (CRMP) certification stands as a vital credential for individuals dedicated to identifying and managing uncertainties within organizations, particularly in the context of finance and accounting certifications, where the effective management of threats is paramount for ensuring economic stability and regulatory compliance. To obtain the CRMP designation, candidates must exhibit their expertise in management principles related to uncertainty through a rigorous examination process.

CRMP-certified professionals are instrumental in developing and implementing management strategies that shield organizations from potential financial losses while enhancing decision-making processes. As the demand for adept management specialists is projected to surge in 2025, organizations increasingly recognize the value of CRMPs in navigating intricate economic landscapes.

Current trends indicate that managing uncertainties is a foremost priority, with 61% of leaders acknowledging ‘attracting and retaining talent’ as a significant challenge anticipated for 2034. This underscores the urgent need for skilled experts capable of adeptly managing financial uncertainties. Furthermore, John G. Stumpf emphasizes that excellence in managing uncertainties and credit quality is essential for success in the services sector, thereby highlighting the importance of the CRMP certification.

The average salary for CRMPs across various industries reflects their significance, with competitive compensation packages being offered to attract top talent. Organizations that have integrated CRMP-accredited experts into their teams report enhanced evaluation capabilities and robust financial strategies. The PwC Pulse Survey reveals that only 33% of leaders in the field plan to increase their total expenditures in the coming year, indicating a cautious approach to budgeting that accentuates the necessity for effective management of uncertainties. As the finance sector continues to evolve, the importance of finance and accounting certifications, particularly the CRMP certification, in shaping effective risk management strategies cannot be overstated, rendering it a critical credential for professionals aspiring to excel in this domain.

Conclusion

The finance and accounting sectors are increasingly competitive, underscoring the necessity for effective recruitment strategies. Boutique Recruiting distinguishes itself by delivering personalized solutions that align candidates’ qualifications with organizational culture, ensuring successful placements that enhance team dynamics.

Key certifications significantly boost career prospects within this field. The Certified Public Accountant (CPA) designation is essential for accountants, providing credibility and diverse opportunities. The Certified Management Accountant (CMA) equips professionals with vital financial management skills, while the Certified Internal Auditor (CIA) emphasizes compliance and risk management.

Furthermore, the Enrolled Agent (EA) certification specializes in taxation, and the Certified Fraud Examiner (CFE) addresses the growing need for fraud prevention. The Certified Information Systems Auditor (CISA) connects finance with IT security, while the Certified Financial Planner (CFP) underscores the importance of personal financial planning. The Certified Payroll Professional (CPP) and Certified Risk Management Professional (CRMP) reflect the evolving demands in payroll and risk assessment.

In conclusion, pursuing these certifications not only enhances individual careers but also fortifies the overall integrity and effectiveness of financial operations. As the industry continues to evolve, focusing on specialized skills and certifications will be crucial for professionals seeking success in this dynamic landscape. Embracing these opportunities is essential for achieving personal and organizational goals in finance and accounting.

Frequently Asked Questions

What distinguishes Boutique Recruiting in the finance and accounting recruitment sector?

Boutique Recruiting stands out by delivering customized solutions tailored to the unique needs of candidates and employers, ensuring that candidates not only meet qualifications but also fit well within the company culture.

Why is a tailored recruitment approach important in finance and accounting?

A tailored approach is crucial because the right match can significantly influence team dynamics and overall business performance, especially in a sector with a high demand for skilled professionals.

What are some of the top positions in demand within finance and accounting as we approach 2025?

Some of the top sought-after positions include Accountant, Financial Analyst, and Tax Manager.

How does Boutique Recruiting connect candidates with employers?

Boutique Recruiting utilizes its extensive network and industry insights to effectively connect high-quality candidates with employers, streamlining the hiring process and enhancing the candidate experience.

What recent trends have been observed in the finance and accounting sector?

Recent trends indicate that 64% of CEOs view climate change as a significant threat to growth opportunities, and the percentage of minority partners in top firms has increased from 9% to 11%, highlighting a commitment to diversity.

How does Boutique Recruiting promote diversity in its recruitment strategies?

Boutique Recruiting actively champions inclusive hiring practices by focusing on candidates with finance and accounting certifications, ensuring a diverse candidate pool.

What role does the CPA designation play in the finance profession?

The CPA designation is regarded as the gold standard in accounting, representing a high level of expertise and ethical standards, and is highly sought after by employers.

What are the educational and experience requirements for obtaining a CPA?

Candidates must pass a rigorous exam and meet specific educational and experience requirements to acquire the CPA credential.

What is the average salary for CPAs in the finance industry in 2025?

The average salary for CPAs in the finance industry is projected to be around $85,000.

What is the significance of the CMA certification in finance and accounting?

The CMA certification is pivotal for those aspiring to excel in fiscal management and strategic decision-making, enhancing skills in fiscal analysis, planning, and control.

What is the projected salary range for newly certified CMAs in entry-level positions in 2025?

The projected salary range for newly certified CMAs in entry-level positions is between $80,000 and $95,000 annually.

How does the CMA certification impact career advancement?

The CMA certification often leads to significant salary increases and promotions, with many CMAs advancing into leadership roles within their organizations.