Overview

To ascend to the role of director of accounting and finance, individuals typically must secure a bachelor’s degree in accounting or finance, coupled with 7-10 years of pertinent experience. Furthermore, the development of critical skills—such as leadership and analytical abilities—is essential. This article underscores the importance of:

- A solid educational foundation

- Relevant professional certifications

- Strategic networking approaches that significantly bolster a candidate’s qualifications and opportunities within this competitive landscape

By understanding these prerequisites, aspiring directors can effectively position themselves for success.

Key Highlights:

- A bachelor’s degree in accounting, finance, or a related field is typically required, with many employers preferring candidates with a master’s degree or MBA.

- Key skills for a director of accounting and finance include analytical skills, leadership, communication, technical proficiency, and compliance knowledge.

- Professional certifications like CPA or CFA enhance qualifications and demonstrate commitment to the field.

- Aspiring directors should gain 7-10 years of relevant experience across various roles such as staff accountant, financial analyst, and accounting manager.

- Networking is crucial; attending industry events, leveraging LinkedIn, and joining professional associations can enhance career connections.

- Continuous education, including advanced degrees and certifications, is vital for maintaining a competitive edge in the financial sector.

- Strategic job applications involve tailoring resumes, crafting compelling cover letters, leveraging networks, and preparing thoroughly for interviews.

- Following up after interviews with thank-you notes can reinforce interest and leave a positive impression on hiring managers.

Introduction

In the competitive landscape of accounting and finance, aspiring directors face a complex journey that intricately weaves together education, experience, and strategic networking. With the demand for skilled professionals projected to rise, it is imperative to understand the essential qualifications, gain relevant experience, and build a robust professional network. Each of these steps is crucial in achieving this coveted role.

Consider the impact of:

- Acquiring advanced degrees and certifications

- Engaging actively in industry events

- Leveraging platforms like LinkedIn

These elements play pivotal roles in shaping a successful career trajectory. As candidates embark on this path, they must also remain adaptable and committed to continuous learning. This commitment ensures they are well-equipped to meet the evolving challenges of financial leadership.

This article delves into the key strategies that can empower individuals to secure director positions in accounting and finance, providing a roadmap to success in this dynamic field. Are you ready to take the first step toward your future in financial leadership?

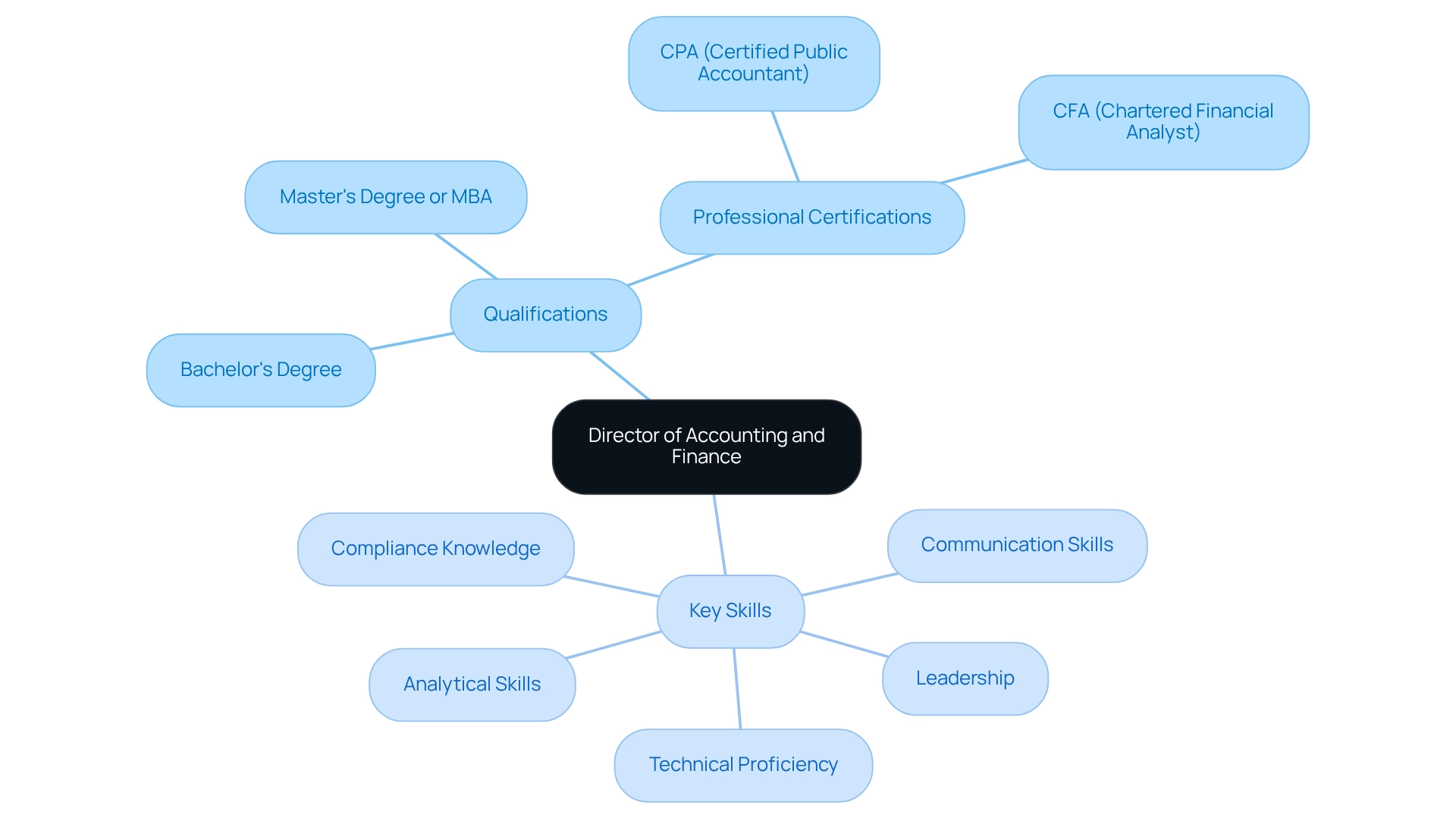

Identify Essential Skills and Qualifications

To become the director of accounting and finance, a robust educational background coupled with a diverse skill set is essential. Typically, a bachelor’s degree in accounting, finance, or a related field is required; however, many employers—approximately 23%—prefer candidates possessing a master’s degree or an MBA, as these qualifications substantially enhance marketability in a competitive job landscape. Notably, 23% of accountants and auditors are employed in accounting, tax preparation, bookkeeping, and payroll services, underscoring the competitive nature of these positions.

Key skills indispensable for this role encompass:

- Analytical Skills: The capacity to interpret complex financial data and make strategic decisions is paramount.

- Leadership: Proven experience in managing teams and projects efficiently is crucial for the director of accounting and finance to direct monetary operations.

- Communication Skills: Strong verbal and written communication skills are necessary for the director of accounting and finance to clearly convey intricate monetary information to stakeholders.

- Technical Proficiency: Technical proficiency in financial software and tools, such as ERP systems, is vital for efficient financial management as a director of accounting and finance.

- Compliance Knowledge: A solid understanding of compliance and regulatory requirements in finance is critical for the director of accounting and finance to ensure adherence to laws and standards.

Furthermore, obtaining professional certifications such as CPA (Certified Public Accountant) or CFA (Chartered Financial Analyst) can significantly enhance qualifications and demonstrate a commitment to excellence in the field. As Michael Carter aptly stated, “To be a CPA is to be a keeper of monetary wisdom,” emphasizing the value of these certifications. These credentials are increasingly important as firms adapt to evolving work cultures and seek candidates capable of driving productivity and innovation in their financial practices.

Boutique Recruiting specializes in targeted recruitment services for accounting positions, encompassing titles such as CAO, Controller, Sr. Accountant, Staff Accountant, Accounts Payable Clerk, and Accounts Receivable Clerk. The trend of increasing temporary staffing, as highlighted in recent studies, indicates that businesses are in search of adaptable leaders who can navigate changing workforce dynamics. Boutique Recruiting is dedicated to connecting qualified candidates with these high-demand positions, ensuring that both candidates and companies achieve the optimal match.

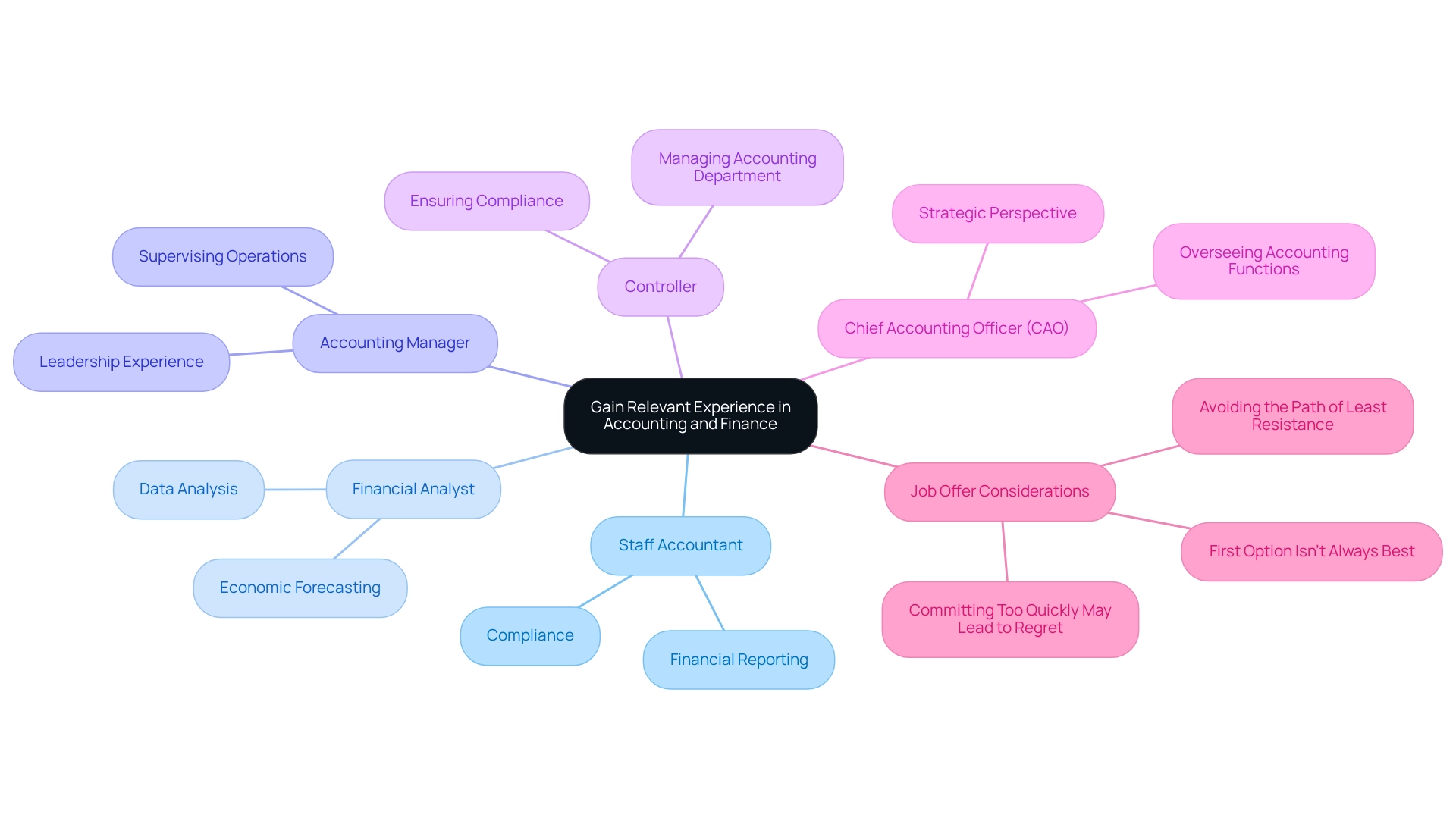

Gain Relevant Experience in Accounting and Finance

To establish a robust foundation for the director of accounting and finance position, it is essential to pursue roles that offer practical, hands-on experience. Beginning with entry-level positions can effectively set the stage for future advancement. Consider the following roles:

- Staff Accountant: This role provides invaluable experience in financial reporting and compliance, crucial for grasping the financial landscape.

- Financial Analyst: Here, you will develop essential skills in data analysis and economic forecasting, both vital for strategic decision-making.

- Accounting Manager: In this capacity, you will supervise accounting operations and lead a team, offering leadership experience critical for a director role.

- Controller: This position involves managing the accounting department and ensuring compliance with monetary regulations, a necessity for aspiring directors.

- Chief Accounting Officer (CAO): As a CAO, you will oversee all accounting functions, delivering a strategic perspective that is invaluable for a director.

Aspiring directors should aim to accumulate at least 7-10 years of relevant experience, progressively embracing greater responsibilities. It is advantageous to work across various sectors, including public accounting firms, corporate finance departments, and financial consulting firms, to diversify your expertise. This varied experience not only enhances your skill set but also prepares you for the complexities of a director’s responsibilities, which include overseeing fiscal statements, managing budgets, and leading audits.

As candidates evaluate job offers, it is crucial to explore all available options and consider how each opportunity aligns with their long-term career goals. The initial job offer may seem attractive, but without assessing it against other potential positions, candidates might overlook superior opportunities that provide advancement, benefits, and alignment with their values. Keep in mind the three key considerations when evaluating job offers:

- The first option isn’t always the best;

- Don’t fall into the trap of taking the road of least resistance;

- Committing too quickly to a job offer may lead to regret.

With the demand for skilled professionals in this field expected to increase by 6% from 2023 to 2033, possessing a well-rounded background will place you advantageously in a competitive job market. As Eric Eddy notes, “Boutique Recruiting’s ability to deliver top-notch candidates quickly and efficiently underscores the importance of having the right support in navigating these career paths.” Furthermore, the evolving role of the director of accounting and finance highlights the increasing complexity of responsibilities, reinforcing the necessity of relevant experience.

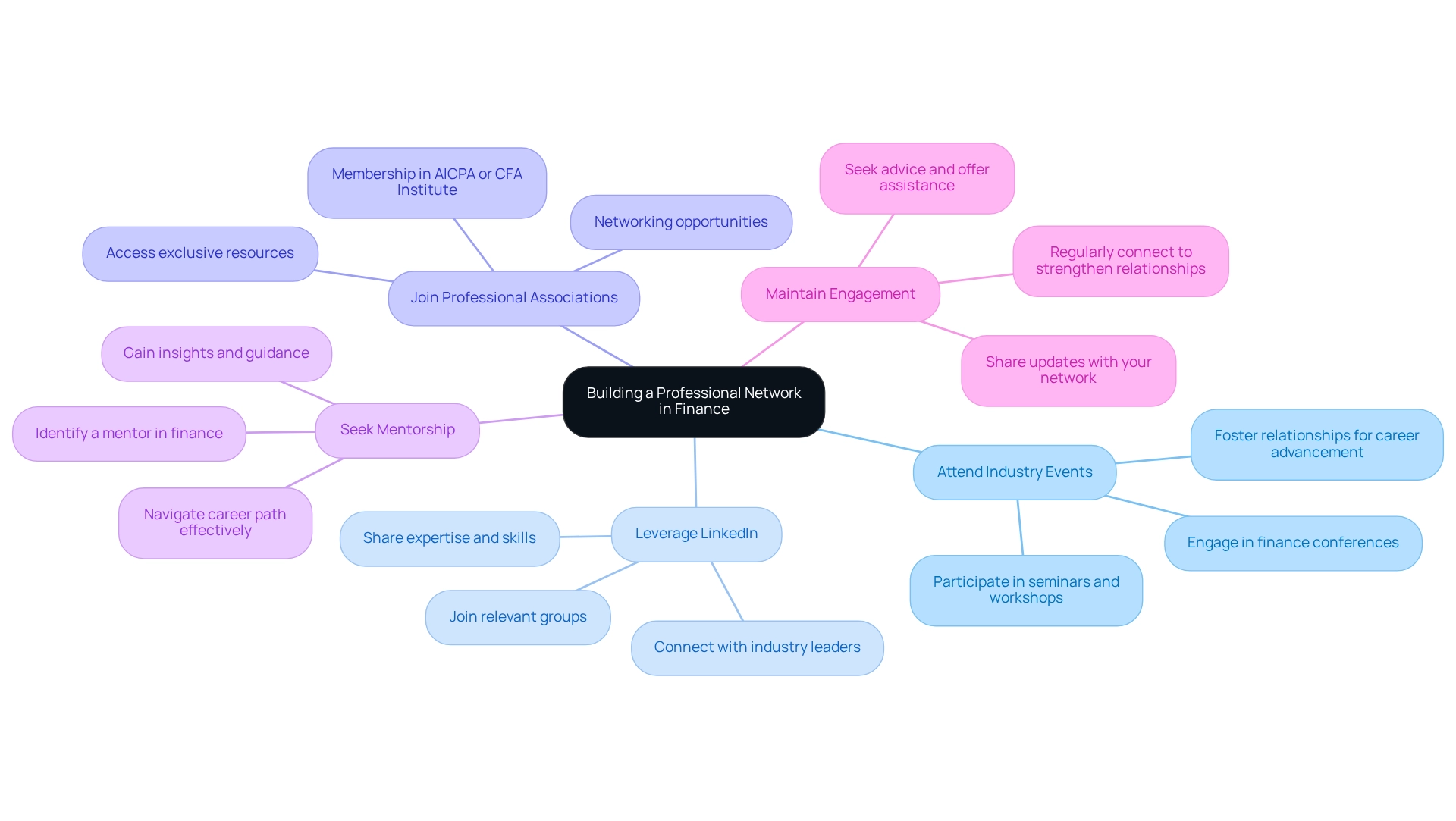

Build a Professional Network in the Financial Sector

Establishing a strong career network is crucial for aspiring directors of accounting and finance in economic management. Did you know that one in four individuals doesn’t network at all? This statistic underscores the importance of proactive involvement in developing your career connections. Here are effective strategies to enhance your networking efforts:

- Attend Industry Events: Engage in finance conferences, seminars, and workshops to connect with professionals and expand your industry knowledge. These events not only provide valuable insights but also foster relationships that can lead to career advancement.

- Leverage LinkedIn: Utilize LinkedIn to connect with industry leaders, join relevant groups, and share your expertise. This platform is a powerful tool for networking, allowing you to showcase your skills and engage with peers.

- Join Professional Associations: Membership in organizations such as the AICPA or CFA Institute offers access to exclusive resources and networking opportunities. These associations can be instrumental in building connections that may lead to job opportunities.

Seek mentorship by identifying a mentor who is a director of accounting and finance to gain insights and guidance on navigating your career path. Mentorship has proven to be a crucial element in attaining positions as a director of accounting and finance, as it provides tailored guidance and assistance.

Regular engagement with your network is vital. Share updates, seek advice, and offer assistance to maintain strong connections. Statistics show that individuals who actively network are more likely to progress in their careers, emphasizing the significance of establishing and maintaining these connections in the financial industry.

While 61% of employees prefer remote meetings, nearly all workers believe that face-to-face meetings are more effective for building lasting relationships. This highlights the value of in-person interactions. As HubSpot observes, “one in four individuals doesn’t network at all,” reinforcing the critical role networking plays in career advancement.

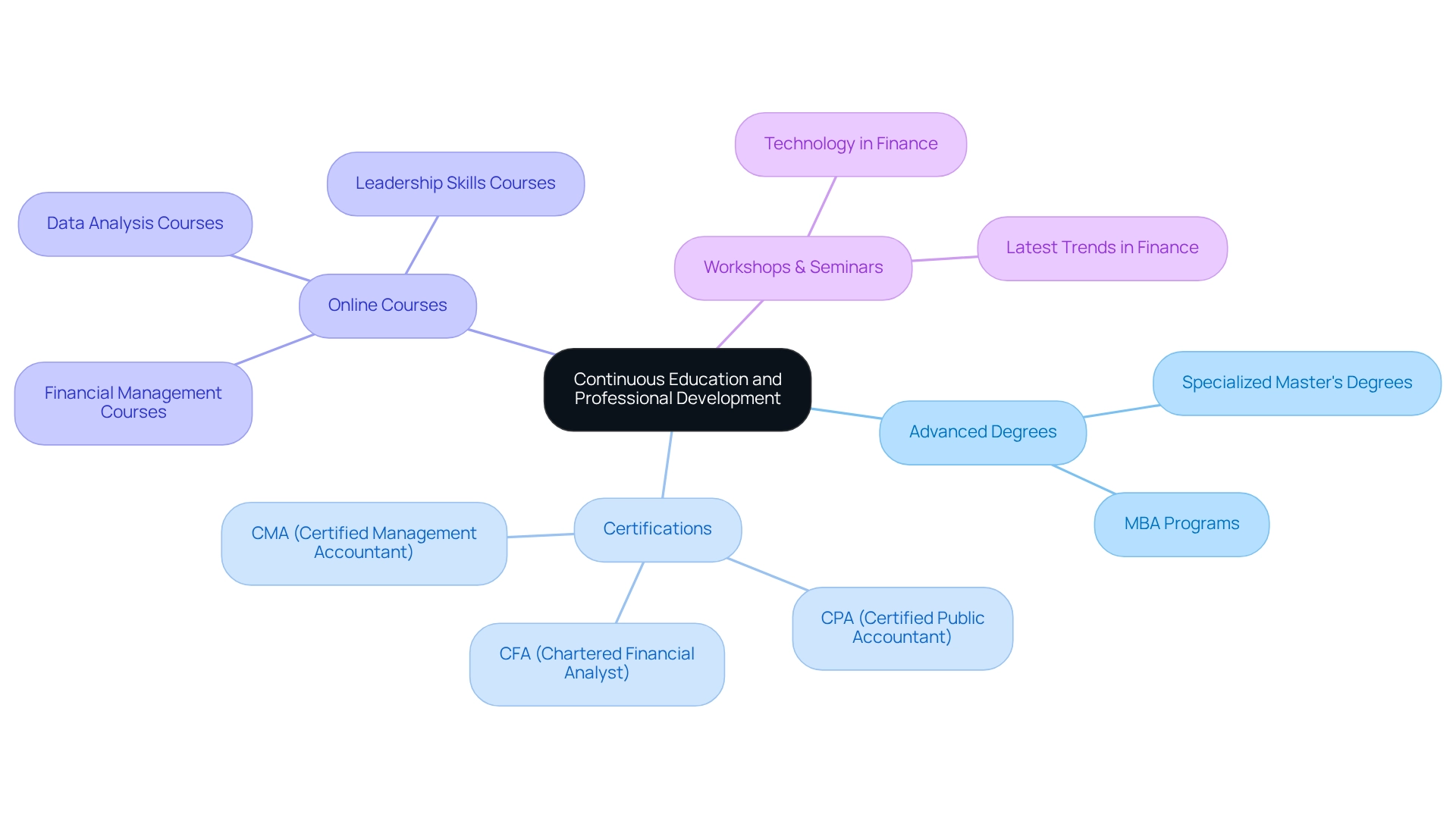

Pursue Continuous Education and Professional Development

To sustain a competitive advantage in the financial sector, participating in ongoing education and career advancement is crucial. Consider these key avenues:

- Advanced Degrees: Pursuing an MBA or a specialized master’s degree in finance or accounting can significantly enhance your qualifications and leadership capabilities.

- Certifications: Earning certifications such as CPA, CFA, or CMA (Certified Management Accountant) is vital for validating expertise and improving career prospects. These credentials are among the most sought-after in the finance sector, reflecting a commitment to excellence in the field.

- Online Courses: Leverage online platforms that offer courses in financial management, data analysis, and leadership skills. This flexible learning approach aligns with the growing preference for self-paced, on-demand training, allowing professionals to tailor their education to fit their schedules.

- Workshops and Seminars: Participating in workshops and seminars provides insights into the latest trends and technologies in finance, fostering a culture of continuous learning that is essential for career advancement.

Regularly updating your skills and knowledge not only enhances employability but also equips you to tackle the complexities of a director role effectively. In fact, organizations that prioritize continuous learning see retention rates rise by 30-50%, underscoring the value of investing in professional development. Furthermore, with 72% of employees expressing excitement for new learning opportunities, yet only 2% of companies effectively meeting this demand, the need for continuous education is more pressing than ever. Additionally, individuals grappling with mental health and burnout are four times as inclined to consider leaving their organization, highlighting how continuous education can improve employee satisfaction and retention. As the economic landscape changes, remaining knowledgeable and flexible is essential for succeeding in leadership roles.

Strategically Apply for Director Positions

To effectively apply for director positions in accounting and finance, consider these strategic steps:

- Tailor Your Resume: Customize your resume to emphasize relevant experience and skills that align with the specific job description. A tailored resume significantly increases your chances of catching a recruiter’s attention; studies show that resumes with targeted content are more effective in securing interviews. Notably, the record for the most skills listed on a resume is 232, highlighting the potential for candidates to showcase a wide range of skills effectively.

- Craft a Compelling Cover Letter: Use your cover letter to articulate why you are an ideal candidate for the role. Highlight how your background and achievements align with the company’s objectives, making a strong case for your fit within their team.

- Utilize Your Network: Leverage your professional network to uncover job openings and seek referrals. Engaging with contacts can provide valuable insights and increase your visibility to hiring managers.

- Prepare for Interviews: Conduct thorough research on the company and its economic strategies. Get acquainted with typical interview questions concerning leadership and financial management to showcase your expertise and preparedness for the position. Be mindful of how your interviewers communicate company values and dynamics; candidates are keenly aware of any red flags during the interview process, such as disorganization or lack of clarity.

- Follow Up: After interviews, send personalized thank-you notes to express your gratitude and reaffirm your interest in the position. This simple gesture can leave a lasting impression and reinforce your enthusiasm for the opportunity.

Additionally, be cautious about contacting hiring managers directly, as it is important to follow proper application procedures. Remember that the first job offer might not be the best; exploring multiple options can lead to better alignment with your career goals and values. By implementing these strategic application techniques and utilizing your network effectively, you can significantly enhance your prospects of securing a director of accounting and finance role. As David Mercado states, “The best way to do it is by using keywords,” so ensure your resume and cover letter are rich with relevant terms that align with the job description.

For personalized assistance in your job search, reach out to Boutique Recruiting to help streamline your application process and connect you with top opportunities.

Conclusion

Aspiring to become a director in accounting and finance necessitates a multifaceted approach, encompassing essential qualifications, relevant experience, strategic networking, and ongoing professional development. A solid educational foundation, complemented by advanced degrees and certifications, significantly enhances marketability in a competitive landscape. The cultivation of key skills—such as analytical abilities, leadership, and technical proficiency—further equips candidates to navigate the complexities of financial leadership roles.

Gaining hands-on experience through entry-level positions and progressively assuming greater responsibilities is crucial for establishing a robust career trajectory. Engaging in diverse roles across various sectors not only broadens expertise but also provides future directors with the necessary insights to adeptly navigate the financial landscape. Moreover, building a professional network through industry events, online platforms, and mentorship can unlock doors and create invaluable opportunities for career advancement.

Continuous education is paramount in this ever-evolving field. Pursuing advanced degrees and certifications, alongside participating in workshops and online courses, ensures that professionals remain competitive and adaptable. As candidates prepare for director positions, tailoring resumes and cover letters, leveraging their networks, and thoroughly preparing for interviews become essential strategies that can significantly enhance their chances of success.

Ultimately, the path to a director role in accounting and finance is a journey that demands commitment, adaptability, and strategic planning. By investing in education, gaining relevant experience, building a strong network, and remaining engaged in continuous learning, aspiring directors can position themselves for success in a dynamic and rewarding career. The future of financial leadership awaits those who are prepared to take decisive action and embrace the opportunities that lie ahead.

Frequently Asked Questions

What educational background is required to become a director of accounting and finance?

A bachelor’s degree in accounting, finance, or a related field is typically required. However, many employers prefer candidates with a master’s degree or an MBA, as these qualifications enhance marketability.

What key skills are essential for a director of accounting and finance?

Essential skills include analytical skills, leadership, communication skills, technical proficiency in financial software, and compliance knowledge.

Why are professional certifications like CPA or CFA important for this role?

Professional certifications such as CPA (Certified Public Accountant) or CFA (Chartered Financial Analyst) significantly enhance qualifications and demonstrate a commitment to excellence in the field.

What entry-level positions can help aspiring directors gain relevant experience?

Entry-level positions that can provide valuable experience include Staff Accountant, Financial Analyst, Accounting Manager, Controller, and Chief Accounting Officer (CAO).

How many years of experience should aspiring directors aim to accumulate?

Aspiring directors should aim to accumulate at least 7-10 years of relevant experience, progressively taking on greater responsibilities.

What should candidates consider when evaluating job offers?

Candidates should consider how each opportunity aligns with their long-term career goals, recognizing that the first option may not always be the best and to avoid committing too quickly to a job offer.

What is the job market outlook for skilled professionals in accounting and finance?

The demand for skilled professionals in this field is expected to increase by 6% from 2023 to 2033, making a well-rounded background advantageous in a competitive job market.