Overview

The article addresses critical interview questions for accounts payable specialists, underscoring the essential skills and experiences candidates must exhibit to secure a position in this competitive field. Proficiency in invoice processing and vendor management is paramount, alongside the necessity for clear communication, meticulous attention to detail, and familiarity with automation tools. These competencies are vital for achieving success in accounts payable roles. As the financial sector evolves, are you prepared to ask the right questions to identify top talent?

Key Highlights:

- Boutique Recruiting specializes in connecting high-quality applicants with employers for accounts payable roles through a personalized recruitment process.

- The firm emphasizes understanding both job requirements and organizational culture to ensure candidate alignment.

- Clear communication and tailored expectations are critical, especially as 26% of job seekers declined offers in 2024 due to poor experiences.

- Candidates must demonstrate proficiency in key accounts payable tasks, including invoice processing, payment approvals, and vendor management.

- 39% of invoices contain errors, highlighting the need for attention to detail in accounts payable roles.

- Automation tools, such as AI-driven workflows, are increasingly important for efficiency in managing accounts payable processes.

- Effective vendor relationship management relies on clear communication and timely payments, which can enhance operational efficiency.

- Candidates should be prepared to discuss their experience with audits and compliance, emphasizing attention to detail and high standards in financial reporting.

- Staying current with accounting regulations is crucial, with strategies including attending workshops and engaging with professional organizations.

- Conflict resolution skills are essential, as they can improve workplace dynamics and productivity.

- Candidates must effectively communicate financial information to non-financial stakeholders, emphasizing clarity and engagement.

- Task prioritization strategies, such as using technology and establishing deadlines, are vital in fast-paced finance environments.

- Articulating career goals in accounts payable roles can align personal aspirations with organizational objectives, enhancing career progression.

Introduction

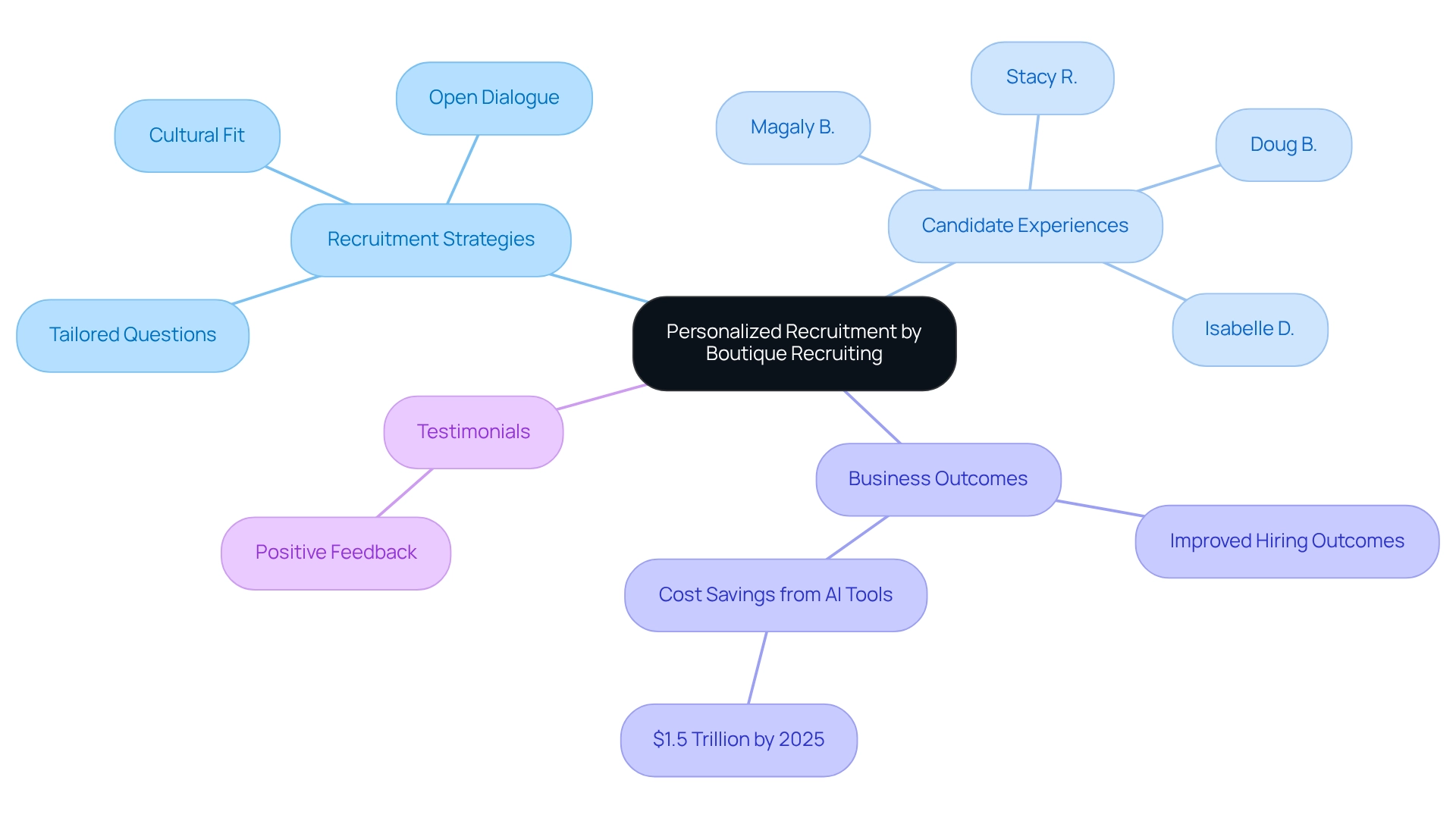

In the competitive realm of finance, recruitment challenges have reached unprecedented levels, making the role of Accounts Payable Specialists more crucial than ever. Boutique Recruiting is at the forefront of this evolution, pioneering a specialized approach that prioritizes personalization. This innovative firm excels in connecting top-tier candidates with employers who seek not only skill but also a cultural fit. As organizations face the dual challenges of high turnover and the demand for exceptional candidate experiences, Boutique Recruiting distinguishes itself by fostering open communication and setting tailored expectations.

This article delves into the intricacies of the recruitment process for Accounts Payable roles, highlighting effective strategies, the impact of automation, and the essential qualities candidates must demonstrate to thrive in this fast-paced environment. Have you considered how the right recruitment partner can transform your hiring landscape? Through testimonials and industry insights, it becomes evident that the right partner can pave the way for successful placements and enhanced organizational performance.

Embrace the opportunity to elevate your recruitment process—reach out for a consultation today.

Boutique Recruiting: Tailored Recruitment for Accounts Payable Specialists

Boutique Recruiting distinguishes itself in the recruitment landscape by expertly connecting high-quality applicants with employers seeking to ask accounts payable specialist interview questions. The firm emphasizes a personalized recruitment process that thoroughly examines the specific requirements of both the role and the organizational culture. This meticulous approach not only identifies individuals with the requisite skills but also ensures alignment with the company’s values and environment.

In today’s competitive job market, where 26% of job seekers declined offers in 2024 due to poor experiences, the importance of clear communication and tailored expectations cannot be overstated. How can organizations enhance their hiring experiences? Boutique Recruiting addresses this challenge by fostering open dialogue with both clients and applicants, thereby enhancing the overall hiring experience. As highlighted by candidates like Magaly B. and Doug B., the supportive and responsive nature of Boutique Recruiting’s recruiters, such as Erika and Amy, plays a crucial role in guiding candidates throughout the job placement process.

Boutique Recruiting has open positions across the U.S. and Canada, showcasing an increasing reliance on personalized recruitment strategies, particularly within finance roles. As organizations increasingly recognize the significance of tailored hiring processes, Boutique Recruiting leverages its extensive industry expertise to implement effective recruitment strategies, which include accounts payable specialist interview questions, for financial positions. This includes a deep understanding of the nuances of the role and the specific needs of the employer, ultimately leading to superior hiring outcomes.

The effectiveness of personalized recruitment is further underscored by data indicating that AI-driven HR tools are projected to save organizations $1.5 trillion globally by 2025. This trend emphasizes the shift toward more effective and customized hiring methods, aligning perfectly with Boutique Recruiting’s focus on the unique elements of each financial position. By enhancing the applicant experience through personalized strategies, as evidenced by testimonials from satisfied individuals like Stacy R. and Isabelle D., Boutique Recruiting significantly increases the likelihood of successful placements, establishing itself as a trusted partner for businesses in search of top-tier talent.

Are you ready to transform your hiring process? Reach out to Boutique Recruiting today for a consultation and discover how personalized recruitment can elevate your organization.

What Experience Do You Have with Accounts Payable?

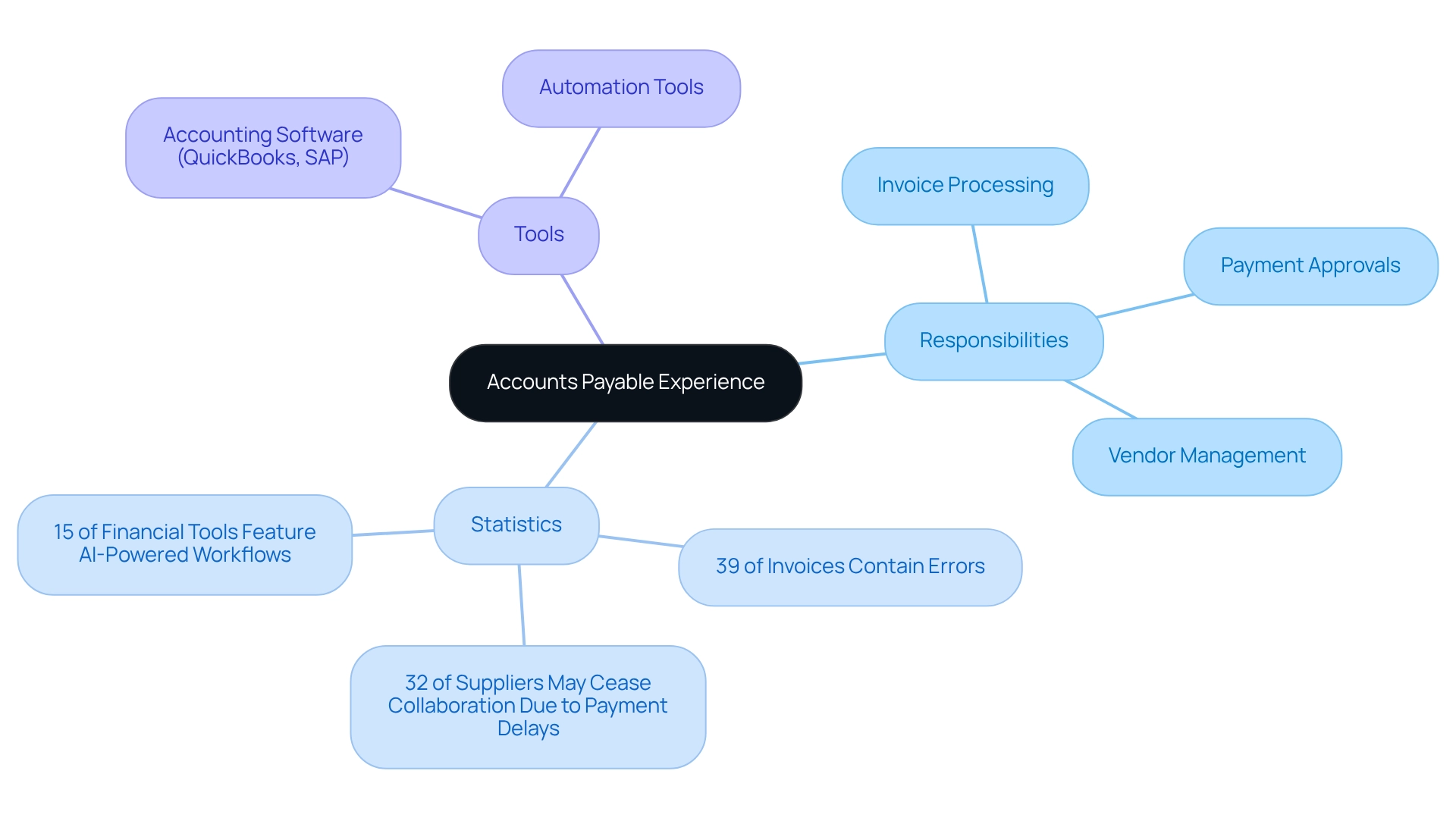

Candidates must be prepared to elaborate on their previous roles in Accounts Payable when answering accounts payable specialist interview questions, emphasizing specific responsibilities such as:

- Invoice processing

- Payment approvals

- Vendor management

This inquiry allows employers to assess the applicant’s experience level and familiarity with industry-standard tools and software. Proficiency in accounting software, such as QuickBooks or SAP, is essential, as these platforms significantly enhance the efficiency of AP processes.

Statistics indicate that 39% of invoices contain errors, underscoring the critical need for meticulous attention to detail in this role. Given that 32% of suppliers may cease collaboration with clients who delay payments, applicants must demonstrate their ability to manage prompt and accurate payments, as their actions directly influence supplier relationships.

Moreover, candidates should be ready to discuss their experience with automation tools, as 15% of financial tools now integrate AI-driven workflows. These tools are instrumental in identifying potential fraud and streamlining operations, making them vital for improving efficiency in AP processes, as reflected in accounts payable specialist interview questions that often address an applicant’s ability to navigate discrepancies between preferred payment methods and actual practices. Understanding these discrepancies can significantly impact an applicant’s efficiency in managing financial obligations. This is emphasized in a recent case study, where 46% of participants noted that processing expenses was a key factor influencing their decisions. This context not only illustrates the importance of experience but also highlights the necessity for applicants to showcase their understanding of the financial implications of their roles.

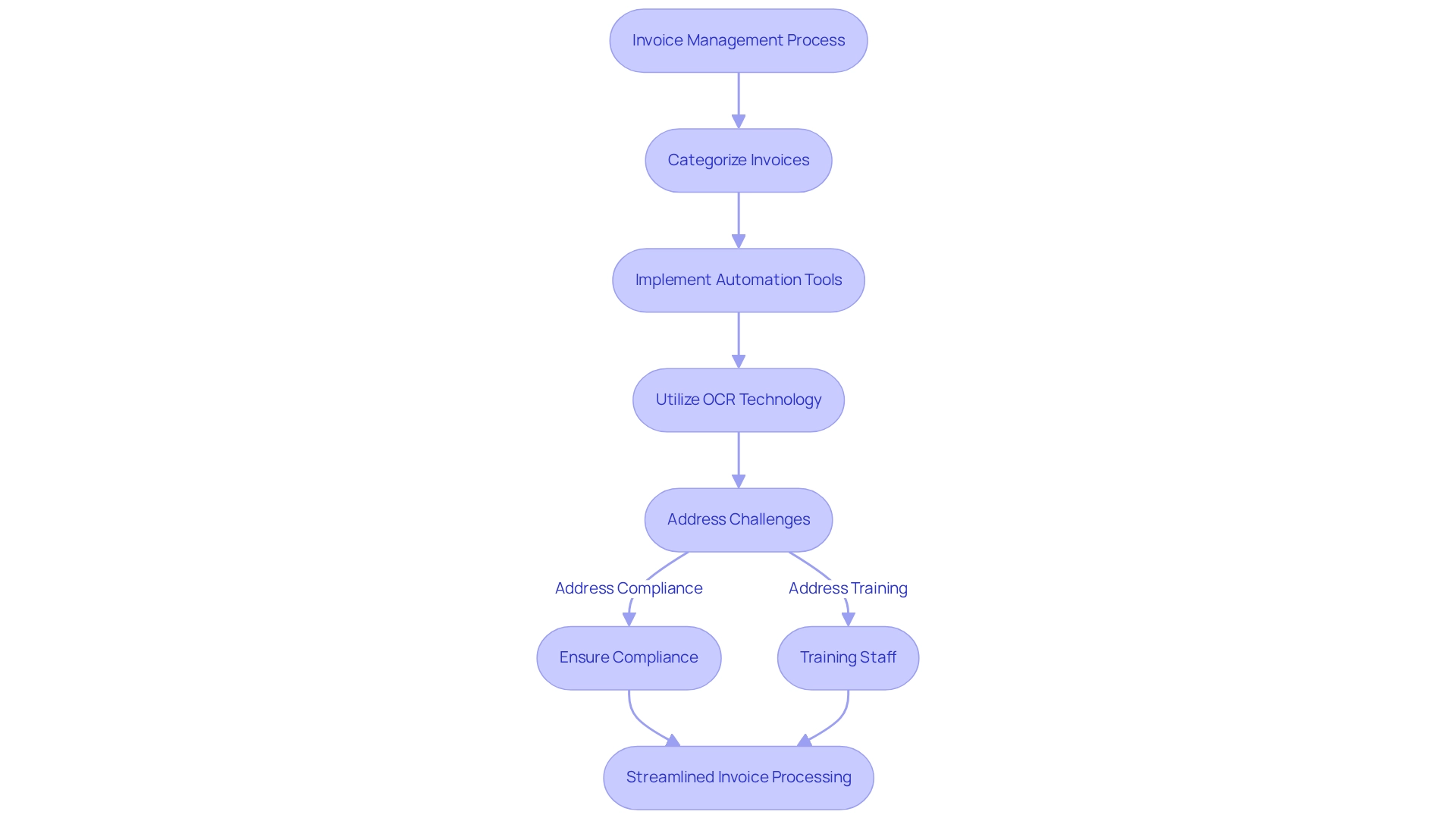

How Do You Handle a High Volume of Invoices?

Candidates must articulate their strategies for managing high volumes of invoices, emphasizing automation tools that enhance efficiency and accuracy. For example, categorizing invoices by due date or vendor aids in prioritizing tasks and ensuring timely payments. This method streamlines processing and mitigates errors, a critical factor considering that Accounts Payable departments handle an average of 10,000 invoices monthly.

As automation technologies evolve, particularly Optical Character Recognition (OCR) integrated with artificial intelligence, they significantly enhance processing speed and accuracy. Abhishek Ajith notes, “As OCR continues to evolve and integrate with other technologies, such as artificial intelligence and robotic process automation, its potential to revolutionize AP processing will only grow.”

This inquiry evaluates an applicant’s organizational skills and their ability to maintain precision under pressure, which are important factors to consider when formulating accounts payable specialist interview questions in a fast-paced financial environment.

However, effective OCR implementation necessitates addressing challenges like:

- Accuracy

- Integration

- Compliance

- Document variability

- Training issues

Furthermore, case studies, such as managing contracts and agreements through automated data extraction, illustrate how OCR technology can streamline contract management processes, enabling organizations to track payment milestones effectively.

How Do You Manage Vendor Relationships?

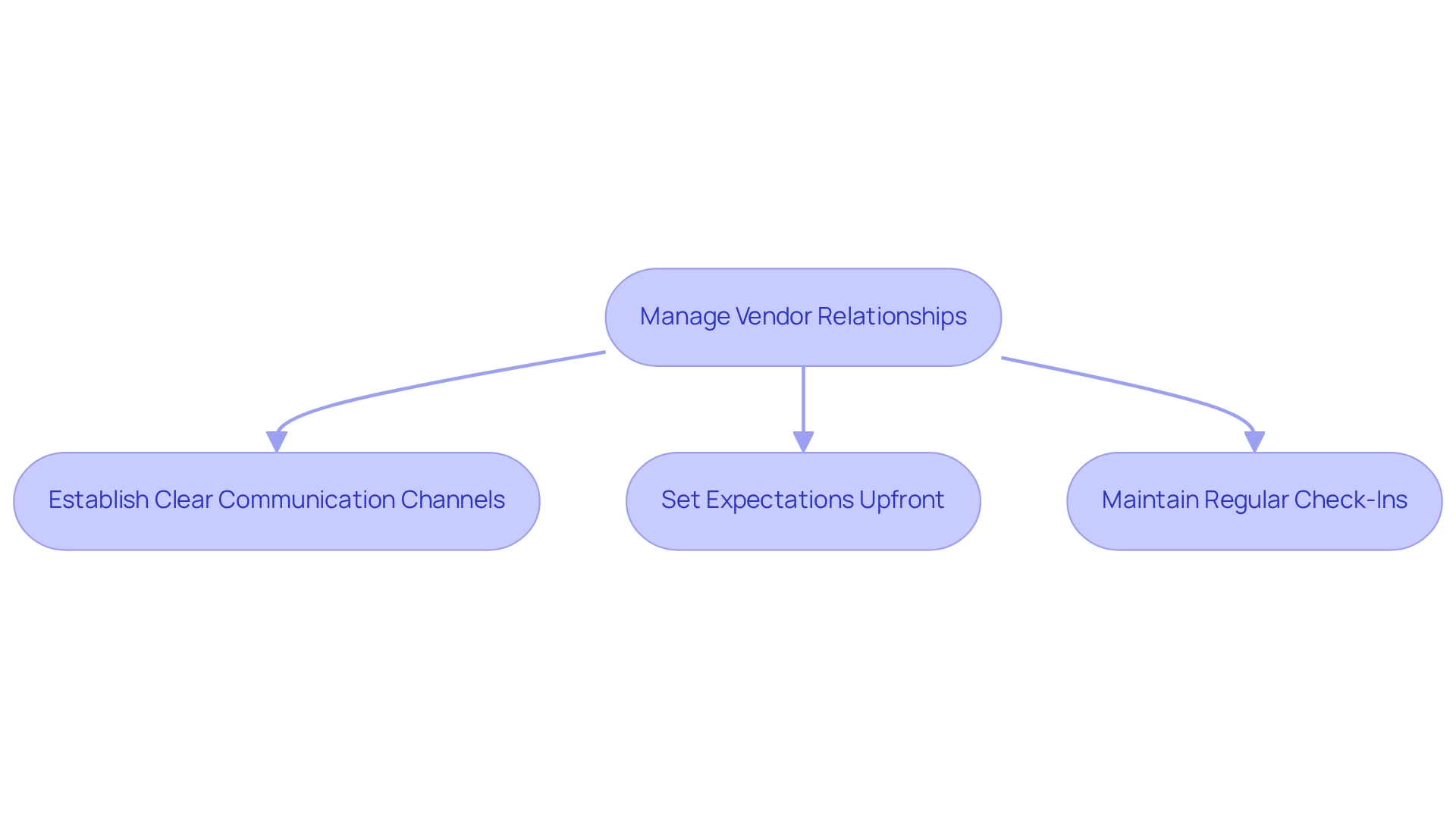

Candidates should articulate their strategies for managing vendor relationships, focusing on effective communication and issue resolution. They may share specific instances where they have cultivated trust with vendors through timely payments and transparent dialogue. This inquiry evaluates a candidate’s capability to nurture positive relationships that yield mutual benefits for both the organization and its suppliers.

Effective vendor relationship management is vital in financial transactions, as it directly affects operational efficiency and financial performance. Statistics indicate that 41% of businesses have adopted automated invoice approval workflows, significantly enhancing communication and reducing processing times. Organizations utilizing automation report a marked decrease in the average invoice processing time, which stands at 14.6 days for manual processes, with 39% of invoices containing errors. This highlights the critical role that effective communication plays in minimizing errors and improving efficiency.

Best practices for managing vendor relationships include:

- Establishing clear communication channels

- Setting expectations upfront

- Maintaining regular check-ins to proactively address any concerns

As Nat Turner aptly states, “Communication is the bridge between confusion and clarity,” underscoring the necessity for transparency in all interactions to foster strong vendor relationships.

Case studies reveal that companies with robust vendor relationships experience fewer disputes and improved service levels, ultimately leading to cost savings and enhanced operational efficiency. By prioritizing effective communication and relationship-building, applicants can showcase their potential to positively answer accounts payable specialist interview questions related to their contributions to the organization’s Accounts Payable function.

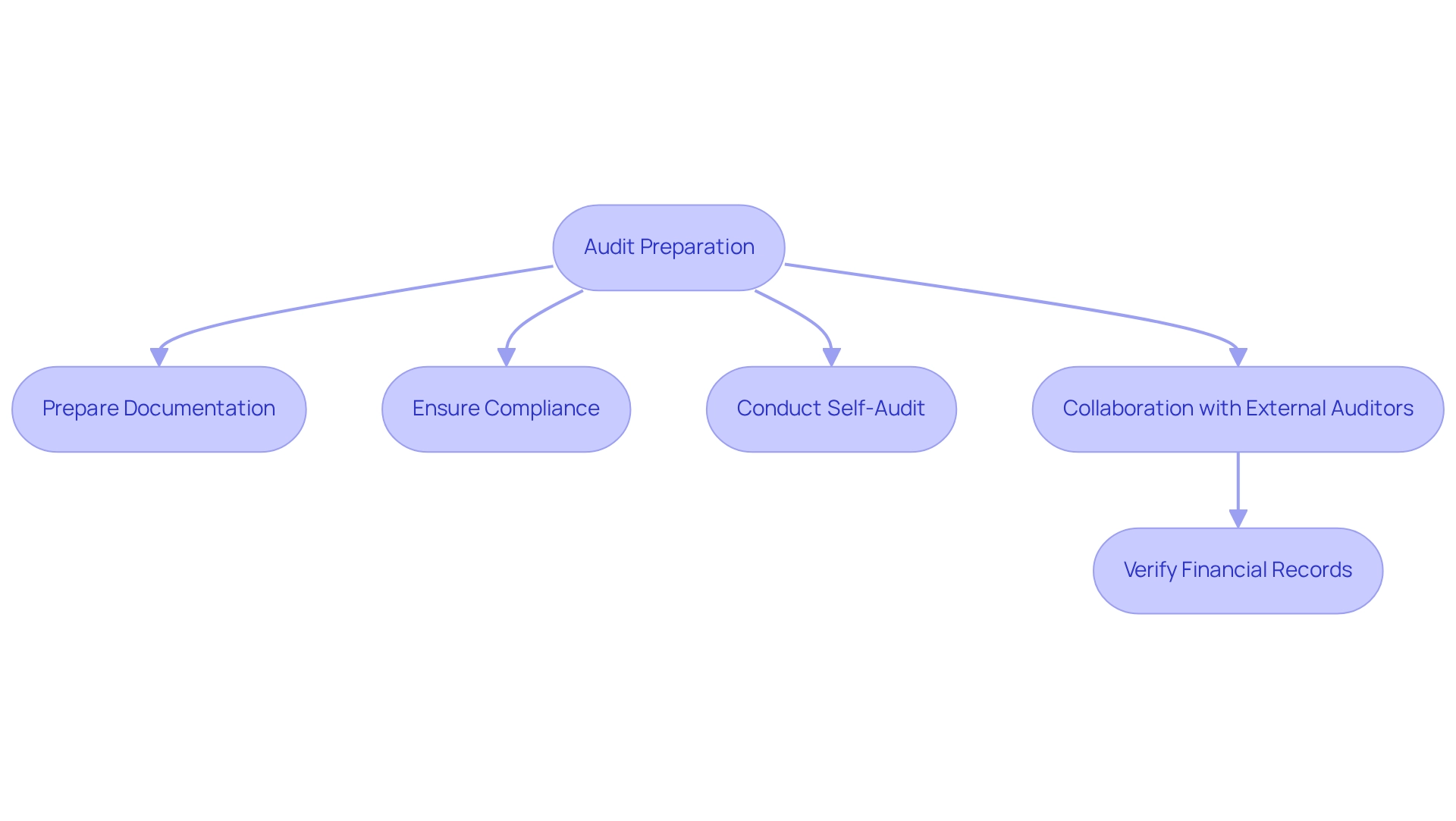

How Do You Handle Accounts Payable Audits?

Candidates must articulate their familiarity with the audit process, detailing their approach to preparing documentation and ensuring compliance with internal controls. They should describe their experiences in conducting self-audits or collaborating with external auditors to verify the accuracy of financial records. This inquiry is pivotal for employers, as it enables them to assess an applicant’s attention to detail and commitment to maintaining high standards in financial reporting.

How do your experiences align with these expectations? This question not only gauges competence but also reflects the candidate’s dedication to upholding the integrity of financial practices.

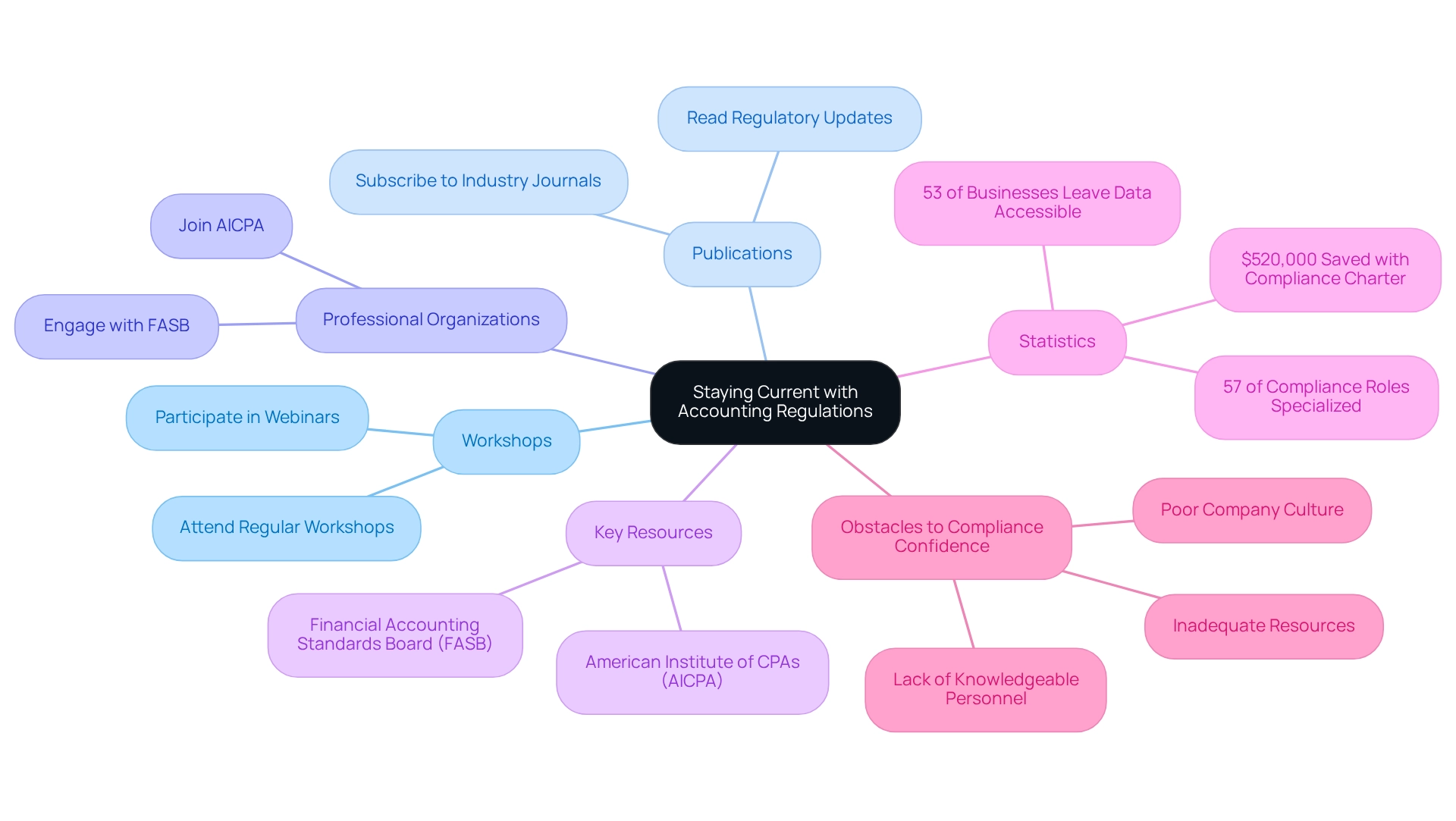

How Do You Stay Current with Changes to Accounting Regulations?

Candidates must articulate their strategies for staying informed about accounting regulations. This may involve:

- Attending workshops

- Subscribing to industry publications

- Engaging with professional organizations

Key resources often referenced include the Financial Accounting Standards Board (FASB) and the American Institute of CPAs (AICPA). Such inquiries reveal not only an applicant’s commitment to ongoing professional development but also underscore the critical nature of compliance in the field. Notably, 57% of corporate risk and compliance professionals indicate that compliance roles have become increasingly specialized. Thus, applicants must demonstrate their awareness of evolving standards and the implications of this specialization on their roles.

Furthermore, statistics reveal that 53% of businesses leave sensitive data accessible to unauthorized employees, potentially leading to significant security breaches and financial losses. This highlights the necessity for rigorous compliance practices. Expert insights suggest that a formal compliance charter can save organizations an average of $520,000, reinforcing the financial implications of staying updated. Additionally, addressing obstacles to compliance confidence—such as a lack of knowledgeable personnel and inadequate resources—is crucial for organizations aiming to enhance their compliance capabilities.

Overall, accounts payable specialist interview questions serve as a vital gauge of an applicant’s proactive approach to navigating the complexities of accounting regulations.

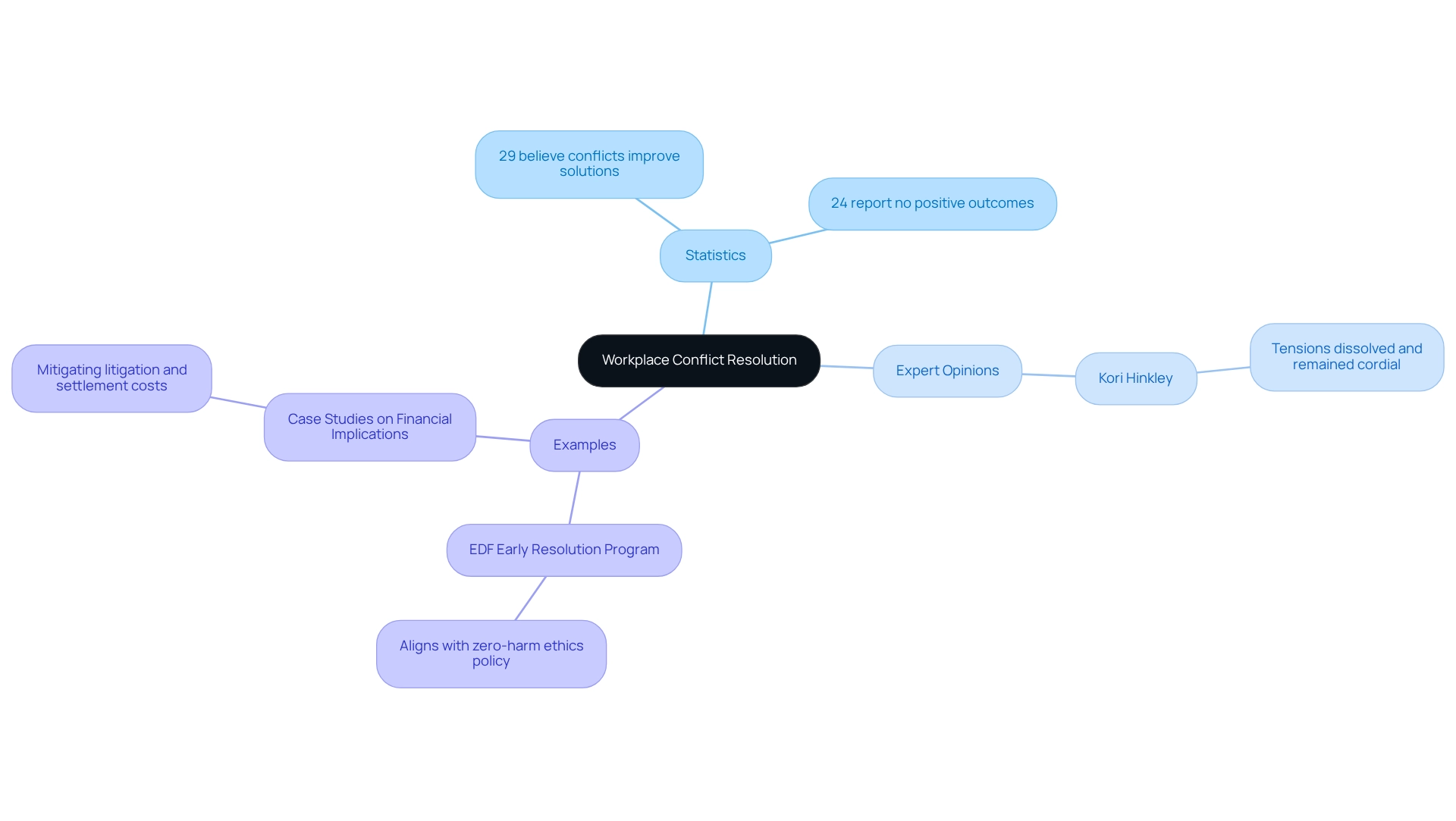

Describe a Time You Resolved a Conflict in the Workplace.

Candidates should provide a specific example of a workplace conflict they encountered, illustrating their approach to resolving the issue and the eventual outcome. This may include mediating between team members or addressing disagreements with vendors. Such scenarios not only assess an applicant’s problem-solving skills but also their ability to maintain professionalism under pressure.

Notably, research indicates that:

- 29% of workers believe conflicts can lead to improved problem-solving solutions.

- 24% report no positive outcomes from such disputes.

This contrast highlights the mixed perceptions of conflict outcomes, underscoring the necessity for effective conflict resolution strategies within finance teams. Furthermore, expert opinions emphasize that professionalism is crucial in navigating workplace conflicts, as it fosters a collaborative environment.

For instance, Kori Hinkley, a workflow coach, noted that resolving tensions can lead to a more cordial workplace atmosphere, reinforcing the importance of maintaining professionalism during conflicts. Organizations that proactively address conflicts—such as EDF with their early resolution program—can mitigate financial burdens associated with lost productivity and potential legal costs, as evidenced by case studies on workplace conflict management.

Overall, applicants’ experiences in conflict resolution can greatly influence team performance and cohesion, making this a crucial area of evaluation during interviews.

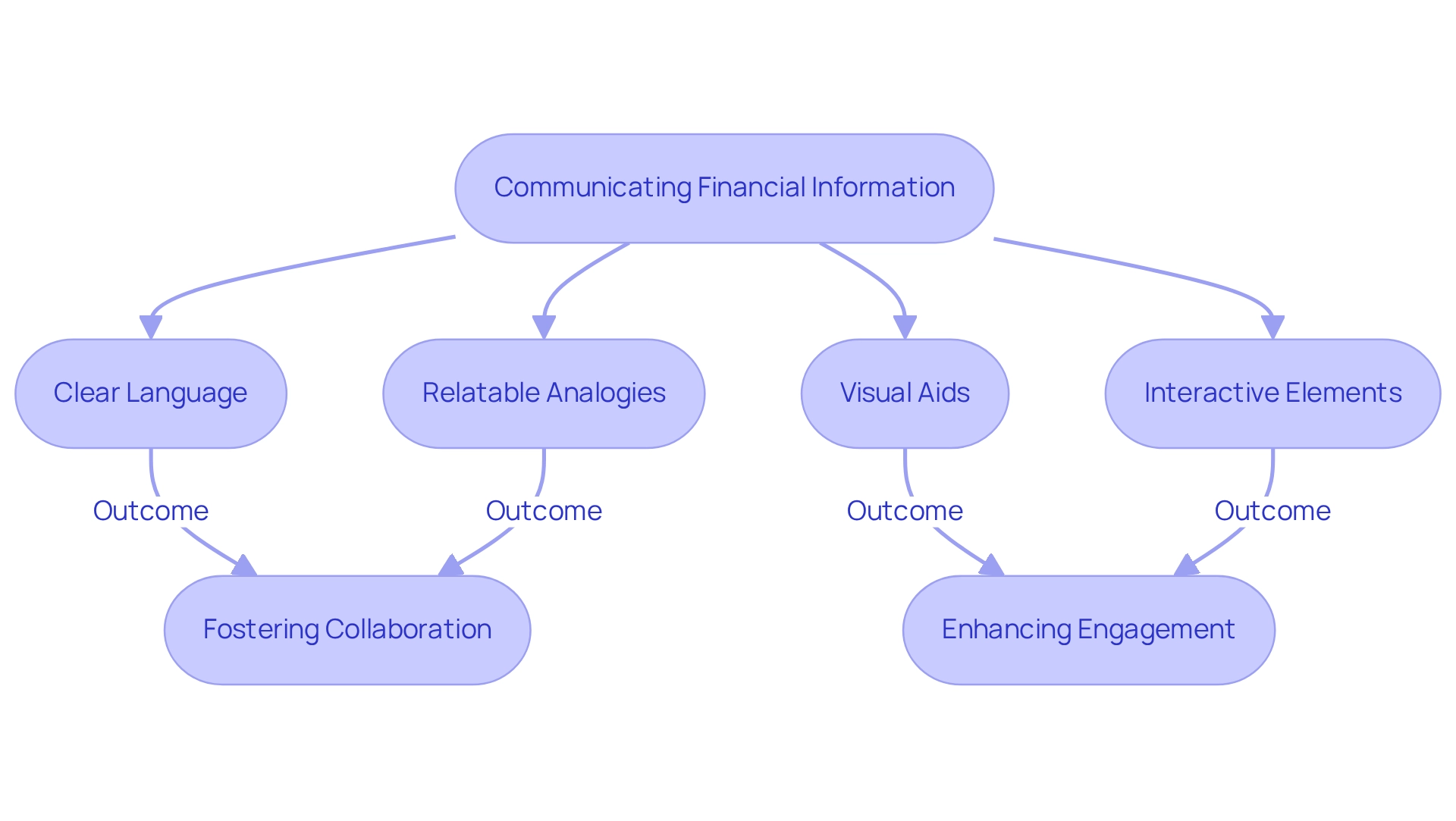

How Do You Communicate Financial Information to Non-Financial Stakeholders?

Candidates must articulate their strategies for conveying financial information to non-financial stakeholders, emphasizing the use of clear language, visual aids, and relatable analogies. They should share specific instances where they successfully presented financial reports to management or other departments, showcasing their ability to translate complex financial data into understandable insights. This question assesses an applicant’s proficiency in fostering collaboration across departments, a crucial element in today’s business environment.

As industry experts highlight, effective communication is essential for building trust and credibility; indeed, 90% of executives agree that clear communication is key to achieving this. Furthermore, successful CFOs, such as Maureen O’Connell, advocate for finance professionals to expand their roles beyond traditional boundaries, enhancing firm valuation through strategic communication. By demonstrating their ability to bridge communication gaps, individuals illustrate their worth in fostering organizational unity and informed decision-making.

Additionally, incorporating interactive elements like quizzes and gamification, as suggested by Jose Rodriguez, can further enhance stakeholder engagement and knowledge retention, making financial information more accessible and engaging. This approach not only aids in communication but also contributes to a CFO’s legacy, defined by the quality and success of their team members.

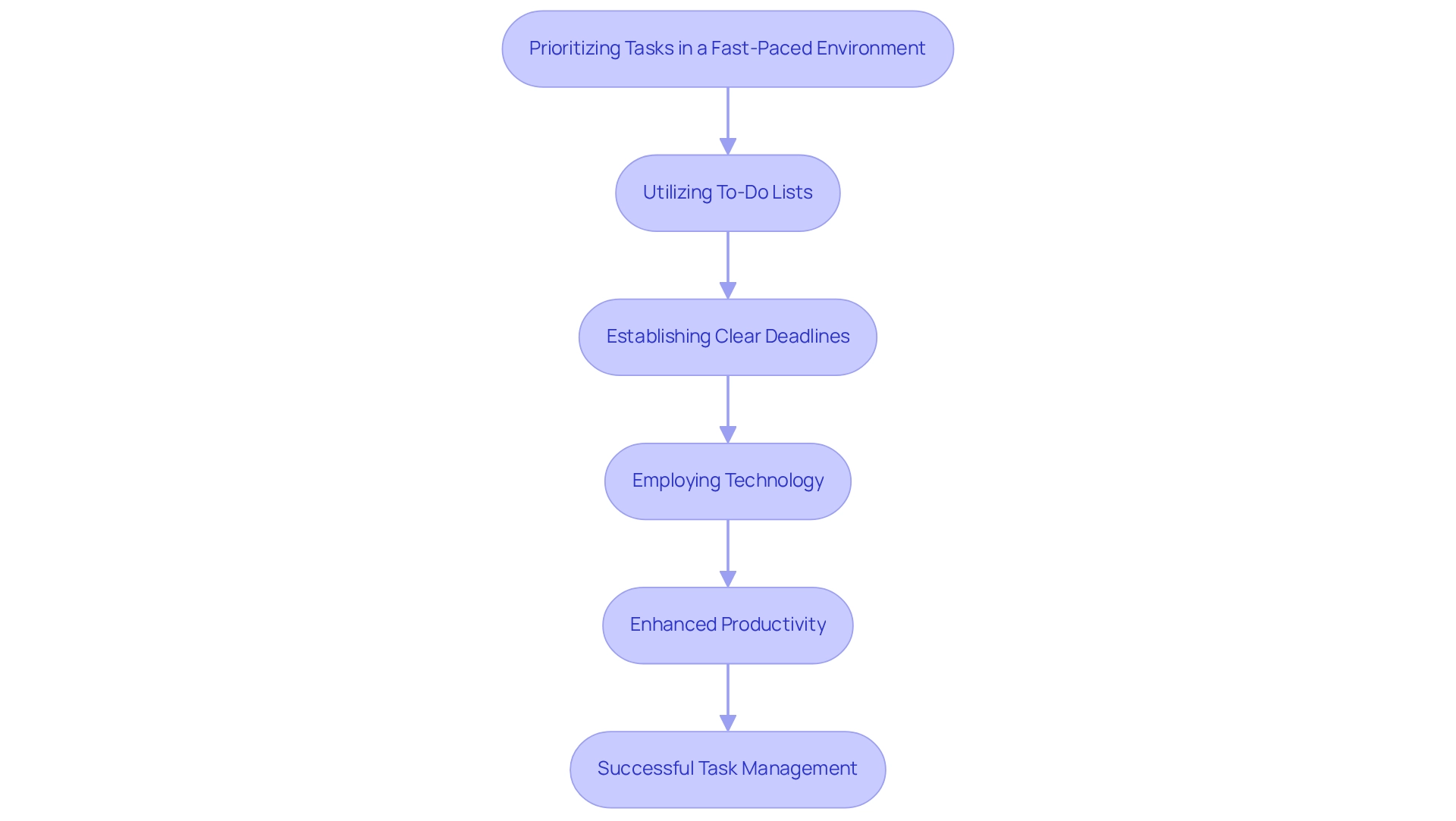

How Do You Prioritize Tasks in a Fast-Paced Environment?

Candidates should articulate their strategies for effectively prioritizing tasks in a fast-paced finance environment when answering accounts payable specialist interview questions. This may include:

- Utilizing to-do lists

- Establishing clear deadlines

- Employing technology to streamline workload management

For instance, applicants might discuss how they have successfully navigated peak periods by implementing automated reminders or project management software, ensuring that all tasks are completed accurately and punctually. This investigation not only uncovers an applicant’s organizational abilities but also their flexibility in changing environments, which is essential for achievement in financial roles as highlighted by accounts payable specialist interview questions.

Furthermore, industry leaders emphasize that leveraging technology can significantly enhance productivity, allowing professionals to focus on high-priority tasks while minimizing the risk of oversight. According to recent statistics, approximately 75% of Accounts Payable professionals utilize task prioritization methods, which is often explored in accounts payable specialist interview questions to underscore its importance in maintaining efficiency and accuracy. As noted by the VP and Global Head of Solution Architecture, “YellowDog have created functionality that we have wanted for over a decade. This can transform how we run our infrastructure,” highlighting the transformative impact of technology on task management.

By sharing specific examples of their experiences, candidates can demonstrate their capability to thrive under pressure, making them valuable assets to potential employers. Moreover, insights from the case study titled ‘Evaluating VoIP’s Business Value’ demonstrate how technology can enhance productivity improvements, further highlighting the necessity for effective task prioritization in financial positions. In a service sector that prioritizes customer satisfaction and efficient service delivery, these practices are essential for enhancing productivity.

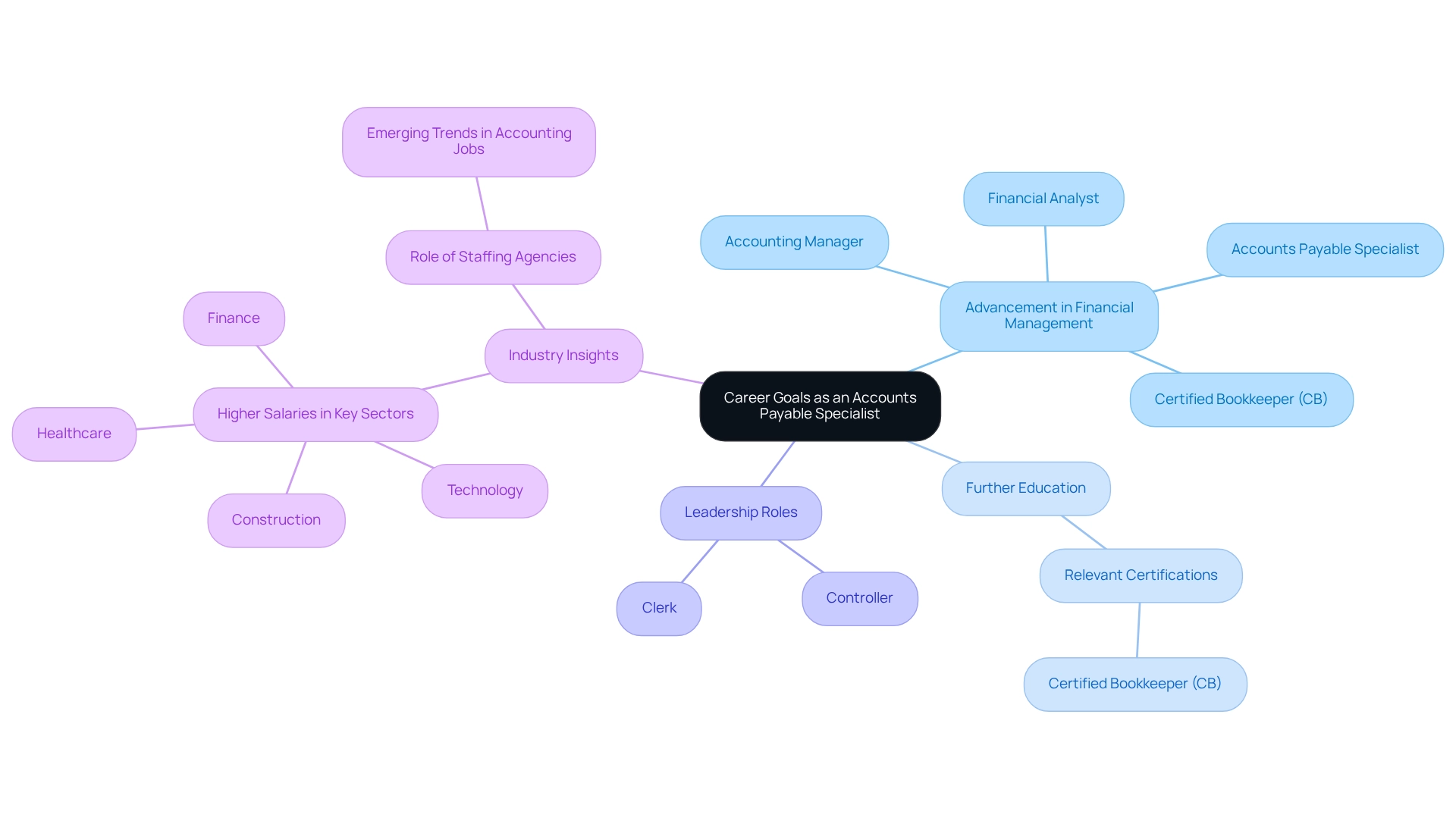

What Are Your Career Goals as an Accounts Payable Specialist?

Candidates must articulate their career objectives clearly, whether they aspire to advance within the financial management domain, pursue further education, or take on leadership roles such as Controller or Clerk, particularly in relation to accounts payable specialist interview questions. It is essential to discuss plans for skill enhancement and contributions to the organization’s success. This inquiry not only unveils a candidate’s ambition but also their capacity for growth within the company, as assessed through accounts payable specialist interview questions.

In the finance sector, establishing career goals is crucial, as it aligns personal aspirations with organizational objectives. For instance, Financial Specialists aiming for positions like accounting manager or financial analyst can enhance their career trajectory by obtaining relevant certifications, such as the Certified Bookkeeper (CB) designation from the American Institute of Professional Bookkeepers, and by preparing for accounts payable specialist interview questions. This certification can significantly facilitate upward mobility within the field.

Statistics reveal that the top 10% of in-demand finance and accounting positions include roles such as:

- Accountant

- Accounting specialist

- Accounting manager

- Accounts payable specialist

- Accounts receivable specialist

- Bookkeeper

- Financial analyst

- Payroll manager/supervisor

- Payroll specialist/administrator

- Tax manager

This highlights the importance of accounts payable specialist interview questions. This underscores the potential career paths available to Accounts Payable Specialists and highlights the opportunities for advancement, as discussed in accounts payable specialist interview questions.

Moreover, sectors such as technology, finance, healthcare, and construction generally offer higher salaries for positions related to accounts payable specialist interview questions, reflecting the intricate financial needs of these industries. Real-world examples demonstrate that job seekers who collaborate with staffing agencies are better positioned to secure rewarding opportunities in the evolving accounting landscape. This accentuates the necessity of proactive career planning and professional development for achieving long-term success in finance.

As Eric Eddy from CPA Resources Global Professionals emphasizes, “the firm’s capacity to provide exceptional individuals swiftly and effectively” underscores the significance of establishing clear career objectives and actively pursuing professional development. Ultimately, candidates who adopt this approach not only enhance their own prospects but also contribute significantly to their organizations, rendering them invaluable assets in the competitive finance industry.

Conclusion

The recruitment landscape for Accounts Payable Specialists is rapidly evolving, and Boutique Recruiting is at the forefront with its personalized approach. By concentrating on the distinctive needs of both candidates and employers, the firm not only streamlines the hiring process but also elevates the overall candidate experience. This focus is particularly vital in a market characterized by high turnover rates and candidate dissatisfaction, which can significantly impede organizational success.

This article emphasizes the critical role of effective communication, tailored expectations, and the integration of automation tools in the recruitment process. Candidates are urged to highlight their specific skills, experiences, and strategies for managing the complexities inherent in Accounts Payable roles. From processing high volumes of invoices to nurturing robust vendor relationships, the capability to navigate these challenges is essential for successful placements.

Ultimately, collaborating with a specialized recruitment firm like Boutique Recruiting can revolutionize the hiring landscape for organizations in pursuit of top-tier talent. By prioritizing personalized strategies and leveraging industry insights, businesses can not only enhance their recruitment outcomes but also cultivate a more engaged and effective workforce. Embracing these innovative practices is crucial for organizations striving to excel in the competitive finance sector.

Are you ready to transform your recruitment strategy? Reach out today for a consultation and discover how Boutique Recruiting can help you secure the talent necessary for your success.

Frequently Asked Questions

How does Boutique Recruiting differentiate itself in the recruitment landscape?

Boutique Recruiting distinguishes itself by expertly connecting high-quality applicants with employers through a personalized recruitment process that thoroughly examines the specific requirements of both the role and the organizational culture.

Why is the recruitment process important in today’s job market?

The recruitment process is crucial because 26% of job seekers declined offers in 2024 due to poor experiences. Clear communication and tailored expectations are essential for enhancing hiring experiences.

What role do recruiters play in the hiring process at Boutique Recruiting?

Recruiters at Boutique Recruiting, such as Erika and Amy, provide supportive and responsive guidance to candidates throughout the job placement process, improving the overall hiring experience.

What types of positions does Boutique Recruiting offer?

Boutique Recruiting has open positions across the U.S. and Canada, particularly focusing on finance roles and emphasizing personalized recruitment strategies.

How does Boutique Recruiting implement effective recruitment strategies?

Boutique Recruiting leverages its extensive industry expertise to implement effective recruitment strategies tailored to the specific needs of employers, which includes asking accounts payable specialist interview questions.

What is the significance of personalized recruitment according to the article?

Personalized recruitment is significant as it enhances the applicant experience and increases the likelihood of successful placements, establishing Boutique Recruiting as a trusted partner for businesses seeking top-tier talent.

What should candidates be prepared to discuss during accounts payable specialist interviews?

Candidates should be ready to elaborate on their previous roles in Accounts Payable, emphasizing responsibilities such as invoice processing, payment approvals, and vendor management.

Why is proficiency in accounting software important for accounts payable specialists?

Proficiency in accounting software, such as QuickBooks or SAP, is essential as these platforms significantly enhance the efficiency of accounts payable processes.

What challenges do accounts payable specialists face regarding invoice accuracy?

Statistics indicate that 39% of invoices contain errors, highlighting the critical need for meticulous attention to detail to manage prompt and accurate payments, which directly influences supplier relationships.

How do automation tools impact the accounts payable process?

Automation tools, including AI-driven workflows, improve efficiency by identifying potential fraud and streamlining operations, making them vital for enhancing accounts payable processes.

What strategies should candidates articulate for managing high volumes of invoices?

Candidates should emphasize strategies such as categorizing invoices by due date or vendor to prioritize tasks and ensure timely payments, which helps streamline processing and mitigate errors.

What are some challenges associated with implementing Optical Character Recognition (OCR) in accounts payable?

Challenges include accuracy, integration, compliance, document variability, and training issues, which need to be addressed for effective OCR implementation.

How does OCR technology enhance accounts payable processing?

OCR technology, especially when integrated with artificial intelligence, significantly enhances processing speed and accuracy, revolutionizing accounts payable processing.