Overview

The article offers essential insights into accounting and finance salary trends that HR managers must consider for effective recruitment and retention strategies.

With the competitive landscape of the financial sector, understanding key factors such as experience, education, industry demand, and regional variations is crucial. These elements significantly influence salary levels.

Moreover, leveraging salary benchmarks and adapting compensation packages is imperative to attract top talent.

In a market where skilled professionals are in high demand, how can organizations ensure they remain competitive?

By employing tailored recruitment strategies that align with industry standards, HR managers can enhance their hiring practices and secure the best candidates.

This article underscores the importance of a proactive approach to compensation, ultimately positioning your firm as a leader in the recruitment field.

Key Highlights:

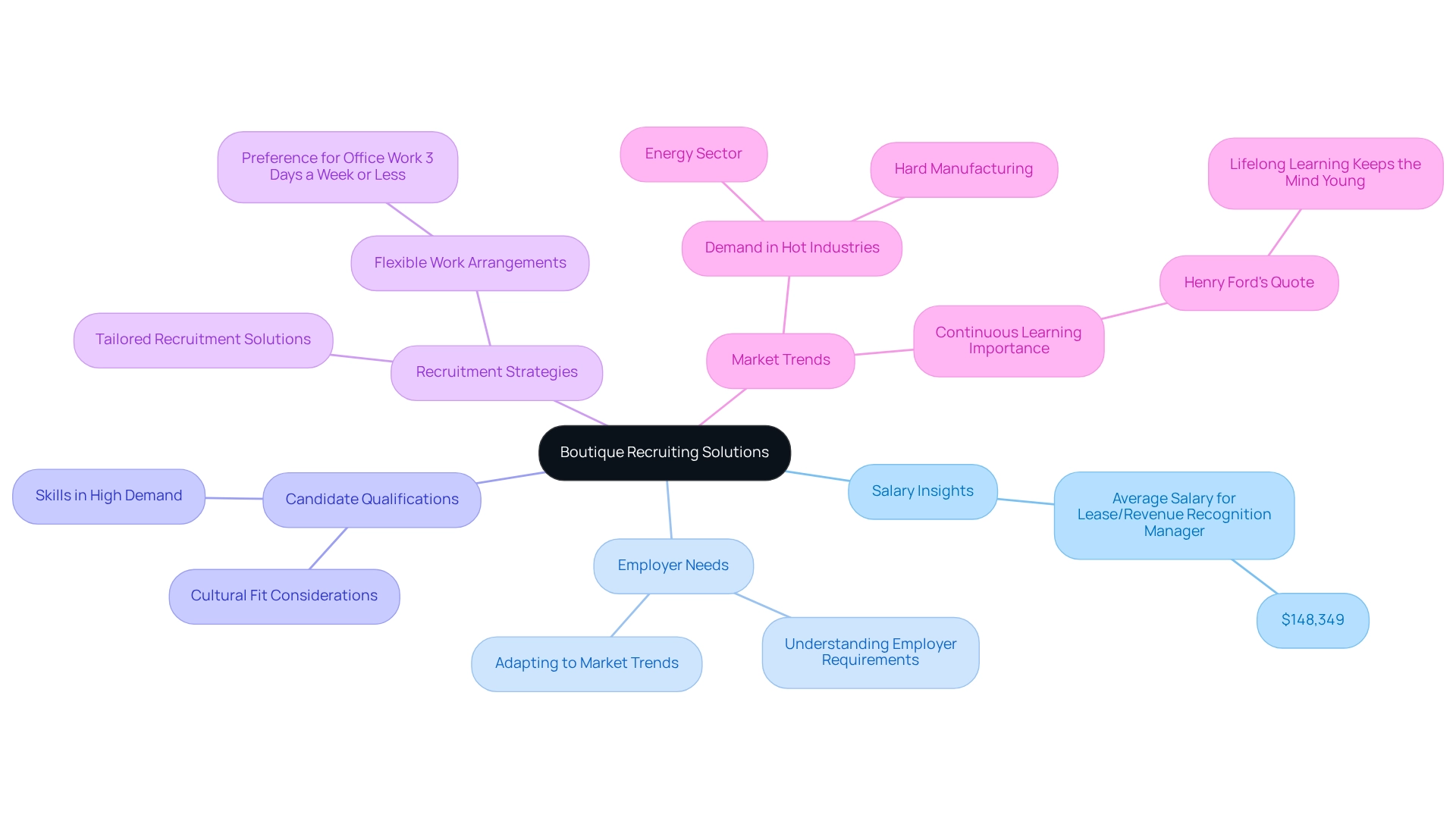

- Boutique Recruiting specializes in tailored recruitment solutions aligned with current accounting and finance salary trends.

- The average salary for a Lease/Revenue Recognition Manager is $148,349, reflecting the complexities of remuneration in finance roles.

- Demand for financial professionals is increasing in sectors like energy and manufacturing, necessitating adaptive recruitment strategies.

- Post-pandemic work preferences show a trend towards remote work, requiring companies to revise hiring strategies and compensation packages.

- Key factors influencing salary levels include experience, education, industry demand, company size, geographic location, and economic conditions.

- Advanced degrees and certifications, such as CPA or CFA, significantly enhance earning potential in accounting and finance roles.

- Economic conditions, including inflation and growth, directly impact salary levels and hiring strategies in the finance sector.

- Utilizing salary benchmarks helps HR managers develop competitive compensation strategies and attract top talent.

- Regional salary variations exist, with urban centers typically offering higher compensation due to demand and cost of living.

- Emerging technologies are reshaping job roles and compensation expectations in accounting and finance.

- HR managers should conduct regular salary reviews, leverage salary data, focus on employee development, and enhance recruitment strategies to navigate salary trends effectively.

Introduction

In the competitive landscape of accounting and finance, understanding salary trends is paramount for organizations seeking to attract and retain top talent. Did you know that 70% of companies struggle to fill key positions in this sector? Boutique Recruiting offers tailored recruitment solutions that align with current salary expectations, providing HR managers with the insights necessary to navigate this dynamic market. As the demand for skilled professionals grows—particularly in lucrative sectors like energy and manufacturing—adapting hiring strategies becomes crucial.

Emerging trends are reshaping work preferences and compensation structures. This article delves into the key factors influencing salary levels, the impact of education and qualifications, and actionable strategies for HR managers to ensure their offerings remain competitive. Consider the regional variations and compliance with labor laws; gaining a comprehensive understanding of these elements is essential for fostering a thriving workforce in today’s evolving job market.

By partnering with Boutique Recruiting, organizations can leverage personalized recruitment services tailored specifically to the financial industry, ensuring they remain at the forefront of talent acquisition. Reach out today to discover how we can help you navigate these complexities with confidence.

Boutique Recruiting: Tailored Recruitment Solutions for Accounting and Finance Salary Insights

Boutique Recruiting stands out in delivering tailored recruitment solutions that align with current accounting and finance salary expectations and trends. By emphasizing a profound understanding of employer needs alongside candidate qualifications, Boutique Recruiting provides HR managers with insights that are both pertinent and actionable. This personalized approach not only enhances recruitment strategies but also empowers organizations to navigate the evolving compensation landscape effectively.

Consider this: the national average income for a Lease/Revenue Recognition Manager is $148,349. This statistic highlights the complexities surrounding remuneration in this field. As the demand for financial professionals escalates—especially in dynamic sectors like energy and manufacturing—Boutique Recruiting observes, “We are seeing particular demand for financial professionals in hot industries such as energy and hard manufacturing, especially those with new technology.” The ability to adapt recruitment strategies is paramount.

Moreover, a significant segment of finance and accounting professionals now prefers to work in the office three days a week or less, reflecting a shift in work preferences post-pandemic. This trend underscores the necessity for companies to revise their hiring strategies and compensation packages, particularly the accounting and finance salary, to attract and retain talent in a competitive job market.

Boutique Recruiting connects candidates with pivotal roles such as CFO, Financial Manager, and Director of Finance across the U.S. and Canada. Their unwavering commitment to aligning services with market trends ensures that clients can attract and retain top talent, ultimately leading to successful placements that fulfill both technical and cultural fit. Are you ready to enhance your recruitment strategy? Reach out for a consultation today.

Key Factors Influencing Salary Levels in Accounting and Finance

Several key factors significantly influence compensation levels in accounting and finance for 2025:

-

Experience: Professionals with extensive experience typically command higher pay, reflecting their proven track record and ability to navigate complex financial scenarios effectively. The correlation between years of experience and income is particularly pronounced in high-demand roles such as financial analysts and accountants, according to industry experts.

-

Education: Advanced degrees and professional certifications, such as CPA (Certified Public Accountant) or CFA (Chartered Financial Analyst), can substantially enhance earning potential. For instance, candidates with the Certified Information Systems Auditor (CISA) certification often experience a notable increase in their compensation offers, as these credentials demonstrate a higher level of expertise and commitment to the field.

-

Industry Demand: The demand for specific roles, particularly financial analysts and accountants, drives compensation increases. Businesses are frequently inclined to provide appealing compensation to attract premier talent in sought-after fields, especially as the economy continues to recover and expand. Boutique Recruiting’s comprehensive compensation guides offer valuable insights into these trends, assisting employers and candidates in navigating the competitive landscape.

-

Company Size: Larger firms generally offer higher wages compared to smaller companies, owing to their greater resources and budget flexibility. This trend is particularly evident in industries where financial expertise is critical to operations, as larger organizations can afford to invest more in their talent.

-

Geographic Location: Salaries can vary significantly based on location, with urban centers typically offering higher compensation due to the cost of living and concentration of financial institutions. For instance, cities such as San Diego, Orange County, and Los Angeles frequently top the nation in compensation levels for finance professionals. Boutique Recruiting’s targeted recruitment services across these key California markets ensure that both employers and candidates are well-informed about regional compensation expectations.

-

Economic Conditions: Broader economic trends, including inflation and market performance, can impact compensation levels. As Warren Buffett suggests, investors should approach decisions with caution, reflecting the need for firms to adjust compensation to remain competitive and retain talent in fluctuating markets.

Understanding these factors is crucial for HR managers aiming to develop competitive compensation packages that attract and retain skilled professionals in the accounting and finance sectors. Boutique Recruiting’s comprehensive compensation guides serve as an essential resource in this endeavor.

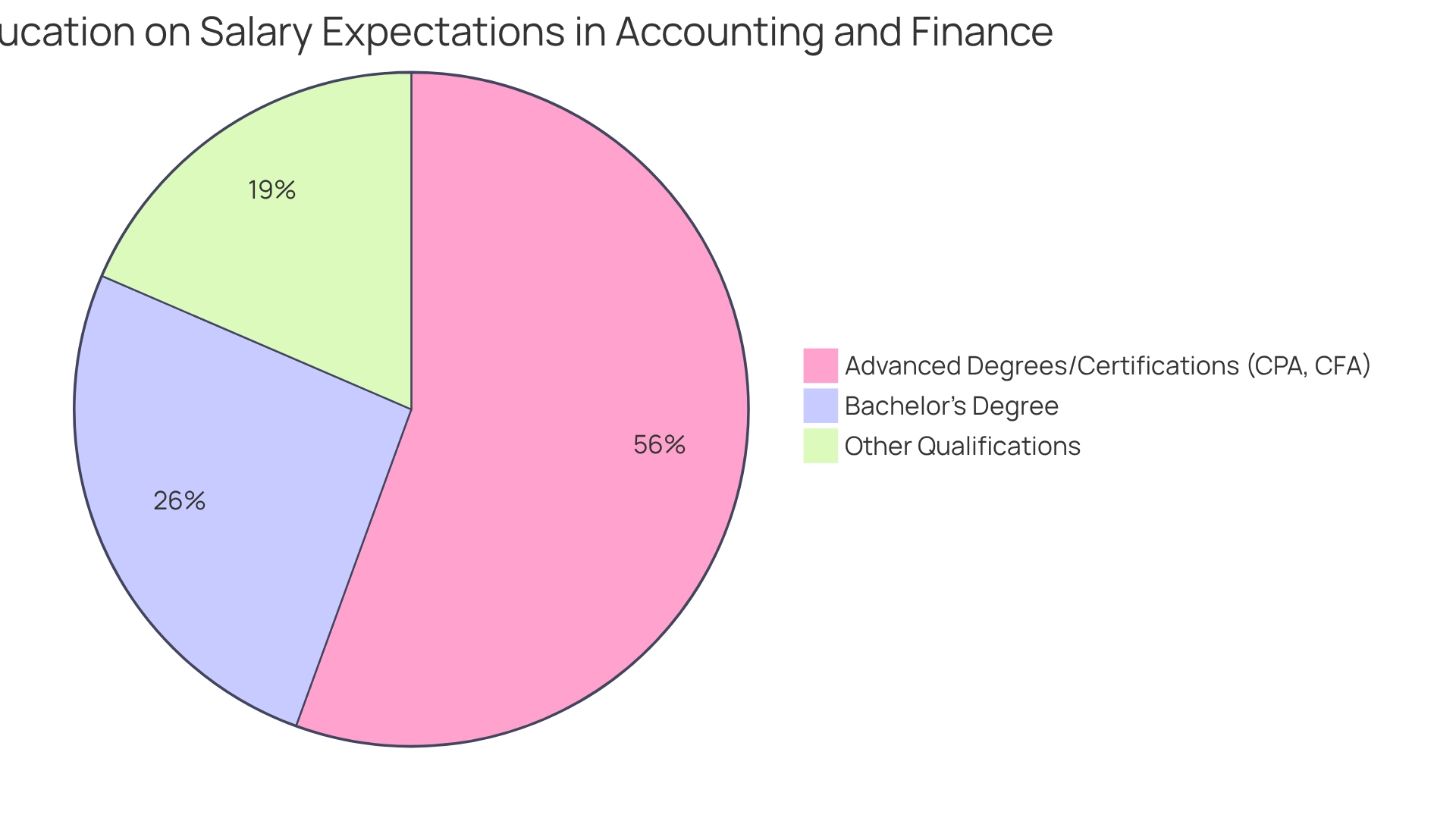

Impact of Education and Qualifications on Salary Expectations

Education significantly influences accounting and finance salary expectations within the sectors. Candidates holding advanced degrees or professional certifications, such as a CPA or CFA, typically command higher accounting and finance salaries compared to those with only a bachelor’s degree. For example, obtaining a CPA designation can result in a compensation increase of 10-15% compared to non-certified counterparts.

Boutique Recruiting’s comprehensive compensation guides provide valuable insights into these trends, aiding HR professionals in crafting competitive remuneration packages. Additionally, financial analysts and marketing specialists have seen real wage increases of 5 to 7 percent, underscoring the rising importance of advanced qualifications in today’s job market.

As the demand for skilled professionals grows, HR managers should consider leveraging Boutique Recruiting’s tailored recruitment services to attract and retain top talent. The Department of Labor and Statistics projects that the employment of accountants and auditors will continue to rise alongside all professions through 2030, emphasizing the need for a competitive accounting and finance salary linked to educational achievements.

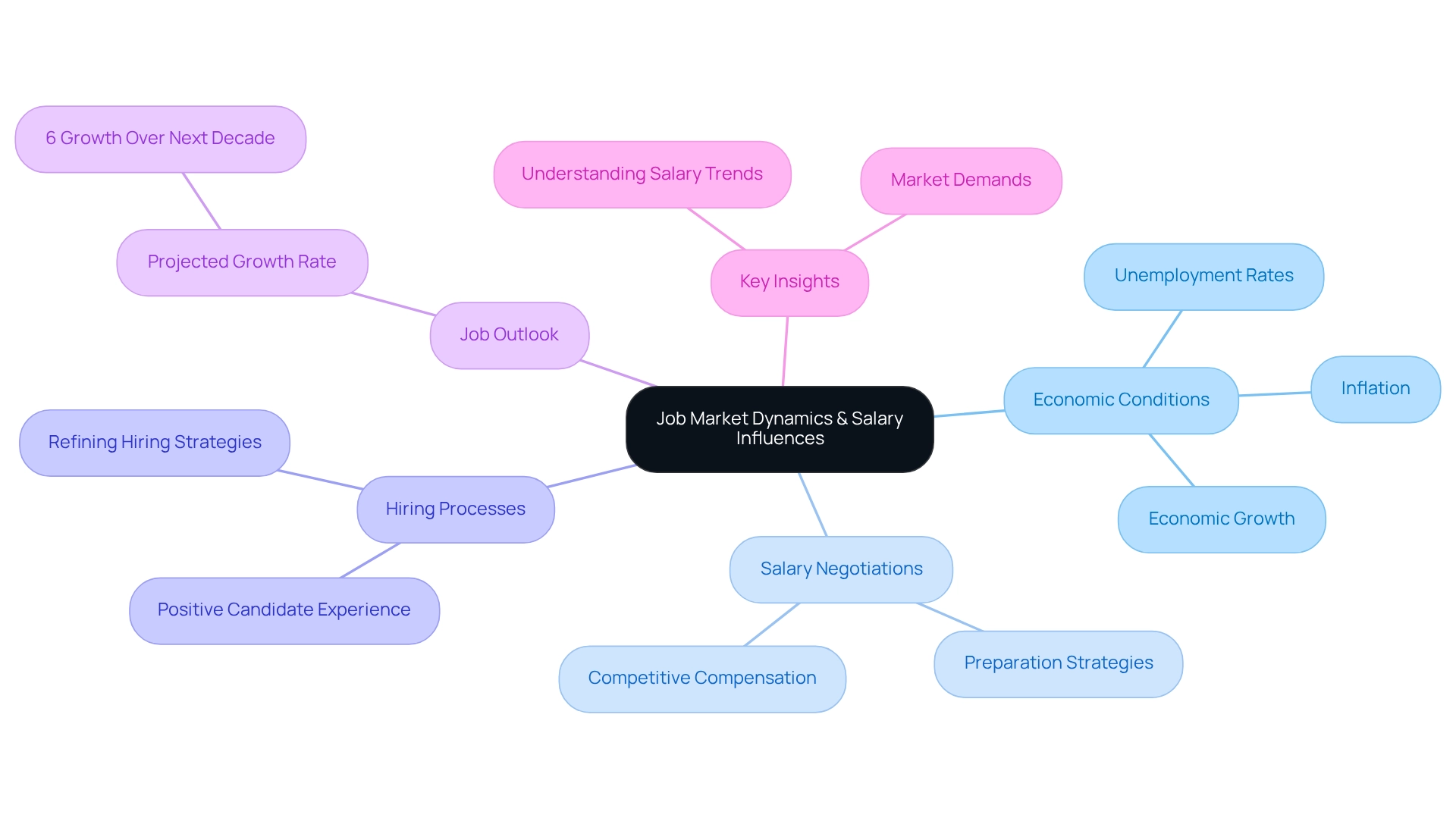

Navigating Job Market Dynamics: Demand and Economic Impact on Salaries

The job market for accounting and finance salary professionals is profoundly influenced by prevailing economic conditions. Key factors such as inflation, unemployment rates, and overall economic growth directly impact wage levels. For instance, during periods of economic expansion, the demand for skilled finance professionals, such as CAO, Controller, and Sr. Accountant, surges, often resulting in a higher accounting and finance salary. Conversely, economic downturns may lead to wage stagnation or even cuts, as companies tighten their budgets.

Understanding these dynamics is crucial for HR managers aiming to navigate salary negotiations effectively and attract top talent. Notably, the job outlook for finance and accounting professionals remains robust, with a projected growth rate of 6% over the next decade. This statistic underscores the importance of staying informed about market trends to maintain a competitive edge in attracting talent, particularly through targeted recruitment services that focus on accounting and marketing positions, such as those provided by Boutique Recruiting.

As Eric Eddy aptly notes, “Attracting top talent demands more than competitive compensation; it also requires navigating the hiring process effectively.” This highlights the necessity for employers to refine their hiring processes to ensure a positive candidate experience, which is essential in the current talent war.

Furthermore, a self-assured and thoroughly prepared strategy for negotiations can significantly enhance the chances of achieving a favorable outcome. Case studies reveal that employees who engage in these discussions with thorough preparation are more successful in negotiating higher compensation, often attaining better results than those who do not.

In summary, HR professionals must remain vigilant regarding the interplay between economic conditions and the accounting and finance salary trends. By understanding how specific economic indicators—such as inflation and unemployment rates—directly influence accounting and finance salary levels, they can offer attractive remuneration packages that entice and retain top-notch candidates in the finance and accounting sectors. Additionally, leveraging personalized recruitment strategies can help distinguish their firms in a challenging market.

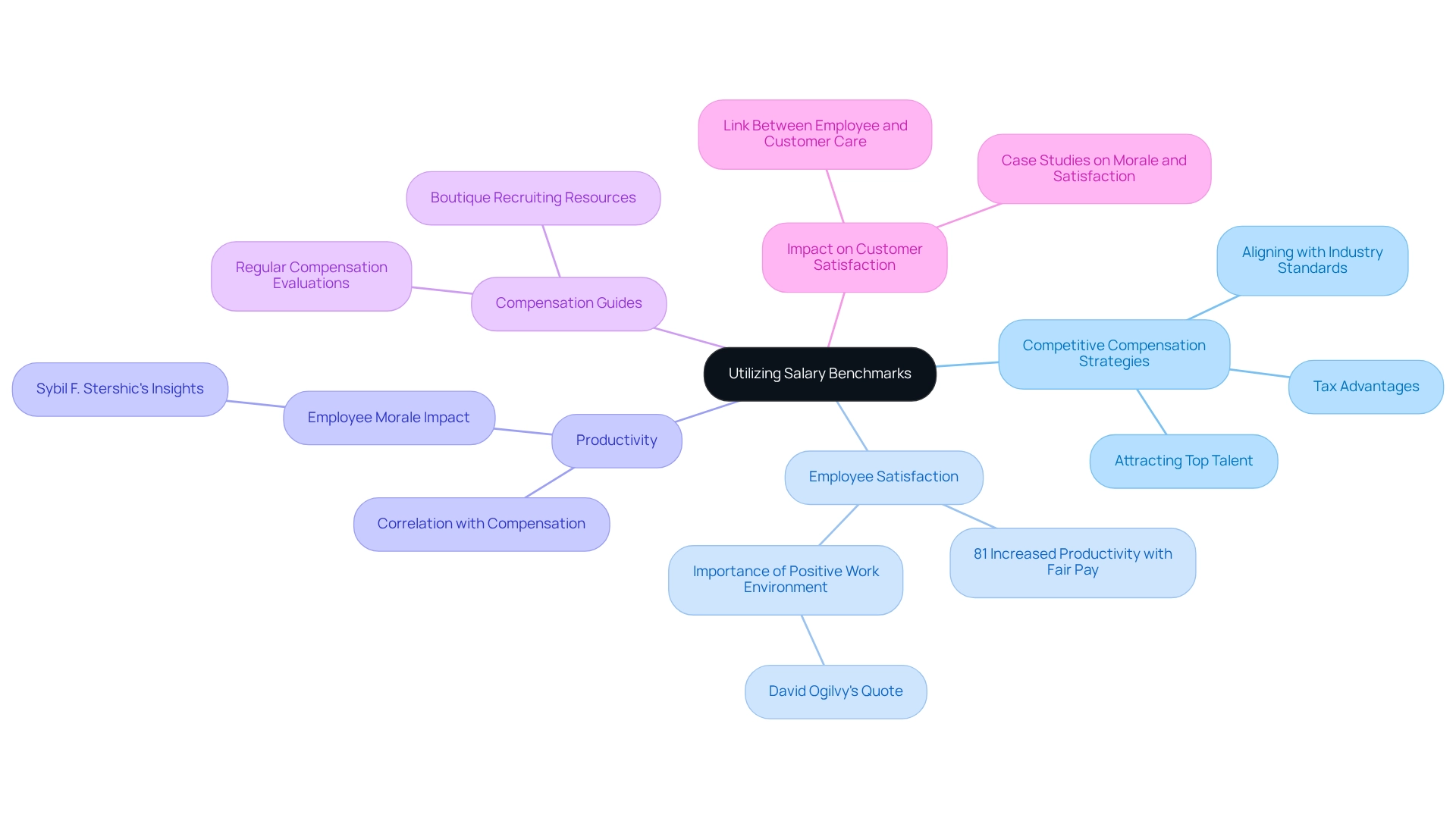

Utilizing Salary Benchmarks for Competitive Compensation Strategies

Employing pay benchmarks is essential for HR managers who seek to develop competitive compensation strategies. By aligning their compensation packages with industry standards, organizations can significantly enhance their appeal to prospective candidates. Boutique Recruiting’s Comprehensive Compensation Guides are invaluable resources, offering detailed insights into current pay trends and benchmarks across California. These guides empower HR managers to make informed decisions regarding compensation packages that meet market expectations.

Expert opinions emphasize the importance of prioritizing people and passion over rigid policies. A recent survey revealed that 81% of employees report enhanced productivity when compensated justly, underscoring the direct correlation between pay satisfaction and employee performance. As David Ogilvy famously stated, “Where people aren’t having fun, they seldom produce good work,” reinforcing the notion that a positive work environment is crucial for productivity.

Moreover, companies that effectively utilize compensation guides, such as those provided by Boutique Recruiting, frequently offer wages that are at or above national averages, benefiting from significant tax advantages. This strategic approach not only attracts top talent but also cultivates a positive work environment. Investing in employee well-being through attractive compensation directly influences customer satisfaction, as evidenced by case studies linking employee morale to customer experiences. Sybil F. Stershic’s insights reveal that when employees feel appreciated, it enhances customer interactions, highlighting the necessity for HR practices that connect employee care with reward strategies.

In summary, leveraging compensation benchmarks transcends mere competitiveness; it fosters a workplace where employees feel valued and motivated. HR managers should consider implementing regular compensation evaluations and utilizing Boutique Recruiting’s comprehensive pay guides to ensure their remuneration strategies are effective and aligned with market trends, ultimately leading to enhanced organizational success.

Regional Salary Variations: Understanding Local Market Dynamics

Substantial regional pay differences exist in the accounting and finance salary sectors. The accounting and finance salary in urban centers, such as New York or San Francisco, typically exceeds that in rural areas due to the cost of living and the demand for skilled professionals.

To navigate these complexities, HR managers can rely on Boutique Recruiting’s detailed Compensation Guide. This guide provides invaluable insights into current market remuneration, including benchmarking tools against competitors.

Download our Salary Guide for comprehensive insights and adjust your compensation strategies accordingly. This ensures you attract and retain top talent across diverse locations.

Emerging Trends: The Impact of Technology on Salary Structures

Emerging technologies are significantly reshaping the accounting and finance salary frameworks in the sectors. Automation and artificial intelligence are streamlining processes, resulting in shifts in job roles and the associated compensation expectations.

For example, positions such as:

- CAO

- Controller

- Senior Accountants

which necessitate advanced technological skills, may command a higher accounting and finance salary as companies actively seek professionals capable of leveraging these tools effectively.

Boutique Recruiting specializes in sourcing high-quality talent for these roles, ensuring that organizations find the right candidates to meet their evolving needs. HR professionals must remain vigilant about these trends to ensure their compensation packages accurately reflect the changing job market.

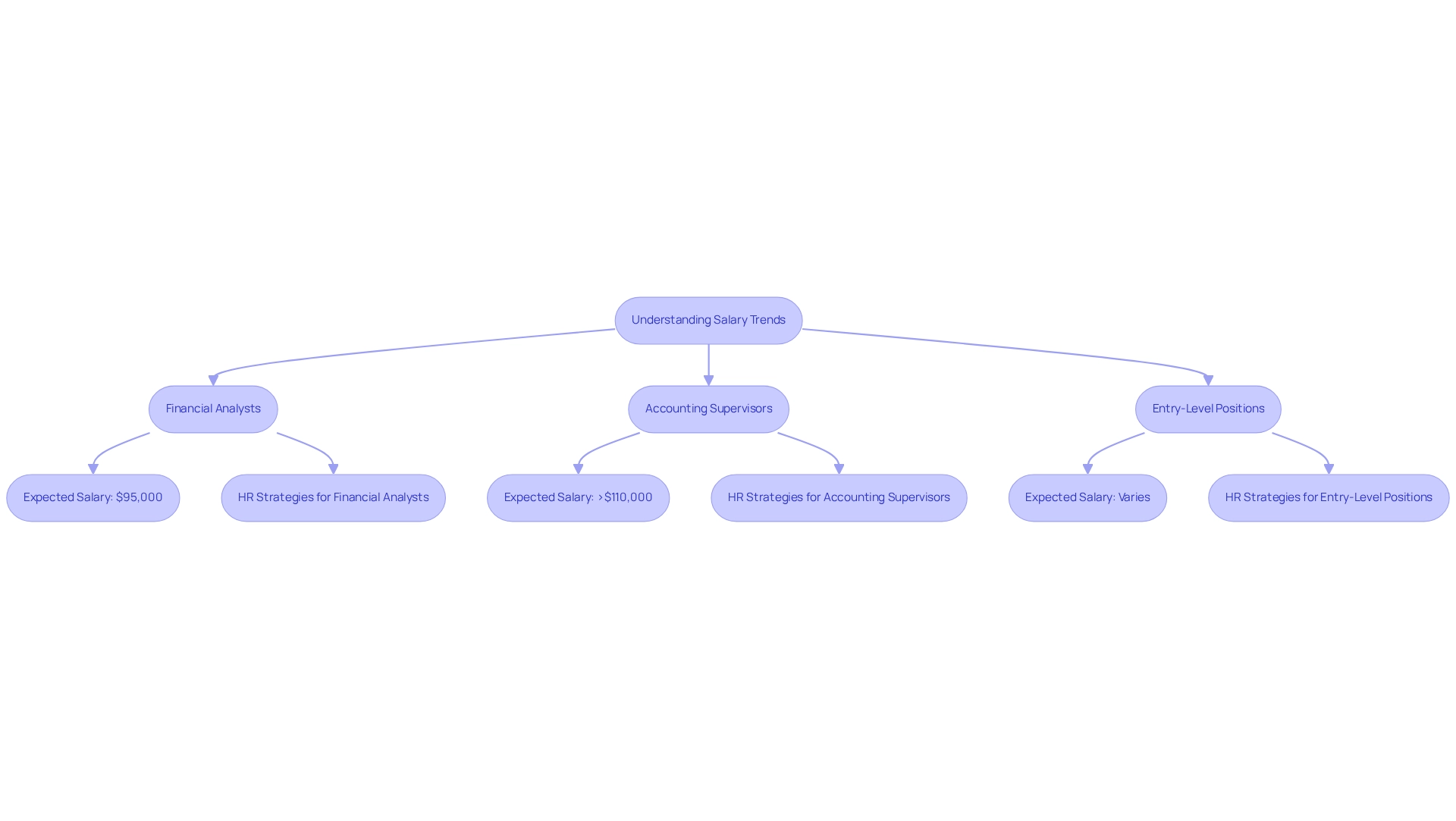

Understanding Salary Trends for Specific Roles in Accounting and Finance

Compensation trends reveal significant disparities across various roles within accounting and finance salary, with financial analysts and accounting supervisors experiencing remarkable income growth compared to entry-level positions. In 2025, the typical accounting and finance salary for a financial analyst in California is expected to be around $95,000, while accounting supervisors can anticipate earnings exceeding $110,000. This upward trajectory underscores the increasing demand for skilled professionals in these roles, driven by the evolving expectations regarding accounting and finance salary in the finance sector.

To effectively attract top talent, HR professionals must tailor their compensation strategies to align with these trends. As Eric Eddy from CPA Resources Global Professionals notes, “The firm’s ability to deliver top-notch applicants quickly and efficiently highlights the critical role of effective recruitment in meeting market demands.” This emphasizes the importance of combining competitive compensation packages with incentives. For instance, with 55% of supervisors providing up to 20% increased compensation to promote in-office attendance, it is essential to consider how such incentives can be incorporated into remuneration packages for financial analysts and accounting supervisors. Furthermore, insights from industry experts suggest that understanding the specific needs and motivations of candidates can further enhance recruitment efforts.

Case studies, such as the changing role of CFOs as corporate strategists, emphasize the necessity for organizations to modify their pay structures to reflect the strategic significance of finance positions. By staying updated on compensation trends and adjusting remuneration strategies accordingly, HR professionals can ensure they remain competitive in attracting and retaining top-quality talent in accounting and finance salary. Additionally, insights from Boutique Recruiting regarding contract talent and consulting solutions provide a broader perspective on the recruitment landscape, which is beneficial for HR managers considering various staffing strategies.

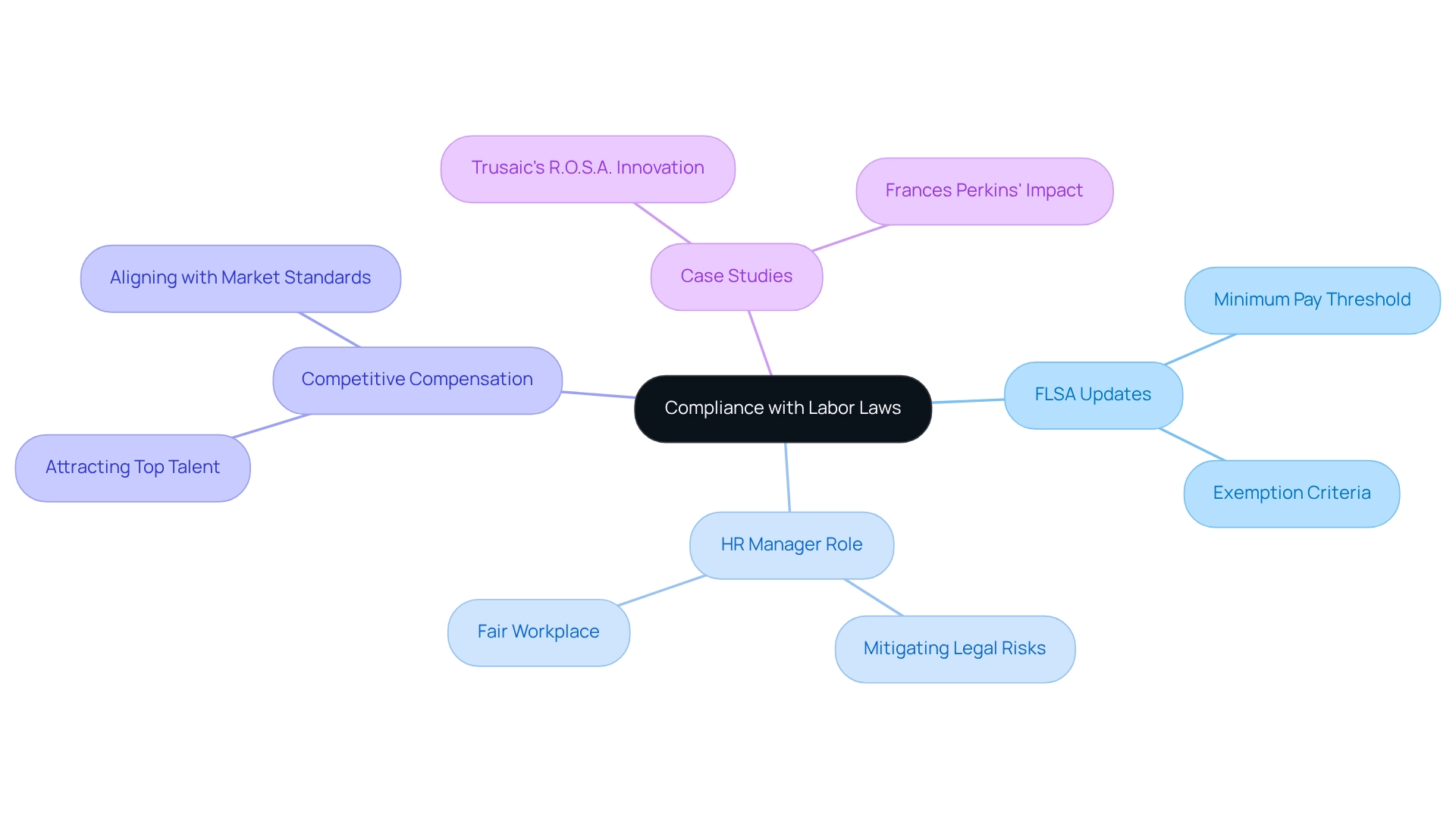

Compliance with Labor Laws: Shaping Salary Structures in Finance

Adherence to labor regulations is crucial in shaping compensation frameworks within the finance sector. Recent updates to the Fair Labor Standards Act (FLSA) have significantly raised the minimum pay threshold for exempt employees, compelling companies to reevaluate their compensation strategies. HR managers must prioritize compliance with these regulations to mitigate legal risks and foster a fair workplace environment. Understanding the nuances of labor laws, including the exemption criteria, is essential for creating competitive compensation frameworks that not only meet legal standards but also align with accounting and finance salary expectations to attract and retain top talent in a competitive market. As organizations adjust to these changes, it is imperative that their compensation offerings reflect both compliance and market competitiveness.

For instance, Trusaic’s R.O.S.A. innovation illustrates how companies are actively addressing compliance challenges by implementing multiple remediation simulations to identify cost-effective pay adjustments. Additionally, the historical context provided by Frances Perkins, the first woman appointed as U.S. Secretary of Labor, highlights the significant impact of labor reforms on employee rights and compensation. Her insights underscore the ongoing importance of compliance in the finance sector.

As organizations navigate these updates, they can look to successful case studies of companies that have adjusted their compensation frameworks in response to labor law changes. These examples offer practical insights for HR professionals aiming to enhance their strategies. The imperative is clear: to thrive in today’s competitive landscape, organizations must ensure that their compensation practices not only comply with regulations but also position them as leaders in attracting top talent.

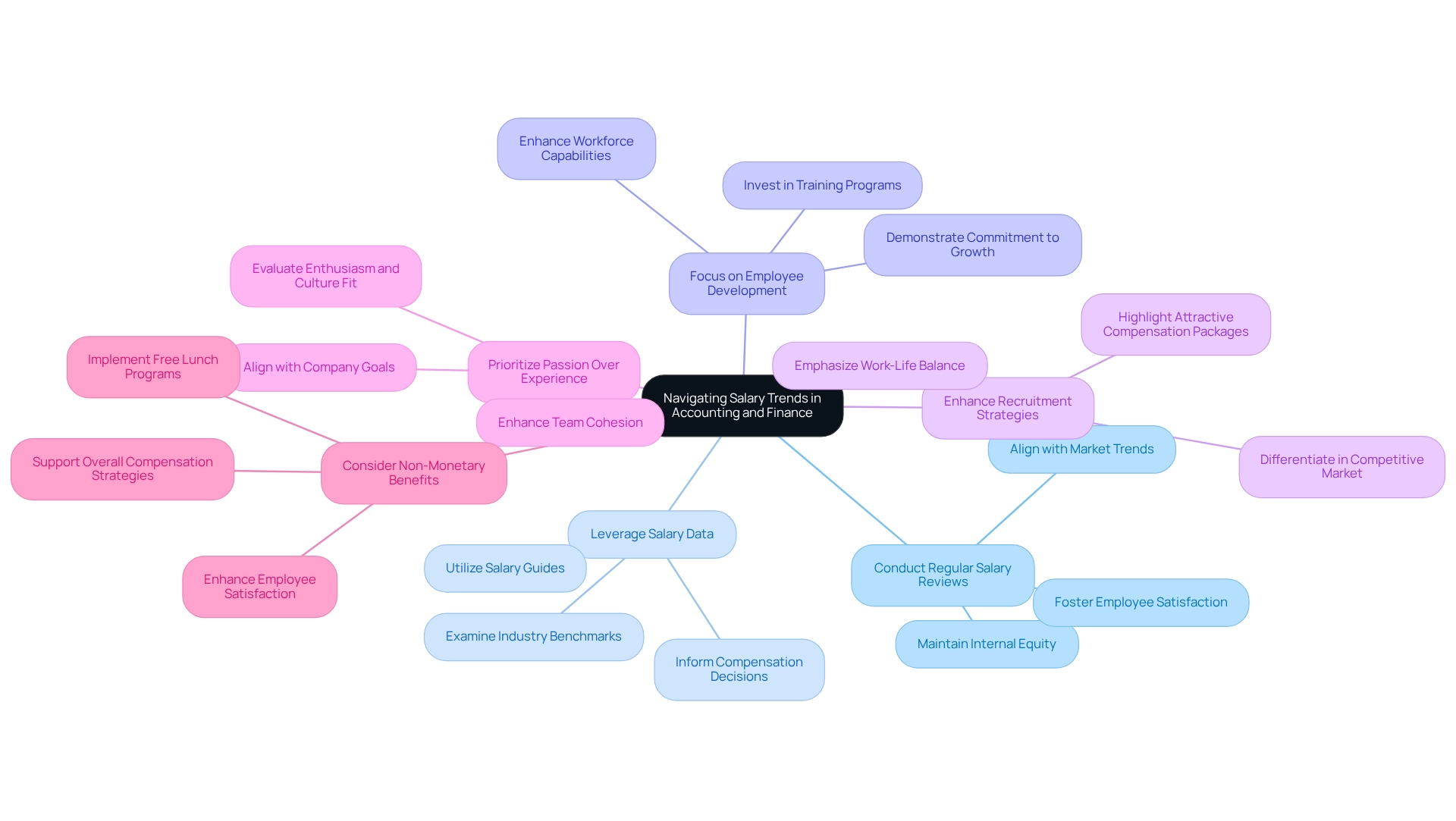

Actionable Strategies for HR Managers on Accounting and Finance Salary Trends

HR managers can implement several actionable strategies to effectively navigate salary trends in accounting and finance:

- Conduct Regular Salary Reviews: Regular assessments and adjustments of salary structures are essential to align with market trends and maintain internal equity. This practice not only ensures competitiveness but also fosters employee satisfaction and retention.

- Leverage Salary Data: Utilizing Boutique Recruiting’s Salary Guide and other benchmarking tools is crucial for informing compensation decisions. By examining industry benchmarks, HR managers can guarantee their offerings stay appealing to potential candidates, positioning their organization advantageously in the challenging talent landscape.

- Focus on Employee Development: Investing in training and development programs enhances employee skills and justifies higher salary offerings. This approach not only improves workforce capabilities but also demonstrates a commitment to employee growth, which can lead to increased job satisfaction.

- Enhance Recruitment Strategies: Tailoring recruitment approaches to highlight attractive compensation packages, including benefits and work-life balance, is vital for attracting top talent. Highlighting these aspects can differentiate an organization in a competitive job market. Additionally, Boutique Recruiting is recognized as a go-to choice for individuals seeking rewarding career opportunities, underscoring the importance of attracting candidates who are not only qualified but also looking for fulfilling roles.

- Prioritize Passion Over Experience: As highlighted in a case study, prioritizing candidates’ passion for the company’s goals can lead to a workforce that aligns more closely with the organization’s identity and values. This strategy can enhance team cohesion and overall performance. HR professionals should consider implementing this approach by evaluating candidates’ enthusiasm and alignment with company culture during the recruitment process.

- Consider Non-Monetary Benefits: A study found that 67% of employees with free lunches at work reported being happy. This statistic illustrates how non-monetary benefits can enhance employee satisfaction, which is relevant to overall compensation strategies.

By implementing these strategies, HR managers can not only navigate accounting and finance salary trends effectively but also contribute to a more engaged and satisfied workforce in the sectors. To gain deeper insights and access comprehensive data, download Boutique Recruiting’s Salary Guide today. As Peter Drucker famously said, “Culture eats strategy for breakfast,” highlighting the importance of aligning recruitment strategies with company culture.

Conclusion

Understanding the complexities of salary trends in accounting and finance is essential for organizations aiming to attract and retain top talent. Key factors influencing salary levels—such as experience, education, industry demand, company size, geographic location, and economic conditions—underscore the importance of aligning compensation strategies with market realities. As the demand for skilled professionals continues to rise, particularly in lucrative sectors, HR managers must adapt their hiring practices to remain competitive.

Emerging trends, including the growing impact of technology and shifts in work preferences, further complicate the landscape. Companies that leverage comprehensive salary guides, like those offered by Boutique Recruiting, can gain valuable insights to refine their compensation packages. By prioritizing compliance with labor laws and understanding regional variations, organizations can create equitable and attractive salary structures that resonate with potential candidates.

Ultimately, adopting actionable strategies—such as regular salary reviews, leveraging salary data, and focusing on employee development—can significantly enhance an organization’s ability to compete for top talent. By fostering a positive work environment and prioritizing employee satisfaction, companies can not only meet market demands but also cultivate a thriving workforce that drives long-term success. As the job market continues to evolve, staying informed and adaptable is crucial for HR managers committed to excellence in talent acquisition.

Frequently Asked Questions

What makes Boutique Recruiting unique in the recruitment industry?

Boutique Recruiting stands out by delivering tailored recruitment solutions that align with current accounting and finance salary expectations and trends, emphasizing a deep understanding of both employer needs and candidate qualifications.

What is the average salary for a Lease/Revenue Recognition Manager?

The national average income for a Lease/Revenue Recognition Manager is $148,349.

Which industries are currently seeing a high demand for financial professionals?

There is particular demand for financial professionals in dynamic sectors such as energy and hard manufacturing, especially those with expertise in new technology.

How have work preferences changed for finance and accounting professionals post-pandemic?

A significant segment of finance and accounting professionals now prefers to work in the office three days a week or less, indicating a shift in work preferences that companies need to consider in their hiring strategies and compensation packages.

What roles does Boutique Recruiting connect candidates with?

Boutique Recruiting connects candidates with pivotal roles such as CFO, Financial Manager, and Director of Finance across the U.S. and Canada.

What factors influence compensation levels in accounting and finance for 2025?

Key factors include experience, education, industry demand, company size, geographic location, and economic conditions.

How does experience affect salary in the finance and accounting sectors?

Professionals with extensive experience typically command higher pay, especially in high-demand roles like financial analysts and accountants.

What role does education play in salary expectations?

Advanced degrees and professional certifications, such as CPA or CFA, can significantly enhance earning potential, with certified individuals often seeing a compensation increase of 10-15% compared to non-certified counterparts.

How does company size impact compensation?

Larger firms generally offer higher wages than smaller companies due to greater resources and budget flexibility.

Why do salaries vary by geographic location?

Salaries can differ significantly based on location, with urban centers typically offering higher compensation due to a higher cost of living and a concentration of financial institutions.

How do economic conditions affect compensation levels?

Broader economic trends, such as inflation and market performance, can influence compensation levels, prompting firms to adjust salaries to remain competitive.

What resources does Boutique Recruiting provide for HR managers?

Boutique Recruiting offers comprehensive compensation guides that assist HR managers in developing competitive compensation packages to attract and retain skilled professionals in the accounting and finance sectors.