Overview

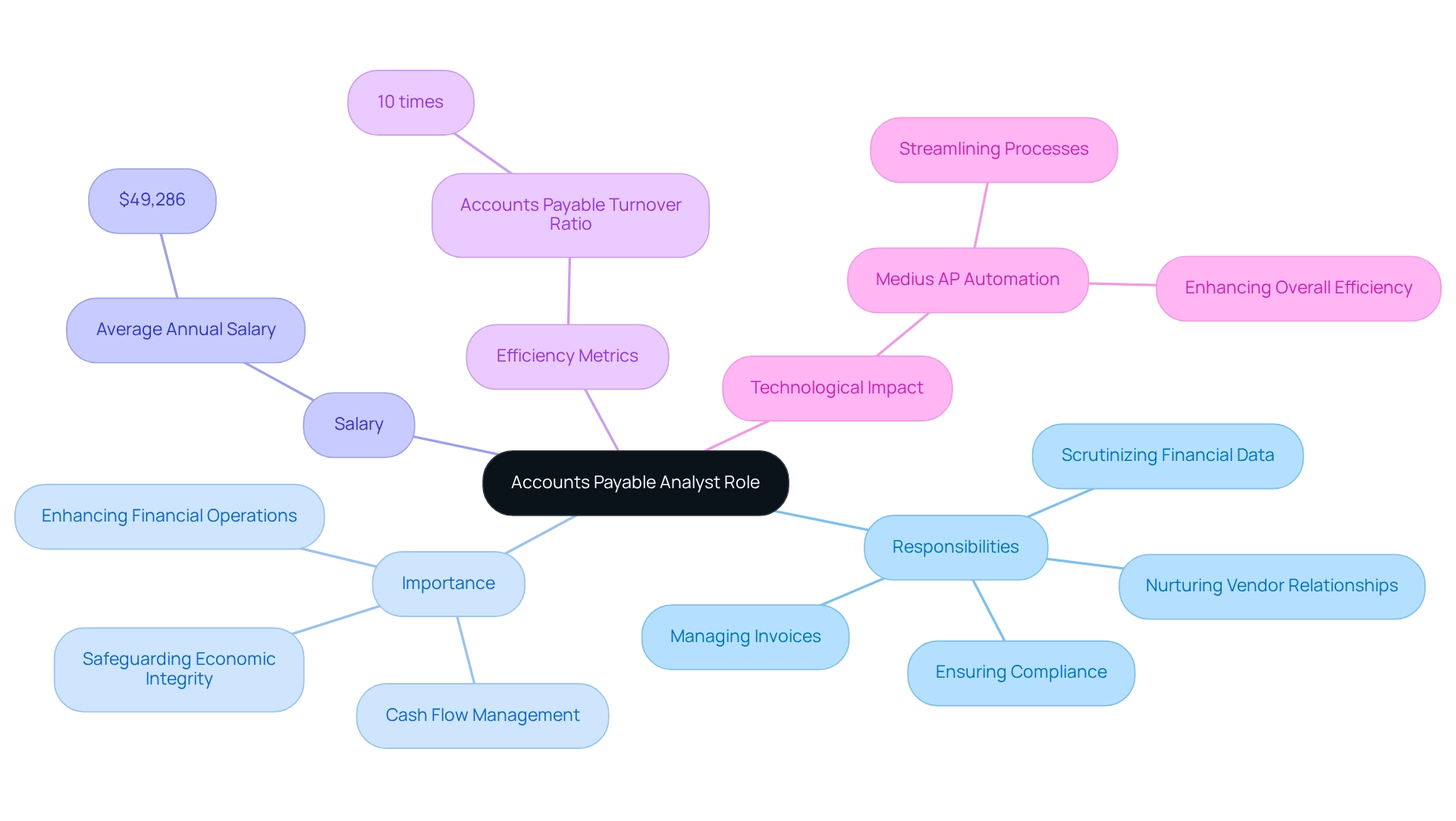

The role of an Accounts Payable Analyst is paramount, as it entails the oversight of a company’s outgoing payments, management of invoices, and the cultivation of vendor relationships to guarantee timely and accurate payments. This position has evolved significantly, necessitating strong analytical skills, collaboration across departments, and the adept use of technology for process optimization. Such advancements underscore its critical importance in maintaining cash flow and enhancing overall financial operations. As the financial landscape continues to change, the capabilities of an Accounts Payable Analyst are more vital than ever.

Key Highlights:

- The Accounts Payable Analyst oversees a company’s outgoing payments, managing invoices and vendor relationships to ensure timely and accurate payments.

- Key responsibilities include processing invoices, verifying purchase orders, and maintaining accurate financial records.

- The role has evolved to involve collaboration across departments, enhancing transaction accuracy and reducing errors.

- As of 2025, the average salary for an Accounts Payable Analyst is approximately $49,286, reflecting the expertise required in this position.

- Candidates typically need a bachelor’s degree in accounting or finance, along with 2-4 years of relevant experience and strong analytical skills.

- Timely payments managed by Analysts are crucial for maintaining cash flow and enhancing vendor relationships, which can lead to better payment terms.

- The use of technology, such as AP automation, is transforming the role, allowing Analysts to focus on strategic financial management.

- The importance of the role is underscored by the need for compliance with financial regulations and the ability to analyze payment data for budgeting and forecasting.

Introduction

In the intricate world of financial management, the role of an Accounts Payable Analyst emerges as a cornerstone of organizational success. Tasked with overseeing outgoing payments, these professionals ensure that invoices are processed accurately and timely, fostering robust vendor relationships that are vital for smooth business operations.

As companies navigate the complexities of cash flow management in 2025, the significance of this role has only intensified. Analysts are not merely managing payments; they are leveraging data to inform strategic financial decisions.

With the rise of automation and the increasing need for cross-departmental collaboration, the responsibilities of Accounts Payable Analysts are evolving. Their expertise is more crucial than ever in maintaining financial integrity and operational efficiency.

Define the Role of an Accounts Payable Analyst

The account payable analyst job description involves being a critical financial expert tasked with overseeing a company’s outgoing payments. This account payable analyst job description encompasses managing invoices, ensuring compliance with financial policies, and nurturing vendor relationships. By guaranteeing that all payments are executed accurately and punctually, the account payable analyst job description emphasizes the essential role this position plays in the financial operations of an organization, which is vital for fostering strong supplier relationships and ensuring seamless business processes. In 2025, the significance of the account payable analyst job description has only escalated, as they are pivotal in managing cash flow and safeguarding the economic integrity of the organization. According to the Bureau of Labor Statistics, the average annual salary for a financial specialist handling invoices is approximately $49,286, reflecting the expertise demanded in this position. Furthermore, if a firm had total purchases of $500,000 in a year and average liabilities of $50,000, the Turnover Ratio for Liabilities would be 10 times, demonstrating the efficiency expected from a Liabilities Analyst.

The responsibilities of a Liabilities Analyst extend beyond meticulous invoice processing; they also involve scrutinizing financial data to uncover discrepancies and ensure compliance with established fiscal policies. Their ability to manage outgoing payments efficiently is underscored by expert opinions, which emphasize that the account payable analyst job description is crucial for sustaining vendor relationships and enhancing financial operations. George Capozzi, a Senior Manager of FP&A at Quadient, underscores the importance of this role in navigating the complexities of financial operations.

Boutique Recruiting specializes in sourcing top-tier talent for accounting positions, ensuring that organizations have access to skilled Analysts capable of refining their financial processes. Case studies, such as the implementation of Medius AP Automation, exemplify how technology can elevate the efficiency of accounts payable processes. The demo showcases how Medius can optimize accounts payable operations, allowing analysts to focus on strategic financial management rather than routine tasks. This evolution in the role highlights the importance of financial analysts in today’s competitive landscape. As Eric Eddy notes, the firm’s ability to provide high-quality candidates promptly and effectively is essential for filling these critical roles, ensuring that organizations have the right talent to manage their financial operations efficiently.

Outline Key Responsibilities and Duties

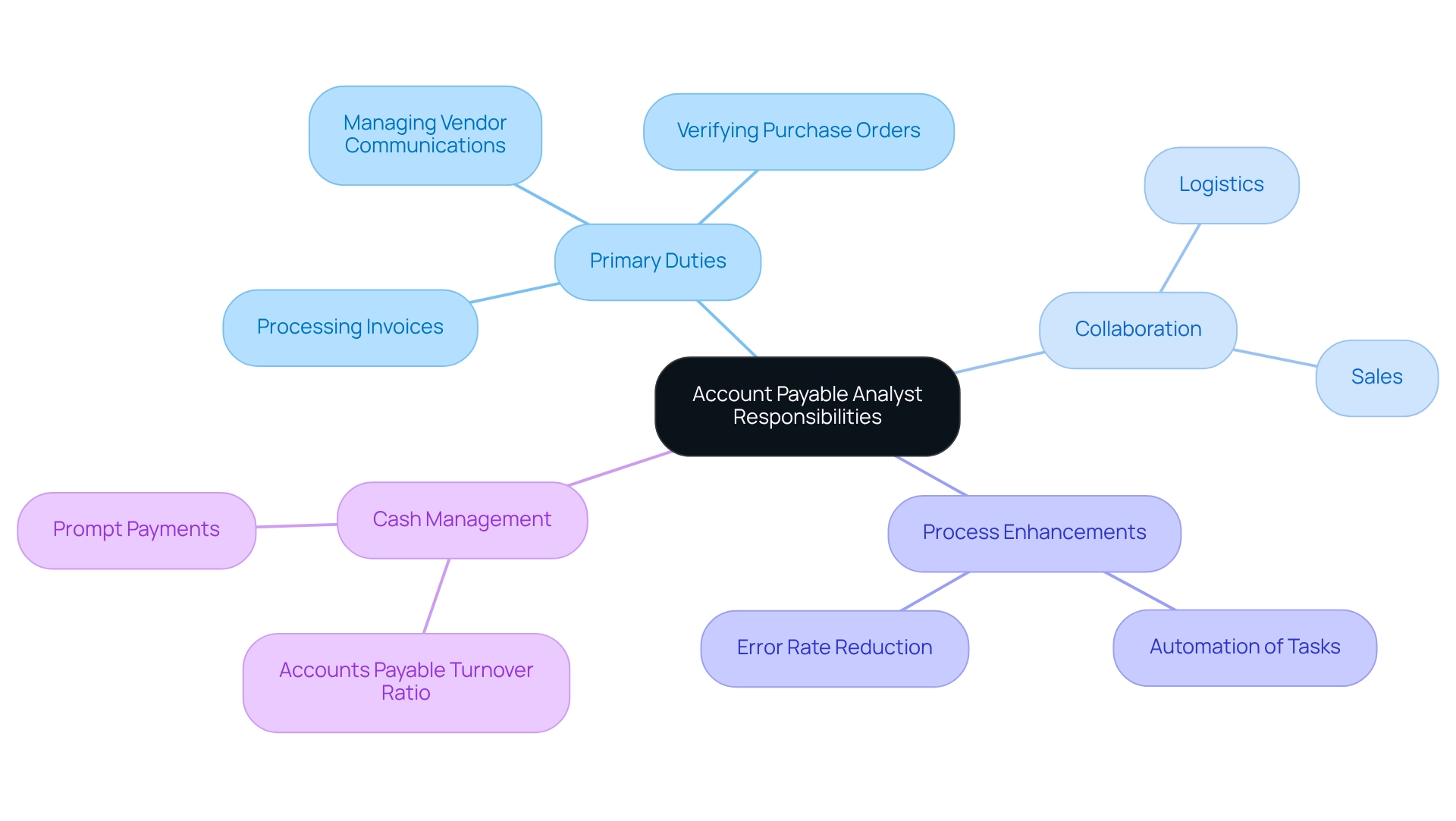

The account payable analyst job description includes primary duties that encompass a range of essential tasks vital for effective budget management. The account payable analyst job description involves:

- Processing invoices and expense reports

- Verifying purchase orders

- Managing vendor communications to ensure timely payments

They play a critical role in reconciling accounts payable ledgers, maintaining accurate records, and preparing comprehensive reports on payment activities, which are all part of the account payable analyst job description. As of 2025, the position has evolved to include collaboration with various departments, such as logistics and sales, ensuring that all transactions are accurately recorded and comply with internal controls. This cross-departmental interaction is crucial for minimizing errors, especially considering that 47% of automation challenges in accounts payable arise from invoice and payment approvals. By automating previously manual tasks, organizations can significantly reduce invoice processing times and costs, lower error rates, and enhance the volume of invoices managed daily.

Moreover, financial analysts are increasingly involved in audits and play a pivotal role in implementing process enhancements aimed at improving efficiency within the accounts settlement function. As organizations strive to navigate contemporary challenges, including invoice exceptions and delays, the capacity to adapt accounts payable processes flexibly is emphasized in the account payable analyst job description, making it essential. This adaptability not only streamlines operations but also fosters better cash management, as evidenced by the accounts payable turnover ratio, which indicates how rapidly a company pays its suppliers. A high turnover ratio reflects effective cash management practices, whereas a low ratio may signal potential cash flow issues or strained supplier relationships. Ultimately, the evolving landscape of accounts payable management necessitates that the account payable analyst job description includes remaining proactive in their roles, consistently seeking methods to optimize processes and minimize error rates, thereby contributing to the overall economic health of their organizations.

Identify Required Qualifications and Skills

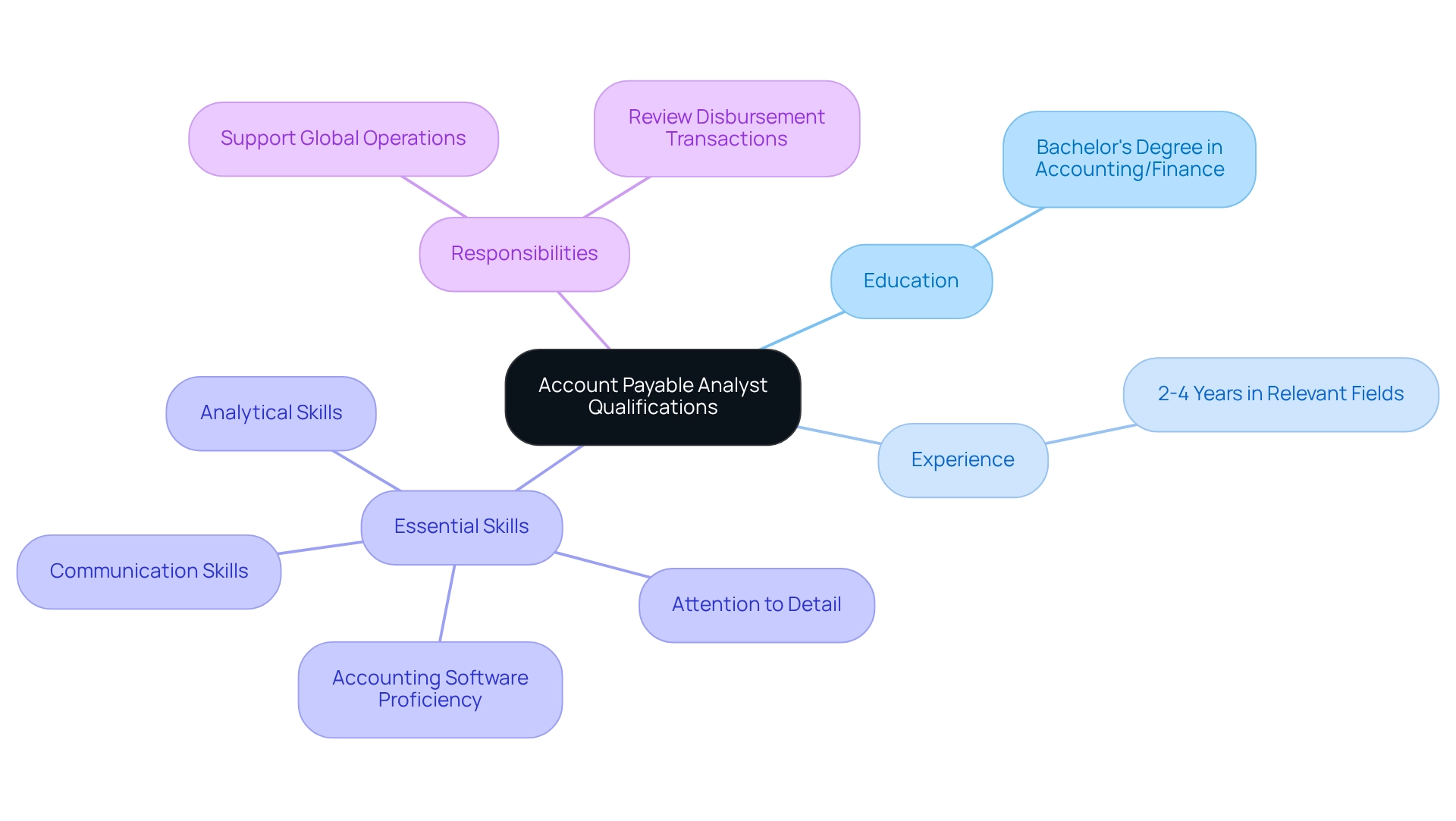

To qualify for the account payable analyst job description, candidates typically need a bachelor’s degree in accounting, finance, or a related discipline. Employers often prioritize individuals with two to four years of relevant experience, as outlined in the account payable analyst job description, or in financial analysis. The account payable analyst job description includes essential skills such as:

- Strong analytical capabilities

- Meticulous attention to detail

- Proficiency in accounting software and ERP systems

Furthermore, excellent communication skills are crucial as outlined in the account payable analyst job description for collaborating with various departments to resolve payment issues and enhance operational processes. A thorough understanding of financial regulations and compliance standards is vital for ensuring adherence to the account payable analyst job description and the industry requirements.

As the position evolves in 2025, candidates with a robust academic foundation and practical experience will stand out, reflecting the increasing complexity of financial operations in a competitive job market. Hiring managers underscore the significance of candidates demonstrating strong analytical skills and attention to detail, as these attributes are critical for success according to the account payable analyst job description. Boutique Recruiting’s tailored talent acquisition solutions emphasize human connections and industry-specific needs, reinforcing their reputation as a trusted partner in identifying qualified candidates who meet these outlined qualifications.

Moreover, the Financial Specialist plays a pivotal role in supporting global operations and scrutinizing disbursement transactions for company bank accounts, highlighting the responsibilities associated with this position.

Explain the Importance of the Role in Financial Operations

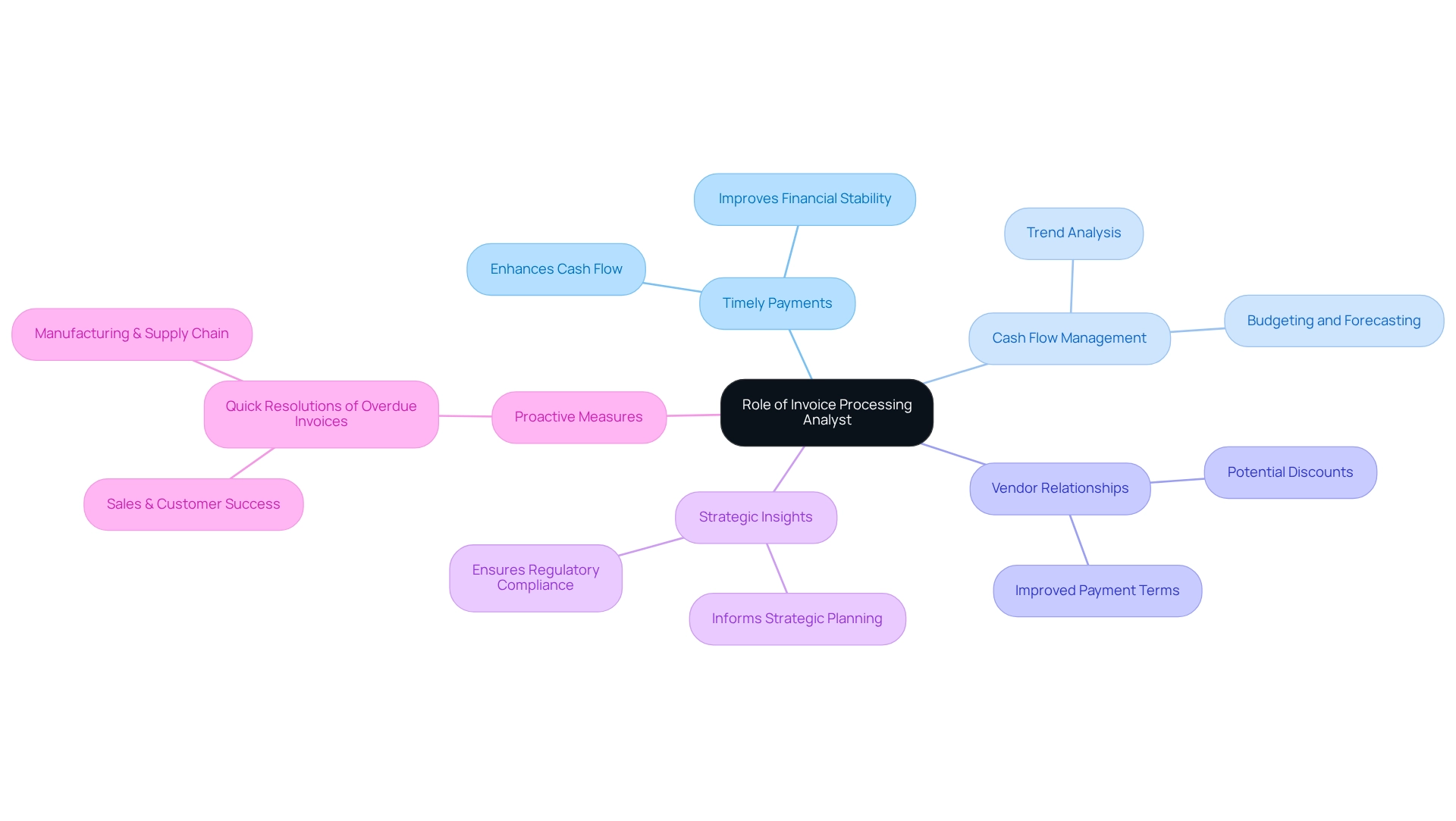

The role of an Invoice Processing Analyst is vital for ensuring that a company’s financial obligations are met with precision and timeliness. Effective management of accounts payable not only enhances vendor relationships but also paves the way for improved payment terms and potential discounts. In 2025, the importance of timely payments is underscored by the fact that 88% of finance professionals believe that enhancing invoice management can significantly free their teams for more strategic initiatives.

Timely payments are crucial for maintaining robust cash flow, which directly influences a company’s financial stability. Financial Analysts are instrumental in this process, analyzing payment data and identifying trends that inform budgeting and forecasting. Their insights are indispensable for strategic financial planning and ensuring compliance with regulatory requirements.

Case studies across various sectors, including manufacturing and supply chain, illustrate that proactive measures taken by Analysts in managing overdue invoices lead to swift resolutions, thus minimizing prolonged delays. This proactive approach not only enhances cash flow management but also highlights the significance of the account payable analyst job description in navigating the complexities of financial operations. As industry leader Alex Louisy points out, streamlining the collections process can be transformative for overall financial health, highlighting the critical nature of this role in today’s competitive landscape.

Conclusion

The role of an Accounts Payable Analyst is undeniably central to effective financial management within organizations. These professionals oversee outgoing payments, process invoices, and maintain strong vendor relationships, all of which are vital for smooth operations. With the increasing complexity of cash flow management in 2025, their expertise is crucial in ensuring timely and accurate payments, ultimately contributing to the financial integrity of the organization.

Moreover, the responsibilities of Accounts Payable Analysts have evolved beyond traditional tasks. Their involvement in cross-departmental collaboration, automation of processes, and implementation of strategic improvements underscores the importance of adaptability in today’s fast-paced business environment. By actively engaging in audits and refining payment processes, these analysts enhance operational efficiency and support robust cash management practices, essential for sustained organizational success.

As the landscape of financial operations continues to evolve, the role of Accounts Payable Analysts will only grow in significance. Their ability to leverage data, streamline processes, and maintain compliance not only strengthens vendor relationships but also positions organizations for strategic financial planning. As businesses navigate the challenges of 2025 and beyond, investing in skilled Accounts Payable Analysts will be a key driver of financial health and operational excellence.

Frequently Asked Questions

What is the primary responsibility of an account payable analyst?

The primary responsibility of an account payable analyst is to oversee a company’s outgoing payments, manage invoices, ensure compliance with financial policies, and nurture vendor relationships.

Why is the role of an account payable analyst important for an organization?

The role of an account payable analyst is essential for managing cash flow, safeguarding the economic integrity of the organization, fostering strong supplier relationships, and ensuring seamless business processes.

What is the average annual salary for an account payable analyst?

According to the Bureau of Labor Statistics, the average annual salary for a financial specialist handling invoices is approximately $49,286.

What are some key responsibilities of a liabilities analyst?

Key responsibilities of a liabilities analyst include processing invoices, scrutinizing financial data to uncover discrepancies, and ensuring compliance with established fiscal policies.

How does technology impact the accounts payable process?

Technology, such as Medius AP Automation, can elevate the efficiency of accounts payable processes, allowing analysts to focus on strategic financial management rather than routine tasks.

What is the significance of the Turnover Ratio for Liabilities in financial analysis?

The Turnover Ratio for Liabilities demonstrates the efficiency expected from a liabilities analyst, illustrating how effectively a company manages its outgoing payments in relation to its total purchases and average liabilities. For example, if a firm had total purchases of $500,000 and average liabilities of $50,000, the Turnover Ratio would be 10 times.

How does Boutique Recruiting contribute to the hiring of account payable analysts?

Boutique Recruiting specializes in sourcing top-tier talent for accounting positions, ensuring organizations have access to skilled analysts capable of refining their financial processes.

{“@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [{“@type”: “Question”, “name”: “What is the primary responsibility of an account payable analyst?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “The primary responsibility of an account payable analyst is to oversee a company’s outgoing payments, manage invoices, ensure compliance with financial policies, and nurture vendor relationships.”}}, {“@type”: “Question”, “name”: “Why is the role of an account payable analyst important for an organization?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “The role of an account payable analyst is essential for managing cash flow, safeguarding the economic integrity of the organization, fostering strong supplier relationships, and ensuring seamless business processes.”}}, {“@type”: “Question”, “name”: “What is the average annual salary for an account payable analyst?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “According to the Bureau of Labor Statistics, the average annual salary for a financial specialist handling invoices is approximately $49,286.”}}, {“@type”: “Question”, “name”: “What are some key responsibilities of a liabilities analyst?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Key responsibilities of a liabilities analyst include processing invoices, scrutinizing financial data to uncover discrepancies, and ensuring compliance with established fiscal policies.”}}, {“@type”: “Question”, “name”: “How does technology impact the accounts payable process?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Technology, such as Medius AP Automation, can elevate the efficiency of accounts payable processes, allowing analysts to focus on strategic financial management rather than routine tasks.”}}, {“@type”: “Question”, “name”: “What is the significance of the Turnover Ratio for Liabilities in financial analysis?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “The Turnover Ratio for Liabilities demonstrates the efficiency expected from a liabilities analyst, illustrating how effectively a company manages its outgoing payments in relation to its total purchases and average liabilities. For example, if a firm had total purchases of $500,000 and average liabilities of $50,000, the Turnover Ratio would be 10 times.”}}, {“@type”: “Question”, “name”: “How does Boutique Recruiting contribute to the hiring of account payable analysts?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Boutique Recruiting specializes in sourcing top-tier talent for accounting positions, ensuring organizations have access to skilled analysts capable of refining their financial processes.”}}]}{“@context”: “https://schema.org”, “@type”: “BlogPosting”, “headline”: “Account Payable Analyst Job Description: Key Roles and Skills”, “description”: “Explore the essential roles and skills of an Account Payable Analyst in this comprehensive job overview.”, “datePublished”: “2025-04-30T00:37:43.929000”, “image”: [“https://images.tely.ai/telyai/sczgxeou-start-at-the-center-with-the-main-role-follow-the-branches-to-discover-responsibilities-salary-details-and-the-impact-of-technology-each-branch-represents-a-different-aspect-of-the-role.webp”, “https://images.tely.ai/telyai/cexjohyn-the-central-node-represents-the-overall-role-with-branches-breaking-down-specific-duties-and-their-relevance-to-other-functions-in-the-organization-follow-the-branches-to-understand-how-each-responsibility-contributes-to-effective-financial-management.webp”, “https://images.tely.ai/telyai/bvgdcmme-the-center-shows-the-job-title-and-each-branch-represents-a-requirement-follow-the-branches-to-see-specific-qualifications-and-skills-needed-for-success-in-this-role.webp”, “https://images.tely.ai/telyai/nypklbyr-the-central-node-represents-the-primary-role-with-branches-showing-how-this-role-influences-key-financial-areas-follow-the-branches-to-see-specific-impacts-and-actions-that-contribute-to-the-overall-success-of-financial-operations.webp”], “articleBody”: “## Overview\nThe role of an Accounts Payable Analyst is paramount, as it entails the oversight of a company’s outgoing payments, management of invoices, and the cultivation of vendor relationships to guarantee timely and accurate payments. This position has evolved significantly, necessitating strong analytical skills, collaboration across departments, and the adept use of technology for process optimization. Such advancements underscore its critical importance in maintaining cash flow and enhancing overall financial operations. As the financial landscape continues to change, the capabilities of an Accounts Payable Analyst are more vital than ever.\n\n## Key Highlights:\n- The Accounts Payable Analyst oversees a company’s outgoing payments, managing invoices and vendor relationships to ensure timely and accurate payments.\n- Key responsibilities include processing invoices, verifying purchase orders, and maintaining accurate financial records.\n- The role has evolved to involve collaboration across departments, enhancing transaction accuracy and reducing errors.\n- As of 2025, the average salary for an Accounts Payable Analyst is approximately $49,286, reflecting the expertise required in this position.\n- Candidates typically need a bachelor’s degree in accounting or finance, along with 2-4 years of relevant experience and strong analytical skills.\n- Timely payments managed by Analysts are crucial for maintaining cash flow and enhancing vendor relationships, which can lead to better payment terms.\n- The use of technology, such as AP automation, is transforming the role, allowing Analysts to focus on strategic financial management.\n- The importance of the role is underscored by the need for compliance with financial regulations and the ability to analyze payment data for budgeting and forecasting.\n\n## Introduction\nIn the intricate world of financial management, the role of an Accounts Payable Analyst emerges as a cornerstone of organizational success. Tasked with overseeing outgoing payments, these professionals ensure that invoices are processed accurately and timely, fostering robust vendor relationships that are vital for smooth business operations. \n\nAs companies navigate the complexities of cash flow management in 2025, the significance of this role has only intensified. Analysts are not merely managing payments; they are leveraging data to inform strategic financial decisions. \n\nWith the rise of automation and the increasing need for cross-departmental collaboration, the responsibilities of Accounts Payable Analysts are evolving. Their expertise is more crucial than ever in maintaining financial integrity and operational efficiency.\n\n## Define the Role of an Accounts Payable Analyst\nThe account payable analyst job description involves being a critical financial expert tasked with overseeing a company’s outgoing payments. This account payable analyst job description encompasses managing invoices, ensuring compliance with financial policies, and nurturing vendor relationships. By guaranteeing that all payments are executed accurately and punctually, the account payable analyst job description emphasizes the essential role this position plays in the financial operations of an organization, which is vital for fostering strong supplier relationships and ensuring seamless business processes. In 2025, the significance of the account payable analyst job description has only escalated, as they are pivotal in managing cash flow and safeguarding the economic integrity of the organization. According to the Bureau of Labor Statistics, the average annual salary for [a financial specialist handling invoices](https://quadient.com/en/blog/what-are-roles-and-responsibilities-accounts-payable) is approximately $49,286, reflecting the expertise demanded in this position. Furthermore, if a firm had total purchases of $500,000 in a year and average liabilities of $50,000, the Turnover Ratio for Liabilities would be 10 times, demonstrating the efficiency expected from a Liabilities Analyst.\n\nThe responsibilities of a Liabilities Analyst extend beyond meticulous invoice processing; they also involve scrutinizing financial data to uncover discrepancies and ensure compliance with established fiscal policies. Their ability to manage outgoing payments efficiently is underscored by expert opinions, which emphasize that the account payable analyst job description is crucial for sustaining vendor relationships and enhancing financial operations. George Capozzi, a Senior Manager of FP&A at Quadient, underscores the importance of this role in navigating the complexities of financial operations.\n\nBoutique Recruiting specializes in sourcing top-tier talent for accounting positions, ensuring that organizations have access to skilled Analysts capable of refining their financial processes. Case studies, such as the implementation of Medius AP Automation, exemplify how technology can elevate the efficiency of accounts payable processes. The demo showcases how Medius can optimize accounts payable operations, allowing analysts to focus on strategic financial management rather than routine tasks. This evolution in the role highlights the importance of financial analysts in today’s competitive landscape. As Eric Eddy notes, the firm’s ability to provide high-quality candidates promptly and effectively is essential for filling these critical roles, ensuring that organizations have the right talent to manage their financial operations efficiently.\n\n\n## Outline Key Responsibilities and Duties\n[The account payable analyst job description](https://www.boutiquerecruiting.com/what-is-the-accounts-receivable-analyst-salary-understanding-pay-structures-and-trends/) includes primary duties that encompass a range of essential tasks vital for effective budget management. The account payable analyst job description involves:\n\n1. Processing invoices and expense reports\n2. Verifying purchase orders\n3. Managing vendor communications to ensure timely payments\n\nThey play a critical role in reconciling accounts payable ledgers, maintaining accurate records, and preparing comprehensive reports on payment activities, which are all part of the account payable analyst job description. As of 2025, the position has evolved to include collaboration with various departments, such as logistics and sales, ensuring that all transactions are accurately recorded and comply with internal controls. This cross-departmental interaction is crucial for minimizing errors, especially considering that 47% of automation challenges in accounts payable arise from invoice and payment approvals. By automating previously manual tasks, organizations can significantly reduce invoice processing times and costs, lower error rates, and enhance the volume of invoices managed daily.\n\nMoreover, financial analysts are increasingly involved in audits and play a pivotal role in implementing process enhancements aimed at improving efficiency within the accounts settlement function. As organizations strive to navigate contemporary challenges, including invoice exceptions and delays, the capacity to adapt accounts payable processes flexibly is emphasized in the account payable analyst job description, making it essential. This adaptability not only streamlines operations but also fosters better cash management, as evidenced by the accounts payable turnover ratio, which indicates how rapidly a company pays its suppliers. A high turnover ratio reflects effective cash management practices, whereas a low ratio may signal potential cash flow issues or strained supplier relationships. Ultimately, the evolving landscape of accounts payable management necessitates that the account payable analyst job description includes remaining proactive in their roles, consistently seeking methods to optimize processes and minimize error rates, thereby contributing to the overall economic health of their organizations.\n\n\n## Identify Required Qualifications and Skills\nTo qualify for [the account payable analyst job description](https://talent.com/salary?job=accounts+payable), candidates typically need a bachelor’s degree in accounting, finance, or a related discipline. Employers often prioritize individuals with two to four years of relevant experience, as outlined in the account payable analyst job description, or in financial analysis. The account payable analyst job description includes essential skills such as:\n\n- Strong analytical capabilities\n- Meticulous attention to detail\n- Proficiency in accounting software and ERP systems\n\nFurthermore, excellent communication skills are crucial as outlined in the account payable analyst job description for collaborating with various departments to resolve payment issues and enhance operational processes. A thorough understanding of financial regulations and compliance standards is vital for ensuring adherence to the account payable analyst job description and the industry requirements.\n\nAs the position evolves in 2025, candidates with a robust academic foundation and practical experience will stand out, reflecting the increasing complexity of financial operations in a competitive job market. Hiring managers underscore the significance of candidates demonstrating strong analytical skills and attention to detail, as these attributes are critical for success according to the account payable analyst job description. Boutique Recruiting’s tailored talent acquisition solutions emphasize human connections and industry-specific needs, reinforcing their reputation as a trusted partner in identifying qualified candidates who meet these outlined qualifications.\n\nMoreover, the Financial Specialist plays a pivotal role in supporting global operations and scrutinizing disbursement transactions for company bank accounts, highlighting the responsibilities associated with this position.\n\n\n## Explain the Importance of the Role in Financial Operations\nThe role of an Invoice Processing Analyst is vital for ensuring that a company’s financial obligations are met with precision and timeliness. Effective management of accounts payable not only enhances vendor relationships but also paves the way for improved payment terms and potential discounts. In 2025, the importance of timely payments is underscored by the fact that 88% of finance professionals believe that [enhancing invoice management](https://docuclipper.com/blog/accounts-payable-statistics) can significantly free their teams for more strategic initiatives. \n\nTimely payments are crucial for maintaining robust cash flow, which directly influences a company’s financial stability. Financial Analysts are instrumental in this process, analyzing payment data and identifying trends that inform budgeting and forecasting. Their insights are indispensable for strategic financial planning and ensuring compliance with regulatory requirements. \n\nCase studies across various sectors, including manufacturing and supply chain, illustrate that proactive measures taken by Analysts in managing overdue invoices lead to swift resolutions, thus minimizing prolonged delays. This proactive approach not only enhances cash flow management but also highlights the significance of the account payable analyst job description in navigating the complexities of financial operations. As industry leader Alex Louisy points out, streamlining the collections process can be transformative for overall financial health, highlighting the critical nature of this role in today’s competitive landscape.\n\n\n\n## Conclusion\nThe role of an Accounts Payable Analyst is undeniably central to effective financial management within organizations. These professionals oversee outgoing payments, process invoices, and maintain strong vendor relationships, all of which are vital for smooth operations. With the increasing complexity of cash flow management in 2025, their expertise is crucial in ensuring timely and accurate payments, ultimately contributing to the financial integrity of the organization. \n\nMoreover, the responsibilities of Accounts Payable Analysts have evolved beyond traditional tasks. Their involvement in cross-departmental collaboration, automation of processes, and implementation of strategic improvements underscores the importance of adaptability in today\u2019s fast-paced business environment. By actively engaging in audits and refining payment processes, these analysts enhance operational efficiency and support robust cash management practices, essential for sustained organizational success. \n\nAs the landscape of financial operations continues to evolve, the role of Accounts Payable Analysts will only grow in significance. Their ability to leverage data, streamline processes, and maintain compliance not only strengthens vendor relationships but also positions organizations for strategic financial planning. As businesses navigate the challenges of 2025 and beyond, investing in skilled Accounts Payable Analysts will be a key driver of financial health and operational excellence.\n\n::iframe[https://iframe.tely.ai/cta/eyJhcnRpY2xlX2lkIjogIjY4MTE3MGQ3MDliMGIyMThhNDc1NTZlNiIsICJjb21wYW55X2lkIjogIjY3YWU2NGU5YzhlZTg4N2E0ZmUzZmYxOSIsICJpbmRleCI6IG51bGx9]{width=\”100%\” height=\”300px\”}”}