Overview

The article presents a comparative analysis of accounting and finance certifications, spotlighting essential credentials such as CPA, CMA, and CFA, and their significance in career advancement.

It is crucial to select the appropriate certification based on individual career aspirations and industry requirements.

Each certification offers unique advantages, challenges, and earning potentials that can profoundly influence a professional’s career trajectory.

Have you considered how the right certification could shape your future in finance?

Key Highlights:

- Accounting and finance certifications validate expertise and enhance career prospects.

- Key certifications include Certified Public Accountant (CPA), Certified Management Accountant (CMA), and Chartered Financial Analyst (CFA).

- CPA is the gold standard for accountants, focusing on auditing, taxation, and financial reporting.

- CMA emphasizes management accounting and financial management, suitable for corporate finance careers.

- CFA is tailored for investment professionals, covering portfolio management and financial analysis.

- Each certification has unique requirements, benefits, and challenges that must align with career goals.

- CPAs often enjoy higher earning potential and job stability, but face rigorous exam and continuing education demands.

- CMAs provide strategic advantages in management roles, while CFAs are respected in investment banking but require extensive study.

- Professionals with certifications typically experience significant career advancement and salary increases.

- Choosing the right certification should align with personal career aspirations and industry demands.

Introduction

In the competitive landscape of accounting and finance, certifications emerge as crucial credentials that not only validate expertise but also significantly enhance career prospects. As professionals navigate their paths, it becomes essential to grasp the nuances of certifications such as:

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Chartered Financial Analyst (CFA)

Each certification presents distinct advantages, aligning with various career aspirations and industry demands. By delving into the specifics of these credentials—including their benefits, drawbacks, and the impact on career trajectories—individuals can make informed decisions that propel them toward success in their chosen fields.

Understanding Accounting and Finance Certifications

Certifications for accounting and finance serve as essential qualifications that validate an individual’s expertise and knowledge in their respective fields. These qualifications not only enhance a person’s resume but also reflect a commitment to career advancement and adherence to industry standards. In today’s competitive employment market, certifications for accounting and finance, including the Certified Public Accountant (CPA) and Certified Management Accountant (CMA), are often prerequisites for advanced positions, making them crucial for professional growth. Understanding the distinctions among these qualifications, including their prerequisites and focus areas, is imperative for professionals eager to elevate their career prospects through certifications for accounting and finance.

Have you considered how these qualifications could impact your career trajectory? The right credentials can open doors to opportunities that might otherwise remain closed. As the landscape of the financial sector continues to evolve, staying informed about the latest certifications for accounting and finance and their relevance is vital. By investing in your professional development, you position yourself as a competitive candidate in a challenging job market. Ultimately, the path to advancement in accounting and finance is paved with the right certifications for accounting and finance. Take charge of your career today—explore the qualifications that align with your professional goals and reach out for guidance on how to navigate this critical aspect of your career development.

Overview of Key Certifications: CPA, CMA, and More

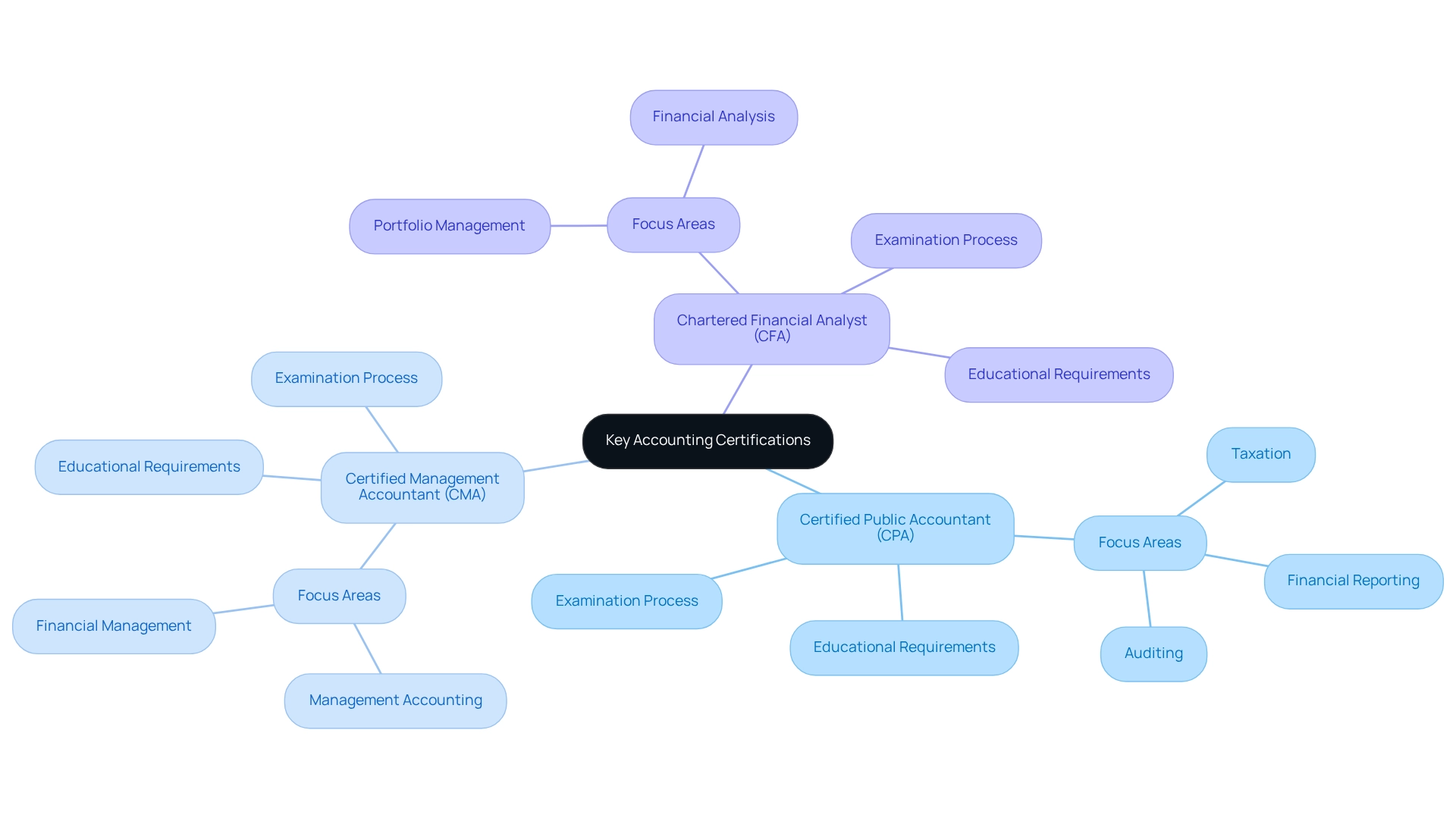

In the realm of accounting and finance, the most prominent certifications include:

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Chartered Financial Analyst (CFA)

The CPA stands as the gold standard for accountants, emphasizing areas such as auditing, taxation, and financial reporting. Conversely, the CMA focuses on management accounting and financial management, making it an ideal choice for those pursuing careers in corporate finance. Tailored specifically for investment professionals, the CFA encompasses essential topics like portfolio management and financial analysis. Each of these credentials presents distinct educational requirements, examination processes, and specialized areas of expertise. Therefore, it is crucial for candidates to select their certification based on their career aspirations and interests.

Evaluating Career Impact: Benefits and Drawbacks of Each Certification

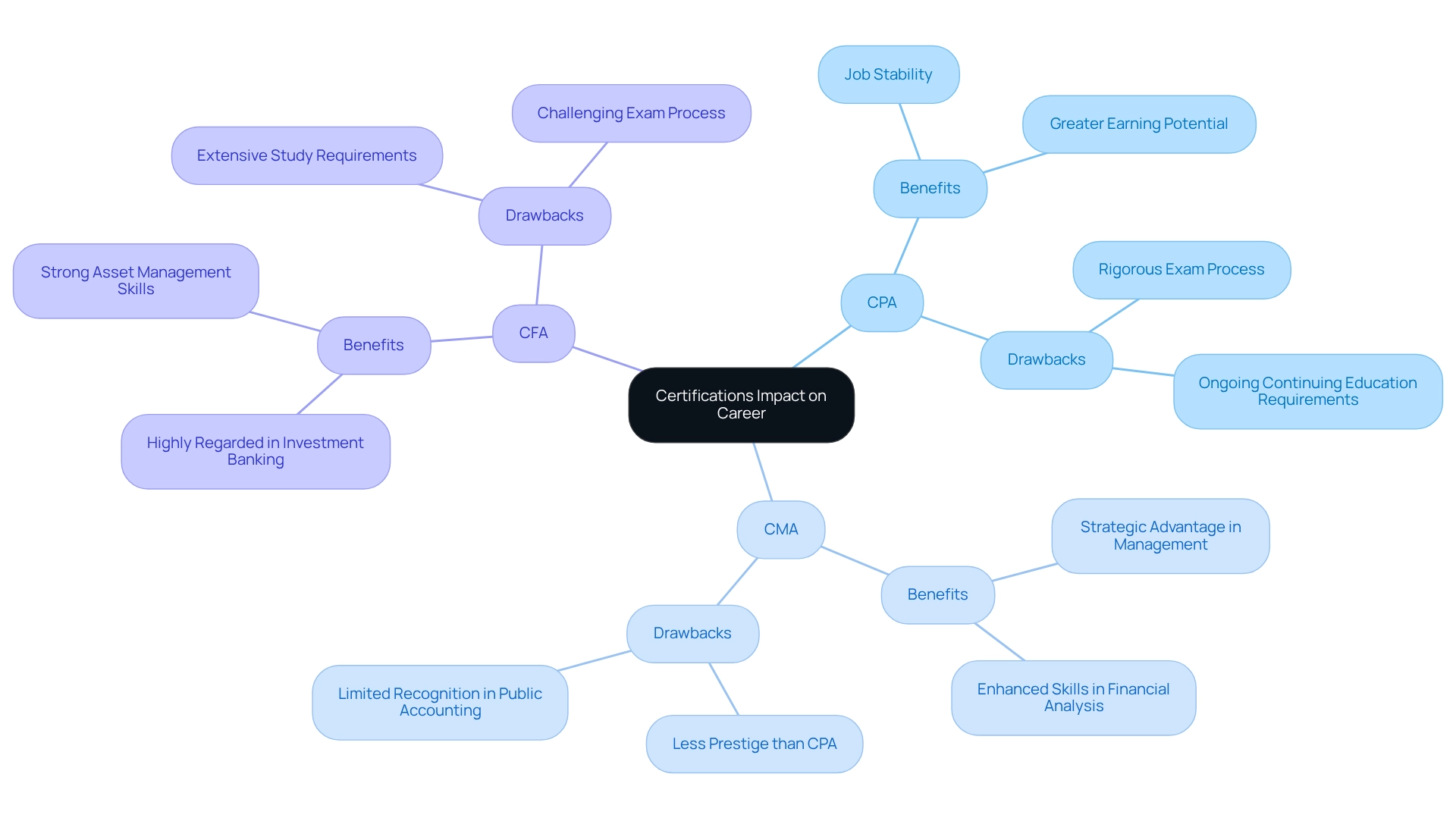

Each credential, such as certifications for accounting and finance, offers unique advantages and disadvantages that are crucial for professionals to consider. The CPA qualification is often associated with greater earning potential and job stability, as CPAs are in high demand across various sectors. However, the rigorous exam process and ongoing continuing education requirements can be daunting for many candidates.

On the other hand, the CMA credential provides a strategic advantage for individuals in management positions, enhancing their skills in financial analysis and decision-making. Yet, it may not hold the same prestige as the CPA in public accounting. The CFA designation is highly regarded in investment banking and asset management; however, the extensive study and exam requirements can present significant barriers for prospective candidates.

Assessing these elements is vital for individuals contemplating which credential to pursue. What are your career aspirations, and how do these qualifications align with them? Understanding the nuances of each certification, particularly certifications for accounting and finance, can empower you to make informed decisions in your professional journey.

Comparative Analysis: Choosing the Right Certification for Your Career Goals

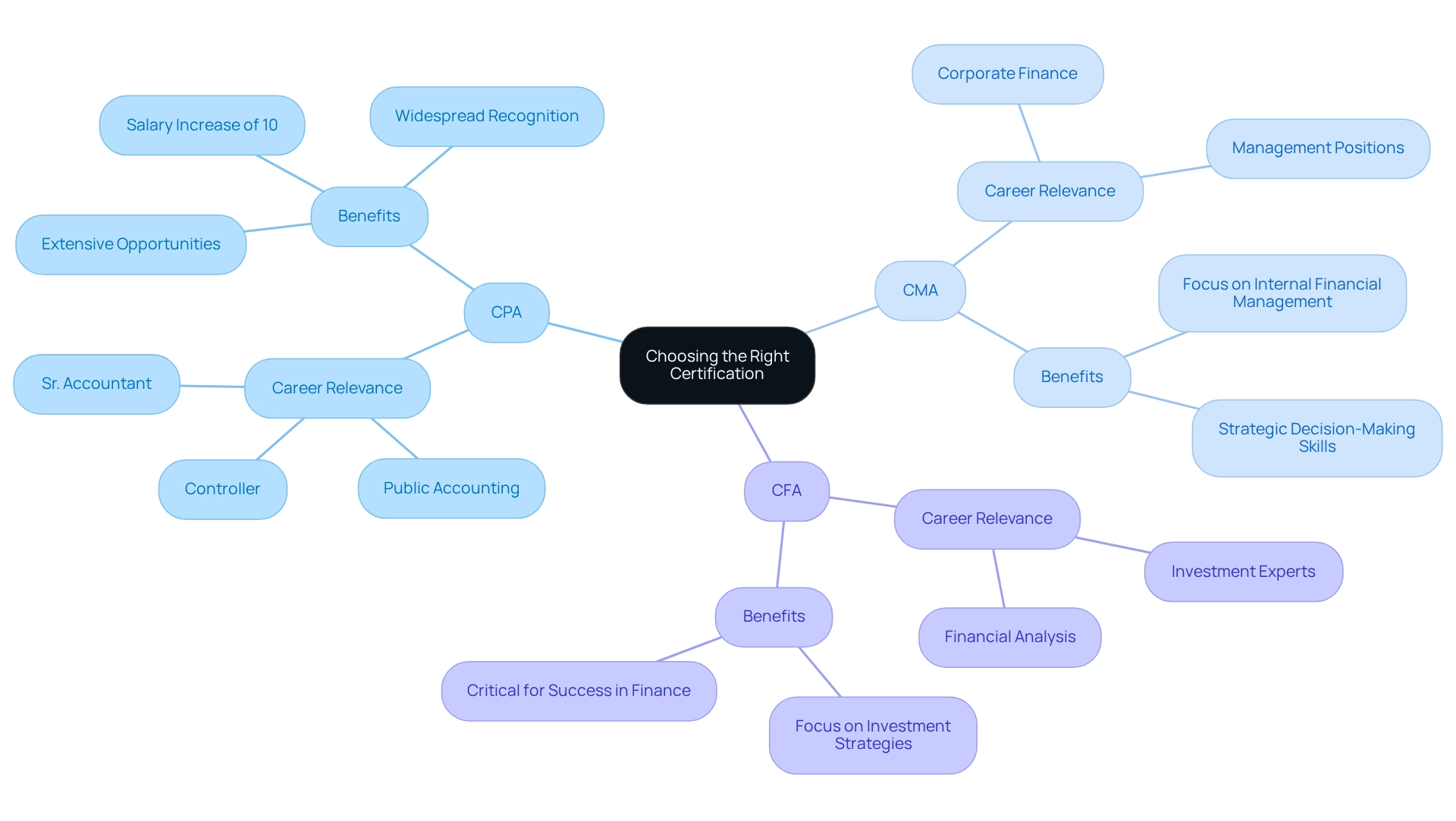

Choosing the suitable certifications for accounting and finance is vital and should align with personal career goals, industry demands, and individual interests. For individuals aiming for public accounting positions such as CAO, Controller, or Sr. Accountant, the CPA designation is often the most advantageous due to its widespread recognition and the extensive opportunities it provides. In contrast, those inclined towards corporate finance or management positions may find the CMA designation more suitable, as it emphasizes skills relevant to internal financial management and strategic decision-making. For investment experts, the CFA credential stands out, concentrating on financial analysis and investment strategies vital for success in that field.

Statistics suggest that professionals with certifications for accounting and finance, including CPA, CMA, or CFA designations, experience significant career advancement, often resulting in higher salaries and more senior roles. For instance, individuals with a CPA can expect a salary increase of up to 10% compared to their non-certified peers. Moreover, job applications should showcase 6-8 pertinent skills to attract recruiters, further stressing the significance of qualifications in improving job opportunities. The current job market shows a strong demand for certifications for accounting and finance, with many employers preferring candidates who possess them.

When selecting a credential, professionals should assess their professional path and the particular skills they aim to improve. Specialist recommendations indicate that matching qualification selections with long-term professional objectives is crucial for enhancing opportunities. Boutique Recruiting can assist candidates in navigating their credential options and exploring job opportunities that align with their aspirations. As Oprah once said, “Would you do your job and not be paid for it? If nobody paid me, I would do this job and take on a second job just to make ends meet. That’s how you know you are doing the right thing.” This viewpoint highlights the significance of matching professional selections with individual passions, which is pertinent when considering credential options. Furthermore, case studies show that numerous professionals have effectively moved between qualifications based on changing professional goals, illustrating the adaptability and significance of these credentials in the ever-changing job market.

Ultimately, the choice should be guided by a comprehensive understanding of how certifications for accounting and finance impact career aspirations and the skills needed to succeed in the targeted job market. Accessing free resources for additional job search support can also be beneficial when considering certification options.

Conclusion

In the dynamic landscape of accounting and finance, certifications such as the CPA, CMA, and CFA serve as pivotal instruments that significantly influence career trajectories. Each certification presents distinct advantages tailored to various professional paths:

- The CPA is renowned for its recognition in public accounting.

- The CMA emphasizes management and corporate finance.

- The CFA is essential for those engaged in investment analysis and portfolio management.

Understanding the specific benefits and challenges associated with each certification is crucial for professionals aiming to navigate their career development effectively. Although the rigorous requirements for obtaining these credentials may present obstacles, the long-term rewards—including higher earning potential, increased job security, and enhanced career mobility—often far outweigh the initial hurdles. As the job market continues to evolve, the demand for these certifications remains robust, further solidifying their value in achieving career success.

Ultimately, selecting the right certification should align with individual career aspirations, industry demands, and personal interests. By thoughtfully evaluating these factors, professionals can strategically position themselves within the competitive landscape of accounting and finance. Embracing the journey of obtaining a certification is not merely a step toward professional growth; it is a significant move toward fulfilling one’s passion in the field.

Frequently Asked Questions

What is the importance of certifications in accounting and finance?

Certifications in accounting and finance validate an individual’s expertise and knowledge, enhance resumes, and reflect a commitment to career advancement and adherence to industry standards.

What are some common certifications in accounting and finance?

Common certifications include the Certified Public Accountant (CPA) and Certified Management Accountant (CMA).

How do certifications affect career advancement in accounting and finance?

Certifications are often prerequisites for advanced positions in accounting and finance, making them crucial for professional growth and career advancement.

Why is it important to understand the distinctions among various certifications?

Understanding the distinctions, including prerequisites and focus areas of different certifications, is imperative for professionals looking to elevate their career prospects.

How can the right certifications impact job opportunities?

The right credentials can open doors to opportunities that might otherwise remain closed, enhancing competitiveness in the job market.

Why is it vital to stay informed about the latest certifications?

Staying informed about the latest certifications and their relevance is important as the landscape of the financial sector continues to evolve.

How can professionals invest in their career development?

By exploring certifications that align with their professional goals and seeking guidance on navigating this critical aspect of career development.