Overview

The divisional controller holds a pivotal position in overseeing the financial activities of a specific division within a corporation. This role is essential for ensuring compliance, facilitating effective communication, and achieving strategic alignment with organizational goals. Their responsibilities encompass:

- Budgeting

- Financial reporting

- Adherence to regulatory standards

These are key elements that drive profitability and operational efficiency in an increasingly complex economic landscape. As the financial sector faces mounting challenges, the significance of this role cannot be overstated.

How can organizations ensure they have the right talent in place to navigate these complexities? The answer lies in recognizing the expertise of divisional controllers. Their strategic oversight is not merely a function; it is a necessity for sustainable growth and success.

Key Highlights:

- The divisional controller oversees financial activities within a specific division, ensuring compliance and effective communication with upper management.

- In 2025, finance teams are expected to establish metrics for growth, with divisional controllers playing a key role in monitoring these metrics.

- Average compensation for divisional controllers in the U.S. ranges from $120,000 to $180,000, reflecting their strategic importance.

- Divisional controllers ensure adherence to regulatory standards, enhancing operational efficiency and reducing compliance risks.

- Key responsibilities include managing monthly closings, budgeting, preparing financial statements, and conducting economic analysis.

- Candidates typically need a bachelor’s degree in accounting or finance, CPA designation, and over ten years of financial management experience.

- Strong analytical skills, attention to detail, and exceptional communication are essential for success in this role.

Introduction

In the intricate landscape of corporate finance, the role of the divisional controller stands as a cornerstone of financial governance and strategic oversight. These professionals are tasked with managing the financial health of specific divisions within larger organizations. They are responsible not only for meticulous financial reporting and compliance but also serve as vital connectors between upper management and operational teams.

As companies navigate an increasingly competitive and complex environment, the importance of divisional controllers is amplified. Their expertise drives growth and sustainability through informed decision-making.

Focusing on aligning financial strategies with broader organizational goals, this article delves into the essential functions, qualifications, and evolving significance of divisional controllers in today’s corporate world.

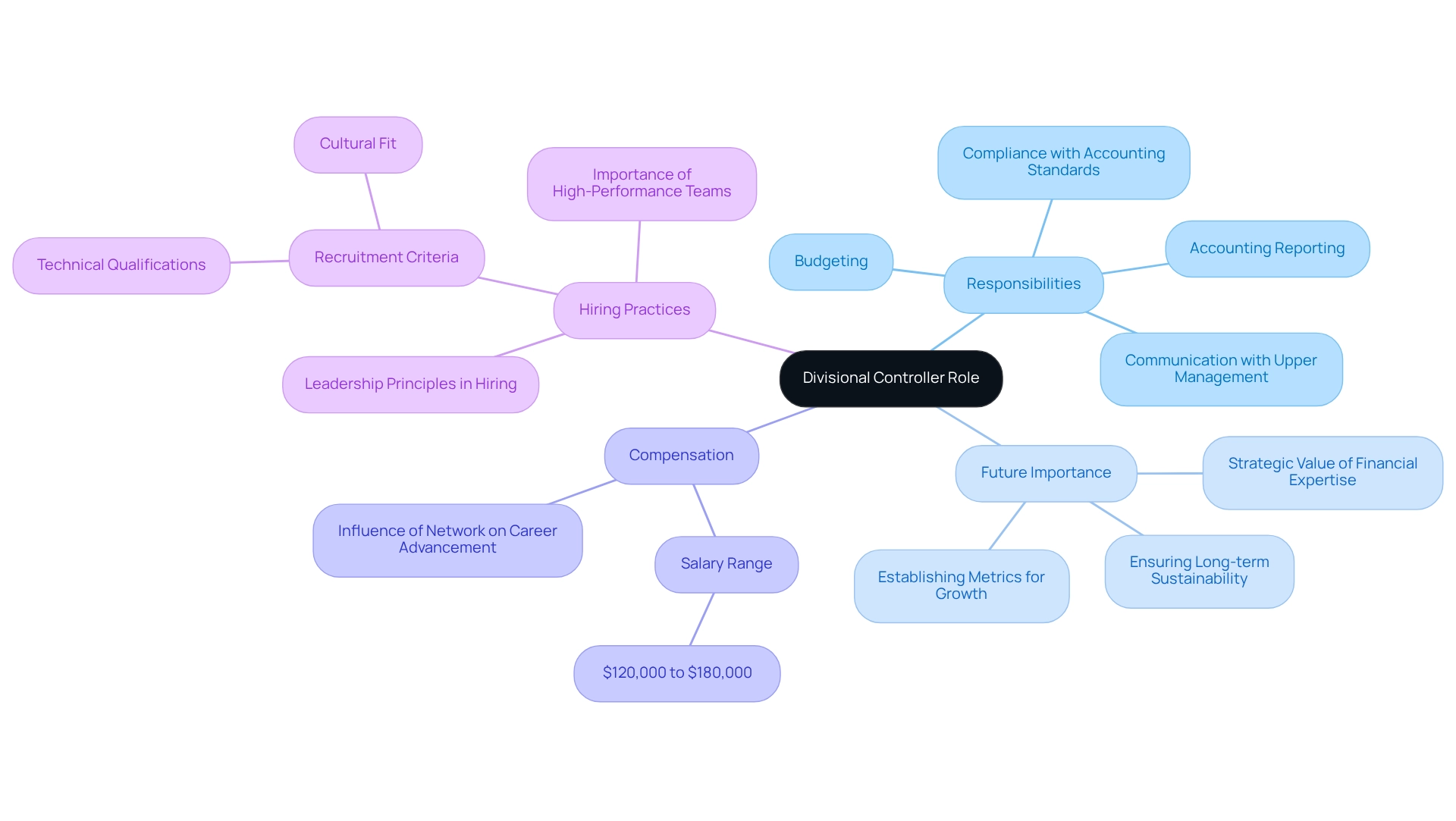

Define the Divisional Controller Role

The divisional controller acts as a senior-level manager, responsible for overseeing the financial activities of a specific division within a larger corporation. This role is multifaceted, encompassing critical functions such as accounting reporting, budgeting, and ensuring compliance with accounting standards. As a vital business associate, the division manager fosters effective communication between the department and upper management, ensuring that financial strategies align with the organization’s overarching objectives. The divisional controller position is essential for maintaining the economic health of the division, thereby playing a significant role in corporate governance.

In 2025, the importance of departmental managers is underscored by the expectation that finance teams will establish metrics and measurements to monitor growth and ensure long-term sustainability. Divisional controllers are pivotal in this context, as they apply and oversee these metrics, ensuring their divisions not only meet budgetary goals but also advance the organization’s strategic aims. As companies increasingly recognize the strategic value of internal financial expertise, the role of department managers becomes even more critical. For instance, Brian Olsavsky from Amazon emphasizes that career success in finance is shaped by both skills and mindsets, guiding their hiring practices to ensure departmental managers possess not only technical qualifications but also a cultural fit within the company. Additionally, Brian Roberts, CFO of Lyft, stresses the significance of recruiting top talent who aspire to be part of a high-performance team, further highlighting the desired attributes in departmental managers.

The average compensation for departmental managers in the U.S. in 2025 reflects their importance, with salary packages often exceeding six figures, typically ranging from $120,000 to $180,000, commensurate with their responsibilities and the value they bring to their organizations. Industry specialists emphasize that being part of a strong network of CFOs can significantly influence career advancement, further accentuating the strategic importance of departmental managers in corporate finance. Furthermore, the case study titled “Leadership Principles in Hiring” illustrates how CFOs employ leadership principles as a framework for hiring and evaluating team members, reinforcing the significance of both skills and attitudes in the selection process. Recent discussions, including those by Luca Maestri, CFO of Apple, regarding the strategic importance of in-house technology development, also reflect the evolving landscape of resource management and the critical role departmental managers occupy within it.

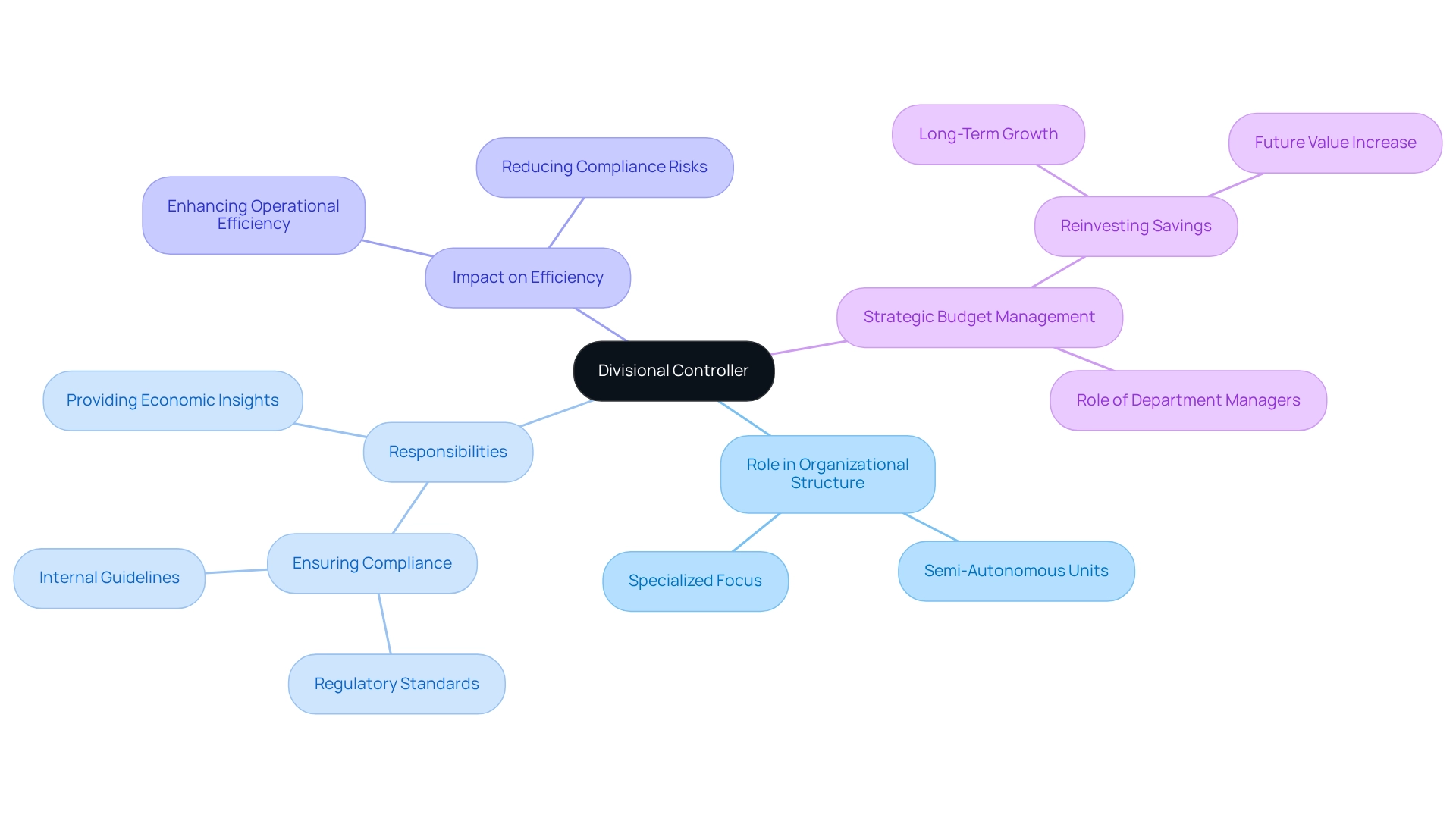

Context and Importance of the Divisional Controller

In a divisional organizational structure, where companies operate through semi-autonomous units, the role of the divisional controller is pivotal. This framework facilitates a specialized focus on distinct products or markets, significantly enhancing operational efficiency. The divisional controller is responsible for ensuring that each segment adheres to regulatory standards and internal guidelines, effectively reducing compliance risks. By providing accurate economic insights, they empower management to make informed choices that promote profitability and growth.

As Cathie Lesjak, CFO of HP, articulates, “If you save a dollar and you reinvest that back into the business in a disciplined way, that dollar is actually worth a lot more in the future.” This statement underscores the significance of strategic budget management, in which departmental managers play a vital part.

In today’s competitive environment, characterized by swift transformations and the necessity for monetary flexibility, the function of divisional managers has never been more essential. Their ability to navigate intricate economic landscapes and offer strategic foresight is crucial for driving organizational success.

The case study ‘Saving for Long-Term Growth’ further illustrates how reinvesting savings can significantly increase future value, emphasizing the strategic importance of department managers in achieving long-term economic success.

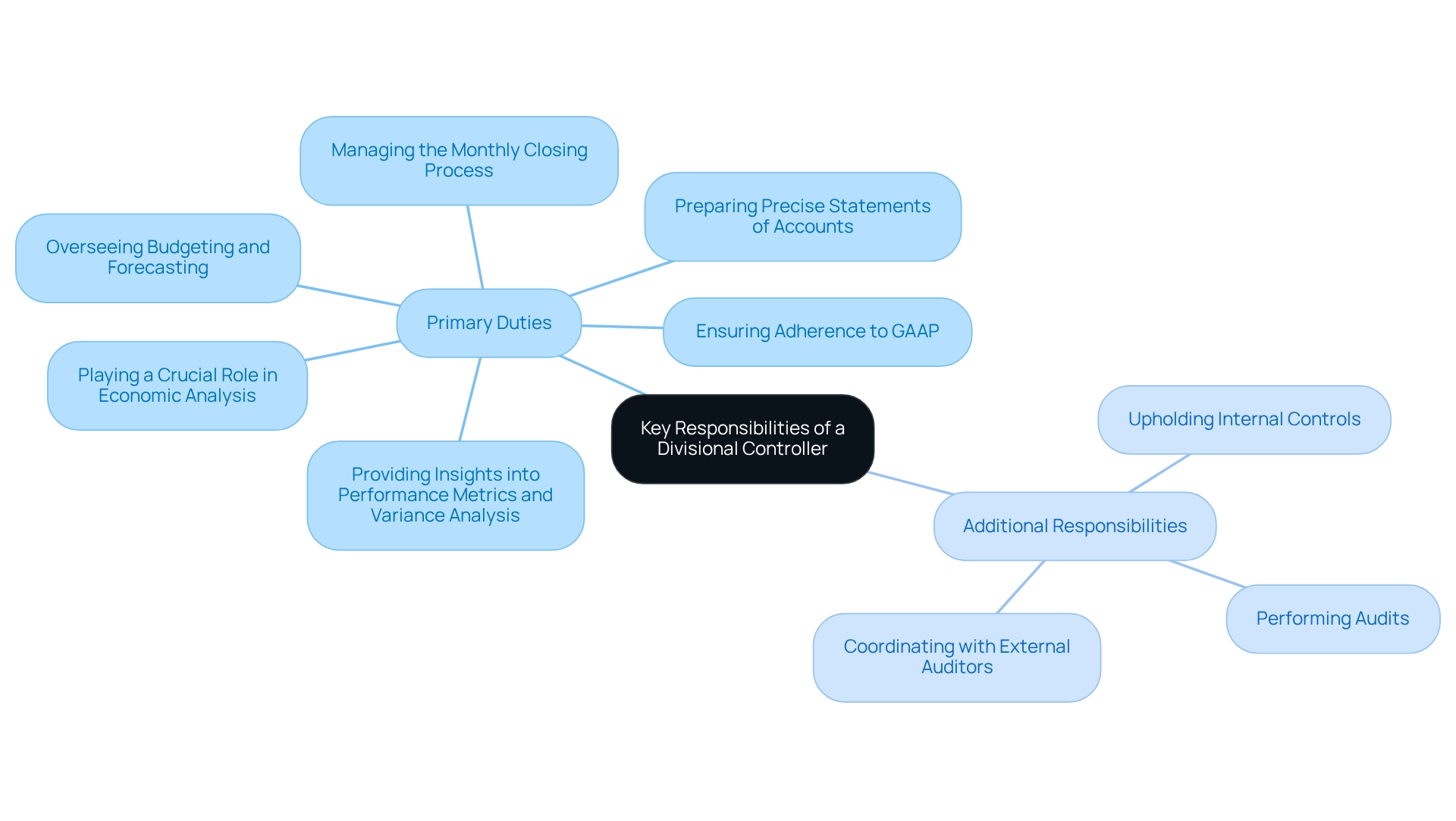

Key Responsibilities of a Divisional Controller

The primary duties of a division manager are pivotal in the financial sector. These responsibilities encompass:

- Managing the monthly closing process

- Preparing precise statements of accounts

- Overseeing budgeting and forecasting

- Ensuring adherence to GAAP (Generally Accepted Accounting Principles)

- Playing a crucial role in economic analysis

- Providing insights into performance metrics and variance analysis

Additionally, departmental managers are accountable for:

- Upholding internal controls

- Performing audits

- Coordinating with external auditors

Their capability to convey monetary information effectively to both fiscal and non-fiscal stakeholders is essential for promoting a culture of transparency and accountability within the division. This expertise not only enhances operational efficiency but also fosters trust among stakeholders, reinforcing the division’s commitment to excellence.

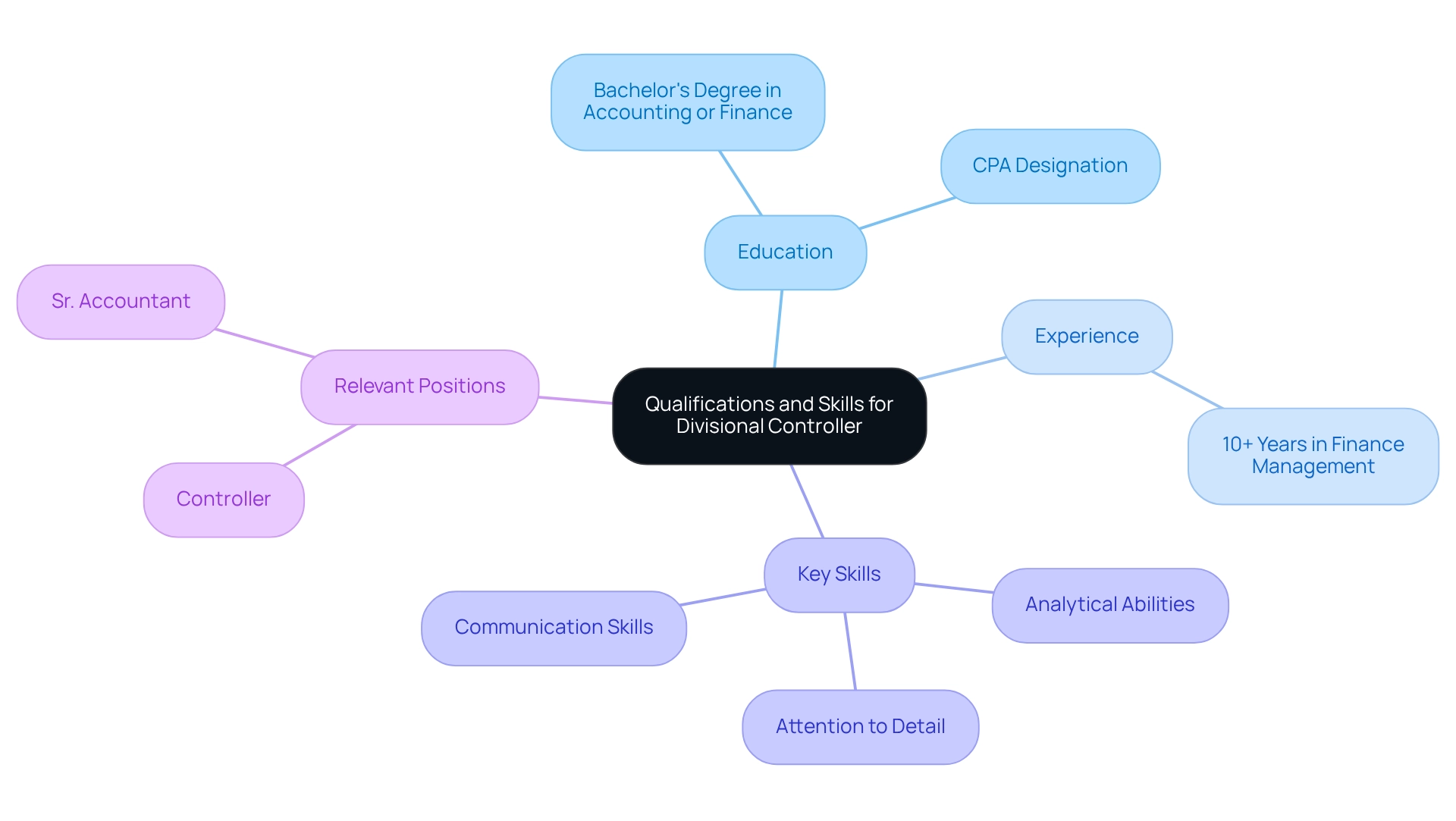

Qualifications and Skills Required for a Divisional Controller

To become a department manager, candidates typically require a bachelor’s degree in accounting, finance, or a related field. Many employers favor applicants with a CPA (Certified Public Accountant) designation. Experience in managing finances, often exceeding ten years, is essential, along with a proven track record in budgeting, forecasting, and performance reporting. Key skills encompass:

- Strong analytical abilities

- Meticulous attention to detail

- Exceptional communication skills

Furthermore, the leadership qualities of divisional controllers are crucial, as they frequently oversee teams and collaborate with other departments to achieve organizational objectives. In today’s technology-driven environment, familiarity with financial software and systems is increasingly valuable. Relevant positions such as Controller and Sr. Accountant provide a solid foundation for aspiring divisional controllers, as the experience gained in these roles directly contributes to the necessary skills and competencies. Boutique Recruiting offers targeted recruitment services that assist organizations in finding candidates with the outlined qualifications, ensuring a strong fit for high-demand finance roles.

Conclusion

The role of the divisional controller is pivotal in corporate finance, serving as a crucial link between operational teams and upper management while safeguarding the financial health of specific divisions. Their responsibilities encompass financial reporting, budgeting, compliance, and strategic analysis—elements essential for navigating today’s complex and competitive business environment. As organizations increasingly focus on aligning financial strategies with overarching goals, the significance of divisional controllers continues to escalate.

Key qualifications for divisional controllers include a robust educational background in finance or accounting, extensive experience in financial management, and strong analytical and communication skills. These professionals contribute not only to achieving financial targets but also facilitate informed decision-making that drives long-term growth and sustainability. The emphasis on hiring individuals who embody both technical expertise and cultural alignment further underscores the strategic importance of this role.

As companies adapt to rapid changes in the market, the divisional controller’s ability to provide strategic foresight and financial insights becomes indispensable. Their contributions extend beyond mere compliance or reporting; they play a crucial role in shaping the future of their divisions and, by extension, the organization as a whole. Embracing the evolving significance of divisional controllers is key for organizations seeking to thrive in an increasingly dynamic financial landscape.

In light of these insights, organizations must prioritize the recruitment of skilled divisional controllers who not only possess the necessary qualifications but also align with the company’s culture. This strategic hiring approach will ensure that companies are well-equipped to navigate the complexities of the financial sector. Are you prepared to elevate your organization’s financial strategy? Reach out today for a consultation on how to secure top-tier divisional controllers who will drive your success.

Frequently Asked Questions

What is the role of a divisional controller?

The divisional controller acts as a senior-level manager responsible for overseeing the financial activities of a specific division within a larger corporation, including accounting reporting, budgeting, and ensuring compliance with accounting standards.

How does the divisional controller contribute to corporate governance?

The divisional controller plays a significant role in corporate governance by maintaining the economic health of the division and ensuring that financial strategies align with the organization’s overarching objectives.

What is expected of finance teams in 2025 regarding metrics and measurements?

In 2025, finance teams are expected to establish metrics and measurements to monitor growth and ensure long-term sustainability, with divisional controllers applying and overseeing these metrics.

Why is the role of departmental managers becoming more critical?

The role of departmental managers is becoming more critical as companies increasingly recognize the strategic value of internal financial expertise, particularly in meeting budgetary goals and advancing organizational strategic aims.

What do industry leaders say about the attributes of successful departmental managers?

Industry leaders, such as Brian Olsavsky from Amazon and Brian Roberts from Lyft, emphasize the importance of hiring managers with both technical qualifications and a cultural fit, as well as recruiting top talent who aspire to be part of a high-performance team.

What is the average compensation for departmental managers in the U.S. in 2025?

The average compensation for departmental managers in the U.S. in 2025 typically ranges from $120,000 to $180,000, reflecting their importance and the value they bring to their organizations.

How can being part of a network of CFOs influence career advancement for departmental managers?

Being part of a strong network of CFOs can significantly influence career advancement, underscoring the strategic importance of departmental managers in corporate finance.

What framework do CFOs use for hiring and evaluating team members?

CFOs employ leadership principles as a framework for hiring and evaluating team members, highlighting the significance of both skills and attitudes in the selection process.

What recent discussions reflect the evolving landscape of resource management?

Recent discussions, including those by Luca Maestri, CFO of Apple, regarding the strategic importance of in-house technology development, reflect the evolving landscape of resource management and the critical role departmental managers occupy within it.