Overview

The article highlights the essential skills, qualifications, and career progression necessary to excel as a Financial Planning and Analysis (FP&A) Director, underscoring the growing demand for these professionals. With an impressive annual increase of over 15% in job postings, it is clear that the market is in urgent need of skilled leaders in financial strategy and analysis.

Key components of FP&A, such as budgeting and forecasting, are critical to this role. As organizations increasingly seek to enhance their financial strategies, the importance of proficient FP&A Directors cannot be overstated. This demand not only reflects the evolving landscape of financial management but also indicates a significant opportunity for career advancement in this field.

In conclusion, the article serves as a vital resource for understanding the landscape of FP&A roles and the qualifications needed to thrive in this dynamic environment.

Key Highlights:

- FP&A is essential for budgeting, forecasting, and analyzing economic data to support strategic decision-making.

- Key components of FP&A include budgeting, forecasting, and analysis, which help organizations align financial strategies with goals.

- Over 65% of companies have integrated risk management with FP&A, enhancing resilience and decision-making.

- Essential qualifications for FP&A directors include a relevant degree, technical skills, analytical abilities, communication skills, and leadership experience.

- The demand for FP&A leaders is rising, with job postings increasing annually by over 15%.

- Career progression in FP&A typically moves from analyst roles to director and executive positions, requiring skill development and networking.

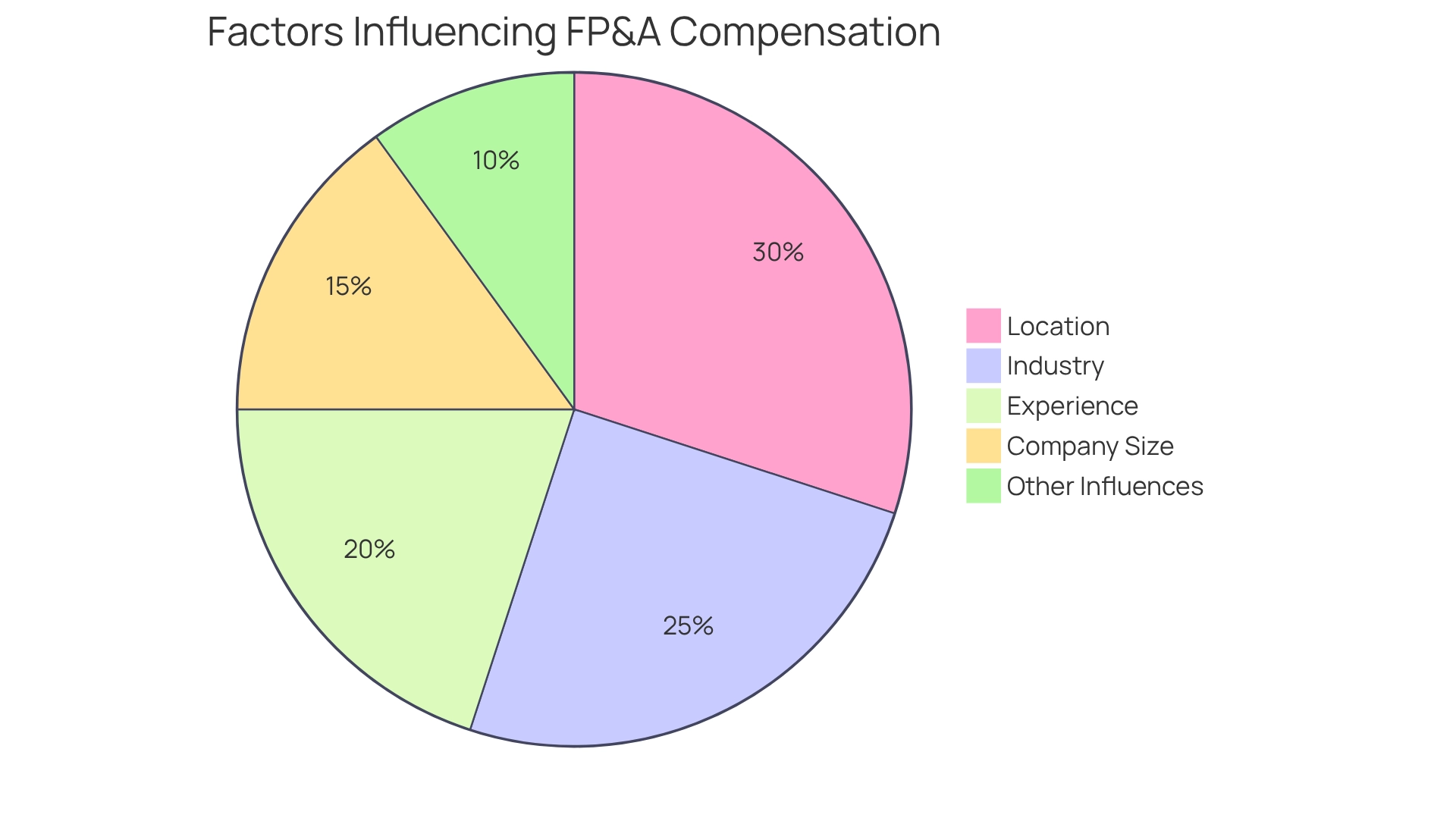

- Average salary for FP&A directors in the U.S. is $198,435, influenced by factors like location, industry, experience, and company size.

- Advanced education is common among FP&A leaders, with only 1.7% holding an Associate’s Degree.

- Performance-based bonuses and incentives significantly contribute to overall compensation for FP&A professionals.

Introduction

In the dynamic landscape of modern business, the role of Financial Planning and Analysis (FP&A) has emerged as a cornerstone for strategic decision-making. As organizations grapple with increasingly complex financial challenges, FP&A professionals are tasked with the critical responsibility of budgeting, forecasting, and analyzing financial data to guide executive decisions. With a growing emphasis on integrating risk management and advanced analytics into FP&A processes, these professionals are not only enhancing operational efficiency but also enriching customer experiences.

This article delves into the essential skills and qualifications required for FP&A Directors, outlines the clear career progression within this field, and discusses the salary expectations that reflect the value of their expertise in driving financial success.

Understand Financial Planning and Analysis (FP&A)

Budgeting Planning and Analysis (BPA) stands as a pivotal function within organizations, focusing on budgeting, forecasting, and analyzing economic data to enhance strategic decision-making. As companies navigate an increasingly intricate economic environment in 2025, the role of FP&A professionals has become even more vital in steering a corporation’s economic well-being through insightful analysis that informs executive decisions.

The FP&A process encompasses several key components:

- Budgeting: Crafting a comprehensive monetary plan that outlines expected revenues and expenses over a specified timeframe, ensuring alignment with organizational objectives.

- Forecasting: Utilizing historical data and market trends to predict future economic outcomes, enabling proactive adjustments to strategies.

- Analysis: Examining economic performance against set budgets and forecasts to pinpoint discrepancies, thus suggesting corrective measures to enhance economic outcomes.

Recent trends indicate that over 65% of companies have integrated risk management practices directly with FP&A, underscoring its crucial function in preserving economic health and mitigating risks. This integration empowers FP&A teams to recognize, examine, and tackle monetary risks efficiently, improving overall organizational resilience and strengthening the decision-making process. Expert insights emphasize the transformative potential of FP&A in decision-making.

Consider the perspective of Chad Martin, CFO at MeridianLink, who highlights the importance of inclusive dialogue, noting that valuable insights can emerge from quieter moments in discussions. This perspective aligns with the growing recognition that the productivity of relationship managers and branch leaders is crucial for controlling costs and enhancing operational efficiency, as noted by PwC. Moreover, companies that leverage advanced analytics, artificial intelligence, and skilled personnel are not only enhancing their operational capabilities but also enriching customer experiences. This trend indicates a wider shift towards data-informed decision-making, where FP&A serves as a key collaborator in managing monetary complexities and advancing operational improvements.

Practical examples illustrate how FP&A functions have significantly enhanced decision-making. Organizations that successfully execute FP&A practices frequently observe improved alignment between monetary strategies and overall business goals, resulting in superior performance outcomes.

In summary, mastering the role of a Planning and Analysis Director necessitates a profound comprehension of budgeting, forecasting, and analysis processes. As organizations continue to evolve, the significance of FP&A in strategic decision-making will only increase, making it a crucial area for professionals aiming to promote economic success.

Identify Required Skills and Qualifications

To excel as a financial planning and analysis director, candidates must blend technical expertise with essential soft skills. Key qualifications include:

- Educational Background: A bachelor’s degree in finance, accounting, or a related field is typically required. Many successful FP&A Directors also hold an MBA or relevant certifications, such as the Certified Corporate FP&A Professional (FPAC).

- Technical Skills: Proficiency in fiscal modeling, data analysis, and advanced Excel capabilities is crucial. Familiarity with FP&A software and ERP systems enhances a candidate’s effectiveness in the role.

- Analytical Skills: The ability to interpret complex economic data and provide actionable insights is essential for driving strategic decisions.

- Communication Skills: Strong verbal and written communication abilities are vital for presenting monetary information to stakeholders and collaborating with cross-functional teams.

- Leadership Abilities: Experience in overseeing teams and projects is essential, as FP&A leaders often guide planning initiatives and mentor junior staff.

In 2025, the demand for FP&A leaders continues to rise, with job postings increasing at an annual rate of over 15%, according to LinkedIn’s economic data. This trend underscores the importance of continuous process improvement methodologies, which can optimize FP&A functions by streamlining workflows and enhancing decision-making processes. Moreover, the financial planning and analysis director performs an essential function in connecting monetary analysis and business strategy execution, balancing operational needs with long-term goals.

Soft skills like emotional intelligence, decision-making under uncertainty, and adaptability are increasingly recognized as essential for success in these positions, particularly in strategic discussions and negotiations. By focusing on these qualifications, candidates can significantly enhance their prospects for becoming a financial planning and analysis director. Additionally, understanding the typical career advancement in FP&A, which frequently begins with entry-level positions like analysts, can provide valuable insights for HR managers evaluating candidates for the role of financial planning and analysis director.

Boutique Recruiting can assist HR managers by tailoring recruitment strategies that align with these qualifications, ensuring a seamless interview process that attracts top candidates.

Explore Career Progression in FP&A

The career trajectory in Financial Planning and Analysis (FP&A) is typically well-defined, offering a clear path for advancement.

- FP&A Analyst: This entry-level position concentrates on data gathering, financial modeling, and fundamental analysis, establishing the foundation for future responsibilities.

- Senior FP&A Analyst: In this role, professionals participate in more intricate analysis, forecasting, and greater interaction with senior management, enhancing their tactical insight.

- FP&A Manager: This position entails supervising the FP&A team, managing budgets, and ensuring alignment with the organization’s strategic objectives, necessitating strong leadership skills.

- Financial Planning and Analysis Director: This position drives monetary strategy and collaborates closely with executive leadership to influence decision-making.

- Vice President of Finance or CFO: These top-level positions encompass overall monetary strategy and leadership across the organization, representing the pinnacle of an FP&A career.

Advancement through these stages necessitates a blend of experience, skill development, and robust networking within the industry. The demand for skilled FP&A professionals is projected to rise, with an 18% increase in job postings anticipated over the next five years. This growth is fueled by the expanding function of FP&A in strategic decision-making, emphasizing the rising necessity for expertise in advanced monetary technologies.

Aspiring financial planning and analysis directors should proactively pursue mentorship opportunities and spearhead projects to enhance their visibility and skill set. Programs that connect emerging leaders with seasoned professionals can provide invaluable insights and guidance. For instance, integrated FP&A systems have been shown to streamline financial information flow, achieving a 35% faster decision turnaround.

This efficiency underscores the importance of effective leadership in FP&A, as it enables finance teams to deliver timely insights that empower executives to make informed decisions rapidly.

Industry leaders emphasize the value of listening to diverse perspectives. Chad Martin, CFO at MeridianLink, advises that valuable insights often come from quieter voices in discussions. This approach not only fosters a collaborative environment but also enriches the decision-making process, which is essential for those aiming to ascend to the role of a financial planning and analysis director.

Additionally, aspiring FP&A professionals should consider participating in mentorship programs that focus on leadership development, as these can provide critical support and guidance throughout their career progression.

Evaluate Salary Expectations and Compensation

Salaries for Financial Planning and Analysis (FP&A) leaders in 2025 reveal significant variation influenced by several key factors, including location, industry, and company size. In the United States, the average salary for a financial planning and analysis director is reported to be $198,435 per year, typically ranging between $157,200 and $210,300. This figure serves as a benchmark for organizations and professionals navigating salary negotiations.

Key factors influencing FP&A compensation include:

- Location: Major metropolitan areas generally offer higher salaries due to increased living costs and a greater demand for skilled professionals. For instance, FP&A leaders in cities like New York and San Francisco often see compensation packages that exceed the national average.

- Industry: Industries such as technology and finance typically provide more lucrative salaries compared to sectors like retail or non-profit, reflecting the higher stakes and complexities involved in financial planning within these fields.

- Experience: Leaders with extensive experience and a proven track record can command premium salaries. Those who have successfully navigated fiscal year-end processes, budget planning, or mergers and acquisitions often find themselves in a stronger negotiating position.

- Company Size: Larger organizations tend to have more resources, allowing them to offer competitive compensation packages that may include bonuses, stock options, and additional benefits.

In addition to base salaries, many FP&A leaders enjoy performance-based bonuses and other incentives that can significantly enhance their overall compensation. During peak times like fiscal year-end, budget planning, or mergers and acquisitions, they may work extra hours, which can further affect their earnings.

Notably, only 1.7% of FP&A leaders hold an Associate’s Degree, indicating that advanced education is common in this field. Understanding these dynamics is crucial for HR managers aiming to attract and retain top talent in the competitive landscape of financial planning and analysis. Furthermore, examining case studies and expert opinions on salary expectations for the financial planning and analysis director role can provide valuable insights into compensation trends across different industries and regions.

To effectively navigate the talent war, HR managers should consider tailored recruitment solutions that highlight the unique value propositions of their organizations, as well as the importance of exploring multiple opportunities for candidates to ensure a successful hiring process.

Conclusion

The evolving landscape of Financial Planning and Analysis (FP&A) underscores its critical role in navigating organizations through complex financial challenges. By mastering essential skills such as budgeting, forecasting, and data analysis, FP&A professionals position themselves as strategic partners, driving informed decision-making and enhancing overall organizational effectiveness. The integration of risk management and advanced analytics further emphasizes the necessity of these roles in today’s business environment, where agility and insight are paramount.

For those aspiring to become FP&A Directors, a clear career progression exists, beginning from entry-level analyst positions and advancing to senior roles that require a blend of technical expertise and leadership capabilities. The demand for skilled FP&A professionals is on the rise, reflecting the growing recognition of their contributions to strategic financial management. As organizations seek to optimize their financial operations, the need for well-qualified FP&A Directors will only continue to escalate.

Salary expectations for FP&A Directors align with their pivotal contributions, demonstrating the value placed on their expertise. Compensation varies based on factors such as location, industry, and experience, with many professionals enjoying lucrative packages that include bonuses and incentives. Understanding these dynamics is essential for both candidates and organizations aiming to attract and retain top talent in this competitive field.

In conclusion, the future of FP&A is bright, presenting ample opportunities for those equipped with the right skills and qualifications. As businesses increasingly rely on data-driven insights for strategic planning, the role of FP&A will remain vital in shaping financial success and organizational resilience. Are you ready to seize these opportunities and elevate your career in FP&A?

Frequently Asked Questions

What is Budgeting Planning and Analysis (BPA)?

BPA is a critical function within organizations that focuses on budgeting, forecasting, and analyzing economic data to enhance strategic decision-making.

Why has the role of FP&A professionals become more vital in 2025?

In 2025, as companies navigate a complex economic environment, FP&A professionals are essential for guiding a corporation’s economic well-being through insightful analysis that informs executive decisions.

What are the key components of the FP&A process?

The key components of the FP&A process include: – Budgeting: Creating a monetary plan outlining expected revenues and expenses. – Forecasting: Predicting future economic outcomes using historical data and market trends. – Analysis: Examining economic performance against budgets and forecasts to identify discrepancies and suggest corrective measures.

How have companies integrated risk management with FP&A?

Over 65% of companies have integrated risk management practices with FP&A, highlighting its importance in preserving economic health and mitigating risks.

What benefits does integrating risk management with FP&A provide?

This integration allows FP&A teams to recognize, analyze, and address monetary risks effectively, improving organizational resilience and enhancing the decision-making process.

What insights does Chad Martin, CFO at MeridianLink, provide regarding FP&A?

Chad Martin emphasizes the importance of inclusive dialogue in discussions, suggesting that valuable insights can emerge from quieter moments, which can enhance decision-making.

How does advanced analytics and artificial intelligence impact FP&A?

Companies leveraging advanced analytics and artificial intelligence improve their operational capabilities and enrich customer experiences, indicating a shift towards data-informed decision-making.

What practical outcomes can organizations expect from effective FP&A practices?

Organizations that effectively execute FP&A practices often see improved alignment between monetary strategies and overall business goals, leading to superior performance outcomes.

What skills are necessary for a Planning and Analysis Director?

A Planning and Analysis Director must have a profound understanding of budgeting, forecasting, and analysis processes to promote economic success within organizations.