Overview

The article explores effective recruitment strategies essential for success in the financial sector, underscoring the significance of technology, employer branding, and adherence to labor laws. It highlights that, although AI and talent intelligence platforms are increasingly being employed, the cultivation of personal relationships and a robust employer brand remains vital for attracting top talent and minimizing hiring costs in a competitive marketplace.

In an industry where recruitment challenges are prevalent, understanding labor laws that influence hiring practices is crucial. Personalized recruitment services tailored to the financial sector can yield substantial benefits, enhancing the quality of hires and improving overall organizational performance.

Consider the experiences of satisfied clients who have transformed their hiring processes through strategic recruitment partnerships. Their testimonials reinforce the trust and efficacy of these approaches, illustrating the tangible advantages of leveraging both technology and personal connections.

As you navigate the complexities of recruitment in the financial sector, we invite you to reach out for a consultation. Together, we can develop a strategy that positions your firm as a leader in attracting top-tier talent.

Key Highlights:

- Recruitment in the financial sector faces challenges due to a competitive job market and evolving skill requirements.

- Key roles in demand include CFOs, Financial Managers, and IT positions such as Chief Technology Officers.

- 54% of organizations consider AI crucial for restructuring recruitment processes, while 59% plan to use talent intelligence platforms.

- Despite technological advancements, the human element remains vital for effective recruitment in a regulated environment.

- A strong employer brand can reduce hiring costs by 50%, highlighting the importance of company culture in attracting talent.

- Recruiters must prioritize regular check-ins and personalized communication to build trust and loyalty with applicants.

- Compliance with labor laws is essential, requiring a comprehensive framework and regular training for recruitment teams.

- 93% of companies are expected to invest in recruitment technology by 2025, emphasizing the need for innovative hiring strategies.

- Diversity and inclusion are increasingly important, with 75% of applicants considering a company’s diversity in job offers.

- Employee engagement platforms are crucial for retention, with 70% of employers citing engagement as key to reducing turnover.

Introduction

In the dynamic and ever-evolving landscape of the financial sector, the recruitment process encounters unprecedented challenges as organizations strive to secure top-tier talent amidst an intensely competitive market. The surge in demand for specialized roles—ranging from CFOs to Chief Technology Officers—compels recruiters to adeptly navigate skill shortages while adapting to new technological advancements. As a significant number of firms embrace AI and talent intelligence platforms, the recruitment landscape is undergoing a transformation. Yet, the human touch remains indispensable for forging meaningful connections.

Moreover, stringent regulatory compliance introduces an additional layer of complexity, necessitating a dual focus on technical proficiency alongside a comprehensive understanding of industry standards. This article delves into the multifaceted challenges of recruitment within the financial sector and explores effective strategies to attract and retain the best candidates in 2025. How can organizations adapt to these changes while ensuring they remain compliant and competitive? The answers lie in a strategic approach to recruitment that prioritizes personalized services tailored to the unique needs of the financial industry.

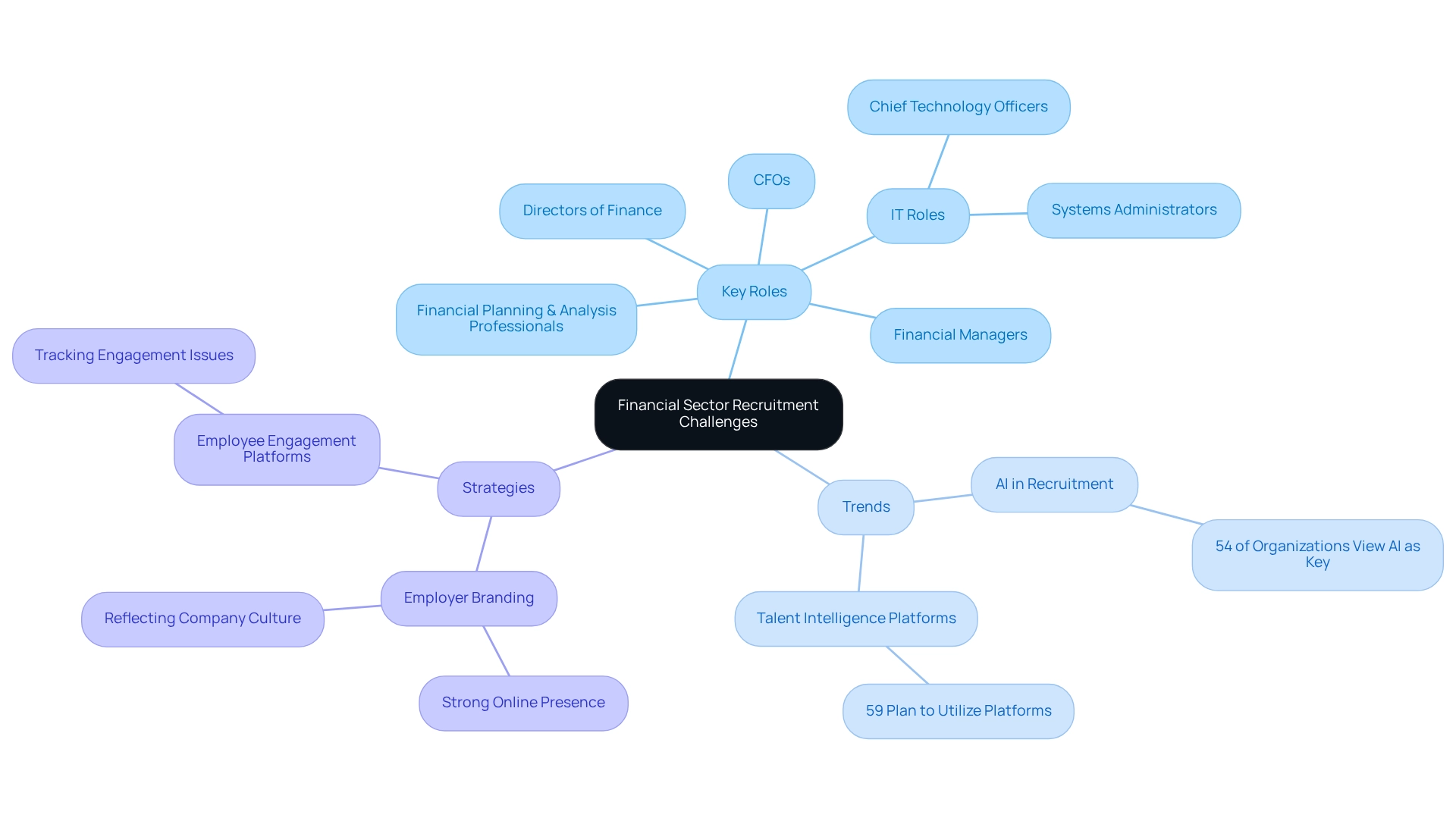

Understand Financial Sector Recruitment Challenges

Hiring in the financial sector in 2025 presents unique challenges, driven by a highly competitive workforce market and rapidly evolving skill requirements. Organizations increasingly seek specialized roles such as:

- CFOs

- Financial Managers

- Directors of Finance

- Financial Planning & Analysis professionals

- IT roles like Chief Technology Officers and Systems Administrators

This demand leads recruiters to face significant skill shortages. Recent statistics reveal that:

- 54% of organizations view AI as a pivotal factor in restructuring their recruit hiring processes, reflecting a shift towards technology-driven staffing strategies.

- 59% of organizations plan to utilize talent intelligence platforms for enhanced recruit hiring, underscoring the trend of leveraging technology in recruitment.

However, while AI streamlines operations, the human element remains crucial in navigating the complexities of recruitment. The financial sector, governed by stringent regulatory compliance standards, complicates the hiring process. Recruiters must ensure that applicants not only possess the necessary technical skills but also understand the regulatory landscape. This dual focus is essential for creating targeted recruit hiring strategies that attract the right individuals while ensuring compliance with industry regulations.

In this competitive landscape, service firms must enhance their employer brand to attract top professionals. A strong online presence that accurately reflects company culture and values can significantly reduce the time to fill positions. By utilizing employee engagement platforms, companies can monitor and address engagement issues, which is particularly vital in the banking industry where talent retention is essential. Understanding these challenges and implementing effective strategies is vital for success in the financial sector’s talent market.

As Eric Eddy from CPA Resources Global Professionals observes, the firm’s capability to provide exceptional candidates swiftly and effectively emphasizes the significance of customized recruit hiring strategies suited to high-demand positions. The increasing application of AI in recruit hiring further underscores the necessity for a balanced strategy that appreciates both technology and human insight. At Boutique Recruiting, we recognize these dynamics and are committed to offering tailored recruit hiring solutions that address the evolving requirements of the finance industry.

Are you prepared to navigate the complexities of recruitment in this challenging landscape? Reach out to us for a consultation and discover how we can help you secure the talent you need.

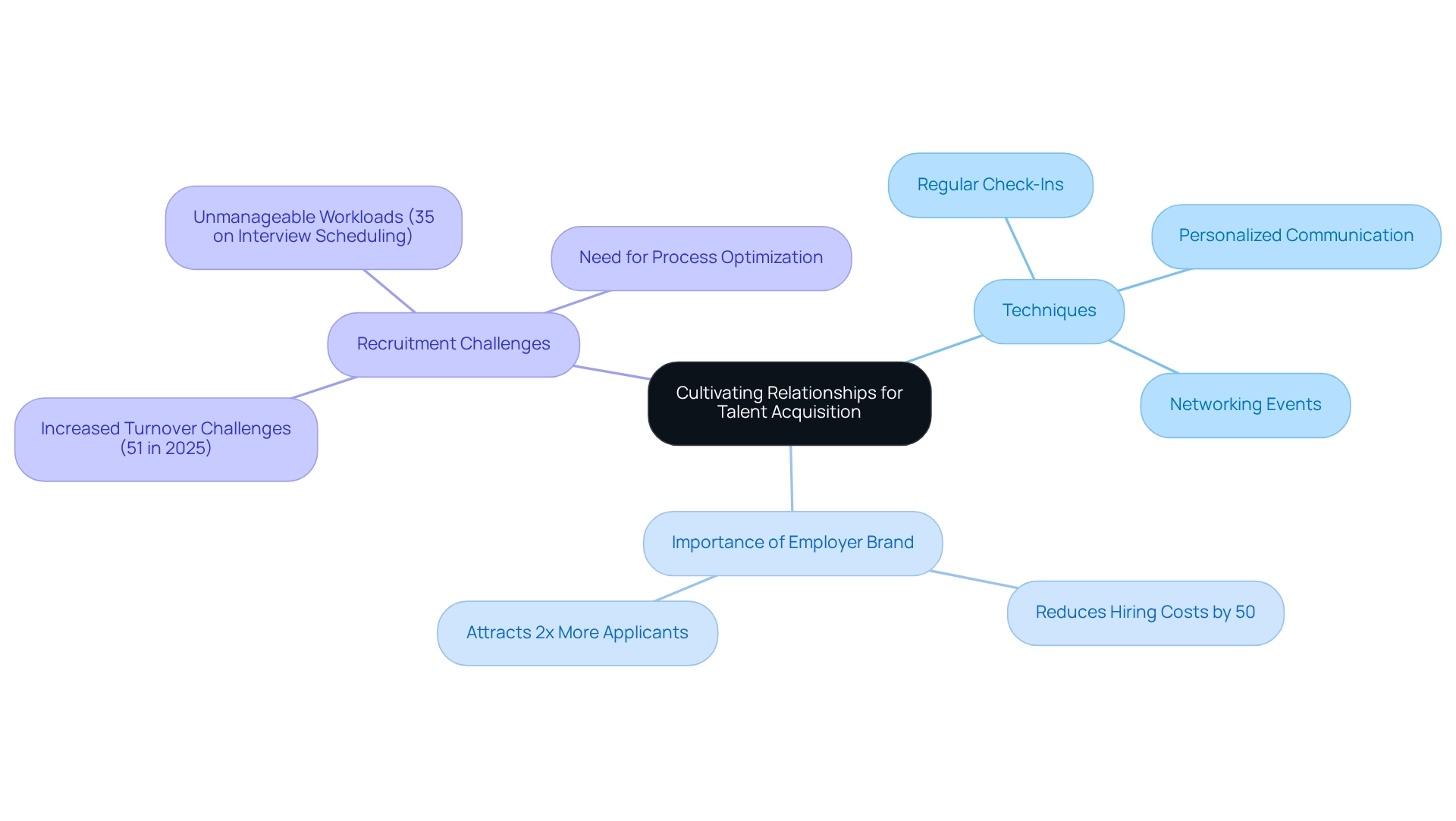

Cultivate Relationships for Tailored Talent Acquisition

Cultivating relationships is essential for effective recruit hiring in the financial sector. Did you know that a strong employer brand can significantly reduce recruitment hiring costs by 50%? Recruiters must prioritize understanding the unique needs and aspirations of applicants alongside the specific requirements of their clients. This tailored method not only helps in recognizing suitable individuals but also nurtures trust and loyalty, which are vital in a competitive market. Techniques to enhance these relationships include:

- Regular Check-Ins: Maintaining ongoing communication with applicants is crucial to understanding their evolving needs. As emphasized by testimonials from clients such as Christina Delgado and Eric Eddy, Boutique Recruiting excels in this area, ensuring that applicants feel supported throughout the hiring process.

- Personalized Communication: Tailoring messages to resonate with individual applicants makes them feel valued. Applicants have commended Boutique Recruiting for their responsiveness and dedication to grasping both the skills and personalities of individuals, resulting in successful placements.

- Participation in Networking Events: Engaging with potential applicants in informal settings helps build rapport. This strategy not only establishes connections but also showcases recruiters’ commitment to personalized service.

Furthermore, with 51% of acquisition leaders anticipating increased recruitment team turnover challenges in 2025, establishing solid connections becomes even more critical. A recent case study on recruiting team workloads revealed that acquisition teams often struggle with unmanageable workloads, dedicating 35% of their time to interview scheduling. This emphasizes the need for process optimization, allowing recruiters to focus more on relationship-building. By prioritizing these strategies, recruiters can create a more customized and effective recruit hiring process that aligns with both applicants and employer expectations, ultimately leading to successful acquisition strategies. Boutique Recruiting currently has open positions available throughout the U.S. and Canada. Their commitment to cultivating significant relationships and providing outstanding applicant experiences establishes them as a frontrunner in tailored talent acquisition. Check out our job board for an up-to-date list of openings.

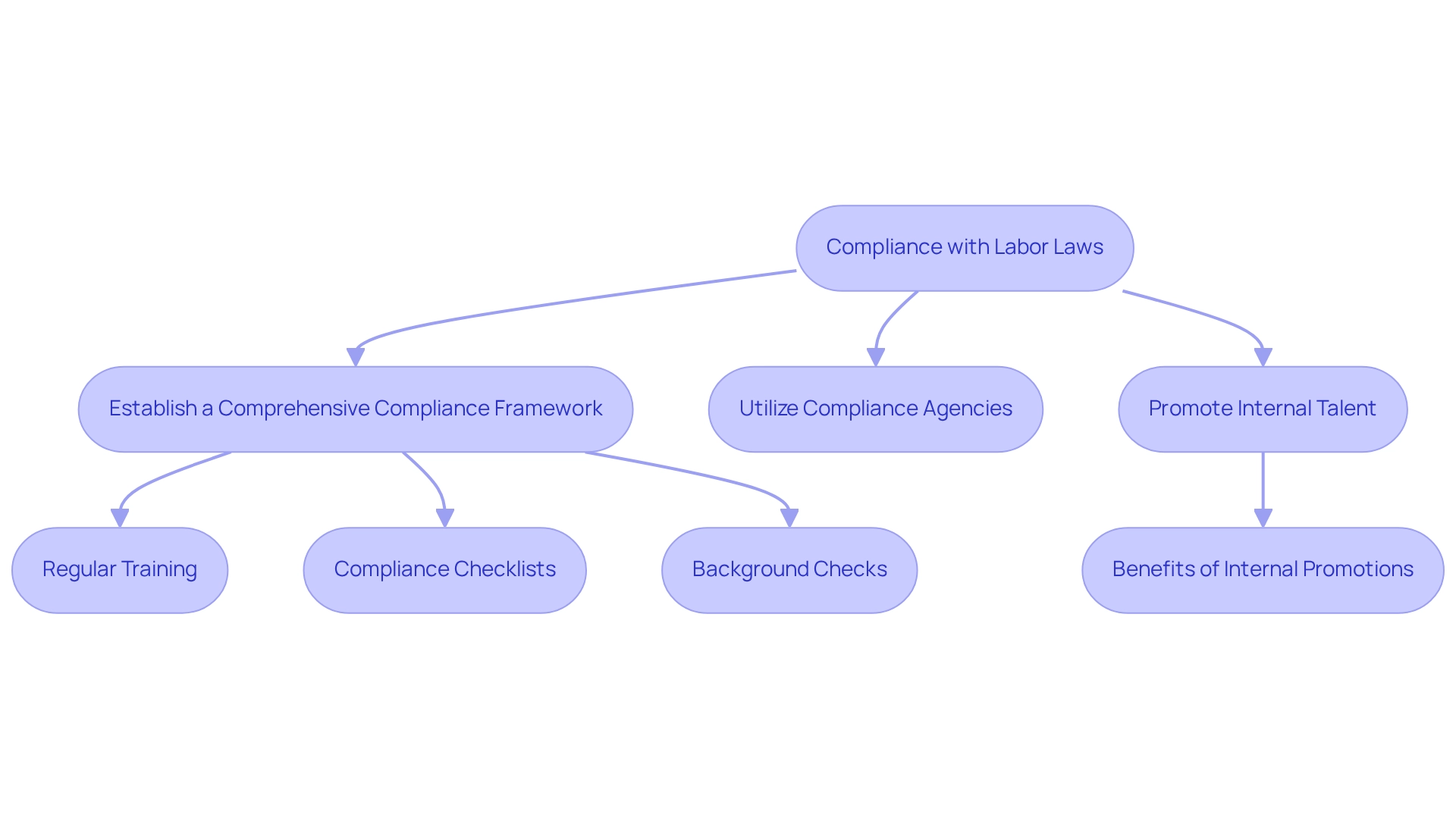

Ensure Compliance with Labor Laws and Regulations

In the economic industry, compliance with labor laws and regulations is crucial for effective recruit hiring practices. Recruiters must remain vigilant about evolving legal requirements, including anti-discrimination laws, data protection regulations, and specific compliance standards pertinent to the industry. To ensure compliance effectively, financial firms can implement the following structured approach:

- Establish a Comprehensive Compliance Framework: Regular training for recruitment teams, the use of compliance checklists, and conducting thorough background checks on candidates are critical components.

- Utilize Compliance Agencies for Recruit Hiring: Seeking support from specialized agencies can help navigate the complexities of compliance in recruit hiring.

- Promote Internal Talent: Organizations that prioritize internal promotions can enhance employee morale and retention, fostering a positive work culture that aligns with compliance objectives.

Focusing on compliance not only reduces risks but also improves an organization’s reputation for integrity, which is essential for attracting skilled individuals in a highly regulated environment. Consider the costly, time-consuming, and error-prone manual compliance processes previously experienced by Shazamme; this underscores the importance of establishing a robust compliance framework. As Rick Maré, Co-Founder and CEO of Boutique Recruiting, noted, “The impact of Akitra’s compliance platform on Shazamme has been nothing short of transformative.” By integrating these practices, companies can navigate the complexities of monetary recruit hiring while ensuring compliance with the latest labor laws and regulations for 2025.

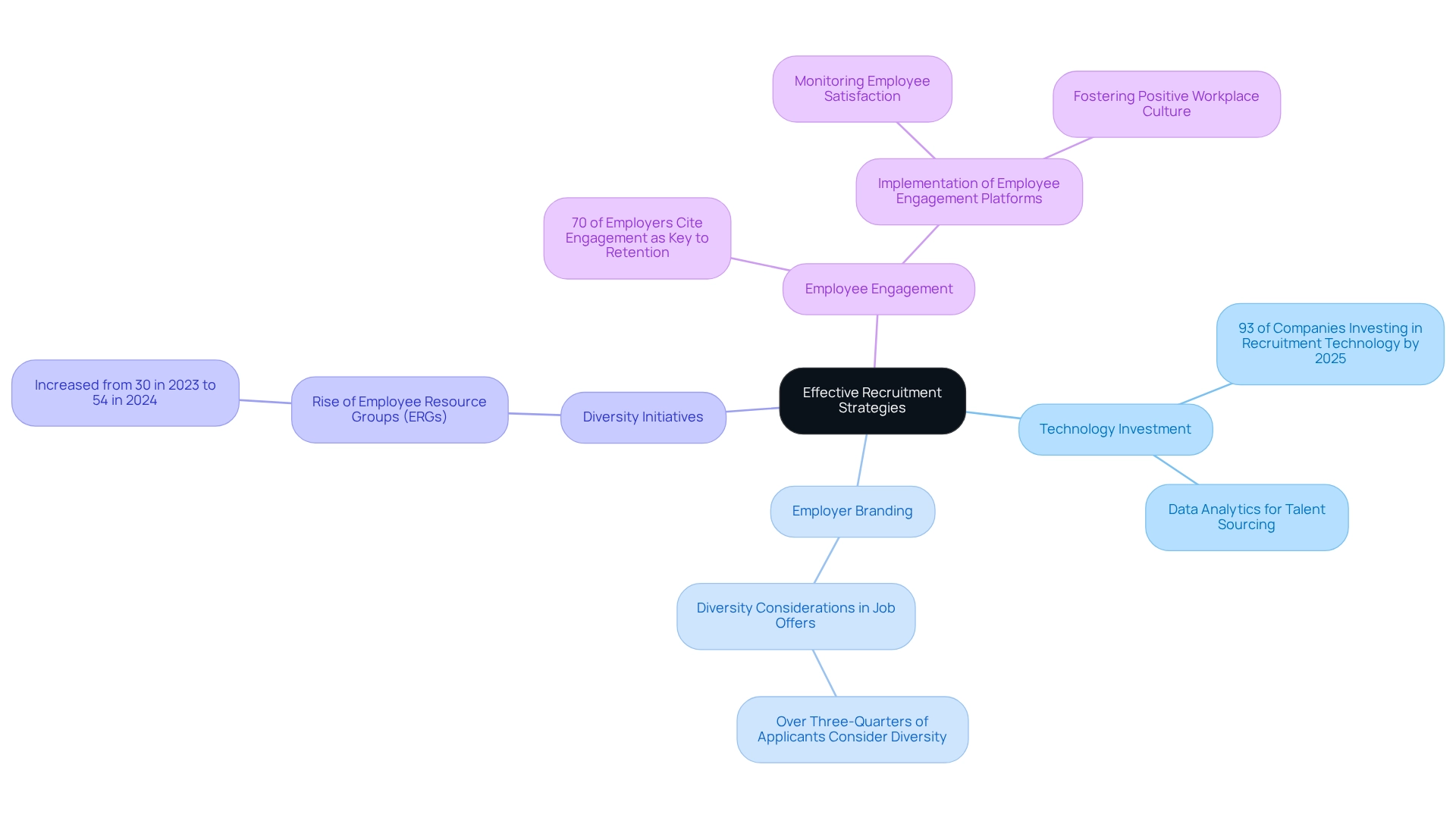

Implement Effective Recruitment Strategies and Best Practices

To attract and retain top talent in the financial sector, organizations must adopt comprehensive recruit hiring strategies tailored to high-demand roles such as CFOs, Financial Managers, and Chief Technology Officers. A staggering 93% of companies are anticipated to invest in recruit hiring technology by 2025, underscoring the need for innovative approaches. Boutique Recruiting leverages technology for talent sourcing, utilizing data analytics to identify trends in recruit hiring and make informed decisions. Enhancing the applicant experience through streamlined application processes is essential for engagement.

Employer branding plays a critical role in communicating organizational values and culture. With over three-quarters of applicants considering a company’s diversity when deciding on job offers, this aspect has never been more important. Boutique Recruiting emphasizes the rise of employee resource groups (ERGs), which have increased from 30% in 2023 to 54% in 2024, highlighting the growing emphasis on diversity and inclusion. It is vital for firms to showcase their commitment to these values.

Furthermore, with 37% of organizations now requiring full in-office work, up from 15% in 2023, recruiters at Boutique Recruiting must adapt their strategies to address this shift in the work environment. Proactive talent pipelining and the strategic use of social media platforms can significantly broaden the talent pool, ensuring that recruiters connect with a diverse range of individuals, particularly in finance and technology sectors.

Case studies highlight the effectiveness of employee engagement platforms, with 70% of employers citing engagement as key to retention. These platforms not only monitor employee satisfaction but also foster a positive workplace culture by addressing engagement concerns proactively, ultimately reducing turnover. By implementing these tailored strategies, Boutique Recruiting enhances its chances of recruit hiring high-quality candidates who align with organizational goals and contribute to long-term success in the financial sector.

Conclusion

The recruitment landscape in the financial sector is undeniably complex, characterized by a competitive talent market, evolving skill requirements, and stringent regulatory compliance. Organizations must navigate skill shortages while leveraging technology, such as AI and talent intelligence platforms, to streamline their hiring processes. Yet, the human element remains crucial in fostering meaningful connections, ensuring candidates not only possess the necessary skills but also comprehend the regulatory landscape.

To attract and retain top talent, financial firms must cultivate strong relationships with candidates. This personalized approach enhances trust and loyalty—vital components in today’s competitive environment. How can regular communication, tailored messaging, and participation in networking events significantly improve the recruitment process? A robust employer brand, coupled with a commitment to personalized service, can reduce hiring costs and attract a wider pool of applicants.

Compliance with labor laws and regulations is another critical aspect of recruitment in the financial sector. By establishing a comprehensive compliance framework and promoting internal talent, organizations can mitigate risks while enhancing their reputation. This strategy not only attracts top talent but also fosters a positive work culture aligned with compliance objectives.

Ultimately, the implementation of effective recruitment strategies and best practices is essential for long-term success in the financial sector. By leveraging technology, prioritizing diversity and inclusion, and focusing on employee engagement, organizations can create a robust recruitment process that aligns with their goals. As the financial landscape continues to evolve, adapting to these changes will be pivotal for firms aiming to secure the best candidates in 2025 and beyond. Ready to transform your recruitment strategy? Reach out for a consultation today.

Frequently Asked Questions

What are the key roles organizations are seeking to fill in the financial sector in 2025?

Organizations are increasingly seeking specialized roles such as CFOs, Financial Managers, Directors of Finance, Financial Planning & Analysis professionals, and IT roles like Chief Technology Officers and Systems Administrators.

What challenges do recruiters face in hiring for the financial sector?

Recruiters face significant skill shortages due to high demand for specialized roles and must navigate complexities related to regulatory compliance while ensuring candidates possess both technical skills and an understanding of the regulatory landscape.

How is AI impacting recruitment in the financial sector?

54% of organizations view AI as a pivotal factor in restructuring their hiring processes, leading to technology-driven staffing strategies. AI helps streamline operations but must be balanced with human insight in recruitment.

What trends are organizations adopting for enhancing recruitment?

59% of organizations plan to utilize talent intelligence platforms to enhance recruitment, reflecting a trend towards leveraging technology in hiring processes.

Why is employer branding important in the financial sector?

A strong employer brand and an accurate online presence can significantly reduce the time to fill positions, helping firms attract top professionals in a competitive market.

What strategies can companies implement to address talent retention in the banking industry?

Companies can use employee engagement platforms to monitor and address engagement issues, which is crucial for talent retention in the banking sector.

How can organizations create effective recruitment strategies in the financial sector?

Organizations should develop targeted recruitment strategies that focus on attracting candidates with the necessary technical skills and regulatory knowledge, while also enhancing their employer brand to appeal to top talent.

{“@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [{“@type”: “Question”, “name”: “What are the key roles organizations are seeking to fill in the financial sector in 2025?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Organizations are increasingly seeking specialized roles such as CFOs, Financial Managers, Directors of Finance, Financial Planning & Analysis professionals, and IT roles like Chief Technology Officers and Systems Administrators.”}}, {“@type”: “Question”, “name”: “What challenges do recruiters face in hiring for the financial sector?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Recruiters face significant skill shortages due to high demand for specialized roles and must navigate complexities related to regulatory compliance while ensuring candidates possess both technical skills and an understanding of the regulatory landscape.”}}, {“@type”: “Question”, “name”: “How is AI impacting recruitment in the financial sector?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “54% of organizations view AI as a pivotal factor in restructuring their hiring processes, leading to technology-driven staffing strategies. AI helps streamline operations but must be balanced with human insight in recruitment.”}}, {“@type”: “Question”, “name”: “What trends are organizations adopting for enhancing recruitment?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “59% of organizations plan to utilize talent intelligence platforms to enhance recruitment, reflecting a trend towards leveraging technology in hiring processes.”}}, {“@type”: “Question”, “name”: “Why is employer branding important in the financial sector?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “A strong employer brand and an accurate online presence can significantly reduce the time to fill positions, helping firms attract top professionals in a competitive market.”}}, {“@type”: “Question”, “name”: “What strategies can companies implement to address talent retention in the banking industry?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Companies can use employee engagement platforms to monitor and address engagement issues, which is crucial for talent retention in the banking sector.”}}, {“@type”: “Question”, “name”: “How can organizations create effective recruitment strategies in the financial sector?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Organizations should develop targeted recruitment strategies that focus on attracting candidates with the necessary technical skills and regulatory knowledge, while also enhancing their employer brand to appeal to top talent.”}}]}{“@context”: “https://schema.org”, “@type”: “BlogPosting”, “headline”: “Recruit Hiring: Strategies for Financial Sector Success”, “description”: “Explore effective strategies for recruit hiring in the competitive financial sector.”, “datePublished”: “2025-05-12T00:00:04.238000”, “image”: [“https://images.tely.ai/telyai/vcexvzmu-the-central-node-represents-the-overall-challenges-of-recruitment-branches-show-key-roles-needed-trends-in-recruitment-strategies-and-approaches-companies-can-take-to-attract-talent-each-branch-and-sub-branch-helps-in-understanding-the-multifaceted-nature-of-the-recruitment-landscape.webp”, “https://images.tely.ai/telyai/ymxuubcv-the-central-node-represents-the-main-focus-of-cultivating-relationships-each-branch-showcases-different-techniques-and-considerations-that-support-this-main-idea-helping-you-visualize-how-they-connect-and-contribute-to-effective-recruitment.webp”, “https://images.tely.ai/telyai/akbhvunj-follow-the-arrows-to-see-how-each-step-contributes-to-ensuring-compliance-each-branch-represents-a-key-strategy-with-smaller-steps-detailing-specific-actions-to-take.webp”, “https://images.tely.ai/telyai/rtmgvens-this-mindmap-starts-with-the-overall-theme-of-recruitment-strategies-branching-out-to-show-specific-areas-of-focus-each-branch-contains-key-statistics-and-practices-helping-you-understand-how-these-elements-contribute-to-attracting-and-retaining-top-talent.webp”], “articleBody”: “## Overview\nThe article explores effective recruitment strategies essential for success in the financial sector, underscoring the significance of technology, employer branding, and adherence to labor laws. It highlights that, although AI and talent intelligence platforms are increasingly being employed, the cultivation of personal relationships and a robust employer brand remains vital for attracting top talent and minimizing hiring costs in a competitive marketplace. \n\nIn an industry where recruitment challenges are prevalent, understanding labor laws that influence hiring practices is crucial. Personalized recruitment services tailored to the financial sector can yield substantial benefits, enhancing the quality of hires and improving overall organizational performance. \n\nConsider the experiences of satisfied clients who have transformed their hiring processes through strategic recruitment partnerships. Their testimonials reinforce the trust and efficacy of these approaches, illustrating the tangible advantages of leveraging both technology and personal connections. \n\nAs you navigate the complexities of recruitment in the financial sector, we invite you to reach out for a consultation. Together, we can develop a strategy that positions your firm as a leader in attracting top-tier talent.\n\n## Key Highlights:\n- Recruitment in the financial sector faces challenges due to a competitive job market and evolving skill requirements.\n- Key roles in demand include CFOs, Financial Managers, and IT positions such as Chief Technology Officers.\n- 54% of organizations consider AI crucial for restructuring recruitment processes, while 59% plan to use talent intelligence platforms.\n- Despite technological advancements, the human element remains vital for effective recruitment in a regulated environment.\n- A strong employer brand can reduce hiring costs by 50%, highlighting the importance of company culture in attracting talent.\n- Recruiters must prioritize regular check-ins and personalized communication to build trust and loyalty with applicants.\n- Compliance with labor laws is essential, requiring a comprehensive framework and regular training for recruitment teams.\n- 93% of companies are expected to invest in recruitment technology by 2025, emphasizing the need for innovative hiring strategies.\n- Diversity and inclusion are increasingly important, with 75% of applicants considering a company’s diversity in job offers.\n- Employee engagement platforms are crucial for retention, with 70% of employers citing engagement as key to reducing turnover.\n\n## Introduction\nIn the dynamic and ever-evolving landscape of the financial sector, the recruitment process encounters unprecedented challenges as organizations strive to secure top-tier talent amidst an intensely competitive market. The surge in demand for specialized roles\u2014ranging from CFOs to Chief Technology Officers\u2014compels recruiters to adeptly navigate skill shortages while adapting to new technological advancements. As a significant number of firms embrace AI and talent intelligence platforms, the recruitment landscape is undergoing a transformation. Yet, the human touch remains indispensable for forging meaningful connections. \n\nMoreover, stringent regulatory compliance introduces an additional layer of complexity, necessitating a dual focus on technical proficiency alongside a comprehensive understanding of industry standards. This article delves into the multifaceted challenges of recruitment within the financial sector and explores effective strategies to attract and retain the best candidates in 2025. How can organizations adapt to these changes while ensuring they remain compliant and competitive? The answers lie in a strategic approach to recruitment that prioritizes personalized services tailored to the unique needs of the financial industry.\n\n## Understand Financial Sector Recruitment Challenges\nHiring in the financial sector in 2025 presents unique challenges, driven by a highly competitive workforce market and rapidly evolving skill requirements. Organizations increasingly seek specialized roles such as:\n\n1. CFOs\n2. Financial Managers\n3. Directors of Finance\n4. Financial Planning & Analysis professionals\n5. IT roles like Chief Technology Officers and Systems Administrators\n\nThis demand leads recruiters to face significant skill shortages. Recent statistics reveal that:\n\n- 54% of organizations view AI as a pivotal factor in restructuring their recruit hiring processes, reflecting a shift towards technology-driven staffing strategies.\n- 59% of organizations plan to utilize talent intelligence platforms for enhanced recruit hiring, underscoring the trend of leveraging technology in recruitment.\n\nHowever, while AI streamlines operations, the human element remains crucial in navigating the complexities of recruitment. The financial sector, governed by stringent regulatory compliance standards, complicates the hiring process. Recruiters must ensure that applicants not only possess the necessary technical skills but also understand the regulatory landscape. This dual focus is essential for creating targeted recruit hiring strategies that attract the right individuals while ensuring compliance with industry regulations.\n\nIn this competitive landscape, service firms must enhance their employer brand to attract top professionals. A strong online presence that accurately reflects company culture and values can significantly reduce the time to fill positions. By utilizing employee engagement platforms, companies can monitor and address engagement issues, which is particularly vital in the banking industry where talent retention is essential. Understanding these challenges and [implementing effective strategies](https://boutiquerecruiting.com) is vital for success in the financial sector’s talent market.\n\nAs Eric Eddy from CPA Resources Global Professionals observes, the firm’s capability to provide exceptional candidates swiftly and effectively emphasizes the significance of customized recruit hiring strategies suited to high-demand positions. The increasing application of AI in recruit hiring further underscores the necessity for a balanced strategy that appreciates both technology and human insight. At Boutique Recruiting, we recognize these dynamics and are committed to offering tailored recruit hiring solutions that address the evolving requirements of the finance industry.\n\nAre you prepared to navigate the complexities of recruitment in this challenging landscape? Reach out to us for a consultation and discover how we can help you secure the talent you need.\n\n\n## Cultivate Relationships for Tailored Talent Acquisition\nCultivating relationships is essential for effective recruit hiring in the financial sector. Did you know that a strong employer brand can significantly reduce recruitment hiring costs by 50%? Recruiters must prioritize understanding the unique needs and aspirations of applicants alongside the specific requirements of their clients. This tailored method not only helps in recognizing suitable individuals but also nurtures trust and loyalty, which are vital in a competitive market. Techniques to enhance these relationships include:\n\n- Regular Check-Ins: Maintaining ongoing communication with applicants is crucial to understanding their evolving needs. As emphasized by testimonials from clients such as Christina Delgado and Eric Eddy, Boutique Recruiting excels in this area, ensuring that applicants feel supported throughout the hiring process.\n- Personalized Communication: Tailoring messages to resonate with individual applicants makes them feel valued. Applicants have commended Boutique Recruiting for their responsiveness and dedication to grasping both the skills and personalities of individuals, resulting in successful placements.\n- Participation in Networking Events: Engaging with potential applicants in informal settings helps build rapport. This strategy not only establishes connections but also showcases recruiters’ commitment to personalized service.\n\nFurthermore, with 51% of acquisition leaders anticipating increased recruitment team turnover challenges in 2025, establishing solid connections becomes even more critical. A recent case study on recruiting team workloads revealed that acquisition teams often struggle with unmanageable workloads, dedicating 35% of their time to interview scheduling. This emphasizes the need for process optimization, allowing recruiters to focus more on relationship-building. By prioritizing these strategies, recruiters can create [a more customized and effective recruit hiring process](https://www.boutiquerecruiting.com/best-practices-for-working-with-career-recruiters-strategies-for-success/) that aligns with both applicants and employer expectations, ultimately leading to successful acquisition strategies. Boutique Recruiting currently has open positions available throughout the U.S. and Canada. Their commitment to cultivating significant relationships and providing outstanding applicant experiences establishes them as a frontrunner in [tailored talent acquisition](https://boutiquerecruiting.com/about). Check out our job board for an up-to-date list of openings.\n\n\n## Ensure Compliance with Labor Laws and Regulations\nIn the economic industry, compliance with labor laws and regulations is crucial for effective recruit hiring practices. Recruiters must remain vigilant about evolving legal requirements, including anti-discrimination laws, data protection regulations, and specific compliance standards pertinent to the industry. To ensure compliance effectively, financial firms can implement the following structured approach:\n\n- Establish a Comprehensive Compliance Framework: Regular training for recruitment teams, the use of compliance checklists, and conducting thorough background checks on candidates are critical components.\n- Utilize Compliance Agencies for Recruit Hiring: Seeking support from specialized agencies can help navigate the complexities of compliance in recruit hiring.\n- Promote Internal Talent: Organizations that prioritize internal promotions can enhance employee morale and retention, fostering a positive work culture that aligns with compliance objectives.\n\nFocusing on compliance not only reduces risks but also improves an organization’s reputation for integrity, which is essential for attracting skilled individuals in a highly regulated environment. Consider the costly, time-consuming, and error-prone manual compliance processes previously experienced by Shazamme; this underscores the importance of establishing a robust compliance framework. As Rick Mar\u00e9, Co-Founder and CEO of Boutique Recruiting, noted, \”The impact of Akitra\u2019s compliance platform on Shazamme has been nothing short of transformative.\” By integrating these practices, companies can navigate the complexities of monetary recruit hiring while ensuring compliance with the latest labor laws and regulations for 2025.\n\n\n## Implement Effective Recruitment Strategies and Best Practices\nTo attract and retain top talent in the financial sector, organizations must adopt comprehensive recruit hiring strategies tailored to high-demand roles such as CFOs, Financial Managers, and Chief Technology Officers. A staggering 93% of companies are anticipated to invest in recruit hiring technology by 2025, underscoring the need for innovative approaches. Boutique Recruiting leverages technology for talent sourcing, utilizing data analytics to identify trends in recruit hiring and make informed decisions. Enhancing [the applicant experience](https://northone.com/blog/small-business/recruitment-statistics) through streamlined application processes is essential for engagement.\n\nEmployer branding plays a critical role in communicating organizational values and culture. With over three-quarters of applicants considering a company\u2019s diversity when deciding on job offers, this aspect has never been more important. Boutique Recruiting emphasizes the rise of employee resource groups (ERGs), which have increased from 30% in 2023 to 54% in 2024, highlighting the growing emphasis on diversity and inclusion. It is vital for firms to showcase their commitment to these values.\n\nFurthermore, with 37% of organizations now requiring full in-office work, up from 15% in 2023, recruiters at Boutique Recruiting must adapt their strategies to address this shift in the work environment. Proactive talent pipelining and the strategic use of social media platforms can significantly broaden the talent pool, ensuring that recruiters connect with a diverse range of individuals, particularly in finance and technology sectors.\n\nCase studies highlight the effectiveness of employee engagement platforms, with 70% of employers citing engagement as key to retention. These platforms not only monitor employee satisfaction but also foster a positive workplace culture by addressing engagement concerns proactively, ultimately reducing turnover. By implementing these tailored strategies, Boutique Recruiting enhances its chances of recruit hiring high-quality candidates who align with organizational goals and contribute to long-term success in the financial sector.\n\n\n\n## Conclusion\nThe recruitment landscape in the financial sector is undeniably complex, characterized by a competitive talent market, evolving skill requirements, and stringent regulatory compliance. Organizations must navigate skill shortages while leveraging technology, such as AI and talent intelligence platforms, to streamline their hiring processes. Yet, the human element remains crucial in fostering meaningful connections, ensuring candidates not only possess the necessary skills but also comprehend the regulatory landscape. \n\nTo attract and retain top talent, financial firms must cultivate strong relationships with candidates. This personalized approach enhances trust and loyalty\u2014vital components in today\u2019s competitive environment. How can regular communication, tailored messaging, and participation in networking events significantly improve the recruitment process? A robust employer brand, coupled with a commitment to personalized service, can reduce hiring costs and attract a wider pool of applicants. \n\nCompliance with labor laws and regulations is another critical aspect of recruitment in the financial sector. By establishing a comprehensive compliance framework and promoting internal talent, organizations can mitigate risks while enhancing their reputation. This strategy not only attracts top talent but also fosters a positive work culture aligned with compliance objectives. \n\nUltimately, the implementation of effective recruitment strategies and best practices is essential for long-term success in the financial sector. By leveraging technology, prioritizing diversity and inclusion, and focusing on employee engagement, organizations can create a robust recruitment process that aligns with their goals. As the financial landscape continues to evolve, adapting to these changes will be pivotal for firms aiming to secure the best candidates in 2025 and beyond. Ready to transform your recruitment strategy? Reach out for a consultation today.\n\n::iframe[https://iframe.tely.ai/cta/eyJhcnRpY2xlX2lkIjogIjY4MjEzYTA0MTBhNGE3NTdjYzVhZjI2NSIsICJjb21wYW55X2lkIjogIjY3YWU2NGU5YzhlZTg4N2E0ZmUzZmYxOSIsICJpbmRleCI6IG51bGx9]{width=\”100%\” height=\”300px\”}”}