Overview

The article underscores the critical interview questions that candidates must prepare for when pursuing head of finance positions. It asserts that comprehensive preparation—encompassing a deep understanding of the company’s challenges, practicing common interview questions, and effectively articulating financial management experiences—substantially boosts candidates’ prospects of success in securing these highly competitive roles.

Key Highlights:

- Thorough preparation for finance interviews includes researching the company, understanding the role, and practicing common questions.

- Candidates must analyze potential challenges the company may face in the near future, such as in 2025.

- Prepared candidates significantly improve their chances of impressing interviewers and securing positions.

- Job seekers should evaluate multiple offers to find roles that align with long-term career goals, rather than accepting the first offer.

- Structuring responses using the STAR method can enhance the clarity and effectiveness of answers during interviews.

- Candidates should be ready to discuss their financial management experiences, including budget management and reporting oversight.

- Effective prioritization of financial projects is crucial, with methodologies like the Eisenhower Matrix aiding decision-making.

- Experience in financial reporting, including generating income statements and balance sheets, is vital for head of finance candidates.

- Conflict resolution skills are essential for leaders in finance, enhancing team dynamics and productivity.

- Candidates must articulate their vision for the finance department, focusing on efficiency, compliance, and team development.

- Understanding and ensuring compliance with financial regulations, such as GAAP and IFRS, is critical for finance leaders.

- Motivating finance teams involves setting clear goals, providing feedback, and recognizing achievements to foster a positive culture.

Introduction

In the competitive landscape of finance, securing a coveted position demands meticulous preparation and strategic insight. Candidates must familiarize themselves with the intricacies of financial concepts and current market dynamics while delving into the specific challenges facing potential employers. This comprehensive approach to interview preparation is vital; it empowers candidates to present themselves with confidence and clarity, ultimately enhancing their chances of success.

With the stakes higher than ever, understanding the nuances of interview dynamics, effective communication, and the importance of aligning personal aspirations with organizational goals can make all the difference in landing a leadership role in finance. As the job market continues to evolve, aspiring finance professionals must adapt their strategies to stand out in a sea of talent. What will set you apart in this competitive arena?

The Importance of Preparation for Finance Interviews

Preparing for finance interviews, particularly those for head of finance positions, involves a multifaceted approach that necessitates thorough research about the company, a deep understanding of the role, and practice with common interview questions. Candidates must not only familiarize themselves with essential financial concepts and current market trends but also analyze the specific challenges the company is projected to face in 2025. This level of preparation is crucial for effectively addressing head of finance interview questions, as it significantly boosts confidence and enables candidates to articulate their thoughts clearly, showcasing their knowledge during the interview.

The impact of interview preparation on applicant success rates is substantial. Statistics indicate that thoroughly prepared individuals are more likely to impress interviewers. Numerous companies, including major firms like Amazon, conduct interviews where applicants meet with between 2 to 7 employees to evaluate their fit comprehensively. This highlights the competitive nature of finance positions and the necessity for applicants to distinguish themselves.

Moreover, candidates should consider key factors when evaluating job offers. The first offer may not always be the best, and exploring multiple opportunities can reveal roles that align more closely with their long-term career goals. Engaging in this process not only helps individuals avoid the pitfall of accepting the first offer for convenience but also allows them to explore organizations that offer advantages, adaptability, and career advancement they may not have initially considered.

In particular, candidates should remember that the initial choice often isn’t the most advantageous. They should avoid the path of least effort; hastily accepting a job offer may lead to regret.

Expert opinions underscore the importance of structuring responses to common head of finance interview questions, such as ‘Tell Me About Yourself,’ into three parts: past experiences, recent accomplishments, and future aspirations. Concluding with a question can further engage the interviewer, showcasing a proactive approach. This advice is especially relevant for individuals seeking to align with the cultural values of prospective employers. As Stacy Milgate, a program manager at AWS, states, “We’re not going to test you to see if you’ve memorized the Leadership Principles, but we do want individuals to be excited about them.”

Additionally, case studies illustrate the effectiveness of preparation strategies. Allowing applicants to ask questions at the end of an interview not only fosters mutual understanding but also signals the employer’s investment in finding the right fit. This practice has been shown to positively impact applicants, enhancing their overall experience.

In summary, effective preparation for interviews in the financial sector involves a strategic blend of research, practice, and engagement, all contributing to an applicant’s success in securing a leadership role in the industry. Boutique Recruiting’s strong track record of success, characterized by numerous satisfied clients and candidates, underscores the importance of thorough preparation and personalized recruitment solutions in achieving favorable outcomes in the competitive finance job market.

Discuss Your Experience in Financial Management

Applicants must prepare to articulate their previous roles in fiscal management, emphasizing specific duties and accomplishments that directly relate to head of finance interview questions. They should consider discussing experiences such as:

- Budget management

- Oversight of reporting

- Leadership in analysis projects

when addressing these interview queries. By providing quantifiable results—such as cost savings or revenue growth—they can significantly enhance the strength of their responses.

Share an Example of a Successful Financial Project

When addressing this question, candidates are encouraged to employ the STAR method (Situation, Task, Action, Result) to effectively structure their responses. They should consider outlining a project in which they implemented a new monetary system that significantly improved reporting accuracy or a cost-reduction initiative that resulted in substantial savings for the company. Emphasizing the impact of their contributions is crucial for demonstrating their value.

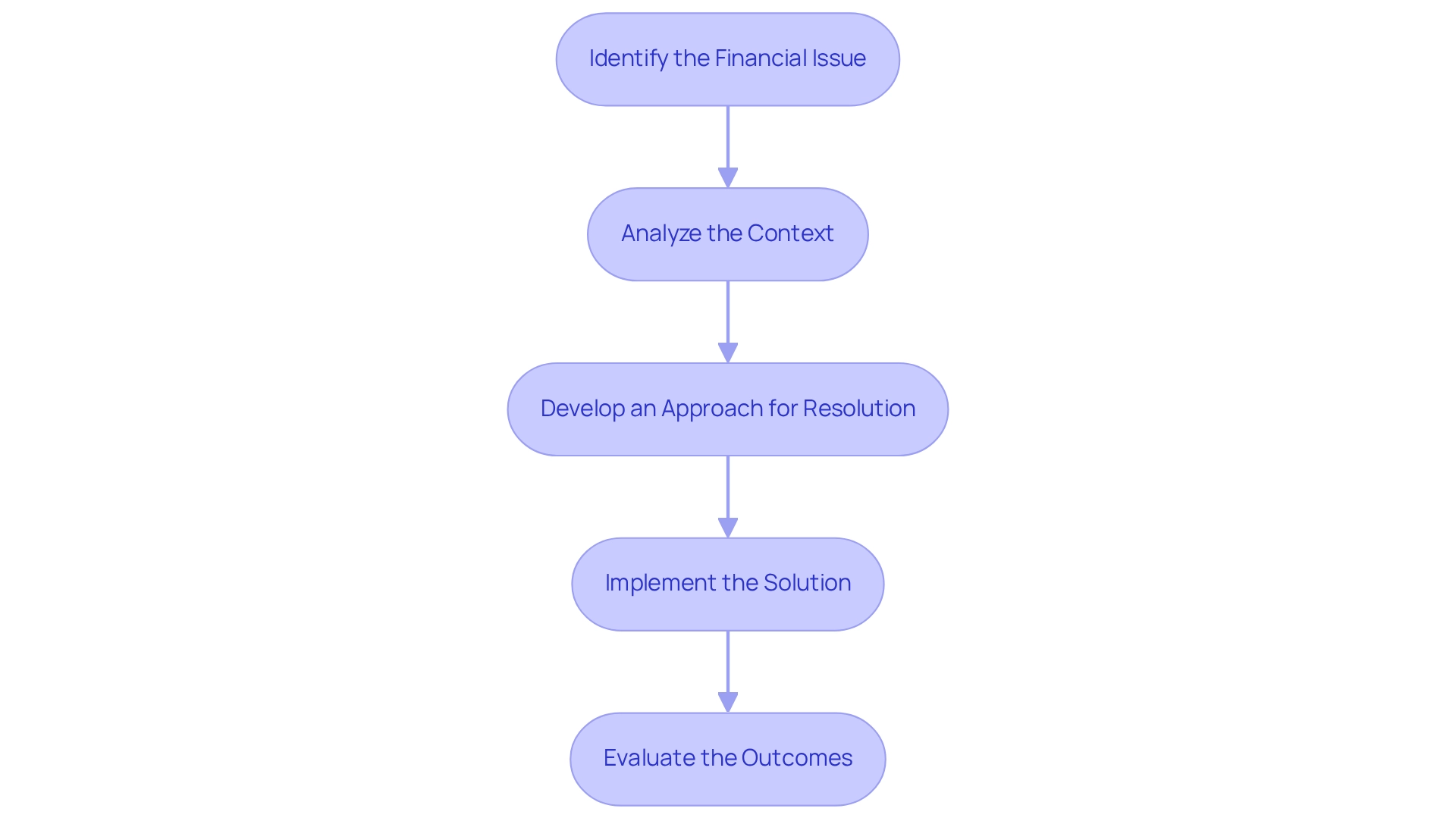

Describe a Complex Financial Issue You’ve Managed

Candidates should prepare to discuss a complex monetary issue they have encountered, detailing the context and their approach to resolving it. This preparation is critical, as the financial sector is rife with challenges such as monetary forecasting mistakes and regulatory compliance hurdles. By emphasizing the steps taken to analyze the problem and the outcomes achieved, candidates can effectively showcase their competency and expertise in navigating these intricate situations.

How Do You Prioritize Financial Projects?

Candidates should articulate their strategies for prioritizing financial projects, emphasizing the importance of assessing project impact, deadlines, and resource availability. They may reference specific tools or methodologies, such as project management software like Asana or Trello, which facilitate efficient task management and tracking. Notably, organizations employing structured project prioritization methods see a significant increase in project success rates; for instance, statistics indicate that 70% of finance professionals believe that effective prioritization directly impacts overall project outcomes.

This aligns with Boutique Recruiting’s strong track record of success, showcasing how effective strategies lead to positive results.

Furthermore, applicants might discuss prioritization frameworks, such as the Eisenhower Matrix or Moscow method, which assist in categorizing projects based on urgency and significance. In interviews, it is advantageous for applicants to present instances of how they have effectively prioritized projects in former positions, demonstrating their decision-making process and the results attained. For instance, a candidate could describe a scenario where they had to balance multiple projects with competing deadlines, detailing how they utilized project management tools to streamline workflows and ensure that critical tasks were completed on time.

Moreover, the significance of reliability in project management tools can be emphasized by citing the SOC 2 data center’s 99.99% uptime, which highlights the necessity for dependable systems in managing monetary projects. A quote from the Managing Director emphasizes that “a worker can move between different facilities and be instantly and securely connected to any systems on their network,” illustrating the critical role of connectivity in project management.

Lastly, the British Columbia Policy on Open Data serves as a real-world example of how structured approaches to project management can promote transparency and engagement, which is especially pertinent to financial positions. By demonstrating a clear understanding of these methodologies and their practical applications, candidates can showcase their ability to contribute to the leadership of an organization effectively.

Discuss Your Experience in Financial Reporting

In the realm of finance recruitment, candidates for head of finance positions must be exceptionally prepared to articulate their reporting experience, a cornerstone of effective leadership in this field. They should be ready to detail the specific financial reports they have generated, including:

- Income statements

- Balance sheets

- Cash flow statements

Each is vital for assessing a company’s economic health. Moreover, familiarity with standard reporting software such as QuickBooks, SAP, or Oracle Financial Services significantly enhances an applicant’s appeal.

Attention to detail is paramount in financial reporting. Candidates ought to convey their strategies for ensuring data accuracy and compliance with relevant regulations. This includes discussing their experience with internal controls and audit procedures, which are critical for maintaining the integrity of financial information.

Statistics indicate that CFO candidates typically possess over 15 years of advanced leadership experience in finance, underscoring the importance of a robust reporting background. Expert insights suggest that applicants should also be prepared to discuss their commitment to reporting best practices in response to head of finance interview questions, including how they have implemented strategies to improve reporting efficiency and accuracy in prior roles. As Sabrinthia Donnelly from Finance Alliance aptly states, “Believe it or not, a crisis management plan is not the same as a business continuity plan.”

While these two concepts share similarities, they possess vital distinctions that underscore the strategic importance of financial reporting in organizational planning.

Furthermore, candidates must be equipped to provide concrete examples of how they have navigated reporting challenges, showcasing their problem-solving skills and adaptability. This not only highlights their technical expertise but also their ability to contribute to the organization’s broader economic strategy. By effectively communicating their reporting experience within the financial sector, candidates can adeptly address head of finance interview questions, positioning themselves as formidable contenders for leadership roles.

Boutique Recruiting’s dedication to excellence and personalized service has established it as a trusted partner for businesses in search of top-tier talent, reinforcing the critical role of financial reporting experience in hiring for these pivotal positions.

How Do You Handle Employee Conflicts in Financial Teams?

Candidates must be prepared to present specific examples of how they have effectively resolved conflicts within their financial groups. This may include detailing their strategies for fostering open communication, mediating discussions, and identifying common interests among group members. For instance, an applicant might recount a scenario where they adeptly navigated a disagreement regarding budget allocations by facilitating a structured dialogue that allowed each party to articulate their concerns and priorities.

This method not only addressed the immediate conflict but also enhanced group cohesion and trust.

Moreover, candidates can underscore the impact of their conflict resolution efforts on overall group performance. Research demonstrates that effective conflict resolution can lead to enhanced collaboration and productivity within finance teams. By illustrating their capacity to transform conflicts into opportunities for growth, candidates can highlight their leadership abilities and their dedication to fostering a positive work environment.

Insights from industry experts underscore the critical role of conflict resolution in financial management. They note that leaders who prioritize conflict resolution can enhance group dynamics and facilitate more effective decision-making processes. Candidates should be ready to discuss how their conflict resolution strategies align with these expert viewpoints, reinforcing their capability to lead groups effectively.

Incorporating relevant case studies, such as ‘Redeveloping Scorecard Metrics for Shareholder Value,’ illustrates how tailored training for conflict resolution can lead to a deeper understanding and application of new metrics, ultimately boosting group performance in finance roles. Furthermore, statistics reveal that organizations with robust conflict resolution practices experience a 25% increase in group performance metrics. This data emphasizes the importance of individuals articulating their experiences and strategies in managing employee conflicts, as it directly correlates with their potential impact on the organization’s success.

Additionally, the necessity for continuous learning in conflict resolution is emphasized through the training provided to both new and seasoned staff, highlighting the need for ongoing development in communication skills. A participant remarked, “Learning is a continuous process. I am taking away with me much more than I actually anticipated to get from the course, including turnaround strategies, the importance of leadership, communication skills, influencing, and negotiating, to name a few.”

This statement underscores the significance of these skills in resolving disputes within financial groups.

Ultimately, Boutique Recruiting’s impressive history, characterized by satisfied clients and candidates, establishes trust in the domain of conflict resolution and group dynamics, underscoring that effective conflict management is vital for success in leadership roles within the financial sector.

What is Your Vision for the Finance Department?

Candidates must articulate a clear vision for the fiscal division, outlining objectives for efficiency, compliance, and team development. They should consider how to leverage technology, enhance processes, and foster team collaboration to achieve these goals. Specifically, applicants for roles such as Chief Accounting Officer, Controller, or Senior Accountant are expected to demonstrate an understanding of how their vision aligns with the company’s overarching mission and the finance department’s contribution to it.

Moreover, candidates should reflect on how Boutique Recruiting’s tailored recruitment solutions can identify individuals possessing the critical skills and experience necessary to excel in these leadership positions. This approach not only addresses the pressing challenges in the financial sector but also underscores the importance of personalized recruitment services designed specifically for this industry.

In a landscape where effective leadership is paramount, the right recruitment strategy can significantly impact organizational success. Are you ready to elevate your hiring process? Reach out to us for a consultation and discover how we can assist you in finding the ideal candidates for your financial leadership roles.

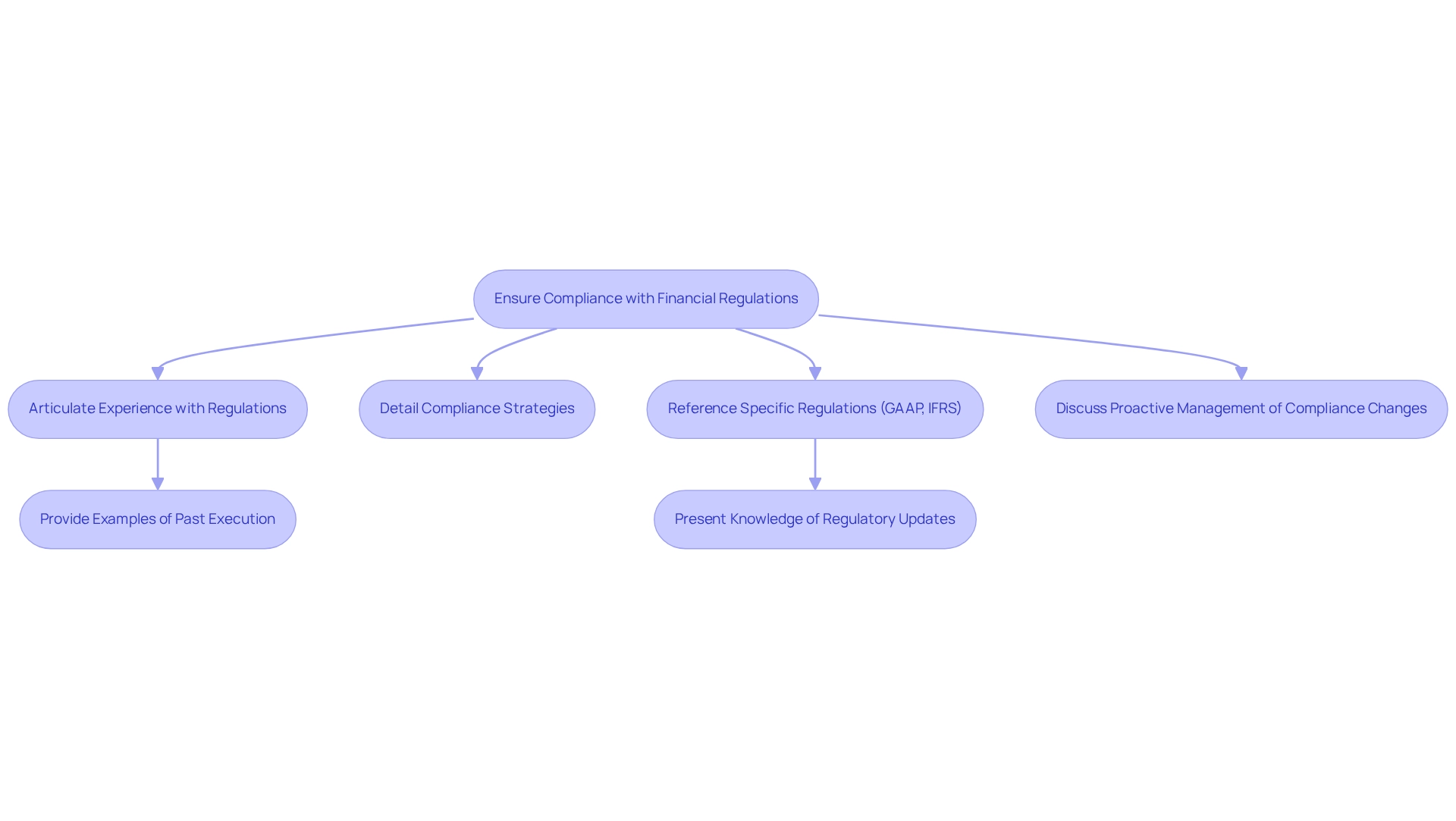

How Do You Ensure Compliance with Financial Regulations?

Candidates must articulate their experience with fiscal regulations and detail their strategies for ensuring compliance within their teams. It is essential for them to reference specific regulations they have encountered, such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards), and to explain how they keep abreast of regulatory changes. For instance, they might discuss their proactive approach to managing the evolving compliance landscape, which is increasingly complex, as highlighted by the implementation of 25,729 international compliance standards across 173 countries by the ISO.

Moreover, applicants should present specific instances of how they have effectively executed compliance measures in past positions. This could encompass strategies created in reaction to increased regulatory oversight, especially considering recent failures in the banking sector that have led institutions to incorporate climate-related risk management into their decision-making processes. The European Central Bank (ECB) and the European Banking Authority (EBA) are emphasizing the necessity for banks to update their strategies by the end of 2024 to effectively manage climate and environmental risks.

Furthermore, applicants should be prepared to discuss their knowledge of the latest updates in GAAP and IFRS as of 2025, demonstrating their dedication to ensuring compliance. Statistics suggest that organizations adopting compliance tools and remaining aware of emerging trends are better equipped to manage the complexities of regulatory frameworks, thus protecting their reputation and operations. As Sharavanan, an Associate Product Marketing Manager, noted, “By embracing these tools and staying abreast of emerging trends, organizations can position themselves to navigate the complexities of compliance effectively and safeguard their reputation, data, and operations in the years ahead.”

By sharing their experiences and insights, applicants can showcase their preparedness for the head of finance interview questions and demonstrate their ability to guide financial groups in a compliant and effective manner. The ongoing discussions, such as the CFTC’s request for public comment on AI use in regulated markets, highlight the dynamic nature of compliance that candidates must navigate.

How Do You Motivate Your Finance Team?

Candidates must articulate their strategies for motivating finance groups, which should encompass:

- Setting clear goals

- Providing regular feedback

- Recognizing achievements

They should delve into how they cultivate a positive group culture and foster professional development. By offering specific examples of successful team motivation initiatives, candidates can effectively illustrate their capabilities as leaders.

Conclusion

Preparing for finance interviews is a complex endeavor that necessitates a combination of research, practice, and strategic insight. Candidates must grasp not only financial concepts and current market dynamics but also the specific challenges that potential employers face. This thorough preparation is essential, as it significantly bolsters a candidate’s confidence and enhances their ability to articulate qualifications clearly during interviews.

Key strategies such as employing the STAR method to structure responses, effectively prioritizing financial projects, and ensuring compliance with financial regulations have been underscored throughout this discussion. Moreover, the significance of conflict resolution and team motivation in finance leadership roles cannot be understated. These factors play a crucial role in a candidate’s overall effectiveness and influence within an organization.

In the competitive realm of finance, candidates must distinguish themselves through meticulous preparation and alignment with organizational goals. By embracing a strategic approach to interview preparation and showcasing their skills and experiences, candidates can markedly improve their chances of securing the leadership positions they aspire to. As the finance landscape evolves, remaining informed and adaptable will be vital for those seeking to thrive in this dynamic field.

Frequently Asked Questions

How should candidates prepare for finance interviews, especially for head of finance positions?

Candidates should conduct thorough research about the company, understand the specific role, and practice common interview questions. They must familiarize themselves with essential financial concepts, current market trends, and analyze the challenges the company may face in 2025.

What is the impact of preparation on interview success rates?

Thoroughly prepared candidates are more likely to impress interviewers, significantly increasing their chances of success. Many companies, including major firms like Amazon, conduct interviews with multiple employees to evaluate applicants comprehensively, highlighting the competitive nature of finance positions.

What should candidates consider when evaluating job offers?

Candidates should explore multiple opportunities instead of accepting the first offer, as it may not be the best fit for their long-term career goals. This approach allows them to find roles that offer better advantages, adaptability, and career advancement.

How should candidates structure their responses to common interview questions?

Candidates should structure their responses into three parts: past experiences, recent accomplishments, and future aspirations. Concluding with a question can engage the interviewer and demonstrate a proactive approach.

What is the STAR method and how can it be used in interviews?

The STAR method stands for Situation, Task, Action, Result. Candidates can use it to structure their responses by outlining specific projects or initiatives they have led, emphasizing the impact of their contributions to demonstrate their value.

Why is it important to ask questions at the end of an interview?

Allowing candidates to ask questions fosters mutual understanding and signals the employer’s investment in finding the right fit. This practice enhances the overall experience for applicants.

What key experiences should candidates highlight during head of finance interviews?

Candidates should articulate their previous roles in fiscal management, focusing on budget management, oversight of reporting, and leadership in analysis projects. Providing quantifiable results, such as cost savings or revenue growth, strengthens their responses.