Overview

The controller title in finance denotes a senior executive tasked with overseeing accounting operations, ensuring financial accuracy, and playing a crucial role in strategic decision-making. This role has evolved significantly, transitioning from traditional record-keeping to that of strategic advisors.

The integration of data analytics and adherence to regulations are now essential functions, enhancing the overall financial health of organizations. This evolution not only reflects the changing landscape of finance but also underscores the importance of adaptability in leadership roles within the sector.

Key Highlights:

- The controller title in finance represents a senior executive responsible for overseeing accounting operations and ensuring financial accuracy.

- Controllers prepare financial statements, manage budgets, and ensure compliance with regulations, playing a crucial role in strategic decision-making.

- The role has evolved from traditional record-keeping to being integral in corporate strategy and risk management.

- Controllers are now seen as strategic advisors, influencing business decisions through data analytics and financial insights.

- Key traits of effective controllers include strong analytical skills, leadership qualities, and exceptional communication abilities.

- The average age of female finance managers is 44.5 years, reflecting a mature demographic with diverse skill sets.

- Controllers differ from CFOs and finance managers: CFOs focus on long-term strategy, while finance managers concentrate on budgeting and forecasting.

- Technological advancements are reshaping the controller role, with a projected 128% increase in RegTech investment by 2030.

- Organizations implementing automation in financial processes report significant efficiency gains and enhanced accuracy.

- The evolving role of controllers emphasizes the need for continuous professional development and adaptability in a changing economic landscape.

Introduction

In the intricate world of finance, the role of the controller emerges as a cornerstone of organizational success, evolving well beyond traditional accounting practices. As senior executives responsible for managing accounting operations, controllers ensure compliance and accuracy in financial reporting while playing a crucial role in strategic decision-making.

This article explores the multifaceted responsibilities of controllers, tracing their historical evolution and distinguishing them from other financial roles, while highlighting the essential characteristics that define their effectiveness.

With the rise of technology and data analytics, controllers are increasingly recognized as strategic advisors, tasked with harnessing insights that propel business growth and operational efficiency.

As the financial landscape continues to evolve, grasping the pivotal role of controllers becomes essential for organizations aiming to thrive in a competitive environment.

Define the Controller Title in Finance

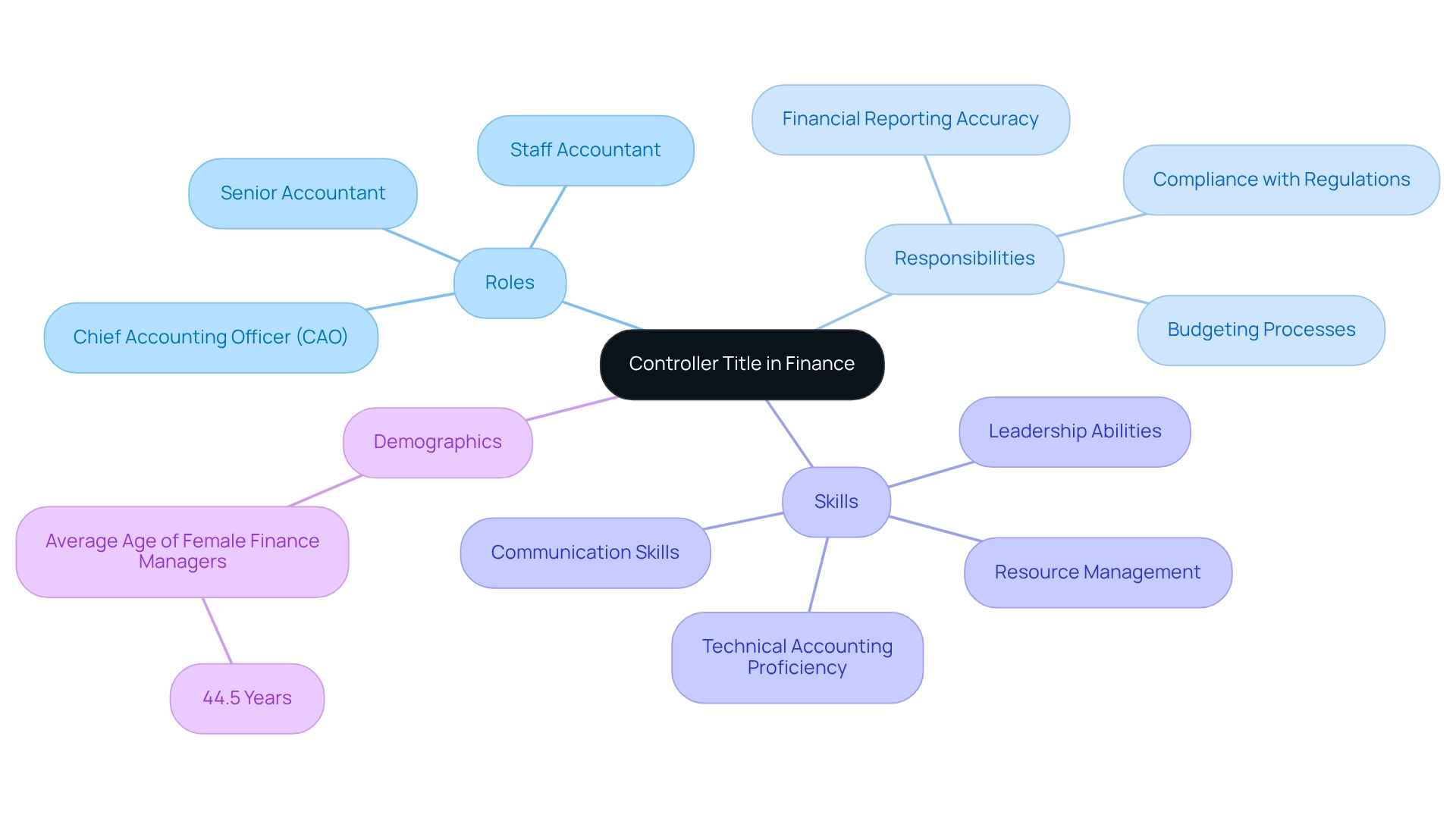

The controller title in finance signifies a senior executive tasked with overseeing a company’s accounting operations, encompassing roles such as CAO, Sr. Accountant, and Staff Accountant. This position is pivotal for ensuring the accuracy of financial reporting, compliance with regulations, and the integrity of economic data. Controllers manage the preparation of financial statements, oversee budgeting processes, and ensure adherence to organizational policies and legal requirements. As the lead accountant, they direct the financial strategy of the company and provide crucial insights for strategic decision-making.

In today’s competitive landscape, the importance of finance managers is underscored by their ability to establish financial policies and ensure compliance with accounting standards. Successful budget managers combine technical expertise with leadership skills, enabling them to effectively oversee financial processes and play an integral role in an organization’s success. Case studies highlight that fiscal managers not only manage accounting tasks but also ensure compliance, playing a vital role in delivering accurate financial information that informs organizational decision-making.

Current statistics indicate that the average age of female finance managers is 44.5 years, reflecting a mature and experienced demographic in this essential role. This maturity is complemented by a diverse skill set that includes not only technical accounting proficiency but also strong communication and resource management capabilities. As Maribel Gonzalez, a Consulting Financial Professional and holder of the controller title in Accounting, articulates, ‘My strong work ethic, communication skills, customer service skills, and passion to help business leaders/owners grow their business and become successful.’ This skill set is crucial for fostering collaboration across departments and ensuring that financial reporting meets the highest standards.

Boutique Recruiting specializes in customized hiring solutions for sought-after finance positions, including the role of financial manager. By understanding the unique needs of each organization, Boutique Recruiting effectively connects firms with qualified candidates who possess the necessary skills and experience.

Ultimately, the title of manager is fundamental to financial oversight, encompassing responsibilities that directly impact an organization’s financial health and strategic direction.

Explore the Historical Context of the Controller Role

The supervisory position has its roots in the essential practices of accounting, where the main emphasis was on careful record-keeping and monetary reporting. Initially seen as the guardians of monetary information, overseers ensured the accuracy of all transactions. However, as businesses expanded and regulatory landscapes became more complex, the responsibilities of the controller title evolved dramatically. Today, they are not simply stewards of historical economic information; they are essential to strategic planning and risk management. This shift underscores the increasing significance of financial oversight in steering organizational success, emphasizing the importance of the controller title as controllers are now expected to engage actively in corporate strategy discussions and investment decisions, transcending their traditional roles centered on compliance and reporting.

A significant case study named ‘Strategic Business Involvement of Financial Managers’ illustrates this transformation, emphasizing how financial managers are encouraged to engage in shaping corporate strategies and investment decisions. By positioning themselves as chief value officers, they can significantly influence the direction of their entities and contribute to sustainable growth.

Recent statistics show that 59% of managers believe that questions regarding career possibilities are sincere, reflecting a wider acknowledgment of their changing function within organizations. This perception shift emphasizes their growing importance in the corporate landscape. Moreover, the median salary for supervisors, reported at around $114,000 per year in base pay, along with an extra $30,000 in remuneration, further demonstrates the importance attributed to this role. As the position evolves, financial managers are increasingly viewed as ‘value articulators,’ tasked with evaluating whether investments meet their financial commitments. Raghvendra Singh, EY Asia-Pacific CFO Advisory Leader, aptly describes this evolution, noting that financial overseers have transformed from traditional accountants into controller titles responsible for value realization. This evolution not only emphasizes the historical importance of controllers in finance but also their vital function in influencing the future of enterprises.

Identify Key Responsibilities and Characteristics of a Controller

Controllers play a pivotal role in safeguarding the financial health of an organization, encompassing a wide array of responsibilities. They oversee the preparation of financial statements, manage the budgeting process, ensure compliance with fiscal regulations, and implement internal controls to protect assets. Furthermore, managers analyze financial data to generate insights that guide strategic decision-making, making their role indispensable in today’s competitive landscape.

Effective managers exhibit several key traits, including strong analytical skills, meticulous attention to detail, leadership qualities, and exceptional communication abilities. These traits empower them to translate complex financial information into actionable insights for stakeholders. For instance, individuals with robust analytical skills can identify trends and anomalies in financial data, which is crucial for informed decision-making. A recent study identified a group of operators, termed ‘confident operators,’ who displayed a heightened propensity for data-driven decision-making and technology adoption. This cohort not only excelled in corporate responsibility but also fostered team development, underscoring the importance of confidence and adaptability within the finance function.

As organizations navigate the evolving economic landscape in 2025, the demand for managers equipped with these skills is paramount. Statistics reveal that compensation growth strategies for CFOs have seen a 29% decline, emphasizing the need for managers to enhance and generate value within their organizations. Their ability to deliver timely and accurate insights into economic conditions positions them as key players in shaping the future of finance.

Distinguish the Controller from Other Financial Roles

The roles of overseer, CFO, and finance manager are critical to effective budget management, each encompassing distinct responsibilities and areas of focus. The controller title primarily oversees daily accounting operations, ensuring the accuracy of financial reporting. This role is essential for maintaining the integrity of financial data, which is vital for informed decision-making.

Conversely, the CFO (Chief Financial Officer) adopts a broader perspective, focusing on strategic budget planning, risk management, and the overall financial health of the organization. The CFO’s role encompasses long-term financial strategy and aligning financial objectives with the company’s vision, making it indispensable for organizational growth.

The finance manager typically concentrates on budgeting and forecasting, playing a pivotal role in resource allocation and financial planning. However, this position may not exert the same level of oversight over accounting practices as the controller, potentially leading to discrepancies in how financial data is processed and presented.

Understanding these distinctions is crucial for organizations aiming to build effective financial teams. For instance, a case study on budgeting and forecasting tools illustrates how financial managers leverage specialized software to create detailed budgets and forecasts. This not only ensures that businesses maintain financial stability but also underscores the manager’s role in operational efficiency, contrasting with the CFO’s strategic focus. The implementation of such tools directly impacts the controller title’s responsibilities, empowering the person in that role to manage daily financial operations effectively. Statistics indicate that the organizational structure of finance teams can vary significantly, influenced by factors such as company size and industry. For example, a part-time accountant in a small business typically incurs costs ranging from $30,000 to $60,000 annually. This statistic underscores the financial implications of staffing decisions and highlights the necessity for companies to consider the unique contributions of each position when structuring their finance teams. By recognizing these contributions, organizations can better align their financial strategies and enhance overall performance.

As Robert Half notes, ‘Accounting duties may be merged into a single position or cover various positions.’ This observation further emphasizes the importance of understanding how responsibilities differ among the controller, CFO, and finance manager roles, enabling organizations to refine their management practices.

The Evolving Role of the Controller in Modern Finance

The function of the overseer has undergone a transformative shift in recent years, driven by technological advancements and the changing landscape of business environments. Controllers are now charged with leveraging data analytics and advanced financial software in their controller title to enhance reporting accuracy and operational efficiency. This evolution transcends traditional accounting roles; financial managers are increasingly regarded as strategic advisors to senior leadership, influencing critical business decisions.

As one expert remarked, “Financial managers must go beyond the figures and provide business insights that impact management.” In the face of increasingly complex economic conditions, the demand for managers to integrate technical accounting skills with a robust understanding of business strategy and operations has reached unprecedented levels. Continuous professional development and adaptability are essential, as managers must stay ahead of trends in reporting and analytics.

Notably, the projected 128% increase in RegTech investment by 2030 underscores the urgency for controllers to embrace technology as part of their controller title, ensuring their relevance within their organizations’ strategic frameworks. Furthermore, case studies reveal that organizations implementing automation in their financial processes can achieve significant efficiency gains, positioning themselves favorably in the marketplace.

For instance, companies that have adopted automated reporting systems have reported accelerated closing times and enhanced accuracy in financial forecasts. This transformation not only elevates the manager’s role but also amplifies their influence within the organization, making them pivotal in guiding the future of finance. Additionally, the Controllers Council plays an essential role in fostering recognition and networking among finance professionals, further supporting the controller title in their evolving responsibilities.

Conclusion

The multifaceted role of the controller in finance has evolved dramatically, positioning these professionals as vital contributors to organizational success. Controllers are no longer merely custodians of financial data; they are strategic advisors who guide decision-making and influence corporate strategies. Their responsibilities have expanded to encompass not only compliance and reporting but also active engagement in shaping the financial future of their organizations.

Effective controllers possess distinct characteristics—such as strong analytical skills, attention to detail, and exceptional communication—that are crucial in today’s complex financial landscape. As technology continues to advance, the ability to harness data analytics and financial software becomes even more critical. Controllers must adapt to these changes, embracing continuous professional development to remain relevant and effective.

Understanding the differences between the roles of controllers, CFOs, and finance managers is essential for organizations aiming to optimize their financial teams. Each role contributes uniquely, collectively enhancing financial management practices. The demand for skilled controllers is on the rise, and their influence within organizations will undoubtedly increase, reinforcing their importance in driving strategic value and operational efficiency.

In conclusion, the evolving role of the controller underscores the imperative for organizations to recognize and empower these professionals. By doing so, companies can ensure they are well-equipped to navigate the complexities of modern finance and maintain a competitive edge in an ever-changing business environment.

Frequently Asked Questions

What is the role of a controller in finance?

The controller in finance is a senior executive responsible for overseeing a company’s accounting operations, ensuring accuracy in financial reporting, compliance with regulations, and the integrity of economic data. They manage financial statement preparation, budgeting processes, and adherence to organizational policies and legal requirements.

How do controllers contribute to strategic decision-making?

Controllers direct the financial strategy of the company and provide crucial insights that inform strategic decision-making, making them integral to an organization’s success.

What skills are essential for successful finance managers?

Successful finance managers combine technical expertise in accounting with leadership skills, effective communication, and resource management capabilities, which are crucial for overseeing financial processes.

What demographic information is available about female finance managers?

Current statistics indicate that the average age of female finance managers is 44.5 years, reflecting a mature and experienced demographic in this role.

How has the role of controllers evolved over time?

The role of controllers has evolved from being stewards of historical economic information to actively engaging in corporate strategy discussions and investment decisions, emphasizing their importance in strategic planning and risk management.

What is the significance of the case study ‘Strategic Business Involvement of Financial Managers’?

This case study highlights the transformation of financial managers into chief value officers who influence corporate strategies and investment decisions, contributing to sustainable growth.

What is the median salary for finance managers?

The median salary for finance managers is around $114,000 per year in base pay, with an additional $30,000 in remuneration.

How are financial managers perceived in the corporate landscape today?

Financial managers are increasingly viewed as ‘value articulators,’ responsible for evaluating whether investments meet their financial commitments, reflecting their growing importance in the corporate landscape.