Overview

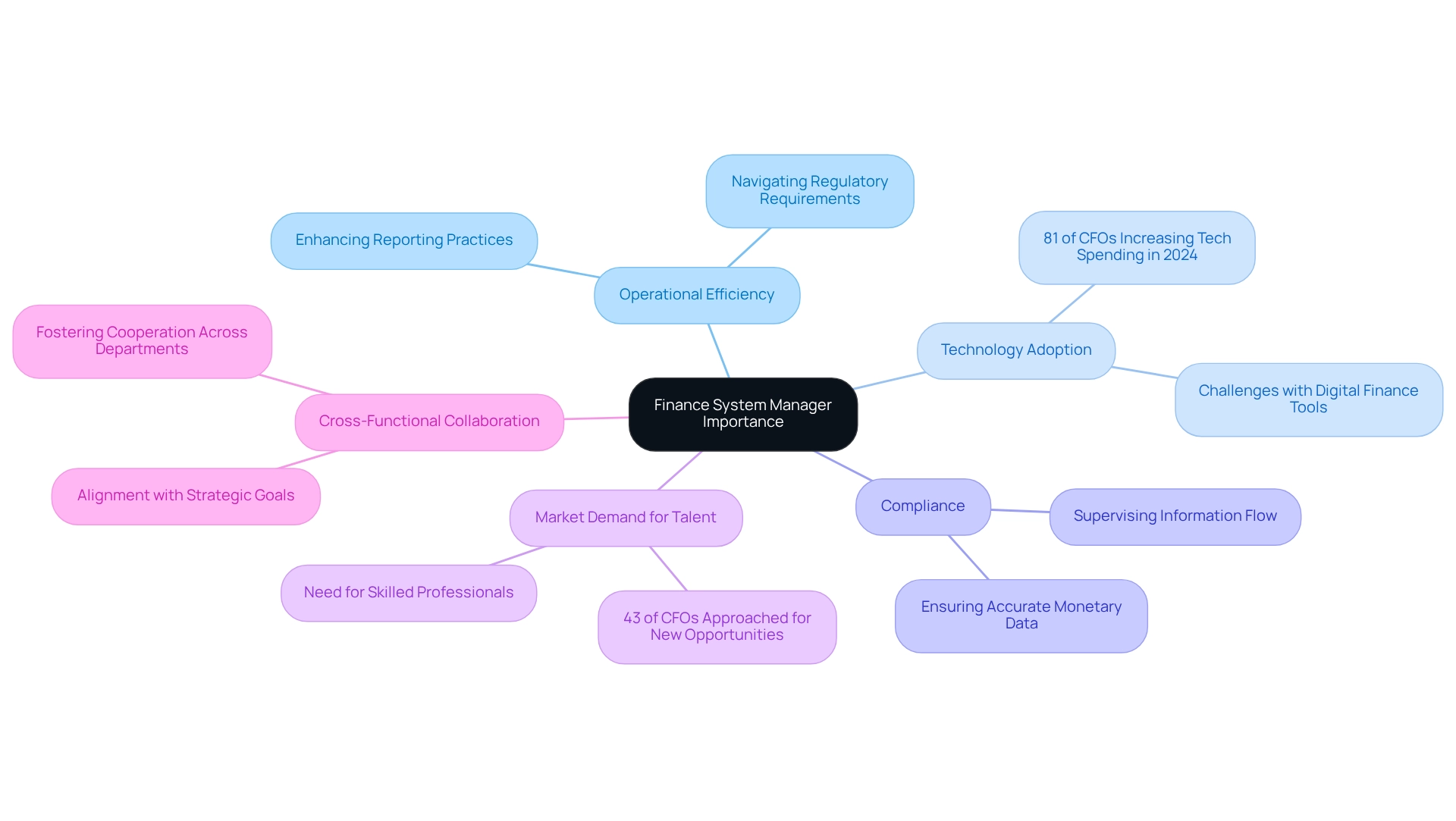

The role of a finance system manager is pivotal within organizations, as it entails the oversight of financial systems, the assurance of data integrity, and the integration of technology to bolster operational efficiency and compliance. This article underscores the evolution of this role, transitioning from basic reporting to a strategic partnership. This shift is propelled by the escalating demand for adept professionals capable of navigating complex regulatory landscapes and spearheading digital transformation initiatives within finance departments.

Key Highlights:

- Finance system managers oversee the implementation, maintenance, and optimization of financial systems within organizations.

- Key responsibilities include designing financial workflows, safeguarding data integrity, and integrating financial systems with business applications.

- The role has evolved to include strategic emphasis as CFOs engage more in corporate strategy and stakeholder relations.

- Finance system managers enhance operational efficiency and compliance, navigating complex regulatory requirements.

- There is a growing demand for skilled finance system managers, with 43% of CFOs frequently approached for new opportunities.

- In 2024, 81% of CFOs plan to increase spending on technology for finance transformation, highlighting the need for proficient finance system managers.

- Successful finance system managers possess strong analytical abilities, attention to detail, and proficiency in financial software.

- Leadership and communication skills are essential for aligning financial strategies with organizational objectives.

- The role has transformed from basic reporting to strategic partnership, integrating advanced technologies like blockchain.

- The finance system manager is pivotal in facilitating digital transformation and ensuring organizations remain competitive.

Introduction

In the dynamic world of finance, the role of the Finance System Manager has emerged as a pivotal force in steering organizations toward operational excellence and strategic growth. As companies increasingly rely on advanced financial technologies, these professionals are tasked with not only managing financial systems but also aligning them with broader corporate objectives. This evolution reflects a significant shift from traditional compliance and reporting functions to a more strategic partnership with executive leadership, positioning the Finance System Manager as integral in driving innovation and efficiency.

With the demand for skilled financial professionals on the rise, understanding the characteristics, skills, and responsibilities of Finance System Managers is crucial for organizations aiming to thrive in a competitive landscape.

Define the Finance System Manager Role

The finance system manager plays a pivotal role in the effective management of an organization’s monetary systems, overseeing their implementation, maintenance, and optimization. This position typically involves leading a team of analysts dedicated to ensuring that financial software and processes seamlessly integrate with the organization’s operational needs. The finance system manager has key responsibilities that include:

- Designing efficient financial workflows

- Safeguarding data integrity

- Facilitating the integration of financial systems with other business applications

In 2025, the role of the Manager of Financial Operations has evolved to encompass a strategic emphasis, reflecting the increasing involvement of CFOs in corporate strategy and stakeholder engagement. As Scott Herren, CFO of Autodesk, asserts, “My position as CFO and the broader finance team’s involvement in the transformation have been critical.” This underscores the importance of the Manager in cultivating a high-performing financial team, as the quality of a CFO’s group significantly influences their legacy and success.

Moreover, Luca Maestri points to a shift towards internal development for enhanced oversight of innovation, highlighting the finance system manager’s role in adapting financial systems to meet evolving organizational demands. Effective applications of Management Administrators within organizations have demonstrated their capacity to enhance economic performance and operational efficiency. Maureen O’Connell, former CFO of Scholastic, emphasizes that CFOs must transition from financial specialists to corporate strategists, a transformation that directly relates to the finance system manager’s role in promoting broader corporate growth and stakeholder confidence. This strategic alignment not only boosts economic well-being but also positions the organization for sustainable success in a competitive landscape.

Context and Importance in Financial Organizations

In today’s economic landscape, the Finance System Manager has become a strategic cornerstone for organizations aiming to maintain operational efficiency and compliance. With companies increasingly leveraging technology to streamline monetary processes, the finance system manager plays a pivotal role in navigating complex regulatory requirements and enhancing reporting practices. Their expertise ensures that monetary data is not only accurate but also readily accessible for informed decision-making and strategic planning.

The significance of Finance System Managers is underscored by the competitive market for monetary talent, exemplified by the statistic that 43% of CFOs report being approached for new opportunities more frequently. This trend highlights the growing demand for skilled professionals who can effectively oversee monetary operations and contribute to organizational success. Their contributions directly influence the integrity of monetary operations, thereby enhancing the organization’s overall health and sustainability.

For instance, a recent case study revealed that 81% of CFOs plan to increase spending on technology in 2024 to bolster finance transformation efforts. However, many face challenges due to insufficient resources for digital finance tools. This gap underscores the essential demand for proficient finance system managers in the field who can effectively implement and oversee these technologies, ensuring that organizations can adapt to the evolving economic environment.

Moreover, as Mark Partin, CFO of BlackLine, articulates, “FP&A used to hold all the cards; they had all the data at their fingertips. Nowadays, valuable data resides across the business. It’s a battle to find out who has the best data, much less what this data is.” This declaration emphasizes the necessity for finance system managers to supervise information flow and guarantee that monetary systems are robust and dependable. Their role transcends mere number handling; it encompasses fostering cross-functional cooperation that aligns economic performance with strategic objectives, ultimately steering the organization toward success.

Additionally, the transition from outdated processes to new systems necessitates a comprehensive overhaul rather than a quick fix. Managers of operational resources play a crucial role in this transition, guiding organizations through the complexities of adopting new technologies and ensuring that all stakeholders are aligned in their efforts to achieve economic excellence.

Key Characteristics and Skills of a Finance System Manager

Successful finance system managers embody a unique combination of technical expertise and interpersonal skills. Key characteristics include:

- Strong analytical abilities

- Meticulous attention to detail

- Proficiency in software and systems, particularly ERP and EPM tools

Strong communication abilities are essential for working with cross-functional teams and stakeholders, ensuring that monetary strategies align with broader organizational objectives. Leadership qualities are equally important, as these managers often oversee teams and drive projects that necessitate coordination across various departments.

A thorough grasp of financial regulations and compliance is crucial, allowing Financial Managers to maneuver through intricate legal environments efficiently. Moreover, adaptability to rapidly evolving technologies and business environments is vital, as the finance sector increasingly integrates innovative solutions. For instance, individuals with IT qualifications are now being recruited into finance roles, reflecting a shift towards valuing diverse skill sets that can be developed further within the industry. This adaptability is essential for finance system managers to thrive in a competitive job market.

As Patrick Chiotti, a Marketing and Communications Specialist, notes, “These abilities are crucial for making sound decisions and strategic plans to optimize the company’s financial resources.” This highlights the significance of analytical skills in the position. In 2025, the demand for Financial Management Managers will continue to underscore these analytical abilities, with positions providing competitive salaries ranging from $124,634 to $169,489 for individuals with ten years of experience or in director positions. This underscores the necessity of cultivating both technical and soft skills to succeed in this dynamic field.

Furthermore, a case study on negotiation skills illustrates how effective negotiation can enhance an organization’s financial position. Robust negotiation abilities allow Financial Managers to obtain favorable conditions with outside entities, showcasing the practical use of these skills in real-life situations. By integrating these skills, finance system managers can significantly contribute to their organizations’ success.

To tackle the changing requirements of the financial sector, Boutique Recruiting highlights customized recruitment strategies designed for in-demand positions such as CFOs, Financial Managers, and Directors of Finance. By comprehending the distinct skill sets necessary for these positions, Boutique Recruiting can successfully pair candidates with organizations, guaranteeing a smooth recruitment process that corresponds with the particular requirements of each position.

Evolution and Development of the Finance System Manager Role

The role of the Financial Management Manager has undergone a significant transformation over recent decades. Initially centered on basic economic reporting and compliance, it has evolved into a strategic position encompassing system integration, data analysis, and process optimization. As organizations increasingly adopt advanced monetary technologies, such as blockchain—which facilitates more effective and rapid interactions among smart devices—Managers of Funds are now expected to serve as both technical experts and strategic partners in driving organizational success. This evolution is in line with broader trends within the finance industry, where data-driven decision-making and technological integration have become paramount.

For example, Cathie Lesjak, CFO of HP, underscores the criticality of reinvesting savings back into the business rather than simply augmenting the bottom line. This approach illustrates the imperative for fiscal operations Managers to adopt strategic management practices that foster long-term growth. Furthermore, as digital transformation takes precedence, the responsibilities of Financial Managers are likely to expand, incorporating innovative technologies and methodologies to optimize financial operations.

George Westerman from MIT asserts that successful digital transformation necessitates changes in processes and mindsets across organizational divisions, thereby amplifying the Manager’s role in facilitating these transitions. As Jack Ma, Founder and Executive Chairman of Alibaba Group, articulates, “The most important thing is to make the technology inclusive – make the world change.” This statement emphasizes the importance of inclusivity in technological advancements within financial services, resonating with the evolving responsibilities of the Manager. As technology continues to redefine the finance landscape, the finance system manager will be pivotal in steering these changes, ensuring that organizations remain competitive and agile in an ever-evolving environment.

Conclusion

The Finance System Manager has emerged as an essential figure in the financial landscape, transitioning from a traditional role centered on compliance and reporting to a strategic partner that propels organizational success. By overseeing the implementation and optimization of financial systems, these professionals guarantee that financial data is precise, accessible, and aligned with broader corporate objectives. Their capacity to integrate advanced technologies and foster cross-functional collaboration positions them as integral to enhancing operational efficiency and driving innovation.

As companies confront escalating demands for skilled financial professionals, the significance of the Finance System Manager cannot be overstated. With the increasing reliance on technology to streamline processes and improve decision-making, these managers are vital in navigating complex regulatory environments and refining financial practices. They embody a unique combination of technical expertise, analytical skills, and robust interpersonal capabilities, rendering them invaluable assets to their organizations.

Looking ahead, the role of the Finance System Manager will continue to evolve in tandem with technological advancements and shifting business needs. By embracing innovation and nurturing a strategic mindset, these professionals will not only contribute to the financial health of their organizations but also drive sustainable growth in an increasingly competitive marketplace. As organizations strive to thrive in this dynamic environment, the Finance System Manager will remain a pivotal force in shaping the future of finance.

Frequently Asked Questions

What is the primary role of a finance system manager?

The finance system manager is responsible for the effective management of an organization’s monetary systems, overseeing their implementation, maintenance, and optimization.

What are some key responsibilities of a finance system manager?

Key responsibilities include designing efficient financial workflows, safeguarding data integrity, and facilitating the integration of financial systems with other business applications.

How has the role of the Manager of Financial Operations evolved by 2025?

By 2025, the role has evolved to encompass a strategic emphasis, reflecting the increasing involvement of CFOs in corporate strategy and stakeholder engagement.

Why is the finance system manager important in cultivating a high-performing financial team?

The finance system manager plays a crucial role in ensuring the effectiveness of the finance team, which significantly influences the legacy and success of the CFO.

What shift in focus is highlighted by Luca Maestri regarding financial systems?

Luca Maestri points to a shift towards internal development for enhanced oversight of innovation, emphasizing the finance system manager’s role in adapting financial systems to meet evolving organizational demands.

How do effective applications of Management Administrators impact organizations?

Effective applications have demonstrated the capacity to enhance economic performance and operational efficiency within organizations.

What transformation must CFOs undergo according to Maureen O’Connell?

CFOs must transition from financial specialists to corporate strategists, which directly relates to the finance system manager’s role in promoting broader corporate growth and stakeholder confidence.

What is the broader significance of the finance system manager’s role in an organization?

The finance system manager’s strategic alignment boosts economic well-being and positions the organization for sustainable success in a competitive landscape.