Overview

The role of a Financial Systems Manager is pivotal in overseeing the design, execution, maintenance, and security of financial systems. This position ensures data accuracy and compliance, which are essential for effective decision-making. As organizations approach 2025, the article underscores that this role demands a unique blend of technical proficiency, robust interpersonal skills, and a keen focus on risk management. These attributes are vital for navigating the evolving demands of the financial sector.

Key Highlights:

- Financial Systems Managers oversee the design, execution, maintenance, and security of monetary frameworks.

- They ensure the accuracy and accessibility of financial data, which is vital for effective decision-making and regulatory compliance.

- Strong interpersonal skills, including communication and leadership, are essential for successful collaboration across departments.

- The role is increasingly important as organizations face demands for data precision and risk management, especially as they approach 2025.

- Proficiency in financial software and systems, along with data analytics, is critical for effective performance.

- Financial Systems Managers are pivotal in implementing advanced monetary systems that mitigate risks and ensure compliance.

- The average salary for this role varies significantly by location and experience, with South Africa averaging $37,600 compared to $112,949 in the U.S.

- Candidates typically require a bachelor’s degree in finance or related fields, with advanced degrees or certifications enhancing career prospects.

- Hands-on experience in financial projects is crucial for career advancement in this field.

Introduction

In the dynamic financial landscape of 2025, the role of a Financial Systems Manager stands as a cornerstone for organizational success. These professionals are tasked with overseeing the design, implementation, and security of financial systems, ensuring that financial data remains accurate, accessible, and secure—critical elements for informed decision-making and regulatory compliance.

As businesses increasingly prioritize digital transformation and risk management, the demand for adept Financial Systems Managers continues to surge. This article delves into the multifaceted responsibilities, essential qualifications, and the significant impact of this role on enhancing operational efficiency and driving strategic initiatives within organizations.

With insights from industry experts and case studies, it underscores the importance of both technical prowess and soft skills in navigating the complexities of modern financial environments.

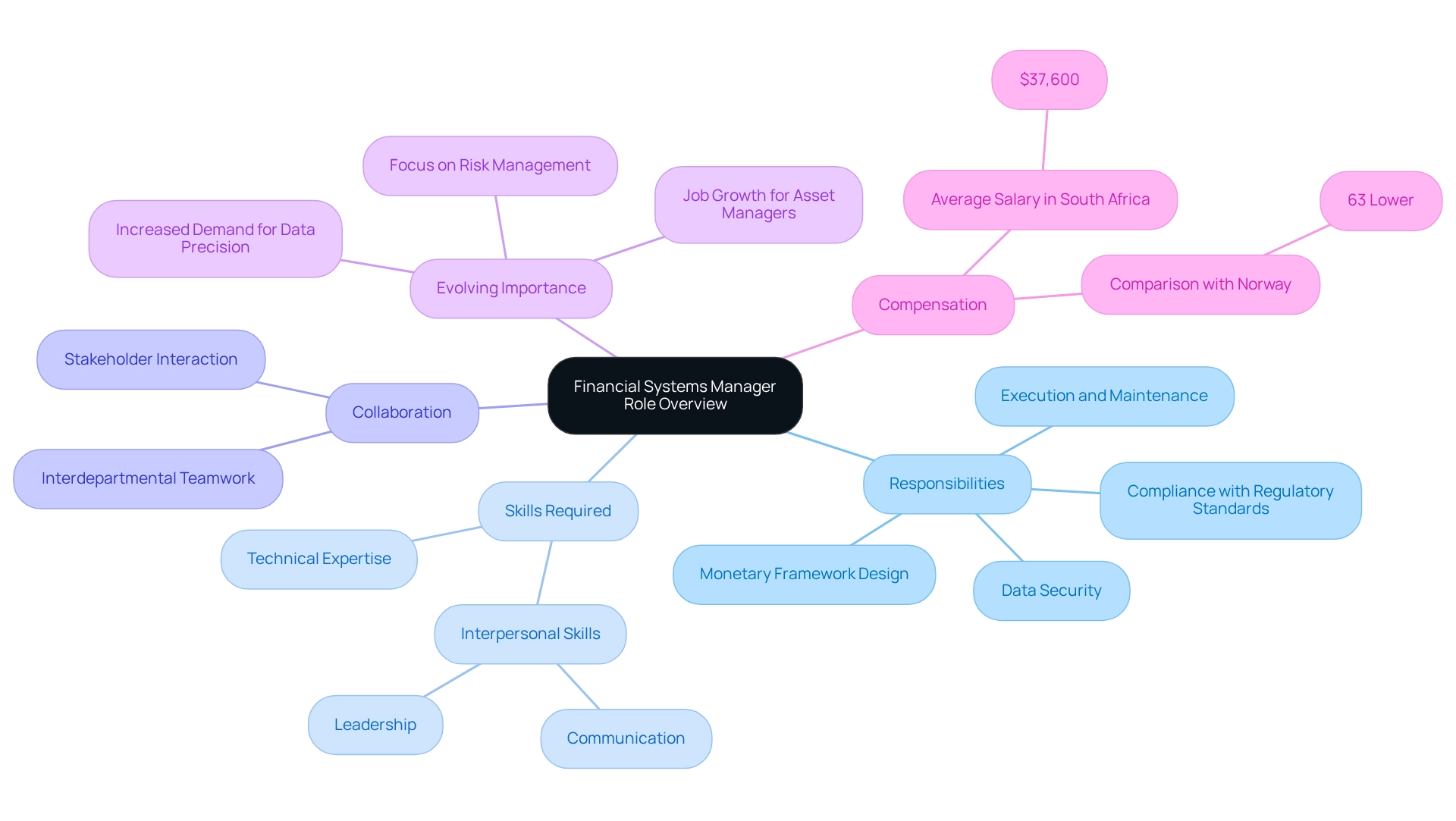

Define Financial Systems Manager: Role Overview

The financial systems manager plays a pivotal role in supervising the design, execution, upkeep, and security of an organization’s monetary frameworks. The financial systems manager plays a crucial role in ensuring the accuracy, accessibility, and security of monetary data, which is vital for effective decision-making and compliance with regulatory standards. By collaborating with various departments, the Manager of Fiscal Operations aligns monetary frameworks with organizational objectives, significantly contributing to the overall economic well-being of the company. As we approach 2025, the importance of this role continues to grow, particularly as organizations face increasing demands for data precision and risk management.

Effective Managers of Finance not only possess technical expertise but also excel in interpersonal skills such as communication and leadership. These abilities are crucial for fostering collaboration across departments. Successful executions of monetary frameworks often hinge on the capacity to interact efficiently with stakeholders, enhancing project success and collaboration. A case study on the significance of soft skills in Asset Management highlights that effective communication and leadership capabilities are integral to improving project outcomes and promoting interdepartmental collaboration.

Moreover, the current landscape underscores a heightened focus on risk management within the finance sector, leading to expanded job prospects for Asset Managers. As organizations strive to navigate complex economic environments, the demand for a financial systems manager who can ensure the integrity of data and systems is more pronounced than ever. This evolving role emphasizes the necessity for work experience in related occupations, as employers increasingly seek candidates who can demonstrate both technical proficiency and the ability to engage effectively with diverse teams.

Significantly, the average compensation for Administrators in South Africa stands at $37,600, which is 63% less than in Norway, illustrating the varying economic environments for this position. Furthermore, numerous accomplished Finance Managers have shared that they began their careers by volunteering for projects where they could experiment with automations and reporting tools. This proactive approach can significantly enhance one’s career trajectory.

Contextual Importance: Financial Systems Manager in Organizations

In the dynamic landscape of 2025, the Financial Systems Manager plays a paramount role in ensuring seamless monetary operations within organizations. This position is vital for maintaining the integrity of monetary data, which is essential for informed strategic planning and operational efficiency.

By implementing advanced monetary systems, financial systems managers mitigate the risk of costly errors and ensure compliance with fiscal regulations, thereby safeguarding the organization’s economic well-being. As businesses increasingly embrace technology, the influence of the financial systems manager on digital transformation becomes critical. They not only facilitate the integration of innovative monetary technologies but also enhance data analytics capabilities, empowering organizations to make data-informed decisions.

Notably, statistics indicate that 76% of executives in the services industry prioritize customer investment, underscoring the necessity for effective management in enhancing customer experiences, while case studies illustrate that organizations with skilled financial systems managers witness substantial improvements in operational efficiency. For instance, firms that have embraced digital transformation report enhanced monetary operations, with many attributing their success to the strategic guidance provided by their financial systems manager.

Digital transformation varies significantly across sectors, with banking services placing a strong emphasis on customer experience, ultimately leading to a competitive edge in the marketplace, which the financial systems manager must prioritize, particularly regarding monetary data integrity and compliance. In an era of heightened regulatory scrutiny, the Manager of Monetary Operations serves as a guardian of compliance, ensuring that all monetary practices adhere to stringent standards.

This multifaceted role transcends mere number management; it encompasses driving strategic initiatives that propel organizations forward in a rapidly evolving business environment. As Eric Eddy noted, the firm’s ability to swiftly and effectively provide exceptional candidates underscores the critical importance of efficient management in economic operations.

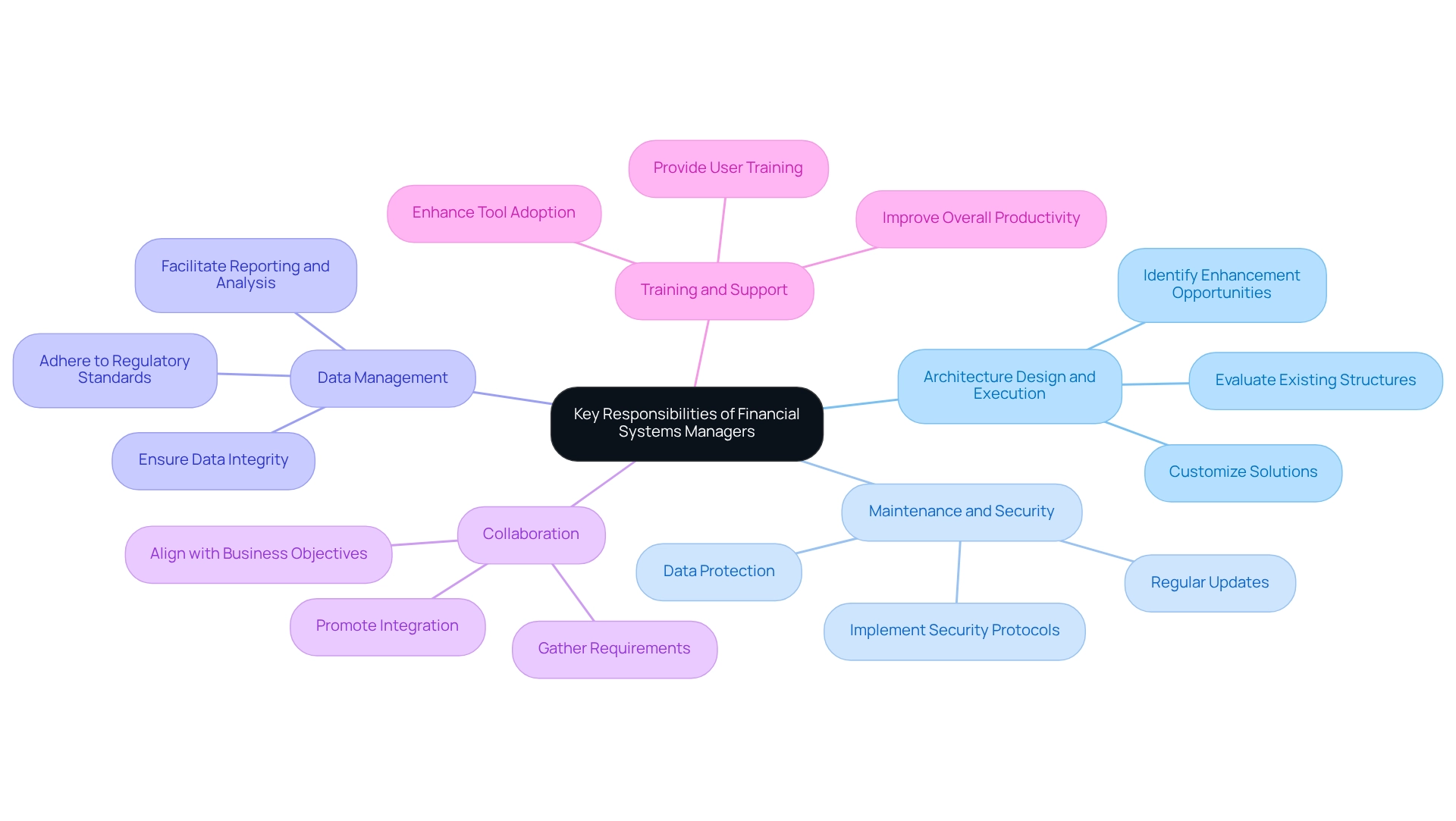

Key Responsibilities: What Financial Systems Managers Do

The role of a financial systems manager is pivotal in the economic landscape, encompassing a variety of duties that ensure the effective operation of monetary frameworks. Their primary responsibilities encompass:

- Architecture Design and Execution: They lead the design and execution of monetary frameworks, customizing solutions to address the unique requirements of the organization. This includes evaluating existing structures and recognizing opportunities for enhancement to improve efficiency and functionality.

- Maintenance and Security: A crucial part of their role is the regular updating and safeguarding of monetary frameworks. This ensures the protection of sensitive data against breaches and unauthorized access, which is increasingly vital in today’s digital landscape. Expert opinions highlight that maintaining strong security protocols is crucial for protecting monetary information.

- Data Management: Systems Managers supervise the integrity of monetary data, ensuring that information is accurate, consistent, and readily available for reporting and analysis. This duty is vital for a financial systems manager to ensure informed decision-making and adherence to regulatory standards.

- Collaboration: The financial systems manager works closely with cross-functional teams to gather requirements and ensure that financial frameworks align with broader business objectives. This partnership promotes a unified method for integration and functionality.

- Training and Support: Offering training to personnel on new platforms and procedures is another essential duty. Management Supervisors guarantee that all users are skilled in using the tools efficiently, which improves overall productivity and tool adoption.

In 2025, the average salary for Management Supervisors demonstrates their expertise and the demand for their abilities, with figures showing a range starting from around $112,949, as noted by Salary.com, and reaching up to $114,000 at top firms like First Solar. The earning potential can vary significantly based on factors such as location, industry, and individual experience, underscoring the importance of understanding these variables for both candidates and employers. Successful case studies emphasize how efficient design and execution can result in enhanced monetary operations, showcasing the worth that Finance Managers contribute to their organizations. Additionally, the targeted industries for recruitment, including finance and data analytics, further illustrate the critical nature of their roles in driving organizational success.

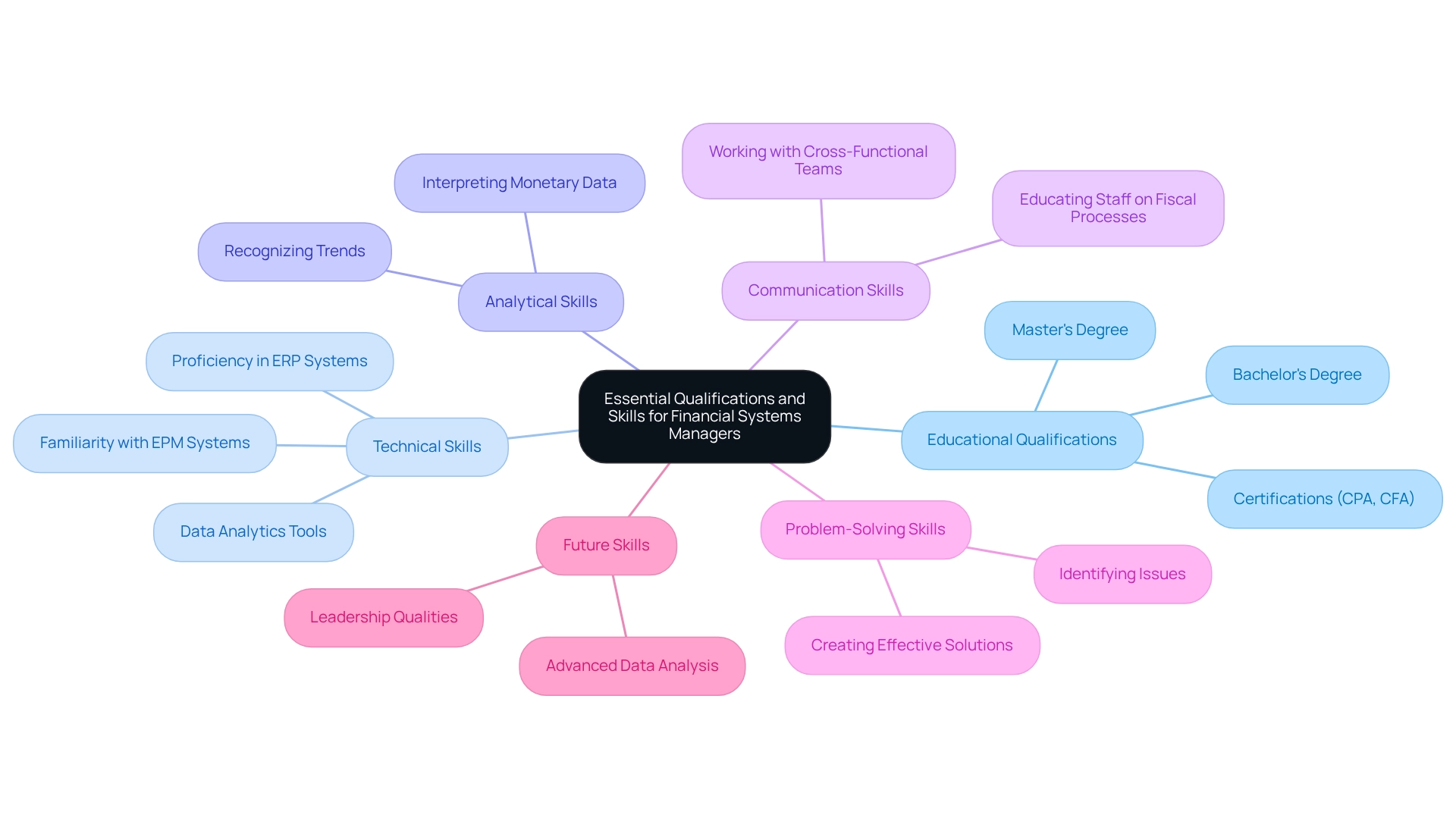

Essential Qualifications and Skills for Financial Systems Managers

To excel as a financial systems manager, candidates typically need a blend of educational qualifications and key skills. A bachelor’s degree in finance, accounting, information systems, or a related field is often essential. Many employers favor candidates with a master’s degree or relevant certifications, such as CPA or CFA, which can significantly enhance career prospects.

Proficiency in monetary software and systems, particularly Enterprise Resource Planning (ERP) and Enterprise Performance Management (EPM) systems, is crucial. Familiarity with data analytics tools is increasingly sought after, as organizations look to leverage data for strategic decision-making.

Strong analytical abilities are vital for interpreting complex monetary data and making informed decisions that drive business success. This skill set allows managers to recognize trends and insights that can enhance economic processes.

Effective communication is crucial for working with cross-functional teams and educating staff on fiscal processes. The ability to convey complex information clearly ensures that all stakeholders are aligned and informed.

The ability to recognize problems and create effective solutions is essential in overseeing economic systems and processes. This skill is particularly important as organizations face evolving challenges in the financial landscape.

In 2025, the most desired skills for Finance Managers will encompass advanced data analysis abilities and leadership qualities, which are essential for overseeing cross-functional teams and guaranteeing project success. Aspiring managers frequently start their careers in entry-level positions such as Analyst or Support Specialist, acquiring practical experience that equips them for more advanced roles. For example, individuals who work on projects connected to monetary frameworks can move into leadership positions that emphasize enhancing economic procedures, showcasing the significance of hands-on experience in addition to formal education.

Additionally, it is noteworthy that the average salary for Asian finance managers is the highest among ethnicities, which may serve as a benchmark for HR managers when considering compensation trends in the field. As one financial systems manager reflected, ‘That one frustration sent me down the rabbit hole of learning how financial systems work,’ highlighting the personal journey and dedication required to succeed in the role of a financial systems manager.

Conclusion

The role of a Financial Systems Manager is pivotal to the success of organizations navigating the complexities of the modern financial landscape. These professionals are not only responsible for the design, implementation, and security of financial systems but also ensure that financial data remains accurate and secure—a necessity for effective decision-making and regulatory compliance. Their contributions extend beyond mere technical expertise; successful Financial Systems Managers excel in communication and collaboration, aligning financial systems with broader organizational goals.

In 2025, the demand for Financial Systems Managers continues to rise, driven by the increasing emphasis on digital transformation and risk management. Their ability to integrate advanced financial technologies and enhance data analytics capabilities directly impacts operational efficiency and strategic planning. Consider the case studies presented: organizations with adept Financial Systems Managers experience significant improvements, underscoring the immense value these professionals bring to their teams.

Ultimately, the evolving nature of this role emphasizes the necessity of a diverse skill set, including technical proficiency, analytical capabilities, and strong interpersonal skills. As businesses prioritize data integrity and compliance in an era of heightened regulatory scrutiny, the Financial Systems Manager stands as a critical guardian of financial health and operational success. Investing in the development of these professionals is not merely beneficial for individual career trajectories; it is essential for the overall prosperity of organizations in today’s competitive environment.

Are you ready to elevate your financial operations? Reach out today to explore how investing in Financial Systems Managers can transform your organization’s future.

Frequently Asked Questions

What is the role of a financial systems manager?

The financial systems manager supervises the design, execution, upkeep, and security of an organization’s monetary frameworks, ensuring the accuracy, accessibility, and security of financial data for effective decision-making and compliance.

Why is the role of financial systems manager becoming more important?

As organizations face increasing demands for data precision and risk management, the importance of the financial systems manager role continues to grow, particularly as we approach 2025.

What skills are essential for an effective financial systems manager?

Effective financial systems managers possess technical expertise along with strong interpersonal skills such as communication and leadership, which are crucial for fostering collaboration across departments.

How does collaboration impact the role of a financial systems manager?

Successful execution of monetary frameworks often depends on the ability to interact efficiently with stakeholders, enhancing project success and interdepartmental collaboration.

What is the current job outlook for financial systems managers?

There is an expanded job prospect for financial systems managers as organizations navigate complex economic environments and require professionals who can ensure data integrity and system security.

What qualifications do employers seek in financial systems manager candidates?

Employers increasingly seek candidates with work experience in related occupations, technical proficiency, and the ability to engage effectively with diverse teams.

How does compensation for financial systems managers vary by location?

In South Africa, the average compensation for administrators in this role is $37,600, which is 63% less than in Norway, highlighting the differences in economic environments for this position.

How can aspiring finance managers enhance their career trajectory?

Many successful finance managers began their careers by volunteering for projects that allowed them to experiment with automation and reporting tools, which can significantly enhance their career prospects.

{“@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [{“@type”: “Question”, “name”: “What is the role of a financial systems manager?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “The financial systems manager supervises the design, execution, upkeep, and security of an organization’s monetary frameworks, ensuring the accuracy, accessibility, and security of financial data for effective decision-making and compliance.”}}, {“@type”: “Question”, “name”: “Why is the role of financial systems manager becoming more important?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “As organizations face increasing demands for data precision and risk management, the importance of the financial systems manager role continues to grow, particularly as we approach 2025.”}}, {“@type”: “Question”, “name”: “What skills are essential for an effective financial systems manager?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Effective financial systems managers possess technical expertise along with strong interpersonal skills such as communication and leadership, which are crucial for fostering collaboration across departments.”}}, {“@type”: “Question”, “name”: “How does collaboration impact the role of a financial systems manager?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Successful execution of monetary frameworks often depends on the ability to interact efficiently with stakeholders, enhancing project success and interdepartmental collaboration.”}}, {“@type”: “Question”, “name”: “What is the current job outlook for financial systems managers?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “There is an expanded job prospect for financial systems managers as organizations navigate complex economic environments and require professionals who can ensure data integrity and system security.”}}, {“@type”: “Question”, “name”: “What qualifications do employers seek in financial systems manager candidates?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Employers increasingly seek candidates with work experience in related occupations, technical proficiency, and the ability to engage effectively with diverse teams.”}}, {“@type”: “Question”, “name”: “How does compensation for financial systems managers vary by location?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “In South Africa, the average compensation for administrators in this role is $37,600, which is 63% less than in Norway, highlighting the differences in economic environments for this position.”}}, {“@type”: “Question”, “name”: “How can aspiring finance managers enhance their career trajectory?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Many successful finance managers began their careers by volunteering for projects that allowed them to experiment with automation and reporting tools, which can significantly enhance their career prospects.”}}]}{“@context”: “https://schema.org”, “@type”: “BlogPosting”, “headline”: “Understanding the Role of a Financial Systems Manager”, “description”: “Explore the pivotal role of a financial systems manager in enhancing organizational efficiency and compliance.”, “datePublished”: “2025-05-01T00:00:10.167000”, “image”: [“https://images.tely.ai/telyai/aweikvtm-the-central-node-represents-the-role-of-financial-systems-manager-with-branches-showing-responsibilities-necessary-skills-collaboration-focus-and-evolving-importance-of-the-role-follow-the-branches-to-explore-each-aspect-and-see-how-they-contribute-to-the-overall-function.webp”, “https://images.tely.ai/telyai/ugsaukjf-this-mindmap-illustrates-the-various-responsibilities-and-impacts-of-a-financial-systems-manager-the-central-node-is-the-managers-role-with-branches-representing-key-areas-of-influence-and-sub-branches-providing-specific-details-and-examples-related-to-each-area.webp”, “https://images.tely.ai/telyai/hzssqkzw-at-the-center-you-have-the-main-role-and-the-branches-show-the-specific-responsibilities-each-color-represents-a-different-area-of-responsibility-making-it-easy-to-see-the-connections-and-details-at-a-glance.webp”, “https://images.tely.ai/telyai/wydqdfgn-the-central-node-represents-the-main-topic-with-branches-showcasing-different-categories-of-skills-and-qualifications-each-branch-can-be-explored-to-understand-the-specific-requirements-and-future-trends-for-aspiring-financial-systems-managers.webp”], “articleBody”: “## Overview\nThe role of a Financial Systems Manager is pivotal in overseeing the design, execution, maintenance, and security of financial systems. This position ensures data accuracy and compliance, which are essential for effective decision-making. As organizations approach 2025, the article underscores that this role demands a unique blend of technical proficiency, robust interpersonal skills, and a keen focus on risk management. These attributes are vital for navigating the evolving demands of the financial sector.\n\n## Key Highlights:\n- Financial Systems Managers oversee the design, execution, maintenance, and security of monetary frameworks.\n- They ensure the accuracy and accessibility of financial data, which is vital for effective decision-making and regulatory compliance.\n- Strong interpersonal skills, including communication and leadership, are essential for successful collaboration across departments.\n- The role is increasingly important as organizations face demands for data precision and risk management, especially as they approach 2025.\n- Proficiency in financial software and systems, along with data analytics, is critical for effective performance.\n- Financial Systems Managers are pivotal in implementing advanced monetary systems that mitigate risks and ensure compliance.\n- The average salary for this role varies significantly by location and experience, with South Africa averaging $37,600 compared to $112,949 in the U.S.\n- Candidates typically require a bachelor’s degree in finance or related fields, with advanced degrees or certifications enhancing career prospects.\n- Hands-on experience in financial projects is crucial for career advancement in this field.\n\n## Introduction\nIn the dynamic financial landscape of 2025, the role of a Financial Systems Manager stands as a cornerstone for organizational success. These professionals are tasked with overseeing the design, implementation, and security of financial systems, ensuring that financial data remains accurate, accessible, and secure\u2014critical elements for informed decision-making and regulatory compliance. \n\nAs businesses increasingly prioritize digital transformation and risk management, the demand for adept Financial Systems Managers continues to surge. This article delves into the multifaceted responsibilities, essential qualifications, and the significant impact of this role on enhancing operational efficiency and driving strategic initiatives within organizations. \n\nWith insights from industry experts and case studies, it underscores the importance of both technical prowess and soft skills in navigating the complexities of modern financial environments.\n\n## Define Financial Systems Manager: Role Overview\nThe financial systems manager plays a pivotal role in supervising the design, execution, upkeep, and security of an organization’s monetary frameworks. The financial systems manager plays a crucial role in ensuring the accuracy, accessibility, and security of monetary data, which is vital for effective decision-making and compliance with regulatory standards. By collaborating with various departments, the Manager of Fiscal Operations aligns monetary frameworks with organizational objectives, significantly contributing to the overall economic well-being of the company. As we approach 2025, the importance of this role continues to grow, particularly as organizations face increasing demands for data precision and risk management. \n\nEffective Managers of Finance not only possess technical expertise but also excel in interpersonal skills such as communication and leadership. These abilities are crucial for fostering collaboration across departments. Successful executions of monetary frameworks often hinge on the capacity to interact efficiently with stakeholders, enhancing project success and collaboration. A case study on the significance of soft skills in Asset Management highlights that effective communication and leadership capabilities are integral to improving project outcomes and promoting interdepartmental collaboration. \n\nMoreover, the current landscape underscores a heightened focus on risk management within the finance sector, leading to expanded job prospects for Asset Managers. As organizations strive to navigate complex economic environments, the demand for a financial systems manager who can ensure the integrity of data and systems is more pronounced than ever. This evolving role emphasizes the necessity for [work experience in related occupations](https://bls.gov/ooh/management/financial-managers.htm), as employers increasingly seek candidates who can demonstrate both technical proficiency and the ability to engage effectively with diverse teams. \n\nSignificantly, the average compensation for Administrators in South Africa stands at $37,600, which is 63% less than in Norway, illustrating the varying economic environments for this position. Furthermore, numerous accomplished Finance Managers have shared that they began their careers by volunteering for projects where they could experiment with automations and reporting tools. This proactive approach can significantly enhance one’s career trajectory.\n\n\n## Contextual Importance: Financial Systems Manager in Organizations\nIn the dynamic landscape of 2025, the Financial Systems Manager plays a paramount role in ensuring seamless monetary operations within organizations. This position is vital for maintaining the integrity of monetary data, which is essential for informed strategic planning and operational efficiency.\n\nBy implementing advanced monetary systems, financial systems managers mitigate the risk of costly errors and ensure compliance with fiscal regulations, thereby safeguarding the organization\u2019s economic well-being. As businesses increasingly embrace technology, the influence of the financial systems manager on digital transformation becomes critical. They not only facilitate the integration of innovative monetary technologies but also enhance data analytics capabilities, empowering organizations to make data-informed decisions.\n\nNotably, statistics indicate that 76% of executives in the services industry prioritize customer investment, underscoring the necessity for effective management in enhancing customer experiences, while case studies illustrate that organizations with [skilled financial systems managers](https://boutiquerecruiting.com/team/angel-slaughter) witness substantial improvements in operational efficiency. For instance, firms that have embraced digital transformation report enhanced monetary operations, with many attributing their success to the strategic guidance provided by their financial systems manager.\n\nDigital transformation varies significantly across sectors, with banking services placing a strong emphasis on customer experience, ultimately leading to a competitive edge in the marketplace, which the financial systems manager must prioritize, particularly regarding monetary data integrity and compliance. In an era of heightened regulatory scrutiny, the Manager of Monetary Operations serves as a guardian of compliance, ensuring that all monetary practices adhere to stringent standards.\n\nThis multifaceted role transcends mere number management; it encompasses driving strategic initiatives that propel organizations forward in a rapidly evolving business environment. As Eric Eddy noted, the firm’s ability to swiftly and effectively provide exceptional candidates underscores the critical importance of efficient management in economic operations.\n\n\n## Key Responsibilities: What Financial Systems Managers Do\nThe role of [a financial systems manager](https://salary.com/research/salary/benchmark/financial-systems-manager-salary) is pivotal in the economic landscape, encompassing a variety of duties that ensure the effective operation of monetary frameworks. Their primary responsibilities encompass:\n\n- Architecture Design and Execution: They lead the design and execution of monetary frameworks, customizing solutions to address the unique requirements of the organization. This includes evaluating existing structures and recognizing opportunities for enhancement to improve efficiency and functionality.\n- Maintenance and Security: A crucial part of their role is the regular updating and safeguarding of monetary frameworks. This ensures the protection of sensitive data against breaches and unauthorized access, which is increasingly vital in today’s digital landscape. Expert opinions highlight that maintaining strong security protocols is crucial for protecting monetary information.\n- Data Management: Systems Managers supervise the integrity of monetary data, ensuring that information is accurate, consistent, and readily available for reporting and analysis. This duty is vital for a financial systems manager to ensure informed decision-making and adherence to regulatory standards.\n- Collaboration: The financial systems manager works closely with cross-functional teams to gather requirements and ensure that financial frameworks align with broader business objectives. This partnership promotes a unified method for integration and functionality.\n- Training and Support: Offering training to personnel on new platforms and procedures is another essential duty. Management Supervisors guarantee that all users are skilled in using the tools efficiently, which improves overall productivity and tool adoption.\n\nIn 2025, the average salary for Management Supervisors demonstrates their expertise and the demand for their abilities, with figures showing a range starting from around $112,949, as noted by Salary.com, and reaching up to $114,000 at top firms like First Solar. The earning potential can vary significantly based on factors such as location, industry, and individual experience, underscoring the importance of understanding these variables for both candidates and employers. Successful case studies emphasize how efficient design and execution can result in enhanced monetary operations, showcasing the worth that Finance Managers contribute to their organizations. Additionally, the targeted industries for recruitment, including finance and data analytics, further illustrate the critical nature of their roles in driving organizational success.\n\n\n## Essential Qualifications and Skills for Financial Systems Managers\nTo excel as a financial systems manager, candidates typically need a blend of educational qualifications and key skills. A bachelor’s degree in finance, accounting, information systems, or a related field is often essential. Many employers favor candidates with a master’s degree or relevant certifications, such as CPA or CFA, which can significantly enhance career prospects.\n\nProficiency in monetary software and systems, particularly Enterprise Resource Planning (ERP) and Enterprise Performance Management (EPM) systems, is crucial. Familiarity with data analytics tools is increasingly sought after, as organizations look to leverage data for strategic decision-making.\n\nStrong analytical abilities are vital for interpreting complex monetary data and making informed decisions that drive business success. This skill set allows managers to recognize trends and insights that can enhance economic processes.\n\nEffective communication is crucial for working with cross-functional teams and educating staff on fiscal processes. The ability to convey complex information clearly ensures that all stakeholders are aligned and informed.\n\nThe ability to recognize problems and create effective solutions is essential in overseeing economic systems and processes. This skill is particularly important as organizations face evolving challenges in the financial landscape.\n\nIn 2025, the most desired skills for Finance Managers will encompass advanced data analysis abilities and leadership qualities, which are essential for overseeing cross-functional teams and guaranteeing project success. Aspiring managers frequently start their careers in entry-level positions such as Analyst or Support Specialist, acquiring practical experience that equips them for more advanced roles. For example, individuals who work on projects connected to monetary frameworks can move into leadership positions that emphasize enhancing economic procedures, showcasing the significance of hands-on experience in addition to formal education.\n\nAdditionally, it is noteworthy that the average salary for [Asian finance managers](https://www.boutiquerecruiting.com/understanding-finance-and-accounting-salaries-a-comprehensive-guide-for-job-seekers/) is the highest among ethnicities, which may serve as a benchmark for HR managers when considering compensation trends in the field. As one financial systems manager reflected, ‘That one frustration sent me down the rabbit hole of learning how financial systems work,’ highlighting the personal journey and dedication required to succeed in the role of a financial systems manager.\n\n\n\n## Conclusion\nThe role of a Financial Systems Manager is pivotal to the success of organizations navigating the complexities of the modern financial landscape. These professionals are not only responsible for the design, implementation, and security of financial systems but also ensure that financial data remains accurate and secure\u2014a necessity for effective decision-making and regulatory compliance. Their contributions extend beyond mere technical expertise; successful Financial Systems Managers excel in communication and collaboration, aligning financial systems with broader organizational goals. \n\nIn 2025, the demand for Financial Systems Managers continues to rise, driven by the increasing emphasis on digital transformation and risk management. Their ability to integrate advanced financial technologies and enhance data analytics capabilities directly impacts operational efficiency and strategic planning. Consider the case studies presented: organizations with adept Financial Systems Managers experience significant improvements, underscoring the immense value these professionals bring to their teams. \n\nUltimately, the evolving nature of this role emphasizes the necessity of a diverse skill set, including technical proficiency, analytical capabilities, and strong interpersonal skills. As businesses prioritize data integrity and compliance in an era of heightened regulatory scrutiny, the Financial Systems Manager stands as a critical guardian of financial health and operational success. Investing in the development of these professionals is not merely beneficial for individual career trajectories; it is essential for the overall prosperity of organizations in today’s competitive environment. \n\nAre you ready to elevate your financial operations? Reach out today to explore how investing in Financial Systems Managers can transform your organization\u2019s future.\n\n::iframe[https://iframe.tely.ai/cta/eyJhcnRpY2xlX2lkIjogIjY4MTJiOThhOGFmZTdjMzVhOGUyZGVlYSIsICJjb21wYW55X2lkIjogIjY3YWU2NGU5YzhlZTg4N2E0ZmUzZmYxOSIsICJpbmRleCI6IG51bGx9]{width=\”100%\” height=\”300px\”}”}