Overview

The key interview questions for finance directors are pivotal, focusing on crucial areas such as budget management, forecasting, and compliance with regulations. These questions are designed to assess candidates’ strategic thinking and leadership abilities. This article outlines specific inquiries that effectively gauge candidates’ technical skills and situational responses. Moreover, it emphasizes the critical importance of cultural fit and interpersonal skills in the finance director role, which are essential for achieving organizational success.

Key Highlights:

- Finance directors manage an organization’s economic well-being, including budget planning, risk management, and fiscal reporting.

- There is a growing demand for finance managers, with approximately 75,100 positions expected annually over the next decade.

- Finance leaders are increasingly involved in strategic decision-making, impacting organizational success and cash oversight.

- Interview questions for finance directors often focus on budget management, forecasting, and compliance with monetary regulations.

- Candidates should prepare for situational and behavioral questions to demonstrate their problem-solving skills and leadership capabilities.

- Technical questions assess candidates’ proficiency in economic principles, reporting, and budgeting strategies.

- Cultural fit and interpersonal skills are crucial for finance directors, influencing team dynamics and organizational success.

- Candidates should ask insightful questions during interviews to demonstrate engagement and understanding of organizational challenges.

- Thorough preparation, including research and mock interviews, enhances candidates’ chances of success in finance director roles.

Introduction

In the ever-evolving financial landscape, the role of a finance director has become increasingly pivotal for organizations striving to achieve sustainable growth and stability. These senior executives are not only responsible for overseeing the financial health of their companies but also play a crucial part in strategic decision-making that shapes the future of the business. As companies face a myriad of challenges, including regulatory compliance and the integration of advanced financial technologies, the demand for skilled finance directors continues to rise.

This article delves into the multifaceted responsibilities of finance directors, the essential skills required for success, and the types of interview questions candidates can expect as they navigate the competitive hiring landscape. By understanding these dynamics, both aspiring finance leaders and organizations can better prepare for the critical conversations that will define their financial futures.

Understanding the Role of a Finance Director

A finance manager is a senior executive responsible for managing the economic well-being of an organization, encompassing a wide range of duties that are critical to success. These responsibilities include budget planning, risk management, record-keeping, and fiscal reporting. Finance leaders play an essential role in strategic decision-making, ensuring that the organization not only achieves its monetary goals but also adheres to regulatory standards.

They guide budgeting procedures, oversee monetary risks, and provide essential insights that influence the organization’s fiscal strategy. The importance of financial executives in strategic decision-making is underscored by recent statistics, indicating that approximately 75,100 positions for fiscal managers are anticipated each year over the next decade. This demand signifies the increasing acknowledgment of monetary leaders as vital contributors in steering organizations through intricate economic environments, particularly in areas such as cash oversight and risk assessment. Moreover, a significant portion of organizations now includes financial leaders in strategic decision-making roles, highlighting their impact on the overall trajectory of the company.

Their duties extend beyond conventional monetary supervision; they are expected to engage in strategic discussions and decisions that shape the organization’s future. Case studies further illustrate the effect of fiscal leaders on organizational success. For instance, organizations that have integrated finance directors into their strategic planning processes report improved economic performance and enhanced risk management. This trend emphasizes the necessity for candidates to not only possess technical financial skills but also to exhibit strategic thinking and leadership capabilities.

Boutique Recruiting distinguishes itself by prioritizing the establishment of enduring relationships and understanding company culture. This approach enables them to present candidates who not only meet technical criteria but also seamlessly fit into the organizational atmosphere. This commitment to long-term success guarantees that clients gain access to top talent, which is crucial for their growth and stability.

Expert opinions further reinforce the significance of finance directors in shaping organizational strategy. As Eric Eddy noted, Boutique Recruiting possesses the capability to swiftly and effectively provide exceptional individuals, a necessity for organizations aiming to fill these crucial positions. The tenacity and drive of the Boutique Recruiting team play a significant role in this process, as they diligently connect individuals with the right opportunities. As the economic landscape continues to evolve, the role of financial leaders is likely to expand, necessitating a focus on innovative budgeting strategies that align with broader business objectives. Understanding these dynamics is essential for both candidates preparing for finance director interview questions and employers evaluating candidate suitability for this vital role.

Common Interview Questions for Finance Directors

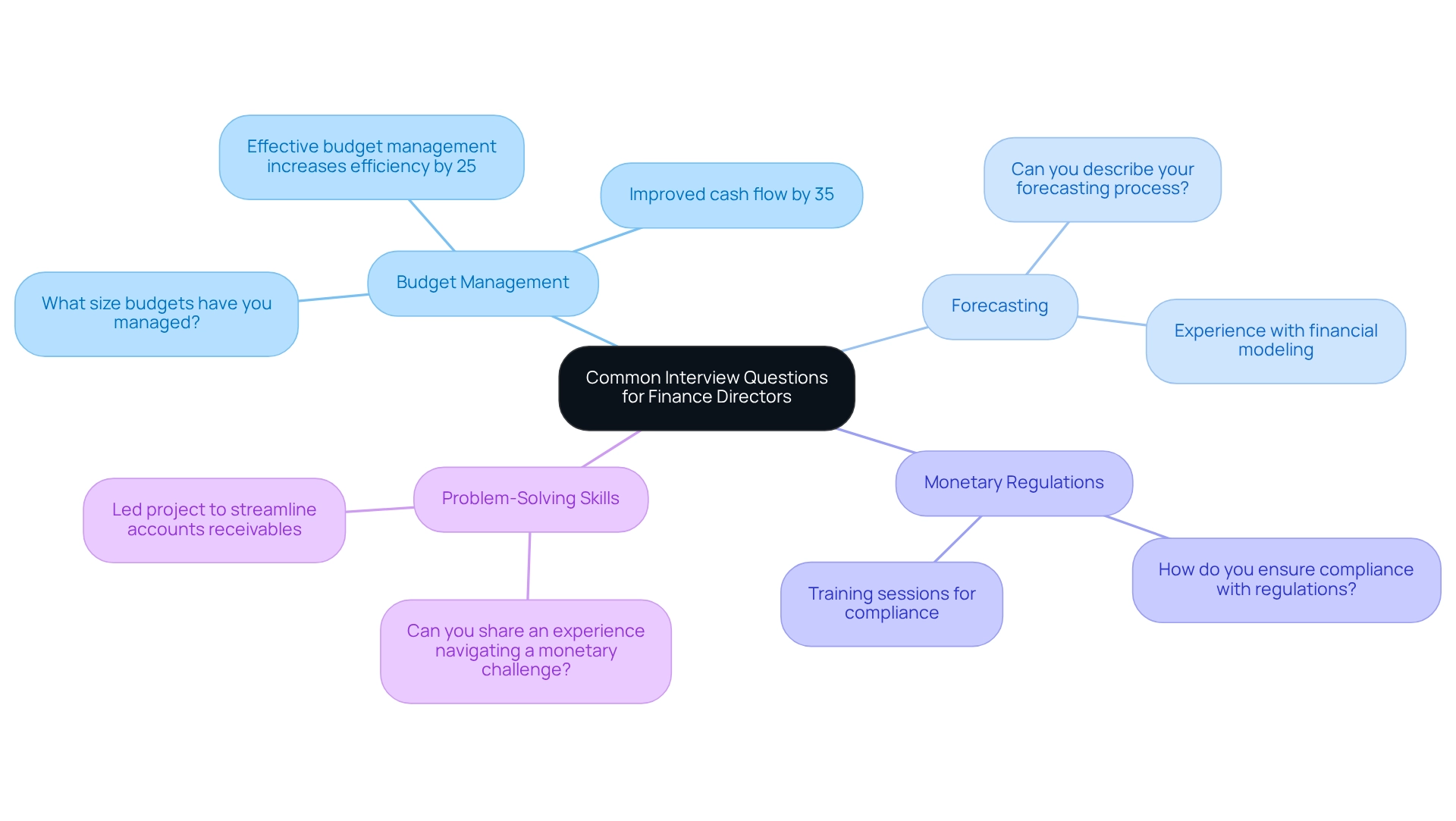

Interview questions for finance director positions typically focus on critical areas such as budget management, forecasting, and adherence to monetary regulations. Candidates should anticipate questions like, ‘What size budgets have you managed in previous roles?’ and ‘Can you share an experience where you navigated a significant monetary challenge?’ These inquiries aim to evaluate an individual’s practical experience and problem-solving skills in real-world scenarios.

For instance, a candidate might discuss their role in a project that improved cash flow by 35% through strategic modifications to the accounts receivables process, illustrating their ability to enhance financial operations. This aligns with the statistic that effective budget management can increase operational efficiency by 25%, underscoring the substantial impact of diligent fiscal oversight.

Furthermore, recognizing the importance of budget management experience is vital, as it directly affects a finance director’s capability to oversee economic health and strategic planning. Insights from HR professionals highlight the necessity for candidates to clearly articulate their specific contributions to financial strategies and outcomes in prior roles. This not only demonstrates their expertise but also links their experiences to the organization’s goals.

Additionally, a case study from Banco Santander emphasizes the role of compliance in leadership within the financial sector. The financial manager implemented quarterly training sessions that achieved a 100% compliance rate during audits, showcasing effective leadership in maintaining regulatory standards. As the landscape of monetary systems evolves, staying informed about typical interview questions for finance director positions in 2025 will further equip candidates to present themselves as strong contenders in the hiring process.

Situational and Behavioral Questions to Expect

Situational and behavioral interview questions for finance director positions serve as crucial tools for assessing how applicants have navigated challenges in their previous roles, particularly in finance leadership positions such as CFO and Financial Manager. For instance, asking applicants to ‘Describe a time when you had to present intricate monetary details to a non-monetary audience. How did you ensure they understood?’ enables interviewers to evaluate not only the applicant’s communication abilities but also their capacity to clarify complex concepts for various stakeholders.

Another effective question is, ‘Can you provide an example of a financial strategy you developed that resulted in measurable business growth?’ This encourages applicants to showcase their analytical thinking and strategic planning abilities. Such questions are essential for comprehending an individual’s past behavior, which frequently serves as the most reliable indicator of future performance. Research indicates that situational and behavioral interview techniques can significantly enhance the selection process, with studies showing that individuals rated 4.50 or higher on these assessments tend to excel in their roles. This statistic is supported by the rigorous methodology outlined in the ‘Methodology of the Situational Interview Study,’ which emphasizes the importance of objective scoring in evaluating candidates.

Furthermore, hiring managers underscore the importance of communication skills in finance, noting that the ability to convey complex information clearly is vital for success in leadership positions. Richard Ronay emphasizes this requirement, asserting that effective communication is a fundamental aspect of successful leadership in finance.

Including situational questions, like ‘Describe a challenging monetary situation you encountered and how you addressed it,’ can provide insights into an applicant’s problem-solving skills and resilience. These inquiries not only reveal how applicants manage pressure but also their approach to teamwork and decision-making in high-stakes situations. Recent findings indicate that the effectiveness of situational interviews can vary, especially in the presence of dilemmas, highlighting the necessity for customized questioning strategies.

By employing a mix of behavioral and situational interview questions for finance director roles, organizations can more effectively identify directors who possess the essential skills to thrive in dynamic and challenging monetary environments. Boutique Recruiting’s customized recruitment solutions specifically address the needs of high-demand financial positions, ensuring that individuals not only meet the technical requirements but also align with the organizational culture. This impressive track record of success, characterized by numerous satisfied clients and candidates, further reinforces the credibility of Boutique Recruiting’s recruitment process.

Technical Questions Related to Financial Management

In the competitive landscape of finance director recruitment, interview questions play a critical role, often focusing on essential areas such as reporting, budgeting, and compliance. Candidates may face inquiries like, ‘Which economic statements do you consider most crucial for evaluating a company’s performance?’ or ‘What is your strategy for budgeting and forecasting within a department or organization?’ These questions not only assess a participant’s technical skills but also evaluate their ability to apply economic principles effectively in practical scenarios.

Candidates should be thoroughly prepared to discuss their proficiency with economic software and tools, alongside their experience in preparing and analyzing economic reports. For instance, an applicant might highlight how they enhanced operational efficiency by 25% through a comprehensive cost-benefit analysis of a recent capital investment, showcasing their analytical skills and impact on the organization’s bottom line. Furthermore, discussing past experiences where they identified and pursued opportunities for improvement can further illustrate their problem-solving capabilities.

Individuals could reference specific outcomes from projects they led, demonstrating their proactive approach to enhancing economic performance. A relevant case study titled ‘Identifying Financial Improvement Opportunities’ serves as a tangible example, illustrating how candidates can effectively communicate their past experiences and the results achieved.

Current trends indicate that interviewers are increasingly focused on finance director interview questions, particularly regarding candidates’ perspectives on fiscal reporting and budgeting. As noted by finance experts, discussing challenges encountered in these areas can unveil an individual’s problem-solving skills and personal growth, irrespective of whether these challenges were personal or career-related. As the CFO of XYZ Corporation articulated, ‘I believe in open and transparent communication when conflicts arise. I encourage team members to express their concerns and actively listen to their perspectives.’ This comprehensive view of an applicant’s background is vital in today’s competitive environment, where the ability to navigate intricate economic landscapes is essential.

By selecting candidates who resonate with these values, firms like Boutique Recruiting enhance their reputation as trusted recruiting partners, specializing in high-demand roles such as CFOs, Financial Managers, and Directors of Finance, while underscoring the importance of personalized recruitment processes.

Strategic and Leadership Questions for Candidates

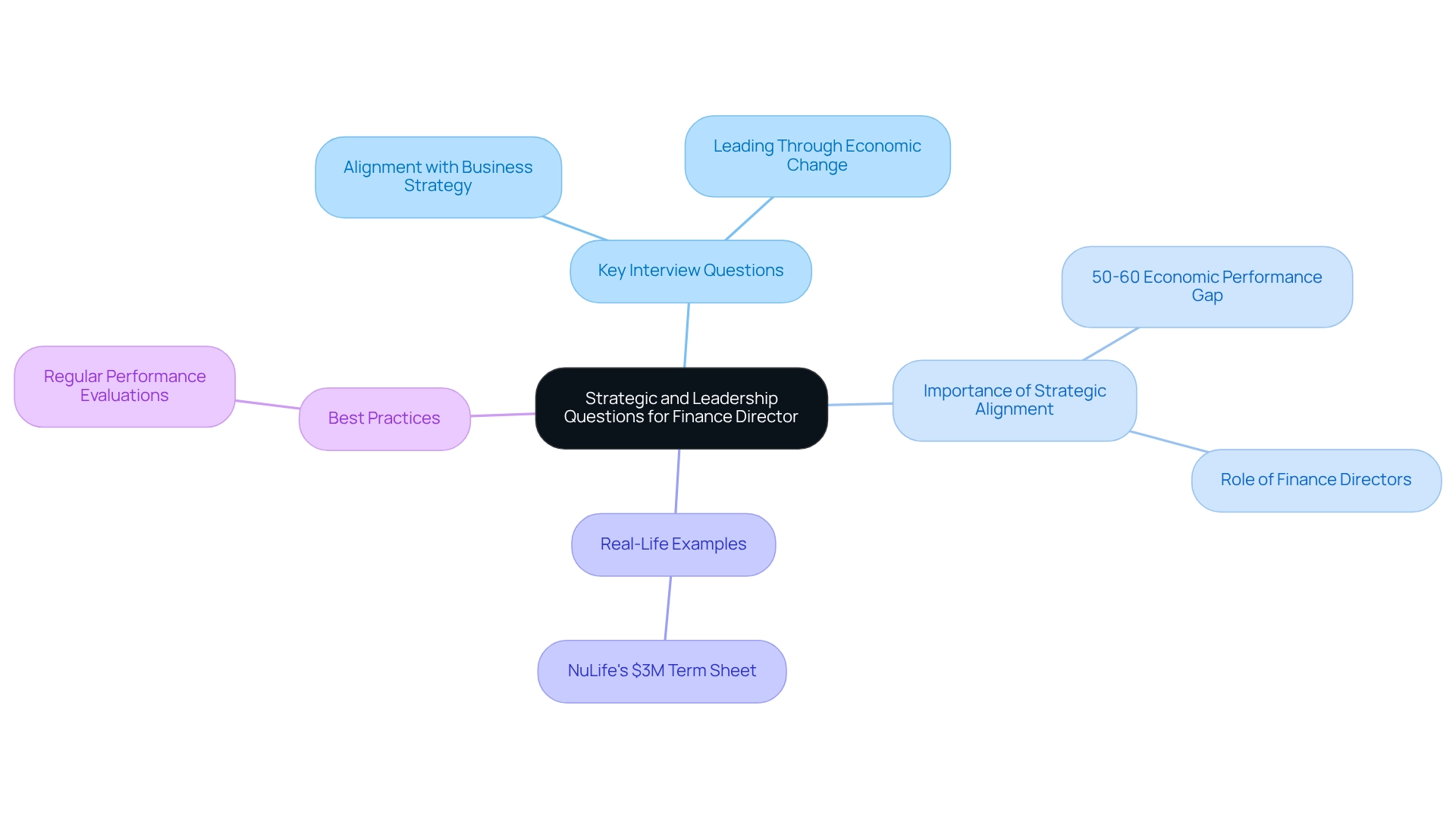

Interview questions for a finance director must encompass strategic and leadership inquiries that are critical in evaluating an individual’s vision and capacity to lead financial initiatives. For example, asking, ‘How do you ensure alignment between the finance department’s goals and the overall business strategy?’ allows interviewers to assess a candidate’s understanding of strategic integration.

Another pivotal question, ‘Can you describe a time when you had to lead a team through a major economic change?’ offers insights into the candidate’s leadership style and adaptability in challenging situations. These inquiries not only measure strategic thinking but also unveil how candidates motivate and manage their teams effectively. Candidates should be prepared to discuss their methods for fostering collaboration and achieving results when responding to interview questions for the finance director role, as these attributes are essential for effective leadership in finance.

Statistics indicate that companies typically achieve only 50-60% of the economic performance their strategies promise, often due to misalignment between departmental objectives and overarching business goals. This misalignment may arise from insufficient communication or a lack of understanding of the broader organizational strategy. In addressing these challenges, finance directors assume a vital role by ensuring their teams align with the company’s strategic vision, a theme often reflected in interview questions for finance director positions.

For instance, in the case of NuLife, the implementation of a robust monetary strategy led to securing a $3M Term Sheet from a venture capital firm, illustrating the tangible benefits of strategic alignment. Additionally, insights from industry leaders underscore the importance of routine performance evaluations to identify gaps between financial forecasts and actual results. As noted by Phoenix Strategy Group, ‘Regular performance evaluations are essential for recognizing any discrepancies between projections and actual outcomes. This allows for timely adjustments to be made, ensuring that the financial strategy remains aligned with business goals and that resources are allocated efficiently.’ This comprehensive approach to leadership in financial management not only enhances operational effectiveness but also positions financial leaders as key contributors to organizational success.

Assessing Cultural Fit and Interpersonal Skills

Assessing cultural compatibility and interpersonal abilities is crucial in interviews for the role, as these qualities greatly affect team dynamics and the overall success of the organization. Candidates should be prepared to answer questions such as:

- How do you handle conflicts within your team?

- What do you think is the key to effective communication in a financial department?

These inquiries are intended to evaluate an applicant’s capacity to work together efficiently, convey ideas clearly, and fit with the organization’s culture.

Interpersonal abilities are especially crucial for leaders, who must manage intricate relationships within their teams and across divisions. Strong negotiation skills, empathy, and the ability to provide constructive feedback are essential for fostering a positive work environment. Research indicates that organizations with a thriving culture experience 102% higher employee satisfaction, underscoring the importance of cultural alignment in leadership roles.

Moreover, statistics reveal that 88% of job seekers consider a healthy workplace culture essential for success, and hiring based on cultural fit can significantly enhance employee retention. As the UJJI Team notes, over half (58%) of employees would consider moving to a competitor if it offered a better culture. This highlights the necessity for finance directors to not only possess technical expertise but also to embody the values and culture of the organization, making relevant interview questions for finance director that assess cultural fit crucial for better hiring decisions. For instance, applicants might be requested to explain a moment when they needed to adjust their communication approach to suit a team’s dynamics or to share an example of how they have enhanced a positive team culture.

Such interview questions for finance director not only reveal interpersonal skills but also demonstrate the candidate’s understanding of the importance of cultural fit in their leadership approach. By prioritizing these elements, organizations can ensure they choose financial directors who will thrive in their unique environments and contribute to long-term success.

Questions Candidates Should Ask During the Interview

Candidates must arrive at interviews well-prepared with questions for finance director roles that reflect their genuine interest in both the position and the organization. For instance, inquiries such as ‘What are the key challenges currently confronting the financial department?’ and ‘How does the accounting team collaborate with other departments to achieve organizational objectives?’ not only demonstrate an applicant’s engagement but also yield vital insights into the organization’s culture and expectations.

In 2025, finance departments face several pressing challenges, including the necessity for enhanced data analytics capabilities, regulatory compliance, and the integration of advanced financial technologies. Understanding these challenges allows applicants to tailor their interview questions for finance director positions effectively, showcasing their proactive mindset and strategic reasoning—qualities that hiring managers highly value.

Moreover, studies indicate that only about 20% of applicants who interview ultimately secure the job, underscoring the importance of making a strong impression through active involvement. Candidates who pose insightful questions are often viewed more favorably, reflecting their authenticity and sincere interest in the role. This approach aligns with Boutique Recruiting’s commitment to enhancing the candidate experience and attracting top talent by promoting transparency and open communication.

Candidates should also consider asking interview questions for finance director roles that delve into the specific metrics used to evaluate the director’s performance, as this can clarify expectations and strategic objectives. Effective questions might include:

- ‘What key performance indicators are most critical for the financial team?’

- ‘How does the financial department contribute to the overall strategic goals of the organization?’

Furthermore, applicants should be candid about their workstyle preferences and salary expectations, as this transparency fosters trust and enables hiring managers to assess compatibility more accurately. By posing targeted interview questions for finance director positions, applicants not only demonstrate their understanding of the financial manager’s role but also present themselves as knowledgeable and engaged prospective leaders within the organization. This strategy is supported by recent studies suggesting that structured interview questions, particularly those focused on past experiences and situational responses, are significant predictors of job performance and turnover.

Richard A. Posthuma noted that ratings of background, situational, and past behavioral interview questions significantly predicted job performance, reinforcing the necessity of thoughtful engagement. Consequently, individuals who participate thoughtfully in the interview process are more likely to connect with hiring managers and secure the desired position.

Preparation Tips for Finance Director Interviews

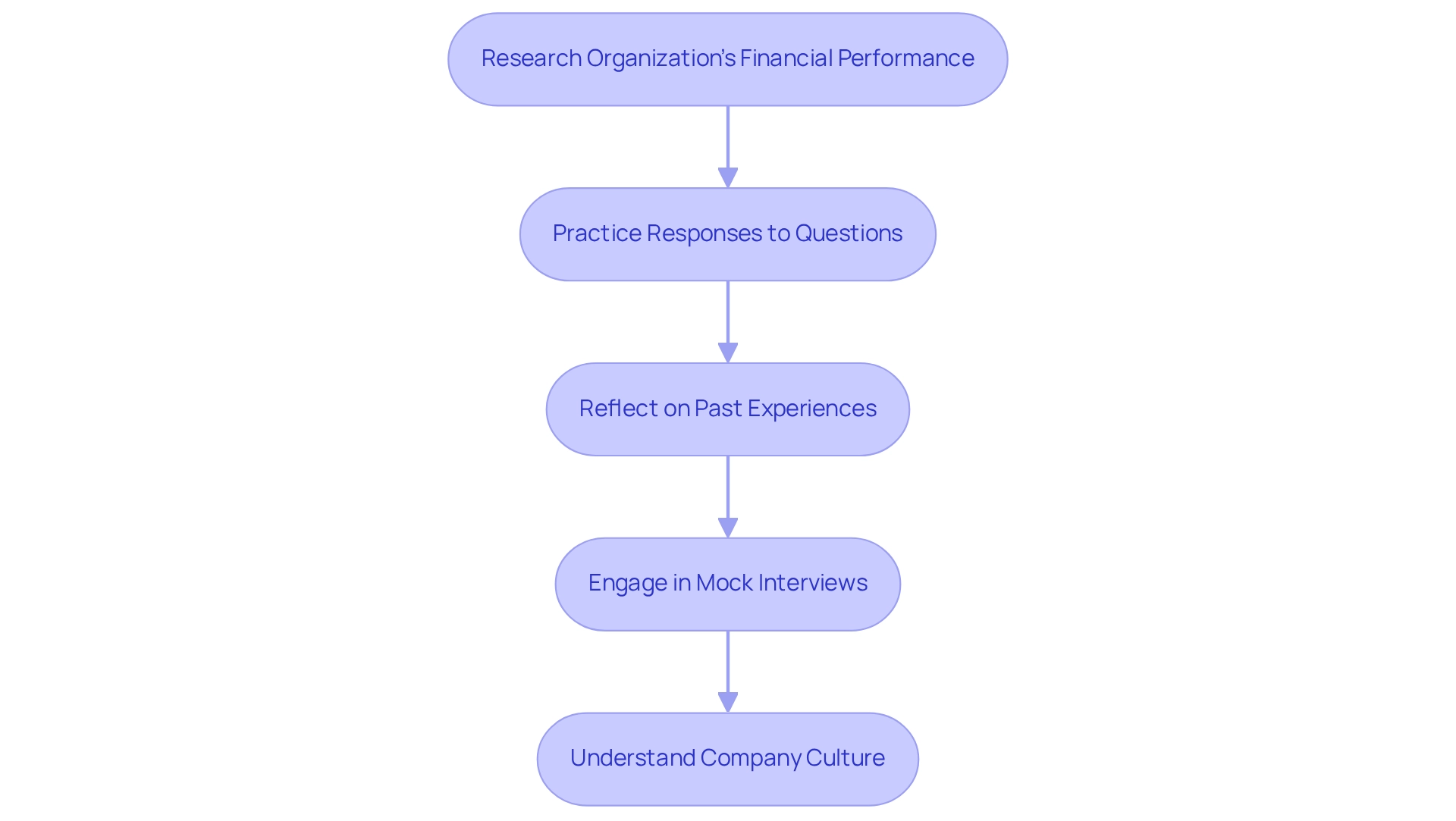

To prepare effectively for a finance director interview, applicants must start by thoroughly researching the organization’s monetary performance, recent news, current industry trends, and the relevant interview questions for finance director positions. Grasping the economic well-being of the organization not only showcases initiative but also equips applicants to engage in informed conversations during the interview. Practicing responses to interview questions for finance director roles and common situational scenarios is crucial for building confidence and articulating thoughts clearly.

Candidates should reflect on their past experiences, preparing specific examples that showcase their skills and achievements. Authenticity and integrity are essential qualities for applicants, as boards depend on trust and honesty among members for effective governance. For instance, proficiency in financial tools like Excel or QuickBooks is often crucial; individuals should be ready to emphasize their knowledge of these tools, as those who do frequently stand out in interviews.

The case study titled “Knowing Your Tools” illustrates that applicants who demonstrate their proficiency in relevant financial tools can align their skills with job requirements, thereby enhancing their chances of being hired.

Engaging in mock interviews with peers or mentors can provide invaluable feedback, significantly enhancing overall performance. Statistics suggest that individuals who participate in mock interviews greatly improve their likelihood of success, with some studies indicating a 30% rise in interview effectiveness. Furthermore, understanding the company’s culture and values is vital.

Tailoring responses to align with the organization’s ethos not only demonstrates fit but also reinforces the applicant’s genuine interest in the role. By combining thorough research, practical preparation, and a clear understanding of the company’s environment, individuals can effectively prepare for interview questions for finance director roles and position themselves as strong contenders.

For example, in a previous role, a candidate identified that their cash conversion cycle was longer than industry standards. They led a project to streamline accounts receivables, which improved cash flow by 35% and reduced days sales outstanding by 15 days within six months. Such impactful contributions highlight the potential outcomes of effective financial leadership, reinforcing the importance of preparation.

At Boutique Recruiting, we emphasize customized recruitment solutions for high-demand roles in the financial sector, including CFO and Financial Manager positions. Our strong track record of success underscores the value of thorough preparation for candidates seeking to excel in interview questions for finance director positions. Candidates who utilize our personalized recruitment strategies often find themselves better equipped to navigate the interview process and secure their desired positions.

Conclusion

The role of a finance director is undeniably essential in today’s dynamic financial landscape, where organizations seek not only to maintain financial health but also to drive strategic growth. Finance directors are tasked with a wide array of responsibilities, including:

- Financial planning

- Risk management

- Compliance

All crucial for guiding companies through complex challenges. The increasing demand for skilled finance directors reflects their importance in executive decision-making processes, ensuring that organizations are equipped to meet both current and future financial objectives.

In preparing for finance director interviews, candidates must be ready to tackle a diverse range of questions that assess their technical expertise, strategic thinking, and interpersonal skills. From situational and behavioral inquiries to technical questions about financial reporting and budgeting, these discussions provide a platform for candidates to showcase their relevant experiences and problem-solving abilities. Moreover, the importance of cultural fit cannot be understated; candidates must demonstrate not only their technical qualifications but also how they align with the organization’s values and culture.

Ultimately, the success of a finance director hinges on their ability to contribute strategically to the organization while navigating complex financial environments. As the role continues to evolve in response to emerging financial technologies and regulatory requirements, both candidates and organizations must remain proactive in their approach to recruitment and professional development. By focusing on the essential skills and competencies outlined in this article, aspiring finance leaders can position themselves as valuable assets to their organizations, driving sustainable growth and fostering financial stability for years to come.

Frequently Asked Questions

What is the role of a finance manager?

A finance manager is a senior executive responsible for managing the economic well-being of an organization, which includes budget planning, risk management, record-keeping, and fiscal reporting.

Why are finance leaders important in strategic decision-making?

Finance leaders are critical in strategic decision-making as they provide essential insights that influence an organization’s fiscal strategy, ensuring that monetary goals are achieved while adhering to regulatory standards.

What is the anticipated demand for finance managers in the coming years?

Approximately 75,100 positions for finance managers are anticipated each year over the next decade, indicating a growing recognition of their importance in navigating complex economic environments.

How do finance directors contribute to organizational success?

Finance directors contribute to organizational success by engaging in strategic discussions and decisions that shape the organization’s future, leading to improved economic performance and enhanced risk management.

What skills are essential for candidates applying for finance director positions?

Candidates should possess technical financial skills, strategic thinking, and leadership capabilities to effectively contribute to an organization’s financial strategy.

How does Boutique Recruiting differentiate itself in the hiring process for finance roles?

Boutique Recruiting prioritizes establishing enduring relationships and understanding company culture, which allows them to present candidates who fit both the technical criteria and the organizational atmosphere.

What types of interview questions can candidates expect for finance director positions?

Candidates can expect questions focused on budget management, forecasting, and adherence to monetary regulations, such as inquiries about the size of budgets managed and experiences navigating monetary challenges.

Why is budget management experience important for finance directors?

Budget management experience is vital as it directly affects a finance director’s ability to oversee the economic health of an organization and contribute to strategic planning.

Can you provide an example of effective leadership in compliance within the financial sector?

A case study from Banco Santander illustrates effective leadership in compliance, where a financial manager implemented quarterly training sessions that achieved a 100% compliance rate during audits.

How can candidates prepare for finance director interviews in the evolving financial landscape?

Candidates should stay informed about typical interview questions and focus on articulating their specific contributions to financial strategies and outcomes in prior roles to present themselves as strong contenders.

{“@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [{“@type”: “Question”, “name”: “What is the role of a finance manager?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “A finance manager is a senior executive responsible for managing the economic well-being of an organization, which includes budget planning, risk management, record-keeping, and fiscal reporting.”}}, {“@type”: “Question”, “name”: “Why are finance leaders important in strategic decision-making?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Finance leaders are critical in strategic decision-making as they provide essential insights that influence an organization’s fiscal strategy, ensuring that monetary goals are achieved while adhering to regulatory standards.”}}, {“@type”: “Question”, “name”: “What is the anticipated demand for finance managers in the coming years?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Approximately 75,100 positions for finance managers are anticipated each year over the next decade, indicating a growing recognition of their importance in navigating complex economic environments.”}}, {“@type”: “Question”, “name”: “How do finance directors contribute to organizational success?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Finance directors contribute to organizational success by engaging in strategic discussions and decisions that shape the organization’s future, leading to improved economic performance and enhanced risk management.”}}, {“@type”: “Question”, “name”: “What skills are essential for candidates applying for finance director positions?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Candidates should possess technical financial skills, strategic thinking, and leadership capabilities to effectively contribute to an organization’s financial strategy.”}}, {“@type”: “Question”, “name”: “How does Boutique Recruiting differentiate itself in the hiring process for finance roles?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Boutique Recruiting prioritizes establishing enduring relationships and understanding company culture, which allows them to present candidates who fit both the technical criteria and the organizational atmosphere.”}}, {“@type”: “Question”, “name”: “What types of interview questions can candidates expect for finance director positions?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Candidates can expect questions focused on budget management, forecasting, and adherence to monetary regulations, such as inquiries about the size of budgets managed and experiences navigating monetary challenges.”}}, {“@type”: “Question”, “name”: “Why is budget management experience important for finance directors?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Budget management experience is vital as it directly affects a finance director’s ability to oversee the economic health of an organization and contribute to strategic planning.”}}, {“@type”: “Question”, “name”: “Can you provide an example of effective leadership in compliance within the financial sector?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “A case study from Banco Santander illustrates effective leadership in compliance, where a financial manager implemented quarterly training sessions that achieved a 100% compliance rate during audits.”}}, {“@type”: “Question”, “name”: “How can candidates prepare for finance director interviews in the evolving financial landscape?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Candidates should stay informed about typical interview questions and focus on articulating their specific contributions to financial strategies and outcomes in prior roles to present themselves as strong contenders.”}}]}{“@context”: “https://schema.org”, “@type”: “BlogPosting”, “headline”: “What Are the Key Interview Questions for Finance Directors? A Comprehensive Overview”, “description”: “Explore essential interview questions for finance directors to enhance your hiring process.”, “datePublished”: “2025-04-12T00:00:13.812000”, “image”: [“https://images.tely.ai/telyai/ycnrclhq-central-node-represents-the-topic-main-branches-indicate-key-areas-of-focus-and-sub-branches-provide-specific-questions-examples-and-statistics-related-to-each-area.webp”, “https://images.tely.ai/telyai/uljojxab-the-central-node-represents-the-overall-theme-with-branches-showing-key-questions-insights-real-life-examples-and-best-practices-related-to-finance-director-leadership.webp”, “https://images.tely.ai/telyai/qxlvefux-each-box-represents-a-step-in-the-interview-preparation-process-with-arrows-indicating-the-sequential-flow-of-actions.webp”], “articleBody”: “## Overview\nThe key interview questions for finance directors are pivotal, focusing on crucial areas such as budget management, forecasting, and compliance with regulations. These questions are designed to assess candidates’ strategic thinking and leadership abilities. This article outlines specific inquiries that effectively gauge candidates’ technical skills and situational responses. Moreover, it emphasizes the critical importance of cultural fit and interpersonal skills in the finance director role, which are essential for achieving organizational success.\n\n## Key Highlights:\n- Finance directors manage an organization’s economic well-being, including budget planning, risk management, and fiscal reporting.\n- There is a growing demand for finance managers, with approximately 75,100 positions expected annually over the next decade.\n- Finance leaders are increasingly involved in strategic decision-making, impacting organizational success and cash oversight.\n- Interview questions for finance directors often focus on budget management, forecasting, and compliance with monetary regulations.\n- Candidates should prepare for situational and behavioral questions to demonstrate their problem-solving skills and leadership capabilities.\n- Technical questions assess candidates’ proficiency in economic principles, reporting, and budgeting strategies.\n- Cultural fit and interpersonal skills are crucial for finance directors, influencing team dynamics and organizational success.\n- Candidates should ask insightful questions during interviews to demonstrate engagement and understanding of organizational challenges.\n- Thorough preparation, including research and mock interviews, enhances candidates’ chances of success in finance director roles.\n\n## Introduction\nIn the ever-evolving financial landscape, the role of a finance director has become increasingly pivotal for organizations striving to achieve sustainable growth and stability. These senior executives are not only responsible for overseeing the financial health of their companies but also play a crucial part in strategic decision-making that shapes the future of the business. As companies face a myriad of challenges, including regulatory compliance and the integration of advanced financial technologies, the demand for skilled finance directors continues to rise. \n\nThis article delves into the multifaceted responsibilities of finance directors, the essential skills required for success, and the types of interview questions candidates can expect as they navigate the competitive hiring landscape. By understanding these dynamics, both aspiring finance leaders and organizations can better prepare for the critical conversations that will define their financial futures.\n\n## Understanding the Role of a Finance Director\n[A finance manager](https://www.boutiquerecruiting.com/top-10-cfo-jobs-to-apply-for-in-2025-explore-the-best-cfo-jobs-available/) is a senior executive responsible for managing the economic well-being of an organization, encompassing a wide range of duties that are critical to success. These responsibilities include budget planning, risk management, record-keeping, and fiscal reporting. Finance leaders play an essential role in strategic decision-making, ensuring that the organization not only achieves its monetary goals but also adheres to regulatory standards.\n\nThey guide budgeting procedures, oversee monetary risks, and provide essential insights that influence the organization’s fiscal strategy. The importance of financial executives in strategic decision-making is underscored by recent statistics, indicating that approximately 75,100 positions for fiscal managers are anticipated each year over the next decade. This demand signifies the increasing acknowledgment of monetary leaders as vital contributors in steering organizations through intricate economic environments, particularly in areas such as cash oversight and risk assessment. Moreover, a significant portion of organizations now includes financial leaders in strategic decision-making roles, highlighting their impact on the overall trajectory of the company.\n\nTheir duties extend beyond conventional monetary supervision; they are expected to engage in strategic discussions and decisions that shape the organization’s future. Case studies further illustrate the effect of fiscal leaders on organizational success. For instance, organizations that have integrated finance directors into their strategic planning processes report improved economic performance and enhanced risk management. This trend emphasizes the necessity for candidates to not only possess technical financial skills but also to exhibit strategic thinking and leadership capabilities.\n\nBoutique Recruiting distinguishes itself by prioritizing the establishment of enduring relationships and understanding company culture. This approach enables them to present candidates who not only meet technical criteria but also seamlessly fit into the organizational atmosphere. This commitment to long-term success guarantees that clients gain access to top talent, which is crucial for their growth and stability.\n\nExpert opinions further reinforce the significance of finance directors in shaping organizational strategy. As Eric Eddy noted, Boutique Recruiting possesses the capability to swiftly and effectively provide exceptional individuals, a necessity for organizations aiming to fill these crucial positions. The tenacity and drive of the Boutique Recruiting team play a significant role in this process, as they diligently connect individuals with the right opportunities. As the economic landscape continues to evolve, the role of financial leaders is likely to expand, necessitating a focus on innovative budgeting strategies that align with broader business objectives. Understanding these dynamics is essential for both candidates preparing for finance director interview questions and employers evaluating candidate suitability for this vital role.\n## Common Interview Questions for Finance Directors\nInterview questions for finance director positions typically focus on critical areas such as budget management, forecasting, and adherence to monetary regulations. Candidates should anticipate questions like, ‘What size budgets have you managed in previous roles?’ and ‘Can you share an experience where you navigated a significant monetary challenge?’ These inquiries aim to evaluate an individual’s practical experience and problem-solving skills in real-world scenarios.\n\nFor instance, a candidate might discuss their role in a project that improved cash flow by 35% through strategic modifications to the accounts receivables process, illustrating their ability to enhance financial operations. This aligns with the statistic that effective budget management can increase operational efficiency by 25%, underscoring the substantial impact of diligent fiscal oversight.\n\nFurthermore, recognizing the importance of budget management experience is vital, as it directly affects a finance director’s capability to oversee economic health and strategic planning. Insights from HR professionals highlight the necessity for candidates to clearly articulate their specific contributions to financial strategies and outcomes in prior roles. This not only demonstrates their expertise but also links their experiences to the organization’s goals.\n\nAdditionally, a case study from Banco Santander emphasizes the role of compliance in leadership within the financial sector. The financial manager implemented [quarterly training sessions](https://himalayas.app/interview-questions/financial-director) that achieved a 100% compliance rate during audits, showcasing effective leadership in maintaining regulatory standards. As the landscape of monetary systems evolves, staying informed about typical interview questions for finance director positions in 2025 will further equip candidates to present themselves as strong contenders in the hiring process.\n\n\n## Situational and Behavioral Questions to Expect\nSituational and behavioral interview questions for finance director positions serve as crucial tools for assessing how applicants have navigated challenges in their previous roles, particularly in finance leadership positions such as CFO and Financial Manager. For instance, asking applicants to ‘Describe a time when you had to present intricate monetary details to a non-monetary audience. How did you ensure they understood?’ enables interviewers to evaluate not only the applicant’s communication abilities but also their capacity to clarify complex concepts for various stakeholders.\n\nAnother effective question is, ‘Can you provide an example of a financial strategy you developed that resulted in measurable business growth?’ This encourages applicants to showcase their analytical thinking and strategic planning abilities. Such questions are essential for comprehending an individual’s past behavior, which frequently serves as the most reliable indicator of future performance. Research indicates that situational and behavioral interview techniques can significantly enhance the selection process, with studies showing that individuals rated 4.50 or higher on these assessments tend to excel in their roles. This statistic is supported by the rigorous methodology outlined in the ‘Methodology of the Situational Interview Study,’ which emphasizes the importance of objective scoring in evaluating candidates.\n\nFurthermore, hiring managers underscore the importance of communication skills in finance, noting that the ability to convey complex information clearly is vital for success in leadership positions. Richard Ronay emphasizes this requirement, asserting that effective communication is a fundamental aspect of successful leadership in finance.\n\nIncluding situational questions, like ‘Describe a challenging monetary situation you encountered and how you addressed it,’ can provide insights into an applicant’s problem-solving skills and resilience. These inquiries not only reveal how applicants manage pressure but also their approach to teamwork and decision-making in high-stakes situations. Recent findings indicate that the effectiveness of situational interviews can vary, especially in the presence of dilemmas, highlighting the necessity for [customized questioning strategies](https://pmc.ncbi.nlm.nih.gov/articles/PMC4856718).\n\nBy employing a mix of behavioral and situational interview questions for finance director roles, organizations can more effectively identify directors who possess the essential skills to thrive in dynamic and challenging monetary environments. Boutique Recruiting’s customized recruitment solutions specifically address the needs of [high-demand financial positions](https://tealhq.com/interview-questions/finance-director), ensuring that individuals not only meet the technical requirements but also align with the organizational culture. This impressive track record of success, characterized by numerous satisfied clients and candidates, further reinforces the credibility of Boutique Recruiting’s recruitment process.\n## Technical Questions Related to Financial Management\nIn the competitive landscape of finance director recruitment, interview questions play a critical role, often focusing on essential areas such as reporting, budgeting, and compliance. Candidates may face inquiries like, ‘Which economic statements do you consider most crucial for evaluating a company’s performance?’ or ‘What is your strategy for budgeting and forecasting within a department or organization?’ These questions not only assess a participant’s technical skills but also evaluate their ability to apply economic principles effectively in practical scenarios.\n\nCandidates should be thoroughly prepared to discuss their proficiency with economic software and tools, alongside their experience in preparing and analyzing economic reports. For instance, an applicant might highlight how they enhanced operational efficiency by 25% through a comprehensive cost-benefit analysis of a recent capital investment, showcasing their analytical skills and impact on the organization\u2019s bottom line. Furthermore, discussing past experiences where they identified and pursued opportunities for improvement can further illustrate their problem-solving capabilities.\n\nIndividuals could reference specific outcomes from projects they led, demonstrating their proactive approach to enhancing economic performance. A relevant case study titled ‘Identifying Financial Improvement Opportunities’ serves as a tangible example, illustrating how candidates can effectively communicate their past experiences and the results achieved.\n\nCurrent trends indicate that interviewers are increasingly focused on finance director interview questions, particularly regarding candidates’ perspectives on fiscal reporting and budgeting. As noted by finance experts, discussing challenges encountered in these areas can unveil an individual’s problem-solving skills and personal growth, irrespective of whether these challenges were personal or career-related. As the CFO of XYZ Corporation articulated, ‘I believe in open and transparent communication when conflicts arise. I encourage team members to express their concerns and actively listen to their perspectives.’ This comprehensive view of an applicant’s background is vital in today\u2019s competitive environment, where the ability to navigate intricate economic landscapes is essential.\n\nBy selecting candidates who resonate with these values, firms like Boutique Recruiting enhance their reputation as trusted recruiting partners, specializing in high-demand roles such as CFOs, Financial Managers, and Directors of Finance, while underscoring the importance of [personalized recruitment processes](https://testgorilla.com/blog/job-interview-statistics).\n## Strategic and Leadership Questions for Candidates\nInterview questions for a finance director must encompass [strategic and leadership inquiries](https://learning.linkedin.com/resources/learning-culture/diversity-workplace-statistics-dei-importance) that are critical in evaluating an individual’s vision and capacity to lead financial initiatives. For example, asking, ‘How do you ensure alignment between the finance department’s goals and the overall business strategy?’ allows interviewers to assess a candidate’s understanding of strategic integration.\n\nAnother pivotal question, ‘Can you describe a time when you had to lead a team through a major economic change?’ offers insights into the candidate’s leadership style and adaptability in challenging situations. These inquiries not only measure strategic thinking but also unveil how candidates motivate and manage their teams effectively. Candidates should be prepared to discuss their methods for fostering collaboration and achieving results when responding to interview questions for the finance director role, as these attributes are essential for effective leadership in finance.\n\nStatistics indicate that companies typically achieve only 50-60% of the economic performance their strategies promise, often due to misalignment between departmental objectives and overarching business goals. This misalignment may arise from insufficient communication or a lack of understanding of the broader organizational strategy. In addressing these challenges, finance directors assume a vital role by ensuring their teams align with the company’s strategic vision, a theme often reflected in interview questions for finance director positions.\n\nFor instance, in the case of NuLife, the implementation of a robust monetary strategy led to securing a $3M Term Sheet from a venture capital firm, illustrating the tangible benefits of strategic alignment. Additionally, insights from industry leaders underscore the importance of routine performance evaluations to identify gaps between financial forecasts and actual results. As noted by Phoenix Strategy Group, ‘Regular performance evaluations are essential for recognizing any discrepancies between projections and actual outcomes. This allows for timely adjustments to be made, ensuring that the financial strategy remains aligned with business goals and that resources are allocated efficiently.’ This comprehensive approach to leadership in financial management not only enhances operational effectiveness but also positions financial leaders as key contributors to organizational success.\n\n\n## Assessing Cultural Fit and Interpersonal Skills\nAssessing cultural compatibility and interpersonal abilities is crucial in interviews for the role, as these qualities greatly affect team dynamics and the overall success of the organization. Candidates should be prepared to answer questions such as:\n\n1. How do you handle conflicts within your team?\n2. What do you think is the key to effective communication in a financial department?\n\nThese inquiries are intended to evaluate an applicant’s capacity to work together efficiently, convey ideas clearly, and fit with the organization’s culture.\n\nInterpersonal abilities are especially crucial for leaders, who must manage intricate relationships within their teams and across divisions. Strong negotiation skills, empathy, and the ability to provide constructive feedback are essential for fostering a positive work environment. Research indicates that organizations with a thriving culture experience 102% higher employee satisfaction, underscoring the importance of cultural alignment in leadership roles.\n\nMoreover, statistics reveal that 88% of job seekers consider [a healthy workplace culture](https://business.com/articles/hire-for-cultural-fit) essential for success, and hiring based on cultural fit can significantly enhance employee retention. As the UJJI Team notes, over half (58%) of employees would consider moving to a competitor if it offered a better culture. This highlights the necessity for finance directors to not only possess technical expertise but also to embody the values and culture of the organization, making relevant interview questions for finance director that assess cultural fit crucial for better hiring decisions. For instance, applicants might be requested to explain a moment when they needed to adjust their communication approach to suit a team\u2019s dynamics or to share an example of how they have enhanced a positive team culture.\n\nSuch interview questions for finance director not only reveal interpersonal skills but also demonstrate the candidate’s understanding of the importance of cultural fit in their leadership approach. By prioritizing these elements, organizations can ensure they choose financial directors who will thrive in their unique environments and contribute to long-term success.\n## Questions Candidates Should Ask During the Interview\nCandidates must arrive at interviews well-prepared with questions for finance director roles that reflect their genuine interest in both the position and the organization. For instance, inquiries such as ‘What are the key challenges currently confronting the financial department?’ and ‘How does the accounting team collaborate with other departments to achieve organizational objectives?’ not only demonstrate an applicant’s engagement but also yield vital insights into the organization’s culture and expectations.\n\nIn 2025, finance departments face several pressing challenges, including the necessity for enhanced data analytics capabilities, regulatory compliance, and the integration of advanced financial technologies. Understanding these challenges allows applicants to tailor their interview questions for finance director positions effectively, showcasing their proactive mindset and strategic reasoning\u2014qualities that hiring managers highly value.\n\nMoreover, studies indicate that only about 20% of applicants who interview ultimately secure the job, underscoring the importance of making a strong impression through active involvement. Candidates who pose insightful questions are often viewed more favorably, reflecting their authenticity and sincere interest in the role. This approach aligns with Boutique Recruiting’s commitment to enhancing the candidate experience and attracting top talent by promoting transparency and open communication.\n\nCandidates should also consider asking interview questions for finance director roles that delve into the specific metrics used to evaluate the director’s performance, as this can clarify expectations and strategic objectives. Effective questions might include:\n\n- ‘What key performance indicators are most critical for the financial team?’\n- ‘How does the financial department contribute to the overall strategic goals of the organization?’\n\nFurthermore, applicants should be candid about their workstyle preferences and salary expectations, as this transparency fosters trust and enables hiring managers to assess compatibility more accurately. By posing [targeted interview questions](https://www.boutiquerecruiting.com/mastering-2nd-interview-questions-a-step-by-step-guide-to-success/) for finance director positions, applicants not only demonstrate their understanding of the financial manager’s role but also present themselves as knowledgeable and engaged prospective leaders within the organization. This strategy is supported by recent studies suggesting that structured interview questions, particularly those focused on past experiences and situational responses, are significant predictors of job performance and turnover.\n\nRichard A. Posthuma noted that ratings of background, situational, and past behavioral interview questions significantly predicted job performance, reinforcing the necessity of thoughtful engagement. Consequently, individuals who participate thoughtfully in the interview process are more likely to connect with hiring managers and secure the desired position.\n## Preparation Tips for Finance Director Interviews\nTo prepare effectively for a finance director interview, applicants must start by thoroughly researching the organization’s monetary performance, recent news, current industry trends, and the relevant interview questions for finance director positions. Grasping the economic well-being of the organization not only showcases initiative but also equips applicants to engage in informed conversations during the interview. Practicing responses to interview questions for finance director roles and common situational scenarios is crucial for building confidence and articulating thoughts clearly. \n\nCandidates should reflect on their past experiences, preparing specific examples that showcase their skills and achievements. Authenticity and integrity are essential qualities for applicants, as boards depend on trust and honesty among members for effective governance. For instance, proficiency in financial tools like Excel or QuickBooks is often crucial; individuals should be ready to emphasize their knowledge of these tools, as those who do frequently stand out in interviews. \n\nThe case study titled \”Knowing Your Tools\” illustrates that applicants who demonstrate their proficiency in relevant financial tools can align their skills with job requirements, thereby enhancing their chances of being hired. \n\nEngaging in mock interviews with peers or mentors can provide invaluable feedback, significantly enhancing overall performance. Statistics suggest that individuals who participate in mock interviews greatly improve their likelihood of success, with some studies indicating a 30% rise in interview effectiveness. Furthermore, understanding the company’s culture and values is vital. \n\nTailoring responses to align with the organization\u2019s ethos not only demonstrates fit but also reinforces the applicant’s genuine interest in the role. By combining thorough research, practical preparation, and a clear understanding of the company\u2019s environment, individuals can effectively prepare for interview questions for finance director roles and position themselves as strong contenders. \n\nFor example, in a previous role, a candidate identified that their cash conversion cycle was longer than industry standards. They led a project to streamline accounts receivables, which [improved cash flow by 35% and reduced days sales outstanding by 15 days](https://tealhq.com/interview-questions/finance-director) within six months. Such impactful contributions highlight the potential outcomes of effective financial leadership, reinforcing the importance of preparation. \n\nAt Boutique Recruiting, we emphasize customized recruitment solutions for high-demand roles in the financial sector, including CFO and Financial Manager positions. Our strong track record of success underscores the value of thorough preparation for candidates seeking to excel in interview questions for finance director positions. Candidates who utilize our personalized recruitment strategies often find themselves better equipped to navigate the interview process and secure their desired positions.\n\n\n\n## Conclusion\nThe role of a finance director is undeniably essential in today\u2019s dynamic financial landscape, where organizations seek not only to maintain financial health but also to drive strategic growth. Finance directors are tasked with a wide array of responsibilities, including:\n\n- Financial planning\n- Risk management\n- Compliance\n\nAll crucial for guiding companies through complex challenges. The increasing demand for skilled finance directors reflects their importance in executive decision-making processes, ensuring that organizations are equipped to meet both current and future financial objectives. \n\nIn preparing for finance director interviews, candidates must be ready to tackle a diverse range of questions that assess their technical expertise, strategic thinking, and interpersonal skills. From situational and behavioral inquiries to technical questions about financial reporting and budgeting, these discussions provide a platform for candidates to showcase their relevant experiences and problem-solving abilities. Moreover, the importance of cultural fit cannot be understated; candidates must demonstrate not only their technical qualifications but also how they align with the organization’s values and culture. \n\nUltimately, the success of a finance director hinges on their ability to contribute strategically to the organization while navigating complex financial environments. As the role continues to evolve in response to emerging financial technologies and regulatory requirements, both candidates and organizations must remain proactive in their approach to recruitment and professional development. By focusing on the essential skills and competencies outlined in this article, aspiring finance leaders can position themselves as valuable assets to their organizations, driving sustainable growth and fostering financial stability for years to come.\n\n::iframe[https://iframe.tely.ai/cta/eyJhcnRpY2xlX2lkIjogIjY3ZjlhZDBkNjkwNGYyMWZmNDVhMmQ3ZCIsICJjb21wYW55X2lkIjogIjY3YWU2NGU5YzhlZTg4N2E0ZmUzZmYxOSIsICJpbmRleCI6IG51bGx9]{width=\”100%\” height=\”300px\”}”}