Overview

The role of a Director of Accounting is critical in overseeing financial operations, ensuring compliance with regulations, and leading the accounting team to maintain the integrity of financial data. In today’s financial landscape, this position has become increasingly vital due to the growing complexity of financial management. Responsibilities such as:

- Fiscal reporting

- Budgeting

- Implementing internal controls

are essential for informed decision-making and organizational success. As organizations navigate these challenges, the demand for skilled Directors of Accounting continues to rise, highlighting the need for tailored recruitment strategies that address the unique requirements of the financial sector.

Key Highlights:

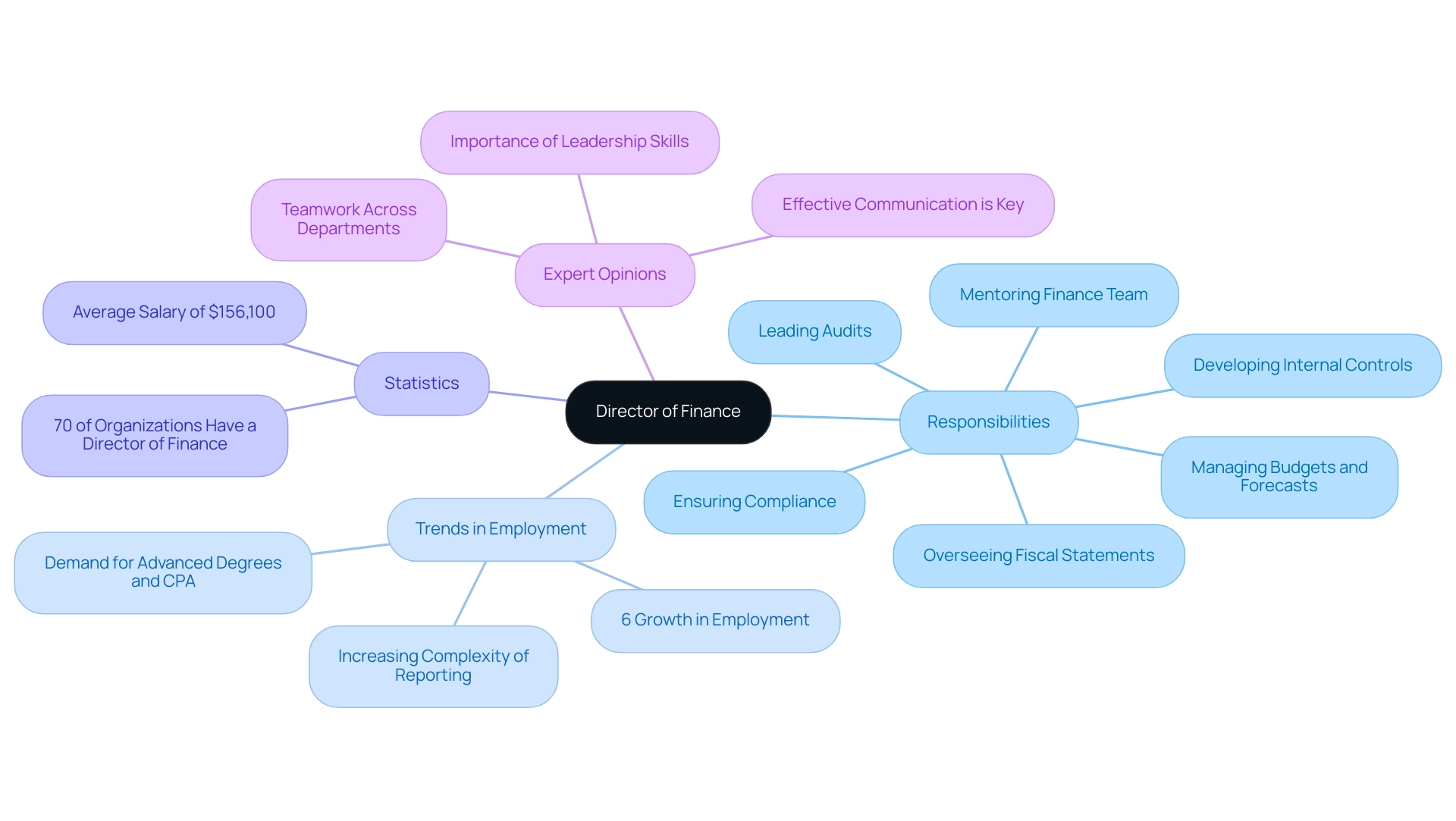

- The Director of Finance is crucial for managing financial operations, developing policies, and ensuring compliance with regulations.

- In 2025, about 70% of organizations have a dedicated Director of Finance, reflecting the increasing complexity of financial management.

- Key responsibilities include overseeing fiscal reports, managing budgets, leading audits, and developing internal controls.

- The demand for finance professionals is projected to grow by 6% from 2023 to 2033, driven by complex reporting requirements.

- Effective Directors of Finance require strong technical, leadership, and communication skills to align financial strategies with business objectives.

- Salaries for Directors of Finance average around $134,345, varying by location, industry, and experience.

- Technological advancements are transforming finance, with tools enhancing data analysis, reporting, and compliance.

- Navigating compliance is critical, with Directors needing to implement internal controls and stay updated on regulations.

- Leadership in finance involves fostering a collaborative environment, mentoring teams, and aligning departmental goals with organizational objectives.

- Career paths typically start from roles like Staff Accountant, progressing through managerial positions to directorship, emphasizing continuous professional development.

Introduction

In the dynamic realm of finance, the Director of Accounting stands as a pivotal figure in driving organizational success. As companies navigate the complexities of financial regulations and the ever-growing demand for transparency, the expertise of a proficient accounting leader becomes essential.

This article examines the diverse responsibilities of a Director of Accounting, underscoring the vital skills and qualifications necessary for excellence. Furthermore, it investigates the profound influence of technological advancements, compliance hurdles, and effective leadership on the accounting function.

As organizations pursue financial stability and growth, grasping the intricacies of this crucial role will illuminate the path for aspiring accounting professionals and employers alike.

Defining the Role of a Director of Accounting

The role of the Director of Finance is increasingly recognized as a pivotal senior-level executive position, responsible for steering an organization’s financial operations. This role encompasses the development and implementation of accounting policies and procedures under the direction of the director of accounting, ensuring compliance with fiscal regulations, and leading the accounting team. As a key player in monetary reporting and strategic planning, the Director of Finance plays a crucial role in safeguarding the integrity of economic data, which is vital for informed decision-making and organizational success.

In 2025, the significance of the Director of Finance role continues to escalate, with a growing number of organizations acknowledging the necessity for robust monetary leadership. Recent statistics reveal that approximately 70% of organizations now have a dedicated Director of Finance, reflecting the increasing complexity of monetary management and the demand for specialized knowledge. Furthermore, monetary managers, including Directors of Finance, earned an average annual salary of $156,100 as of May 2023, underscoring the economic advantages associated with this position.

The responsibilities of a Director of Finance are multifaceted and include:

- Overseeing the preparation of fiscal statements and reports

- Ensuring adherence to reporting standards and regulations

- Managing budgeting and forecasting processes

- Leading audits and coordinating with external auditors

- Developing internal controls to mitigate monetary risks

- Mentoring and developing the finance team to enhance performance

Current trends indicate a shift toward greater strategic involvement in business operations, with Directors of Finance increasingly engaging in cross-departmental initiatives to propel organizational growth. This evolution is bolstered by the projected 6% growth in employment within the financial profession from 2023 to 2033, as reported by the U.S. Bureau of Labor Statistics. This growth is largely attributed to the rising complexity of monetary reporting requirements and an improving economy, which highlights the demand for qualified professionals in the field, particularly those with advanced degrees and CPA certification.

Expert opinions emphasize that effective Directors of Finance not only possess strong technical skills but also excel in leadership and communication. Their ability to foster teamwork across departments is essential for aligning resource strategies with overarching business objectives. Successful case studies illustrate how director accounting positions have revolutionized financial operations, resulting in improved efficiency and enhanced financial performance within their organizations.

As Eric Eddy noted, Boutique Recruiting’s capacity to deliver top-tier candidates swiftly and efficiently is crucial in this competitive landscape. Boutique Recruiting specializes in sourcing high-quality temporary employees for roles such as CAO, Controller, Sr. Accountant, and Staff Accountant, ensuring that businesses have access to the finest talent in accounting and finance.

With an impressive conversion rate of 88%, Boutique Recruiting is dedicated to providing quality temporary employment solutions. Their recruitment process is meticulously designed to identify and attract top talent, enabling businesses to navigate an increasingly competitive environment effectively. As companies strive for economic stability and expansion, the position of the Director of Finance remains indispensable, further underscoring the importance of having skilled experts in these critical roles.

Core Responsibilities of a Director of Accounting

The primary duties of a Director of Finance are diverse and essential to the economic well-being of an organization. This role primarily involves overseeing the preparation of precise monetary reports, ensuring compliance with Generally Accepted Accounting Principles (GAAP), and managing the financial team effectively. Additionally, a Director of Finance coordinates audits, which are crucial for maintaining transparency and trust with stakeholders.

Beyond these foundational tasks, the Director is responsible for developing budget forecasts that guide strategic decision-making. This entails examining economic data to recognize trends and inform business strategies, a necessity in today’s competitive environment. Establishing strong internal controls is another critical responsibility, aimed at reducing financial risks and safeguarding the organization’s assets.

Recent insights from the ‘Demand for Skilled Talent’ report underscore that finance and bookkeeping leaders are prioritizing the attraction and retention of top talent through competitive salaries and workplace flexibility. As the financial software market is projected to reach $11.8 billion in the next eight years, the role of the Director of Finance is evolving to encompass emerging technologies, further expanding their responsibilities. This shift necessitates that Directors remain informed about technological advancements that can streamline financial processes and enhance reporting accuracy.

Moreover, case studies reveal that successful statement preparation is a hallmark of effective Directors of Finance. For instance, the ‘Recruitment Trends for 2025’ report emphasizes that organizations that streamline their hiring processes and collaborate with specialized recruiters, such as Boutique Recruiting, have reported improved outcomes in securing high-potential candidates for roles like CAO, Controller, and Sr. Accountant.

This proactive approach not only enhances operational efficiency but also positions the organization favorably in the eyes of stakeholders, thereby reducing the average time spent on reporting.

As Eric Eddy noted, the ability of firms like Boutique Recruiting to deliver top-notch candidates quickly and efficiently is essential in this competitive landscape. Their impressive track record of success reinforces the importance of effective recruitment in securing qualified Directors of Finance who can navigate these evolving challenges. Boutique Recruiting employs customized recruitment strategies that focus on understanding the specific needs of financial firms, ensuring they attract the right talent for each position.

In summary, the Director of Finance plays a vital role in maintaining the financial integrity of an organization, necessitating a blend of technical knowledge, strategic insight, and effective communication skills to convey complex financial information to various stakeholders. Testimonials from satisfied clients of Boutique Recruiting further illustrate their effectiveness in sourcing high-quality candidates for accounting roles, solidifying their reputation in the industry.

Essential Skills and Qualifications for Success

A director of accounting must possess a robust set of essential skills to effectively navigate the complexities of money management. Key competencies include:

- Strong analytical abilities, enabling the director to interpret data and make informed decisions.

- Proficiency in financial reporting, as the director is responsible for ensuring accurate and timely statements that comply with regulatory standards.

- A comprehensive understanding of compliance regulations, given the increasing scrutiny on financial practices across industries.

Typically, applicants for this position hold a bachelor’s degree in finance or a related field, with many enhancing their credentials through an MBA or acquiring professional certifications such as CPA. These educational qualifications are complemented by substantial experience; most finance directors possess at least 10-15 years in financial or managerial positions, including a minimum of five years in leadership roles. This trajectory often involves progressing through various finance roles, equipping them with the necessary expertise to lead effectively.

Leadership skills are essential, as the Director of Finance must manage and mentor the team, fostering a collaborative environment that encourages professional growth. Furthermore, strong communication skills are crucial for conveying complex financial information to non-financial stakeholders, ensuring that all parties understand the implications of financial data on business operations.

In 2025, the demand for director accounting remains high, with over 3,104 positions available in the Chicago area alone, reflecting the critical nature of this role in organizations. As Eric Eddy noted, Boutique Recruiting has demonstrated “the firm’s ability to deliver top-notch candidates quickly and efficiently,” highlighting the importance of finding qualified professionals in this competitive market. Boutique Recruiting specializes in targeted recruitment services for financial positions, including CAO, Controller, Sr. Accountant, and Staff Accountant, ensuring that firms can access the best talent available.

Salaries for these positions range from $125K to $175K annually, according to Ashley Northeast, underscoring the value placed on experienced professionals in this field. As the finance sector continues to evolve, the focus on both technical and interpersonal skills will be essential for success in leadership positions within this domain.

Are you ready to secure the top talent your organization needs? Reach out today for a consultation and discover how Boutique Recruiting can help you navigate the complexities of financial recruitment.

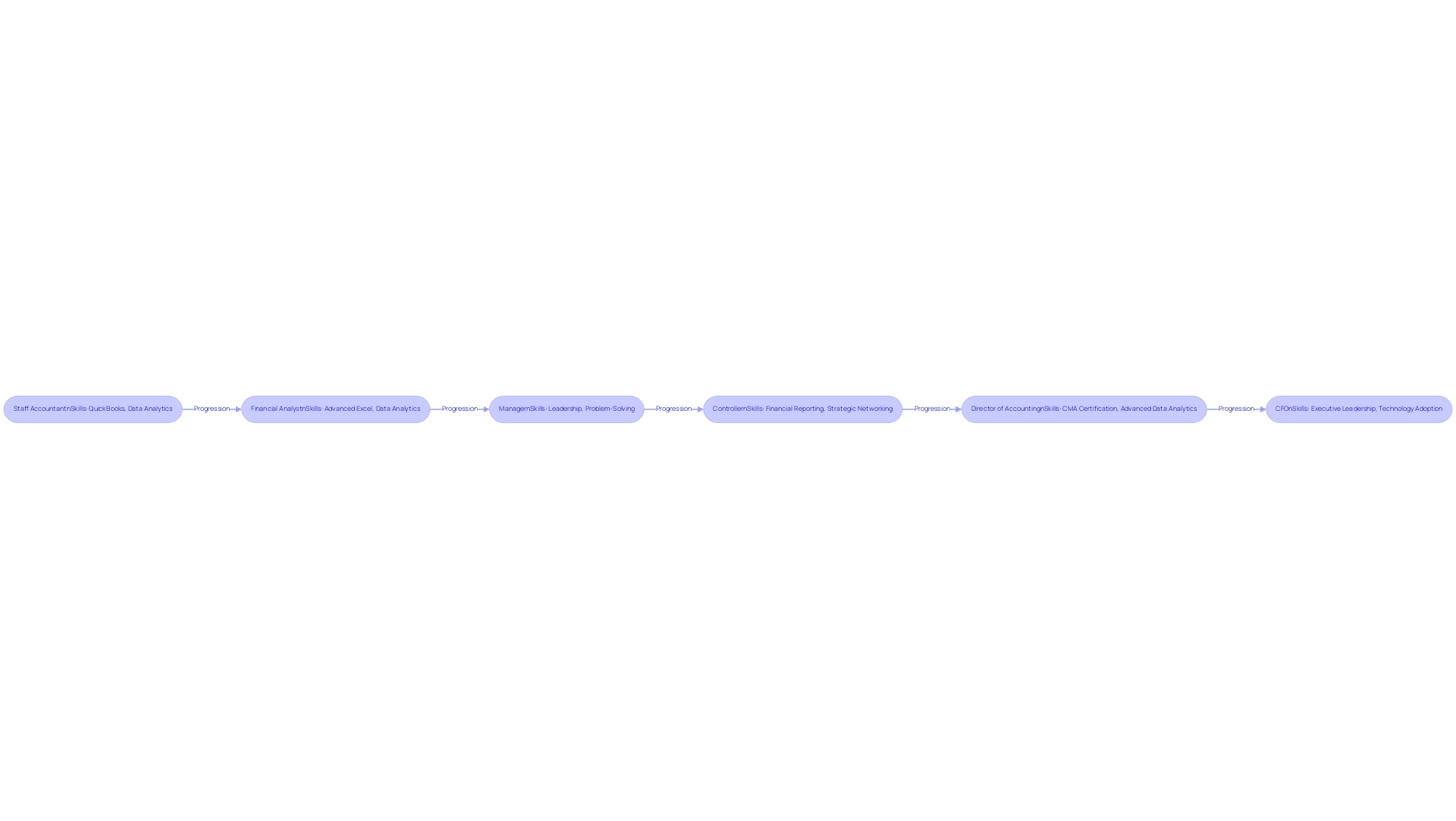

Career Path and Advancement Opportunities

The journey to becoming a Director of Accounting typically commences with foundational roles such as Staff Accountant or Financial Analyst. As professionals accumulate experience, they often progress to managerial positions or controllers, which are vital stepping stones on the path to directorship. This upward trajectory is not solely about experience; it also involves acquiring specific skills that are increasingly sought after in the industry.

Employers are particularly keen on candidates who are proficient in tools such as QuickBooks, advanced Excel, and cloud-based payroll systems, alongside strong data analytics capabilities. Moreover, soft skills like adaptability and problem-solving are highly regarded, reflecting the profession’s evolving nature.

Advancement opportunities extend well beyond the Director role, with many professionals aspiring to higher executive positions, including Chief Financial Officer (CFO) or other senior management roles. Continuous professional development is paramount in this competitive landscape. Pursuing relevant certifications, such as the Certified Management Accountant (CMA), which necessitates both work experience in management finance and passing a rigorous exam, can significantly enhance career prospects.

Statistics reveal a robust demand for skilled financial professionals, with numerous organizations actively seeking candidates who possess both technical expertise and interpersonal skills. The landscape of 2025 indicates that those who invest in their professional growth and networking are more likely to secure advancement opportunities. Insights from industry experts suggest that the average time to ascend to a Director of Accounting position can vary; however, with strategic career planning and skill development, professionals can expedite their journey.

Case studies illustrate that successful career paths to the Director of Accounting role often involve a blend of targeted skill acquisition and strategic networking. For example, professionals who engage in mentorship and actively participate in industry events tend to have a clearer understanding of the skills needed for advancement and are better positioned to seize opportunities as they arise. As Eric Eddy noted, Boutique Recruiting’s ability to deliver top-notch candidates quickly and efficiently underscores the importance of having the right support in navigating these career paths, particularly for high-demand finance and technology roles. Moreover, as technology continues to reshape the CFO and finance functions, those who embrace these changes will find themselves at a competitive advantage, further enhancing their career trajectories.

The Demand for Skilled Talent report by Robert Half offers valuable insights into employment trends and strategies for attracting and retaining talent, emphasizing the necessity for financial professionals to adapt to the evolving landscape.

Salary Expectations and Influencing Factors

As of March 2025, the average yearly salary for a Director of Finance in the United States stands at approximately $134,345. This figure, however, is subject to considerable variation influenced by several key factors, including geographic location, industry demand, and the size of the organization. For instance, Directors of Finance in metropolitan areas or sectors experiencing a surge in demand for financial expertise often command higher salaries.

In California, for example, the average salary for Finance Directors reaches $141,850, reflecting the state’s competitive job market. Conversely, Texas ranks 37th among 50 states for Director of Finance salaries, indicating a lower average pay relative to other areas.

Experience, educational qualifications, and professional certifications significantly impact salary levels. Directors with advanced degrees or specialized certifications typically see enhanced earning potential. Furthermore, many employers supplement base salaries with bonuses and comprehensive benefits packages, which can significantly elevate overall compensation. The salary landscape for director accounting roles is dynamic, with trends indicating a competitive job market in 2025.

As organizations continue to seek top-tier talent, understanding these salary expectations and the factors influencing them is essential for both employers and candidates navigating this critical position. Boutique Recruiting specializes in targeted recruitment services for finance roles, ensuring that financial firms can effectively attract and retain top candidates. By leveraging personalized recruitment processes and seamless interview experiences, Boutique Recruiting enhances the hiring journey for both employers and candidates.

The salary range for director accounting roles varies significantly, from $50,500 to $201,000, highlighting the competitive nature of this field. Have you considered how these factors might influence your recruitment strategy? Understanding these dynamics is crucial for staying ahead in the competitive financial sector.

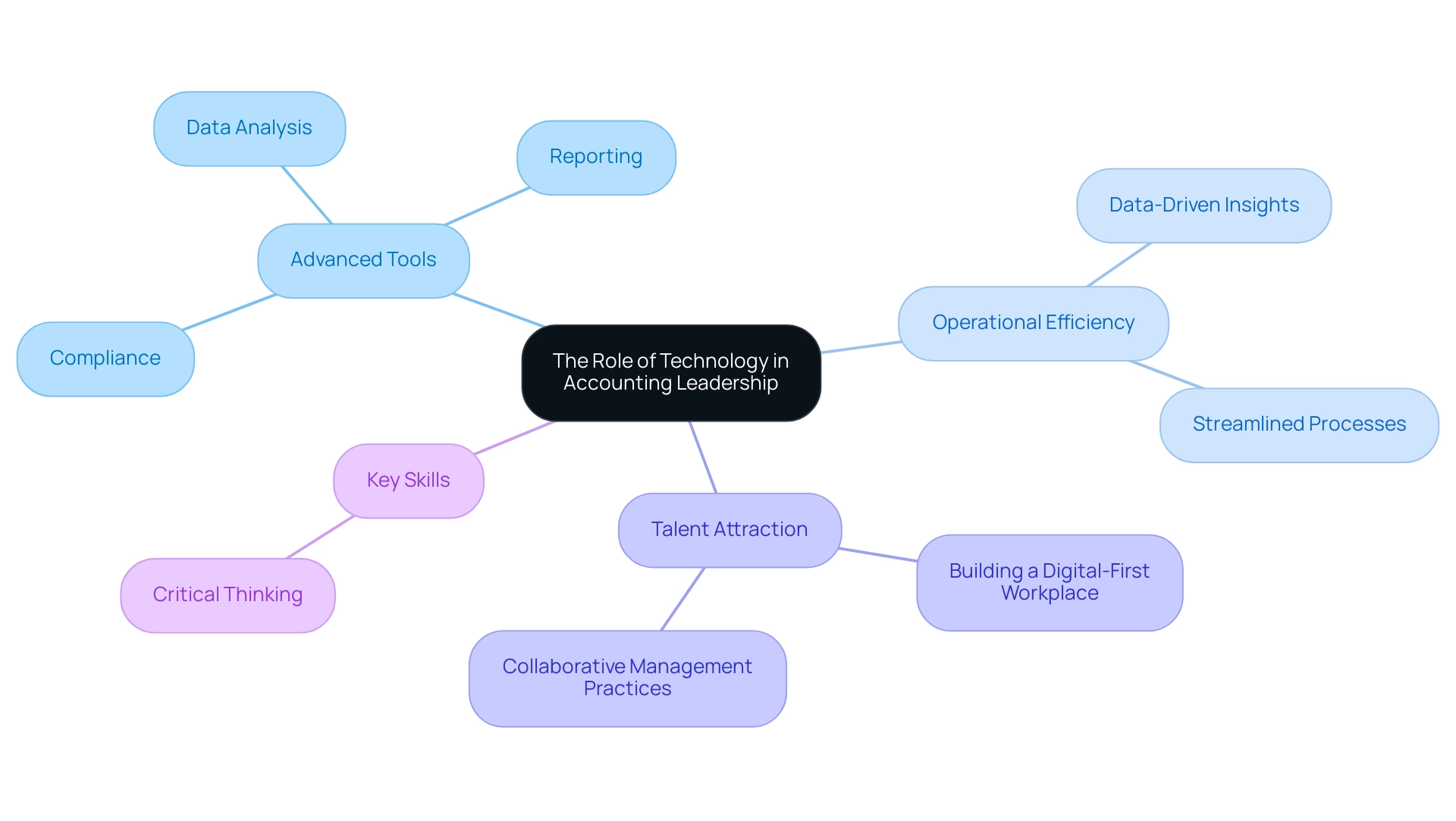

The Role of Technology in Accounting Leadership

Technology is transforming leadership in finance, empowering Directors to utilize advanced tools for data analysis, reporting, and compliance. The adoption of innovative software solutions, including cloud-based financial management, automation, and artificial intelligence, facilitates real-time financial insights and enhances decision-making capabilities. In fact, 58% of senior finance executives express a desire to boost operational efficiency through data-driven insights, underscoring the critical role technology plays in contemporary financial practices.

As the landscape evolves, it is imperative for the director of accounting to remain informed about the latest technological advancements to sustain a competitive edge. Embracing these innovations not only streamlines processes but also enables financial leaders to redirect their focus toward strategic initiatives rather than being bogged down by routine tasks.

Expert opinions emphasize that the function of technology in financial management is gigantic, as it transforms the traditional method of bookkeeping into a more accurate and efficient model. This shift is further illustrated by case studies demonstrating how firms that adopt advanced technologies like AI and machine learning can attract younger talent and improve operational efficiency. For example, a recent initiative titled “Building a Digital-First Workplace in Finance” showcases how integrating modern financial technologies and fostering collaborative management practices can enhance a firm’s appeal to prospective employees while shifting towards more strategic service offerings.

Moreover, critical thinking is identified as the most important soft skill for today’s accountants, especially in strategic business advisory roles. This skill is essential as leaders in finance navigate complex monetary environments and provide valuable insights to their organizations.

In summary, the integration of technology in financial departments is not merely a trend but a necessity for effective leadership. By leveraging these tools, the director of accounting can ensure their teams are equipped to meet the demands of a rapidly changing financial landscape, ultimately positioning themselves as strategic partners within their organizations. Additionally, accounting technology helps accountants find answers to complex questions and communicate relevant tax information, further solidifying their role as committed partners to clients.

Navigating Compliance and Regulatory Challenges

Navigating compliance and regulatory challenges is a critical responsibility for a director of accounting. These professionals must ensure that their organizations adhere to financial regulations, including Generally Accepted Accounting Principles (GAAP) and various tax laws. Staying abreast of legislative changes is essential; failure to comply can lead to significant repercussions, including loss of clients, reputational damage, and substantial fines.

To effectively manage compliance risks, the director of accounting should implement robust internal controls and risk management strategies. This includes fostering a culture of compliance within their teams, where ethical practices and accountability are prioritized. As highlighted by recent case studies, such as those involving CPA firms grappling with the complexities of the Sarbanes-Oxley Act and adapting to post-Brexit regulatory changes, it is imperative for accounting leaders to regularly update compliance protocols and invest in advanced compliance management software.

These firms have found that regularly updating their compliance strategies not only mitigates risks but also enhances their operational efficiency.

Moreover, insights from compliance officers underscore the pivotal role that directors play in ensuring regulatory adherence. They are not only responsible for overseeing compliance but also for educating their teams about the importance of these regulations. For instance, automating accounts payable processes has been shown to reduce paperwork by 90-95% and enhance efficiency by 20-27%, illustrating how technology can support compliance efforts.

This statistic highlights the tangible benefits of leveraging technology in compliance management.

As Ken Shaw, an Accounting Professor, notes, “The measure we use is known as the M-Score, which is a firm-level measure of the likelihood of misreporting…” This emphasizes the importance of utilizing effective measures to assess compliance risks.

As the landscape of financial regulations continues to evolve, directors of accounting must remain vigilant and proactive in addressing current compliance challenges. By leveraging successful risk management strategies and staying informed about recent regulatory changes, they can navigate the complexities of their role and contribute to their organization’s overall success. Collaborating with a reliable recruiting agency such as Boutique Recruiting can also be crucial in locating qualified Directors of Finance who are prepared to manage these challenges effectively.

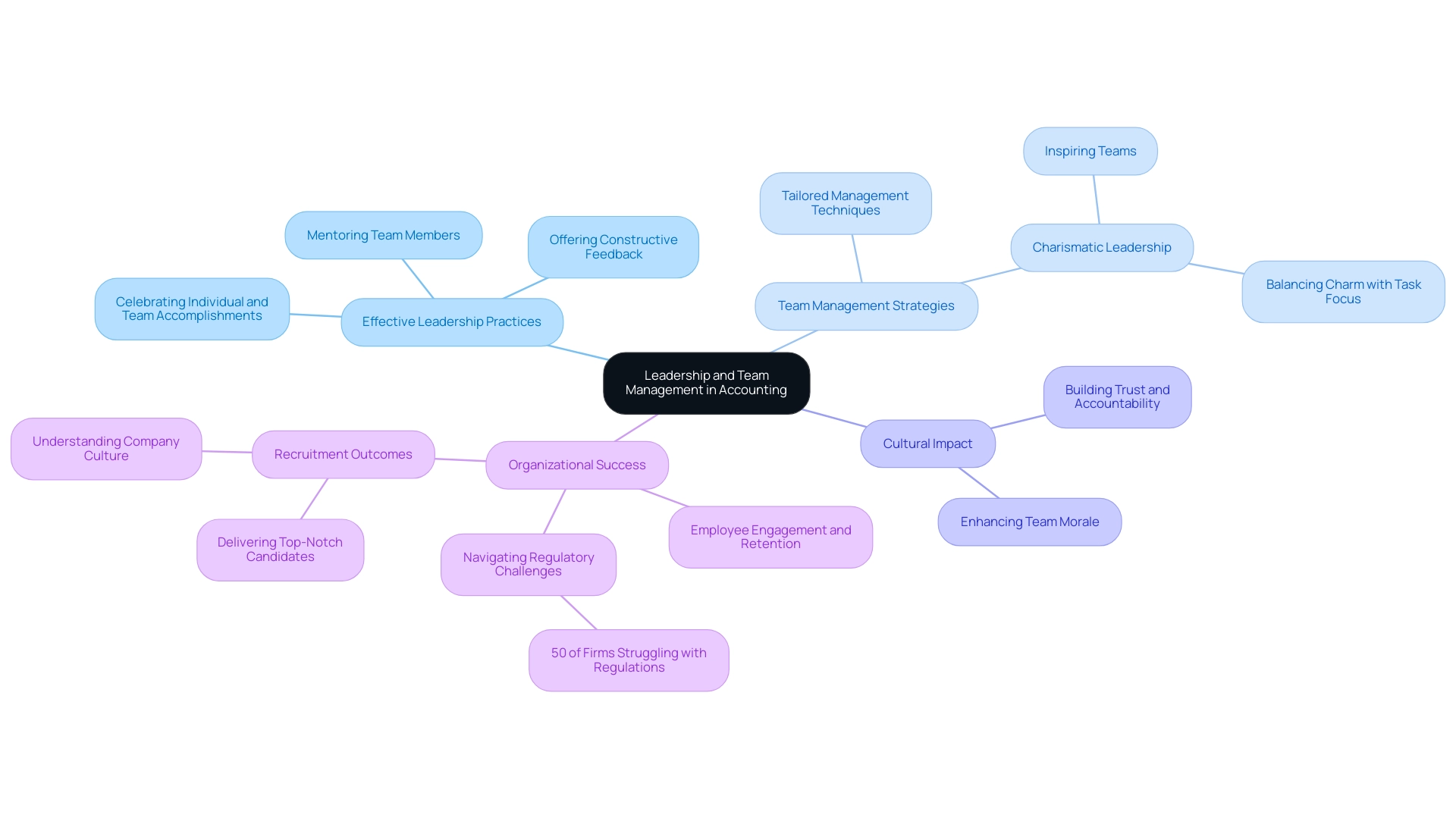

Leadership and Team Management in Accounting

Effective leadership and team management are crucial for a Director of Finance, as they directly influence departmental performance and the achievement of organizational goals. To foster a high-performing team, Directors should prioritize creating a collaborative environment that promotes open communication and continuous professional development. This involves:

- Mentoring team members

- Offering constructive feedback

- Celebrating individual and team accomplishments

A culture rooted in trust and accountability not only boosts team morale but also enhances productivity.

Research indicates that organizations with strong leadership practices see a significant improvement in employee engagement and retention, which is crucial in the competitive landscape of finance. In fact, 50 percent of firms reported challenges in adapting to evolving regulations in 2022, underscoring the need for effective leadership to navigate such complexities. Directors of accounting should implement leadership strategies that align with contemporary trends in the industry. For instance, adopting a charismatic leadership style can inspire and motivate teams towards a shared vision, although it is essential to balance this with a focus on essential tasks to avoid potential pitfalls of self-centeredness.

Case studies reveal that successful financial teams often thrive under leaders who can blend charm with strategic oversight, ensuring that team objectives are met without compromising on critical responsibilities. This corresponds with the insights from Eric Eddy, who noted the importance of delivering top-notch candidates quickly and efficiently, highlighting how effective leadership can enhance recruitment outcomes.

Moreover, expert opinions emphasize the significance of tailored team management techniques that resonate with the unique dynamics of financial departments. By understanding the specific needs of their teams and the broader organizational culture, Directors can effectively lead their departments to not only meet but exceed performance expectations. Boutique Recruiting’s impressive track record of success in targeted recruitment services for finance and marketing roles underscores the importance of effective leadership in achieving organizational goals.

Their personalized recruitment strategies are essential in navigating the talent war, ensuring that organizations attract and retain top candidates. This meticulous approach to leadership not only cultivates a positive work environment but also positions the director accounting function as a vital contributor to the overall success of the organization.

Conclusion

The role of the Director of Accounting is undeniably crucial in steering organizations towards financial integrity and success. This position encompasses a diverse array of responsibilities, from ensuring compliance with regulations and overseeing financial reporting to leading teams and fostering collaboration across departments. As the demand for skilled accounting leaders continues to rise, particularly in the face of evolving technological advancements, the significance of this role cannot be overstated.

Key competencies such as strong analytical skills, effective communication, and a solid foundation in financial principles are essential for success in this position. As organizations increasingly prioritize strategic financial management, the Director of Accounting must not only adapt to changing regulations but also embrace innovative technologies that enhance operational efficiency and decision-making capabilities.

Moreover, the journey to becoming a Director of Accounting is marked by continuous professional development and strategic career planning. With competitive salary expectations influenced by various factors, including geographic location and industry demand, aspiring professionals must remain attuned to market trends and invest in their growth to secure advancement opportunities.

Ultimately, the Director of Accounting is more than just a financial steward; this role is pivotal in shaping the future of organizations by driving financial strategy, ensuring compliance, and fostering a culture of excellence within accounting teams. As businesses navigate an increasingly complex financial landscape, the expertise and leadership of a Director of Accounting will remain integral to achieving long-term success and stability. Organizations must recognize this critical role and invest in attracting top talent to secure their financial future.

Frequently Asked Questions

What is the role of a Director of Finance?

The Director of Finance is a senior-level executive responsible for steering an organization’s financial operations, developing and implementing accounting policies, ensuring compliance with fiscal regulations, and leading the accounting team.

What are the primary responsibilities of a Director of Finance?

The primary responsibilities include overseeing the preparation of fiscal statements and reports, ensuring adherence to reporting standards, managing budgeting and forecasting processes, leading audits, developing internal controls to mitigate financial risks, and mentoring the finance team.

How has the significance of the Director of Finance role changed recently?

The significance has escalated, with approximately 70% of organizations now having a dedicated Director of Finance, reflecting the increasing complexity of financial management and the demand for specialized knowledge.

What is the average salary for monetary managers, including Directors of Finance?

As of May 2023, monetary managers, including Directors of Finance, earned an average annual salary of $156,100.

What trends are emerging in the role of Directors of Finance?

Current trends indicate a shift toward greater strategic involvement in business operations, with Directors of Finance engaging in cross-departmental initiatives to drive organizational growth.

What is the projected employment growth for the financial profession?

The U.S. Bureau of Labor Statistics projects a 6% growth in employment within the financial profession from 2023 to 2033, driven by rising complexity in monetary reporting requirements and an improving economy.

What skills are essential for effective Directors of Finance?

Effective Directors of Finance need strong technical skills, leadership abilities, and excellent communication skills to foster teamwork and align resource strategies with business objectives.

How does Boutique Recruiting contribute to the hiring of Directors of Finance?

Boutique Recruiting specializes in sourcing high-quality candidates for financial roles, ensuring businesses have access to top talent. They have an impressive conversion rate of 88% and employ customized recruitment strategies to meet the specific needs of financial firms.

Why is the role of the Director of Finance considered indispensable?

The Director of Finance is vital for maintaining the financial integrity of an organization, requiring a blend of technical knowledge, strategic insight, and effective communication to convey complex financial information to stakeholders.